Weekly Editors Picks (1202-1208)

Weekly Editors Picks is a functional column of Odaily. In addition to covering a large amount of real-time information every week, it also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news and pass you by.

Therefore, our editorial department will select some high-quality articles worth spending time to read and collect from the content published in the past 7 days every Saturday. From the perspectives of data analysis, industry judgment, opinion output, etc., we will provide those in the encryption world with You bring new inspiration.

Next, come and read with us:

Investment and Entrepreneurship

Grayscale Research: Demystifying Bitcoin’s Ownership Landscape

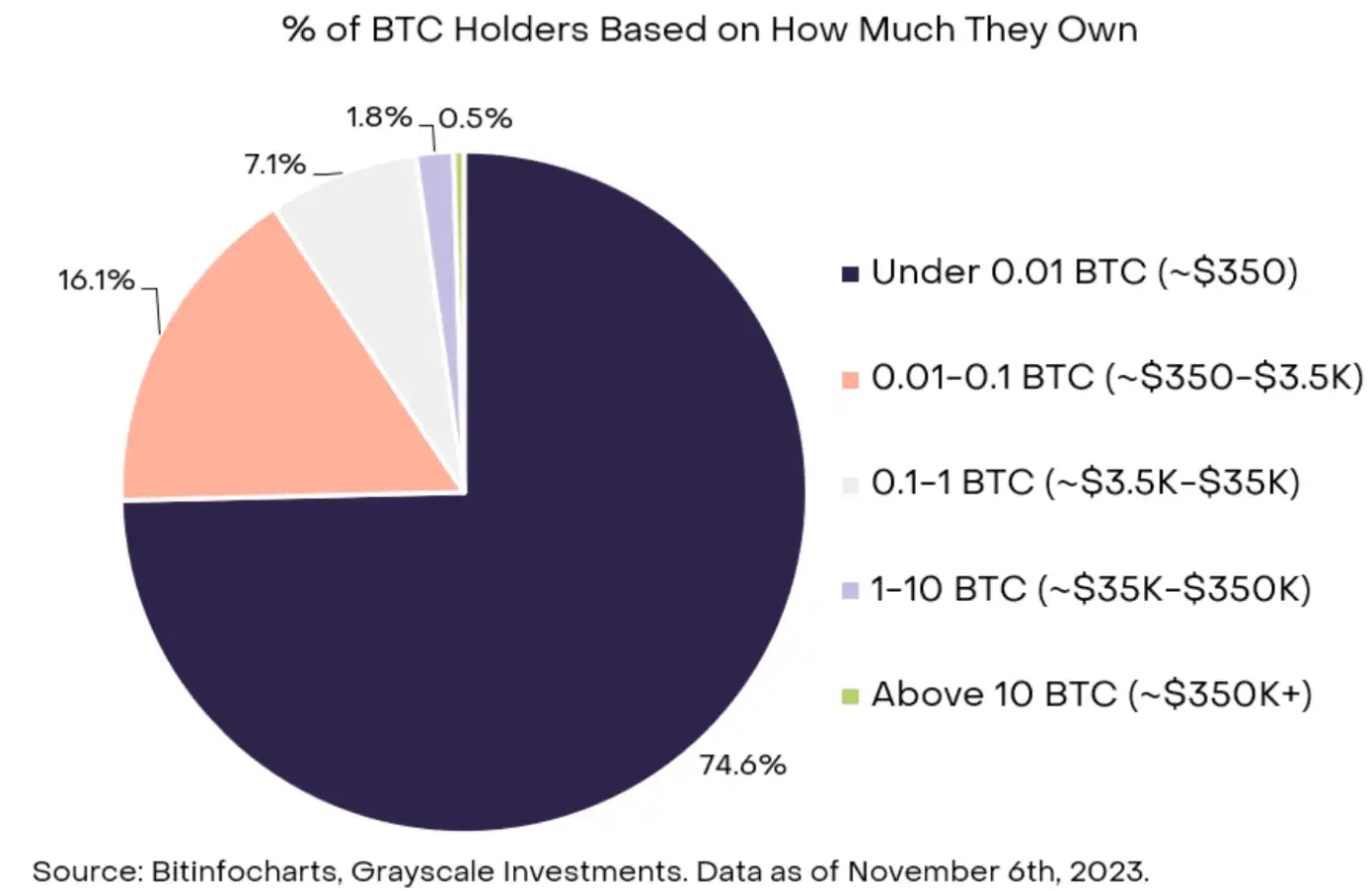

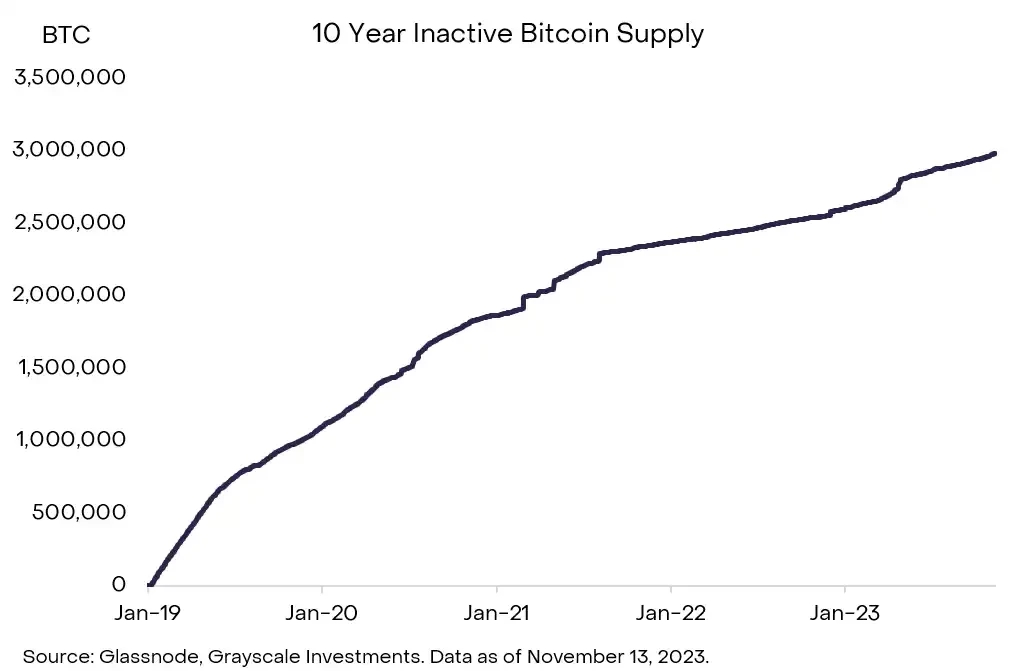

Bitcoin ownership is widely distributed among various groups. 74% of Bitcoin holders own less than 0.01 Bitcoin. About 40% of Bitcoin ownership falls into identifiable categories, including trading platforms, miners, governments, public company balance sheets, and dormant supply. 14% of the Bitcoin supply has not moved in 10 years. We believe this portion of the supply can be attributed to original Bitcoins owned by Satoshi Nakamoto, lost Bitcoins or addresses, and holders for up to ten years. As shown in the chart below, ten-year inactive supply has been growing since 2019 and is currently at an all-time high. Illiquid and long-term holder supply has surged to unprecedented levels, while short-term supply has dropped to rock bottom levels.

14% of the Bitcoin supply has not moved in 10 years. We believe this portion of the supply can be attributed to original Bitcoins owned by Satoshi Nakamoto, lost Bitcoins or addresses, and holders for up to ten years. As shown in the chart below, ten-year inactive supply has been growing since 2019 and is currently at an all-time high. Illiquid and long-term holder supply has surged to unprecedented levels, while short-term supply has dropped to rock bottom levels.

The dynamics of Bitcoin ownership are likely to be increasingly reinforced by the impact of macro events, such as the evolution of global policy and regulation (e.g., the approval of a U.S. spot Bitcoin ETF), and developments in the crypto market, such as the 2024 Bitcoin halving.

Grayscale: Crypto fundamentals improve, will Bitcoin continue to rise?

Certain macro risks in financial markets have declined, including geopolitical conflicts in the Middle East and the risk of a hard landing for the U.S. economy.

The combination of tight token supply, easing macro risks, and a U.S. presidential election that will focus on excessive government borrowing may be beneficial to Bitcoins valuation in 2024.

IOSG Ventures: BTC data interpretation, we have entered a new bull market cycle

We are currently in the middle and early stages of a medium-length bull market cycle and are entering a climbing phase. The current Bitcoin bull cycle is unusually smooth compared to previous cycles, but if historical patterns are followed, IOSG expects at least 10 more corrections (over -5%) before reaching the peak of this cycle. Although Bitcoin halving events coincide with changes in market cycles, they may not be the direct cause of market changes but are instead consistent with broader global economic trends.

The revival of POW projects is the result of the joint efforts of many parties. In essence, miners have the computing power to look for new POW projects, the community looks for projects with low market value and good narratives, and mining machine manufacturers look for projects that can gain community support. At the same time, the rise of AI has increased computing power to the level of infrastructure in the data era, and the POW project has its own computing power and can easily be combined with AI to create a secondary superposition of narratives.

A brief summary of POW tokens with a market cap of over $40 million

2024 Crypto Narrative Outlook and Investment Guide

The most important key narratives driving the bull market are: Bitcoin ETFs, lower interest rates, and the Bitcoin halving. The author foresees a fall in prices followed by a rise in interest rates. Retail investors can just keep investing simple. 2024 will be dominated by institutions.

Considering ETF beneficiaries, best investment options: COIN (stocks) / BTC / ETH, derivative narrative: BRC-20 / LSTs. Considering the Lindy Effect, best choices: SOL, derivative narrative: TIA/Aptos/L2. Considering regulatory and product market fit, best investment options: MMX/dYdX, derivative narrative: other perp DEXes. When considering decentralized AI, top pick: TAO/OLAS. Considering GameFi, best investment options: Overworld/Treeverse/Prime/L3 E 7, Derivative Narrative: NFTs → BLUR.

Other potential narratives: dePIN/RWAs, deSci, Memes (BONK/DOGE/PEPE/HPOS 10 INU), RUNE/CACAO, GambleFi, airdrops (LayerZero/Starnet/ZKSync).

Take stock of 7 major agreements that are about to usher in a major launch

Frax V3 and Fraxchain, Synthetix Andromeda version and de-inflation of SNX, Fluid in Instadapp, Eigenlayer + LRT, Uniswap V4, Stacks Satoshi upgrade, monolithic L1 growth: Fantom 2.0 upgrade and SEI V2.

DeFi

Uniswap Growth History: From Zero to Infinity

Looking back at Uniswap’s step-by-step journey from v0 to v4: proof of concept → functional DEX → capital efficiency → ultimate platform.

Uniswap v4 brings efficiency and customization to the AMM design space, enabling the creation of pools with different features and functions. This is a big step forward, but at a predictable cost: as the number of pools explodes, liquidity fragmentation increases, and therefore routing becomes more challenging.

E 2 M Research: Is decentralized lending led by Aave a good business model?

A very long article that basically covers everything we need to know about Aave.

MT Capital analyzes Jito: Reshaping the Solana staking market landscape

Jito is the first liquidity staking protocol on Solana that combines MEV income and staking income. TVL has increased by nearly 70% in the past 30 days, which is expected to reshape the Solana staking market structure.

Jito is about to launch the governance token JTO. There are few JTOs circulating in the early market, and the main selling pressure comes from airdrop users. JTO has limited usage scenarios and poor value capture capabilities. Jito needs new incentives and ecological expansion to stimulate the continued growth of Jito TVL, thereby alleviating the selling pressure of airdrop users to a certain extent and maintaining the stability of JTO value.

Backed by Solanas new assets, the influx of new users, the increase in transaction volume, and Solanas extremely low liquidity staking ratio, the LSD protocol represented by Jito is expected to capture a higher staking TVL. Solanas potentially huge MEV value gives Jito a higher imagination.

NFT

Bankless: With two potential trump cards in hand, can OpenSea bottom out and rebound?

The author believes that OpenSeas opportunity lies in that it has not yet released its own token or its own L2.

Web 3.0

The article mainly introduces Zero Knowledge Proof, Fully Homomorphic Encryption and corresponding representative projects.

To summarize from a technical perspective, ZK focuses on proving the correctness and protecting the privacy of statements; FHE focuses on performing calculations without decryption and protecting the privacy of data.

From the perspective of the development of the blockchain industry, projects using ZK technology developed early. From ZCash, which only has a transfer function, to the zkVM blockchain that supports smart contracts, which is currently under development, there are more blockchains than FHE. Industry technology has accumulated; and the FHE theory was born much later than ZK and is a hot spot in the academic world. It was not until recently that Web3 projects using FHE technology for financing appeared, so the development started slower than ZK.

The common point between the two points to the development of computing power, and the development of the privacy track has enjoyed the dividends of the explosion of computing power.

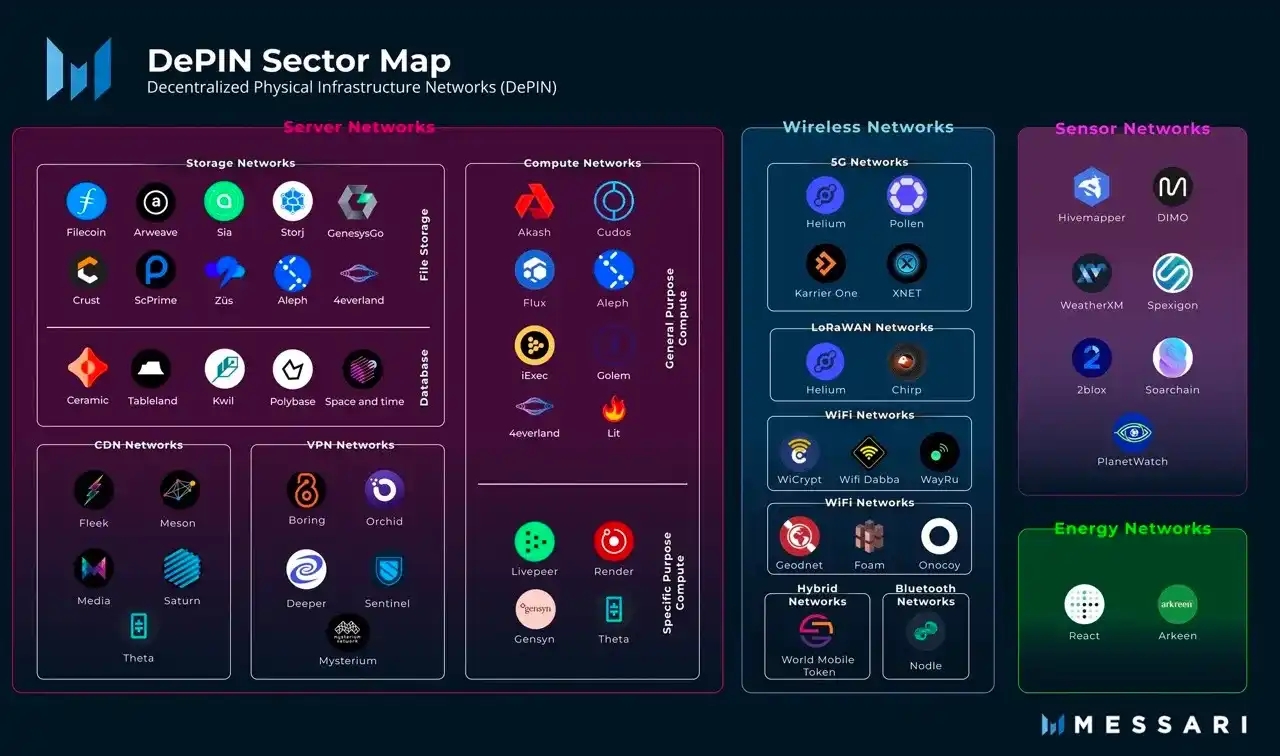

A Deep Dive into DePIN: Decentralized Hardware Meets the New Data Economy

DePIN may be a turning point in the adoption of web3 in the real world.

1kx: An in-depth interpretation of decentralized social protocols

Bitcoin Ecology

What other potential projects are worth paying attention to in the Bitcoin L2 narrative?

The article focuses on Tectum and BEVM.

Interactive Guide: In addition to Ordi, how to buy other popular items in the Bitcoin ecosystem?

Contains purchase methods for BTC protocol tokens such as $Nostr, $ATOM, BSSB, ALEX and TOOTHY (NFT).

Ethereum and Scaling

Has the advantage peaked? An article exploring the prospects and challenges of Ethereum

Ethereum leads both in terms of valuation and relative adoption relative to all cryptoassets (ETH.D). What made Ethereum successful in the past is exactly why it will fail in the future. There was a time when Ethereum was the only viable smart contract platform for developers to build on. Legitimate use cases (DeFi, NFTs) put ETH a big step ahead. But at this stage, the focus turns to value accumulation (ultrasonic currency) and competing with Bitcoin to become the de facto Internet-native store of value (flippening). The desire to be both a smart contract platform and a decentralized “ultrasonic currency” adds significant resistance (higher gas costs, network congestion) for edge users and developers.

Modular blockchain frameworks provide a set of trade-offs that can be chosen. We are now in a state where blockchain infrastructure is starting to emerge that supports various points on the trade-off curve. In terms of blockchain design, Ethereum is no longer on the efficient frontier. Unless there are fundamental changes in the way Ethereum operates, both as a community and as an organization, the relative advantage over valuation and usage has peaked.

Glassnode: Ethereum pledge pool dynamics and market activities

Recently, the number of Ethereum pledged validators withdrawing from the pool has gradually increased, causing the growth rate of ETH issuance to slow down. At the same time, the surge in network activity, especially the promotion of token transfers and stablecoins, has led to an increase in transaction demand, which in turn has exerted upward pressure on gas prices, and the daily destruction of ETH fees through EIP 1559 has also increased. The combination of these two forces has caused the global ETH supply to once again show a deflationary trend.

CEXs have been dominating staking withdrawal events since October, with Kraken and Coinbase seeing the most notable outflows.

Another recommended article on mechanism design interpretation: Read more to understand why Rollup needs a safety committee?》。

Multiple ecology

A deep dive into the differences between Ethereum and Solana

In order to ensure the security of a blockchain, some form of value proposition is required. Solana charges state rents from decentralized application (DApps) teams and voting fees from validators, which validators must pay to participate in voting for blocks.

These two features, which do not exist in Ethereum, create additional value drivers for the Solana Token (SOL), which somewhat offsets the impact of the lack of transaction fee demand on the SOL price, while also mitigating some of the Security and public resource issues (such as state bloat). The problem is that both of these may limit decentralization (due to the increased fixed cost of becoming a validator), and in addition, due to the existence of state rent and the difficulty of coordinating payments at the community level, actually limit the immutability of DApps.

On the other hand, this model and the cNFT model also show how costs can sometimes be hidden. If there are too many rent seekers, user costs may increase, and Solana structurally provides some opportunities that Ethereum does not have. At the same time, cNFTs are very attractive to users and offer them lower costs, thus lowering overall fees. These reduced fees will be passed on to the DApp team to pay RPC (remote procedure call) fees to maintain data.

While Ethereum achieves immutability, autonomy, and censorship resistance, at least in theory, and charges users a high premium accordingly, Solana is cheap and passes the cost of security onto validators and DApp providers. Solana DApps minimize the difficulty of gaining trust from their teams (impacting autonomy), and in theory, the economies of scale for Solana validation should be at least greater than for Ethereum validators (decentralization).

Hot Topics of the Week

In the past week,Bitcoin breaks through 40,000 USDT,Cryptocurrency market capitalization exceeds $1.6 trillion,South Korean won surpassed the US dollar to become Bitcoin’s largest legal currency trading pair, accounting for 42.8% in November,Bitcoin Core developer kills inscription sparks controversy,Bitwise files second revised document for Bitcoin spot ETF application with SEC,BlackRock files revised filing for Bitcoin spot ETF, Reuters:SEC is negotiating key details with Bitcoin spot ETF applicant;

In addition, in terms of policy and macro markets, Federal Reserve Chairman Powell:Fed ready to further tighten monetary policy if time is right;

In terms of opinions and voices, U.S. Space Force officials:Bitcoin has “national strategic importance”, President of El Salvador:Domestic Bitcoin investment has a floating profit of US$3.6 million and will be held for a long time,Glassnode:The vast majority of BTC investors have returned to floating profits, and many indicators have entered the uptrend field, founder of IOSG:The bull market is starting to come back, it’s time to get past the hype and memes,Coinbase CEO:No plans to launch Base network token, cosine:Safe multi-signature wallet needs to improve the interaction security design to solve the problem of phishing attacks with the same address with the first and last numbers, founder of Ordinals:All current Runes protocols are irrelevant to me;

In terms of institutions, large companies and leading projects,LayerZero Labs stated that the protocol has native tokens and will be committed to token distribution, which is expected to be completed in the first half of 2024,Arbitrum ArbOS upgrade sparks “hard fork” discussion,The price of the euro stablecoin AEUR on Binance is abnormal,Jito announces airdrop details,Ordinals project BitcoinShrooms featured on Sotheby’s;

NFT and GameFi areas,Ouyang Jing releases new song Nobody, previewing Stephen Chows new NFT...Well, it’s been another week of ups and downs.

Attached is the Weekly Editors Picks seriesportal。

See you next time~