Crypto VC transformation in progress: from fundraising difficulties to a new token paradigm

Original article by Mason Nystrom ( @masonnystrom )

Compiled by | Odaily Planet Daily ( @OdailyChina )

Translator | Ethan ( @ethanzhang_web3 )

Editor's note: Entering 2025, the financing environment of the primary market continues to be under pressure, and insufficient LP returns and tight VC dry powder (Note: dry powder refers to cash reserves or highly liquid assets held by companies or venture capital funds) have become structural problems. But at the same time, the pre-seed round of financing has picked up, the activity of mergers and acquisitions has increased, and the activity of early projects has not decreased. A series of signals are also quietly pointing to the reconstruction logic of the next crypto venture capital cycle.

The author of this article, Mason Nystrom, has long been concerned about the evolution of crypto capital structure and financing data trends. The article focuses on some key issues in this field: Why does the current market seem to be sluggish but the total amount of financing is stable? Why has the VC structure changed from "equity + token" to "token first"? How will the new round of competition unfold between Fintech VC and Crypto VC? What kind of capital operation model is implied behind Liquid Venture?

Facing the coming of a new cycle, these basic and critical issues deserve to be seen earlier. The following is the original content of Mason Nystrom , translated by Odaily Planet Daily.

Opening: The current environment is difficult

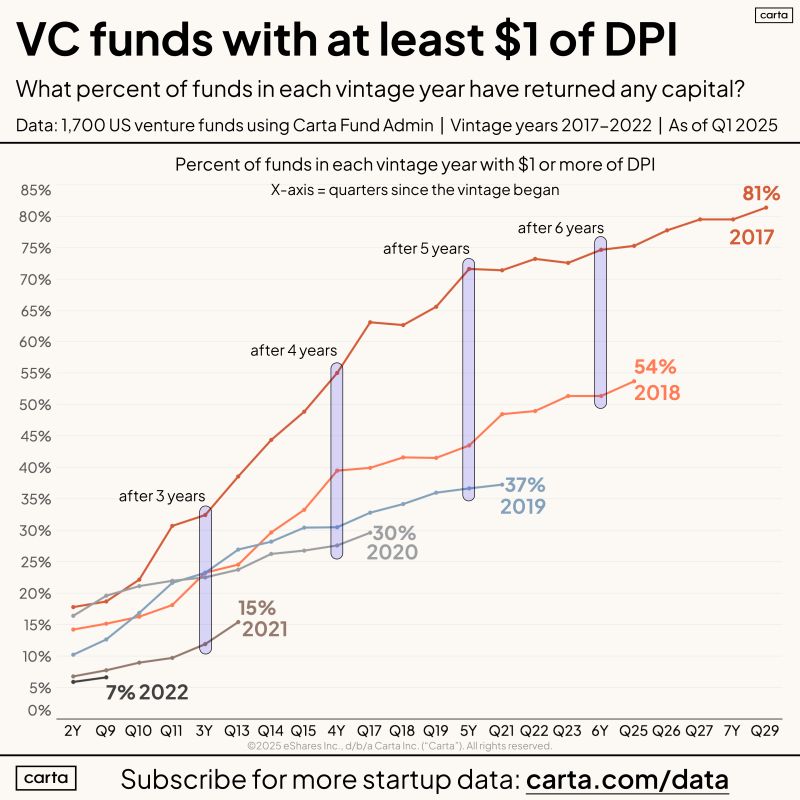

Fundraising is difficult because both the upstream DPI and LP capital levels face challenges.

Looking at the entire venture capital market, various funds have returned less money to LPs in the same period of time compared to the past few rounds. This in turn has led to a reduction in the available funds for existing and emerging VCs, ultimately making the fundraising environment for entrepreneurs more difficult.

What does this mean for crypto VCs?

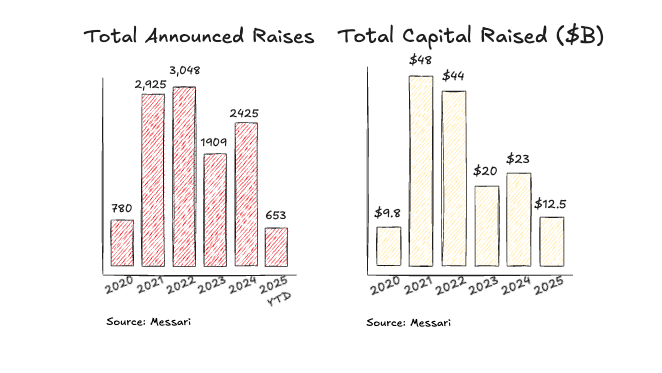

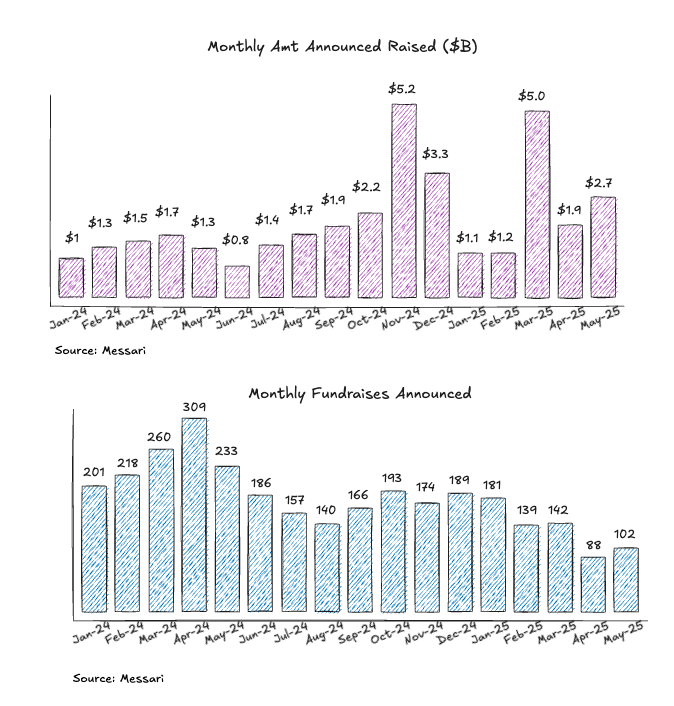

Transaction volume slows in 2025, but the pace of funding remains the same as in 2024

The decrease in the number of investments may be due to the fact that many VC funds are approaching the end of their operations, resulting in less available capital;

Some large funds are still driving large transactions, so overall capital deployment is on par with the past two years.

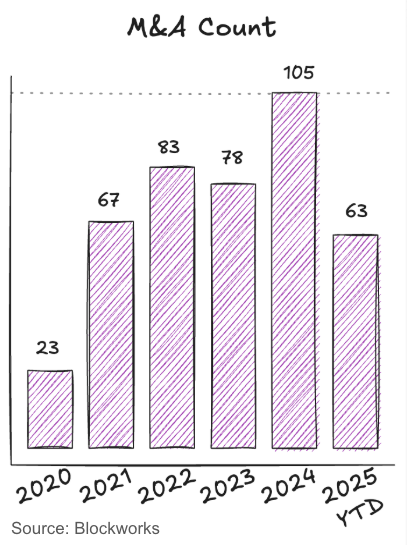

Crypto industry M&A activity has continued to improve over the past two years, benefiting liquidity and exit opportunities

Over the past two years, merger and acquisition (M&A) activity in the crypto space has continued to pick up, sending positive signals for market liquidity and exit opportunities.

Recent large-scale M&A cases including NinjaTrader, Privy, Bridge, Deribit, HiddenRoad, etc., show that the trend of industry integration is accelerating, and also provide valuation support and a basis for the exit of more crypto equity projects.

Trends behind changes in financing structure

Deal volume is stable, but concentrated in early stages

Over the past year, the number of transactions in the crypto industry has remained relatively stable overall, with some of the larger late-stage financing rounds completed (or announced) in the fourth quarter of 2024 and the first quarter of 2025.

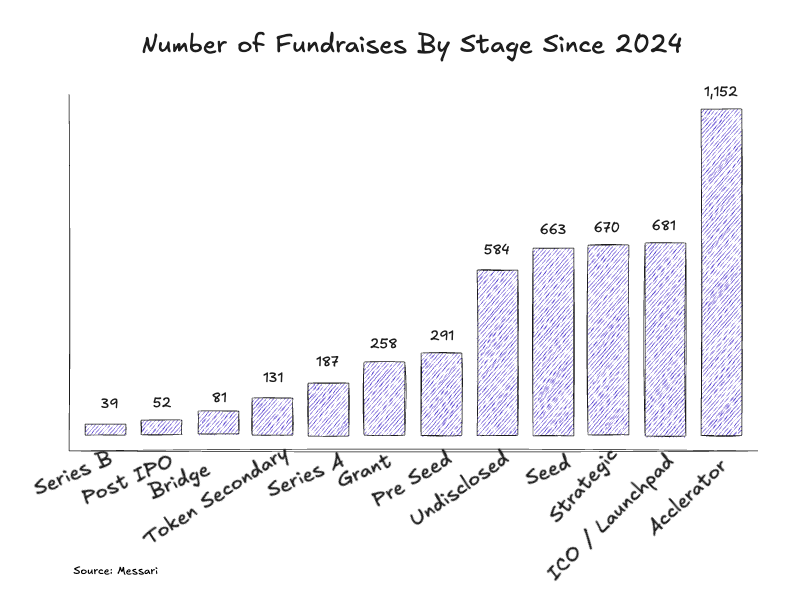

This phenomenon is largely due to the fact that a large number of deals are concentrated in early stages such as pre-seed, seed and accelerators, which typically have more available capital.

Accelerators and Launchpads become the main force (from the perspective of the financing stage)

Since 2024, a large number of accelerators and Launchpads have emerged in the market. This trend may reflect the tightening capital environment and the founders' preference to issue tokens in advance and launch projects in a more flexible manner.

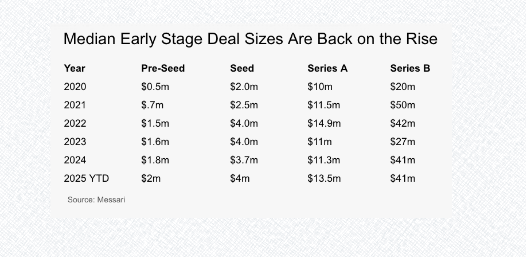

Median size of early-stage funding rounds is recovering

Pre-seed stage financing amounts continue to grow year-on-year, indicating that the market still has sufficient capital support at the earliest stages;

Median funding for Seed, Series A and Series B rounds has approached or returned to 2022 levels.

Three predictions for the future of crypto VC

Prediction 1: Tokens will become the main investment vehicle

The market is gradually shifting from the dual structure of "token + equity" to a single asset structure , that is, an asset carries both the value of the project and the logic of investment returns.

One asset, one value accumulation narrative.

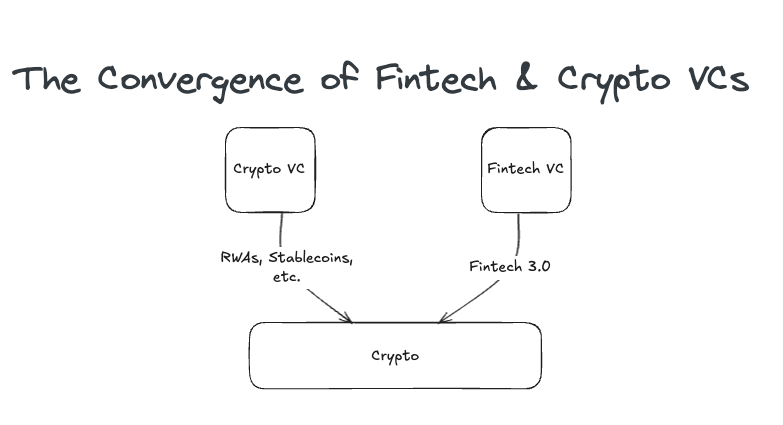

Prediction 2: Accelerated integration of Fintech VC and Crypto VC

Almost all Fintech investors are transforming into crypto investors. They are laying out the next generation of payment networks, new digital banks, and asset tokenization platforms—all of which run on crypto infrastructure.

Competition is approaching crypto VCs - crypto funds that have not yet ventured into areas such as stablecoins and on-chain payments will find it difficult to compete with experienced Fintech investors.

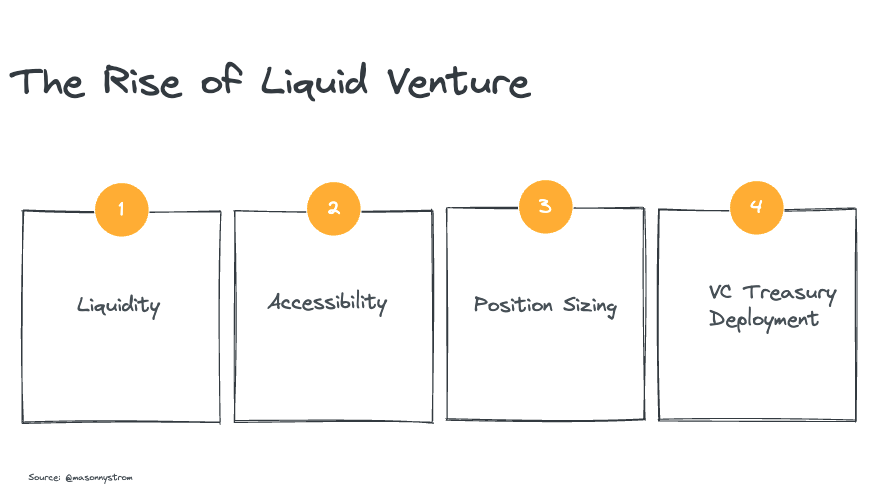

Prediction 3: The rise of “Liquid Venture”

The so-called "Liquid Venture" refers to a new form of obtaining venture capital opportunities in the tradable token market .

Liquidity: High liquidity of public assets/tokens means faster exit paths;

Accessibility: Traditional private VCs have a high threshold for participation, while Liquid Venture allows investors to buy target tokens directly in the market without having to “grab quotas” or participate through OTC.

Position management: As projects issue tokens at an earlier stage, small funds can also establish meaningful investment positions, while large funds can also deploy in high-market-cap tokens;

Treasury allocation: Many VC funds with excellent historical performance have long allocated their treasury to tokens such as BTC and ETH, and have thus obtained excess returns. In my personal judgment, in the future bear market cycle, this practice of early capital call and allocation of mainstream tokens will become the norm in the industry.

Crypto VC: The forefront of venture capital

Venture capital is moving towards a fusion of public and private capital markets, with more and more traditional venture capital funds choosing to participate in liquid markets (such as post-IPO holdings) or secondary market investments as companies generally postpone listing. Crypto is at the forefront of this change.

The crypto industry continues to drive innovation in capital market structure. As more and more assets are put on-chain, companies will also be more inclined to raise capital in a chain-first manner.

Finally, the results of crypto projects often show a stronger power-law distribution than traditional venture capital. The top crypto assets are competing to become the underlying infrastructure of sovereign digital currencies or new financial systems . The differences in such results will be greater, but it is the extreme power-law effect and high volatility of the crypto market that continue to attract capital to pursue asymmetric returns.