The Quiet Period in the Crypto Market: Cyclical Turning Point and Structural Opportunities in 2025

- 核心观点:加密市场处于中期盘整阶段。

- 关键要素:

- 与2019年QT结束期相似。

- 风险评分接近历史盘整水平。

- 监管与机构基础更坚实。

- 市场影响:为下一轮上涨蓄力。

- 时效性标注:中期影响。

Original title: The Forgotten Phase: Why the Crypto Market Might Be Stuck Between Cycles

Original author: Christina Comben, The Coin Republic

Original article translated by BitpushNews

Key points:

The cryptocurrency market may be neither a bull market nor a bear market, but rather in a "forgotten mid-term phase," similar to the calm period following the end of quantitative tightening in 2019, which often foreshadows the start of a new upward trend.

The Federal Reserve's end to quantitative tightening, along with similar levels of market risk ratings, suggests that the crypto market is in a consolidation phase rather than a prelude to a collapse.

Despite short-term volatility, pro-crypto regulatory policies, the launch of ETFs, and large-scale institutional adoption make the market foundation in 2025 far more solid than in 2019.

Current Market Situation: A Difficult-to-Define Status

"Is it a bull market or a bear market?"—this most frequently discussed question in the crypto market may no longer be applicable by the end of 2025. When traders and analysts try to label the current market, they find that it refuses to be simply defined.

Crypto prices have failed to replicate the parabolic surge of 2021, but they're far from the despair of a true bear market. So, what exactly happened?

Crypto trader Dan Gambardello interpreted this as: We may be in the "forgotten chapter" of the cycle.

This period of calm mirrors the one from July to September 2019: when the market consolidated sideways, the Federal Reserve ended quantitative tightening, and the crypto market seemed to be in a strange period of stagnation before the next big move.

The Ghost of 2019

Looking back at the crypto news in July 2019: The Federal Reserve officially announced the end of quantitative tightening, a policy shift that marked a subtle but important change in global liquidity.

A few months later in September, the policy tightening officially ended. This paved the way for a subsequent moderate rise, which ultimately triggered the market boom of 2020-2021.

Now, history seems to be repeating itself. The Federal Reserve has once again announced that it will end quantitative tightening in December 2025. In both of these periods, macro liquidity has begun to shift, but market confidence in crypto prices has not kept pace.

"The news that quantitative tightening has ended has just been announced," Gambardello said in the video. "This is neither the peak of a bull market nor the bottom of a bear market, but rather a blurry area in between."

This "intermediate state," often overlooked in crypto news, is precisely the key phase of the cycle reset. In 2019, Bitcoin's risk score hovered around 42, almost identical to the current 43. Despite the price difference, market sentiment exhibits a similar level of uncertainty.

Crypto Market Risk Indicators and the Value of Patience

"If you believe that ending QT will boost liquidity, consider gradually building a position during any pullbacks before December 2025," Gambardello advised.

His AI-driven system, called "Zero," recommends rational allocation of funds, identifying risky areas rather than chasing market momentum.

He pointed out that Ethereum's risk model score was 11 in 2019, while it is now 44. Cardano's score is 29. These figures, based on volatility and sentiment data, help macro investors plan their entry points, rather than trading volatility emotionally.

If the rating falls back to the 30 or 20 range, it may present a long-awaited accumulation opportunity for long-term holders.

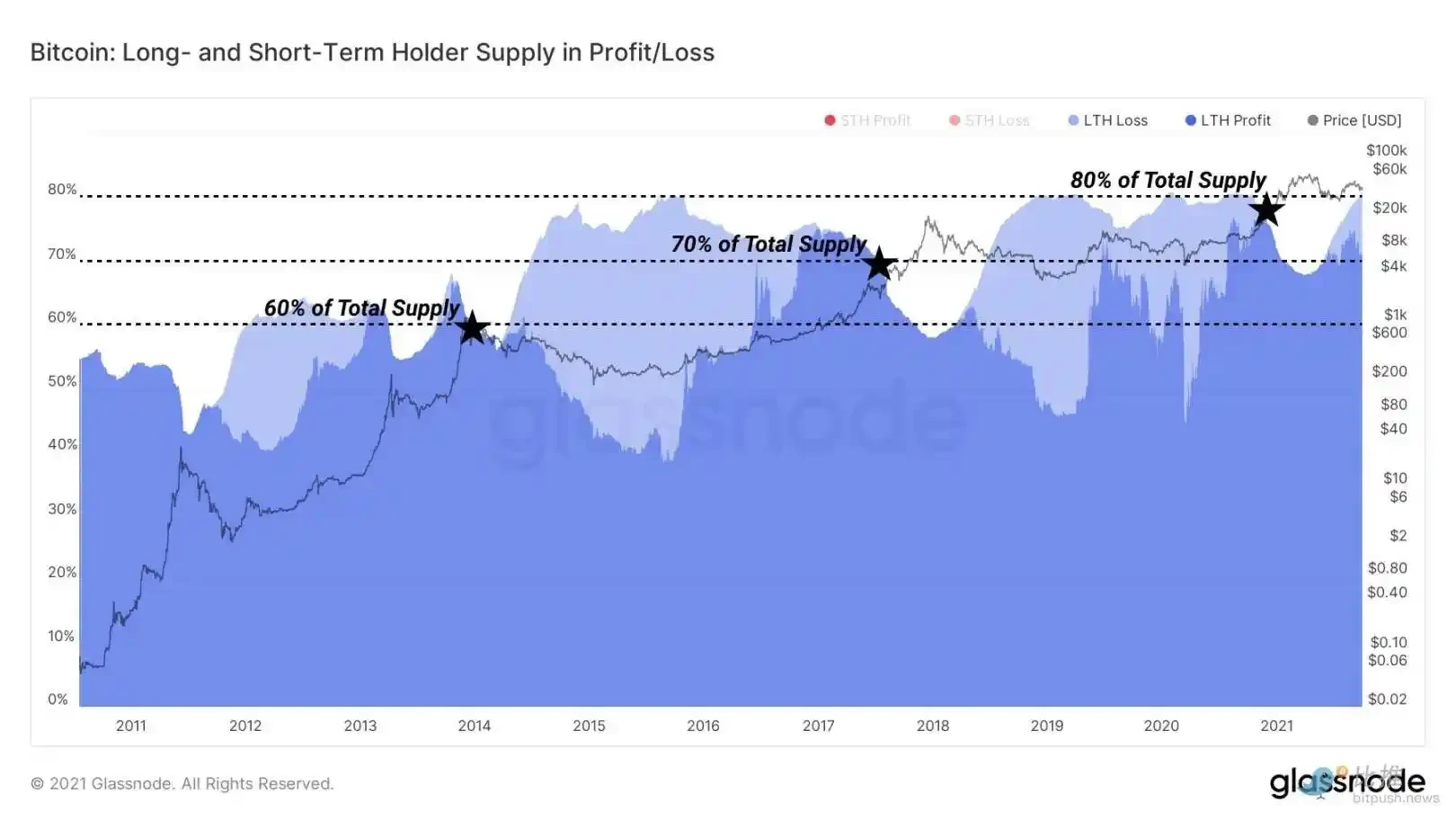

Glassnode data supports this pattern. During medium-term consolidation, the supply from long-term holders typically increases as speculative traders exit.

In 2019, long-term Bitcoin holders accounted for over 644% of the circulating supply; by 2025, this figure will again approach the same level. Patience seems to be the secret weapon of calm investors.

Chart source: studio.glassnode.com

What information are the charts conveying?

The price action on Ethereum's weekly chart shows a striking similarity. In July 2019, shortly after QT ended, Ethereum tested its 20-week moving average, rebounded, and then dipped again, only truly recovering months later.

This summer, the same 20-50 week moving average crossover occurred again; this serves as a reminder that cycles always push and pull between hope and fatigue.

Gambardello explained that a key signal to watch out for is whether Ethereum can break through its 20-week moving average. This is a short-term confirmation signal to determine whether the market will repeat the trend of 2019.

Otherwise, a temporary drop in total market capitalization to the $3 trillion range (compared to the current $3.6 trillion shown on CoinMarketCap) could repeat the scenario of the past: the drop would be enough to scare away retail investors, but not enough to end the upward trend.

Different decades, same market psychology

Of course, 2025 is not a simple replica of 2019. The headlines in crypto news are different, and the macro landscape has changed dramatically.

A pro-crypto US government has taken office. The Clarity Act and the GENIUS Act have essentially ended the regulatory uncertainty that had kept investors up at night. The Ethereum ETF is now available for trading.

Stablecoin issuers are subject to regulation. BlackRock now holds the top spot with $25 billion in crypto ETF assets.

This institutional power won't disappear overnight. Instead, it changes the rhythm of the market, transforming it from one driven by adrenaline to one managed by spreadsheets and stress tests.

What we are witnessing may not be another bull or bear market, but rather a more subtle shift: a transitional phase within a larger monetary climate system.

The Fed's shift in liquidity, the appointment of a new chairman before May, and the normalization of regulations may all contribute to making 2025 a quiet preparatory period before the next rally.

Gambardello doesn't believe we're entering a bear market, but rather in a "frustrating consolidation phase."

Yes, it's frustrating. But perhaps it's necessary. If the crypto market in 2019 taught us anything, it's this: boredom is often the prelude to a breakthrough.