Trillion-dollar stablecoins are implemented through OEM

- 核心观点:稳定币发行外包成新趋势。

- 关键要素:

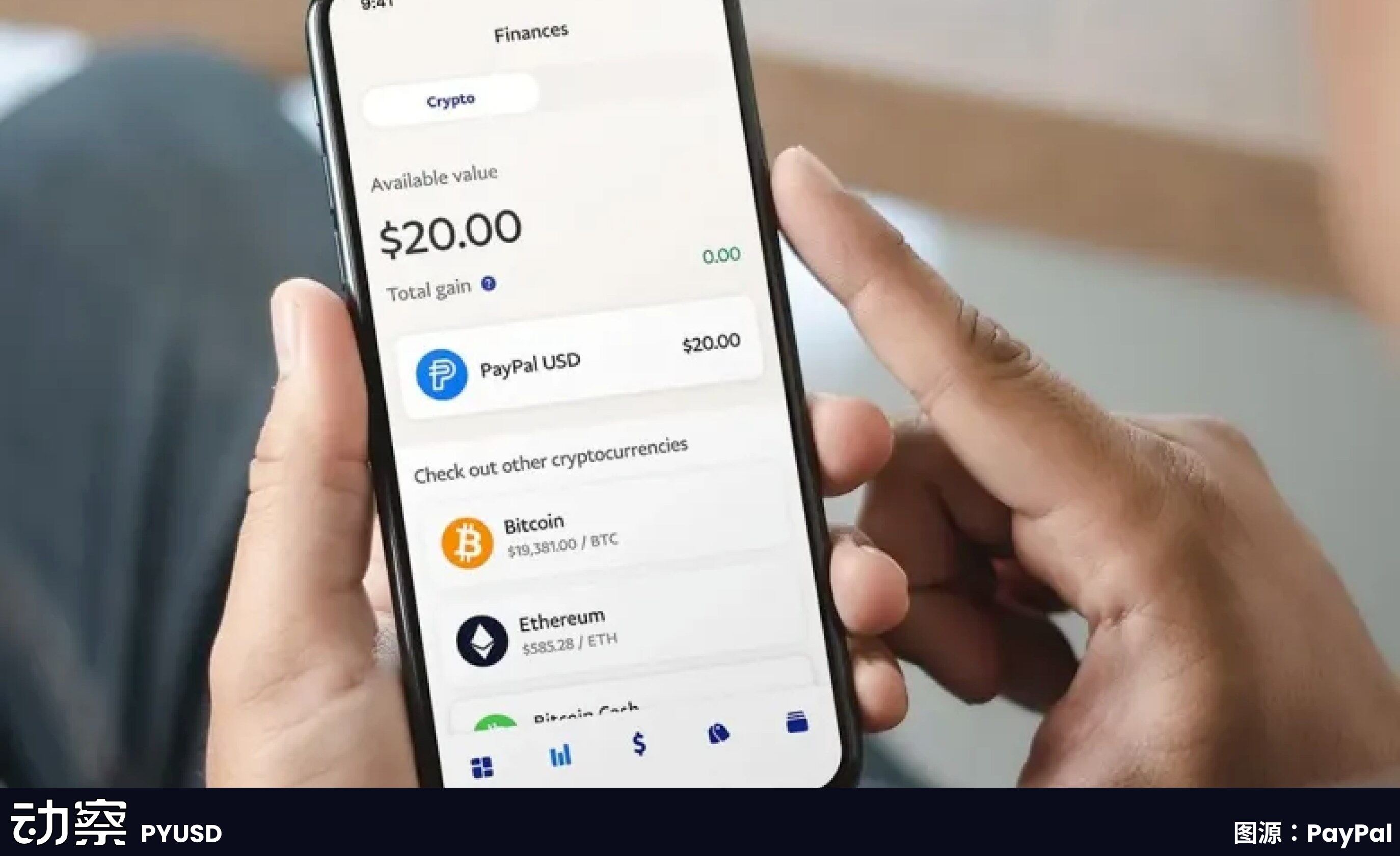

- Paxos为PayPal代工发行PYUSD。

- Bridge为MetaMask推出mUSD稳定币。

- Stably提供快速白牌稳定币发行。

- 市场影响:降低发行门槛,加速行业普及。

- 时效性标注:中期影响。

Original title: "The Future Trillion-Dollar Stablecoin Foundries"

Original author: Sleepy.txt

Bridge, the stablecoin issuance platform under Stripe, one of the world's largest online payment infrastructures, has launched the native stablecoin MetaMask USD (mUSD) for MetaMask, a wallet application with more than 30 million crypto users.

Bridge is responsible for the entire issuance process from reserve custody, compliance audits to smart contract deployment, while MetaMask focuses on polishing the front-end product interface and user experience.

This cooperation model is one of the most representative trends in the current stablecoin industry. More and more brands are beginning to choose to outsource the complex issuance process of stablecoins to professional "OEM factories", just like Apple outsources the production of iPhones to Foxconn.

Since the iPhone's inception, Foxconn has almost always been responsible for core production. Today, approximately 80% of the world's iPhones are assembled in China, with over 70% of these produced in Foxconn factories. At one point, Foxconn Zhengzhou employed over 300,000 workers during peak season, earning it the nickname "iPhone City."

The cooperation between Apple and Foxconn is not a simple outsourcing relationship, but a typical case of division of labor in modern manufacturing.

Apple focuses its resources on user-centric aspects, such as design, system experience, brand narrative, and sales channels. Manufacturing does not provide a differentiating advantage for the company, but rather involves significant capital expenditure and risk. Consequently, Apple has never owned its own factories, instead outsourcing production to specialized partners.

Foxconn has built core capabilities in these "non-core" areas. They build production lines from scratch, manage raw material sourcing, process flow, inventory turnover, and shipping cadence, and continuously reduce manufacturing costs. They have established a comprehensive set of industrial processes for supply chain stability, delivery reliability, and production capacity flexibility. For brand clients, this means the foundation for frictionless expansion.

The logic behind this model is division of labor and collaboration. Apple doesn't have to bear the fixed burden of factories and workers, and it can also avoid manufacturing risks during market fluctuations. Foxconn, on the other hand, leverages economies of scale and multi-brand capacity utilization to extract overall profits from extremely low per-unit profits. Brands focus on creativity and consumer outreach, while contract manufacturers shoulder the responsibility of industrial efficiency and cost management, creating a win-win situation for both parties.

This hasn't just changed the smartphone industry. Since the 2010s, computers, televisions, home appliances, and even automobiles have all gradually shifted to a contract manufacturing model. Companies like Foxconn, Quanta, Wistron, and Jabil have become key nodes in the restructuring of the global manufacturing industry. Manufacturing has become modularized and packaged, transforming it into a capability that can be scaled and sold externally.

More than a decade later, this logic began to be transplanted to a seemingly unrelated field: stablecoins.

On the surface, issuing a stablecoin requires only on-chain minting. However, the work behind making it truly operational is far more complex than one might imagine. Compliance frameworks, bank custody, smart contract deployment, security audits, multi-chain compatibility, account system integration, and KYC module integration all require long-term investment in both financial strength and engineering capabilities.

We previously broke down this cost structure in detail in "How Much Does It Cost to Issue a Stablecoin?" For an issuing institution starting from scratch, initial investment often reaches millions of yuan, often consisting of inexhaustible, fixed expenses. After launch, annual operating costs can reach tens of millions of yuan, covering various components such as legal, auditing, operations and maintenance, account security, and reserve management.

Today, some companies are beginning to package these complex processes into standardized services, providing plug-and-play solutions to banks, payment institutions, and brands. While they may not appear in the spotlight themselves, their presence is often visible behind the issuance of a stablecoin.

Foxconn has also begun to appear in the world of stablecoins.

The Foxconns of the Stablecoin World

In the past, launching a stablecoin meant juggling three roles: financial institution, technology company, and compliance team. Projects needed to negotiate with custodian banks, build cross-chain contract systems, complete compliance audits, and even navigate licensing issues in various jurisdictions. For most companies, this hurdle was too high.

The "foundry" model emerged to address this problem. A "stablecoin foundry" is an organization that specializes in issuing, managing, and operating stablecoins for other businesses. They aren't responsible for building the end-user brand, but rather for providing the complete infrastructure behind the scenes.

These companies are responsible for building a complete infrastructure, from front-end wallets and KYC modules to back-end smart contracts, custody, and auditing. Clients only need to specify the desired currency and the markets in which they want to launch; the foundry handles all the other steps. Paxos played this role when partnering with PayPal to launch PYUSD: custodian of US dollar reserves, on-chain issuance, and compliance integration. PayPal only needed to display the "stablecoin" option on the product interface.

The core value of this model is reflected in three aspects.

The first is cost reduction. If a financial institution were to build a stablecoin system from scratch, the initial investment could easily reach millions of dollars. Compliance licensing, technical research and development, security audits, and bank partnerships all require separate investments. By standardizing processes, foundries can reduce the marginal cost per customer to a level far lower than building their own.

The second is time savings. While traditional financial products often take years to launch, a fully self-developed stablecoin project can take 12–18 months to implement. The OEM model allows clients to launch products within a few months. Stably's co-founder has publicly stated that their API access model allows a company to launch a white-label stablecoin in just a few weeks.

The third issue is risk transfer. The biggest challenge for stablecoins lies not in technology, but in compliance and reserve management. The Office of the Comptroller of the Currency (OCC) and the New York State Department of Financial Services (NYDFS) have extremely strict regulatory requirements for custody and reserves. For most companies hoping to test the waters, shouldering the full compliance responsibility is unrealistic. Paxos has secured major clients like PayPal and Nubank precisely because it holds a New York State trust license, which allows it to legally custody US dollar reserves and fulfill regulatory disclosure obligations.

Therefore, the emergence of stablecoin foundries has, to some extent, changed the industry's entry barriers. Previously, the high initial investment that only a few giants could afford can now be split, packaged, and sold to more financial or payment institutions with demand.

1|Paxos: Turning Processes into Products and Compliance into Business

Paxos' business direction was determined early on. It doesn't emphasize branding or market share, but rather focuses on building capabilities around one key goal: turning the issuance of stablecoins into a standardized process that others can choose to purchase.

The story begins in New York. In 2015, the New York State Department of Financial Services (NYDFS) opened a digital asset license, and Paxos became one of the first limited purpose trust companies to receive it. That license was more than just symbolic; it empowered Paxos to custody client funds, operate blockchain networks, and perform asset settlements. Such qualifications are rare in the United States.

In 2018, Paxos launched the USDP stablecoin, subjecting its entire process to regulatory scrutiny: reserves were held in banks, audits were disclosed monthly, and minting and redemption mechanisms were written on-chain. This approach wasn't widely adopted due to high compliance costs and slow implementation. However, it did establish a clear and controllable structure, breaking down the stablecoin creation process into standardized modules.

Later, Paxos did not focus on promoting its own currency, but packaged this set of modules into a service and provided it to others.

The two most representative customers are Binance and PayPal.

BUSD is a stablecoin service provided by Paxos for Binance. Binance controls the brand and traffic, while Paxos assumes issuance, custody, and compliance responsibilities. This model operated smoothly for several years until 2023, when the New York Department of Finance (NYDFS) ordered Paxos to cease new minting, citing inadequate anti-money laundering (AML) reviews. This incident only served to highlight Paxos's role in issuing BUSD.

A few months later, PayPal launched PYUSD, still listing Paxos Trust Company as the issuer. PayPal had users and a network, but lacked regulatory credentials and had no intention of building its own. Through Paxos, PYUSD was able to launch legally and compliantly, entering the US market. This was a prime example of Paxos's "OEM" capabilities.

Its model is also being replicated overseas.

Paxos obtained a major payment institution license from the Monetary Authority of Singapore (MAS) in Singapore, using this license to launch its USDG stablecoin. This marked the first time Paxos completed the entire process outside the United States. The company also established Paxos International in Abu Dhabi to focus on overseas operations and launched the yield-bearing USDL stablecoin, using a local license to avoid US regulation.

The purpose of this multi-jurisdictional structure is very direct: different customers and different markets require different compliant and feasible issuance paths.

Paxos launched its stablecoin payment platform in 2024, beginning to handle corporate collection and settlement services. It also participated in the development of the Global Dollar Network, hoping to connect stablecoins from different brands and systems and facilitate clearing. It aims to provide a more complete backend infrastructure.

However, the closer one gets to regulation, the more vulnerable they become to scrutiny. The NYDFS once singled out Paxos for inadequate anti-money laundering due diligence in the BUSD project. Paxos was fined and required to submit rectifications. While this wasn't a fatal blow, it did demonstrate that Paxos's path was destined to be neither lightweight nor ambiguous. It could only continue to strengthen its compliance efforts and define clear boundaries. It incorporated every regulatory requirement and every security step into its product process. When others use it, they simply attach their brand and issue a stablecoin. Paxos handles the rest. This is its positioning, and it represents a business model that deeply integrates technology and regulation.

2|Bridge: Stripe's heavyweight OEM

The addition of Bridge marks the emergence of a true giant in the stablecoin foundry market for the first time.

It was acquired by Stripe in February 2025. Stripe is one of the world's largest online payment infrastructures, processing hundreds of millions of transactions daily and serving millions of merchants. Stripe's established expertise in compliance, risk management, and global operations has now been ported to the blockchain through Bridge.

Bridge's positioning is straightforward: providing businesses and financial institutions with comprehensive stablecoin issuance capabilities. Rather than simply outsourcing technology, it modularizes and packages mature aspects of the traditional payment industry into standardized services. Bridge handles reserve custody, compliance audits, and contract deployment. Clients simply call an API to integrate stablecoin functionality into their front-end products.

The MetaMask collaboration is a prime example. As one of the world's largest Web 3 wallets, with over 30 million users, it lacks financial licenses and reserve management credentials. Through Bridge, MetaMask was able to launch mUSD in a matter of months, eliminating the years it would take to build regulatory compliance and financial systems.

Bridge's business model is platform-based. Rather than tailoring products to individual clients, it aims to build a standardized issuance platform. This approach aligns with Stripe's approach to payments: using APIs to lower barriers to entry allows clients to focus on their core business. Just as countless e-commerce companies and apps once integrated credit card payments, businesses can now use a similar approach to issue stablecoins.

Bridge's advantage comes from its parent company. Stripe has established a global network of compliance partners, facilitating Bridge's entry into new markets. Stripe's existing merchant network also provides a natural potential customer base. For businesses interested in exploring stablecoins but lacking on-chain technology or financial expertise, Bridge offers a ready-made solution.

However, there are limitations. As a subsidiary of a traditional payment company, Bridge may be more conservative than crypto-native companies, and its iteration speed may not be fast enough. Stripe's brand influence in the crypto community is also far less than in the mainstream business world.

Bridge's market positioning is more inclined towards traditional finance and corporate clients. MetaMask's choice of this reflects its need for a trusted financial partner, not just a technology provider.

Bridge's entry signals that the stablecoin foundry business is gaining attention from traditional finance. With the entry of more players with similar backgrounds, competition in this sector will intensify, but it will also drive the industry towards maturity and standardization.

3|Stably: Building a lightweight production line for the mid-segment market

Stably, founded in 2018 and headquartered in Seattle, began as a startup, like many similar companies, by issuing its own stablecoin, Stably USD. However, this approach quickly proved difficult to break through. With little chance of competing with Tether and USDC, Stably shifted its focus to another niche: facilitating the issuance of other stablecoins.

Its business is clearly labeled "White Label Stablecoin Issuance Platform" on its official website. This means that clients don't need a development team or to write their own contracts. Simply through an API call, they can issue a stablecoin under their own name within a few weeks. The client decides on the chain, coin name, and branding, while Stably is responsible for connecting the backend systems.

This logic sets the stage for its difference from Paxos. Paxos's approach is asset-heavy and compliance-focused. All reserves must be placed in a trust account, managed by the company, with interest accruing to Paxos. Stably's approach is much more relaxed. Reserves remain in customers' bank accounts, as long as they meet custody standards.

Stably doesn't touch funds or provide custodial services, instead generating revenue through technical and operational service fees. This allows clients to retain all remaining profits, while the contract manufacturer only receives "work wages."

This is crucial for many small and medium-sized institutions. The interest earned on reserve funds is often far higher than the issuance revenue itself. Handing this over to large companies like Paxos would effectively cede this portion of revenue. Stably's solution, however, allows clients to retain interest while enabling rapid onboarding at a lower cost.

Speed is another selling point. Stably promises a "live launch within two months" and has demonstrated actual deployment cycles of four to six weeks in multiple cases. In contrast, Paxos often takes several months or even longer. For payment companies or local banks seeking to conduct a regional pilot, this difference in pace translates into different costs.

Stably's customer profile differs significantly from Paxos's. While Paxos serves global platforms like PayPal and Nubank, Stably targets the mid-tier market: regional financial institutions, cross-border payment providers, Web 3 wallet providers, and e-commerce payment interface companies. These companies don't require top-tier regulatory compliance and don't plan to expand globally immediately; they simply want the system to work well in their specific scenarios.

From a technical perspective, Stably has expanded its chain compatibility. Ethereum, Polygon, BNB, Arbitrum, and Base are all supported. They are continuously expanding their network, ensuring that clients have ready-made interfaces for any chain they wish to launch on. They are building a lightweight, replicable template network.

The limitations are also obvious. Stably lacks the backing of major clients, strong regulatory credentials, and a strong brand. It primarily attracts clients who are sensitive to speed and revenue but less demanding about compliance. This means it struggles to secure the services of truly large banks and payment giants, but it still has room to thrive in the mid-market.

It's widely believed in the industry that potential stablecoin issuers extend beyond giants. Beyond names like PayPal and Binance, there are also numerous second-tier payment institutions, regional banks, and B2B platforms. These companies may not develop their own blockchain systems, but instead rely on stablecoins to run their businesses. Stably exists to provide these clients with a fast, affordable, and risk-averse path.

If the value of Paxos lies in building a heavy-duty compliance production line, then the significance of Stably lies in proving that there is indeed another type of demand in the market. They do not want the most secure and standardized system, but a shortcut to issuance that can be run with a low threshold.

4|Agora: A lightweight stablecoin issuance platform from Wall Street

The story of Agora is inseparable from its founder, Nick van Eck. Behind the name lies the family background of VanEck, a world-renowned asset management company. VanEck manages a vast portfolio of ETFs and funds, and has long held a strong position in traditional financial markets. Nick left this position, bringing his traditional financial resources to the crypto space and founding Agora.

From the outset, Agora secured backing from top venture capital firm Paradigm. Paradigm is one of the industry's most active crypto funds, having previously invested in projects like Coinbase, Uniswap, and Blur. This investment signaled the market's rapid attention to Agora, which boasts both the backing of Wall Street family connections and the backing of Silicon Valley crypto capital.

Agora aims to address not the pain points of a single institution, but the barriers to entry for the entire industry. Its vision is straightforward: to make issuing stablecoins as easy as registering a domain name. For most companies, applying for licenses, building compliance structures, and developing smart contracts on their own are prohibitively expensive and time-consuming. Agora provides a plug-and-play, white-label stablecoin issuance platform.

Clients only need to decide on the currency, brand, and usage scenario. The rest is already packaged: the account system, reserve custody interface, contract deployment and redemption logic, and information disclosure process. Agora is responsible for connecting these links, allowing clients to quickly generate a stablecoin, just like opening a SaaS account.

Compared to Paxos's heavy-handed compliance approach, Agora takes a lighter approach, attempting to make stablecoin issuance a standardized service. It emphasizes lowering the barrier to entry rather than the advantages of a license. For potential customers, the advantages lie in fast onboarding and low costs, while Agora's backend handles risk and compliance.

This model is inherently attractive. There are numerous small and medium-sized payment companies, regional banks, and even e-commerce platforms in the market that have a need for stablecoins but lack the ability to build their own systems. The interface provided by Agora makes this possible for these potential customers.

However, there's still a long way to go between vision and reality. First, ensuring compliance remains crucial. Stablecoins can't legally exist simply by registering a domain name. Regulatory requirements vary significantly across markets, and Agora needs to meet the legal and financial requirements of multiple jurisdictions to truly replicate its capabilities.

Secondly, it does not have large-scale customer cases in the industry. Paradigm's investment and Nick van Eck's last name are more of an endorsement of potential.

In a market already entrenched by Paxos, Stably, and BitGo, Agora stands out as a new challenger. It doesn't emphasize secure custody or the burden of licensing barriers, but instead seeks to transform issuance into a public service using a minimalist interface. Whether this proves successful remains to be seen. However, its vision points to a new possibility for the stablecoin industry: making issuance a standardized service like domain name registration.

The next step for stablecoin "OEM"

The stablecoin outsourcing model is still in its early stages, but it has already shown a trend. When issuance becomes a capability that can be outsourced, the market's imagination will not only stay on the issuance itself, but will extend to more commercial applications.

Cross-border payments are the most obvious use case. Today, the majority of global cross-border transactions still rely on the SWIFT system. This system is slow, costly, and lacks 24/7 availability. Even between major banks, funds can take days to clear.

The emergence of stablecoins offers a faster alternative. Through standard interfaces provided by foundries, regional banks or payment companies can quickly access stablecoin settlement networks, enabling real-time cross-border remittances for corporate clients. This means that financial infrastructure, previously the preserve of giants, can be opened up with lower barriers to entry.

Another promising area is corporate treasury management. For most businesses, the efficiency of fund flow and management has long been underestimated. If stablecoins can be embedded in corporate cash pools, they could provide new tools in supply chain finance, cross-border trade, and everyday payments.

For example, companies can use stablecoins to transfer funds between subsidiaries, reducing waiting times and providing greater transparency into the status of funds. The value of the foundry model lies in enabling small and medium-sized banks and B2B platforms to provide this service more quickly without having to build systems from scratch.

Market opportunities are also evolving. For the past few years, stablecoins have primarily been an experiment for crypto-native companies. However, as regulations become clearer, traditional financial institutions are being drawn into the market. Banks, clearing networks, and regional financial platforms are beginning to experiment with embedding stablecoins within their systems.

For them, building their own stablecoins is too risky, and the compliance modules and custody interfaces provided by foundries are the easiest way to get in. Once these customers enter the market, the scale and use cases of stablecoins will expand rapidly.

From a technical perspective, cross-chain interoperability is a challenge that must be addressed in the coming years. Current stablecoins are still scattered across different blockchains and are incompatible with each other. This presents a problem for end users, as the same stablecoin may have two different versions on Ethereum and BNB Chain.

Foundries are trying to standardize cross-chain transfers and liquidations, allowing assets on different chains to flow seamlessly. If this layer is established, the liquidity and application scope of stablecoins will be significantly improved.

Business models will also evolve accordingly. Currently, most contract manufacturers are still in the customization phase, offering a customized solution for each customer. However, as demand grows, standardized products will gradually replace high-cost custom services. Just as cloud computing initially began with hosted and private solutions, and later developed one-click SaaS platforms, stablecoin issuance will follow a similar trajectory, transitioning from high-threshold project collaborations to low-threshold product deployment. Lowering the barrier to entry means more potential customers can enter the market.

In other words, the future of stablecoin foundries will not just help others issue stablecoins, but will gradually build a global financial network. The ultimate competitive advantage will not only be in compliance and custody capabilities, but also in who can embed stablecoins into real-world commercial chains faster and at lower cost.

Conclusion

Foxconn didn't design the iPhone, but it made its global adoption possible. Stablecoin foundries play a similar role. They don't pursue independent brands, but instead perform the hard work behind the scenes, bringing a stablecoin from concept to reality.

In recent years, the barrier to entry for issuing stablecoins has steadily risen. Regulatory requirements have become increasingly detailed, and compliance procedures are multiplying: license applications, reserve custody, cross-border disclosures, smart contract deployment, and audits—any of which can halt a project. For most institutions, jumping in directly means tens of millions of dollars in budgets, a year or more of preparation time, and a potentially volatile regulatory environment. The significance of foundries lies in transforming these burdens into optional services.

This is why PayPal chose Paxos, Metamask partnered with Bridge, and companies like Agora are beginning to offer white-label stablecoin issuance solutions. Their logic mirrors Foxconn's: through standardization and scalability, they break down complex processes into reusable modules. Clients only need to define the market and brand; the foundry handles the rest.

As regulations gradually take hold, this sector is gaining clearer market boundaries. The US GENIUS Act and Hong Kong's stablecoin licensing system are both pushing stablecoin issuance out of its gray area and into the institutionalized arena. With clearer rules, demand will grow even faster. Whether it's payment companies packaging US dollars as on-chain assets or emerging market banks experimenting with launching regional stablecoins, they are likely to become the next wave of customers.

These "Foxconn factories of stablecoins" are becoming the invisible infrastructure at the bottom of finance. They control compliance templates, audit standards, and cross-chain tools, controlling the path for digital assets to enter the real world. Just as Foxconn builds an invisible hardware supply chain, stablecoin foundries are also building a production line for digital finance.