K-line กำลังกระโดด ผู้ดูแลสภาพคล่องอาจสูญเสียเงิน ทำไม AEUR สกุลเงินยูโรที่มีเสถียรภาพจึงเพิ่มขึ้นมากกว่า 200%

ต้นฉบับ - โอเดลี่

ผู้เขียน - หนาน จื้อ

4 ธันวาคมBinance ประกาศเปิดตัว Anchored Coins EUR (AEUR) เหรียญ stablecoin ยูโรและคู่การซื้อขายแบบเปิด นอกจากนี้ Binance ยังเปิดตัวคู่การซื้อขาย AEUR/USDT, BTC/AEUR, ETH/AEUR และ EUR/AEUR และเปิดตัวกิจกรรมที่ไม่มีค่าธรรมเนียม

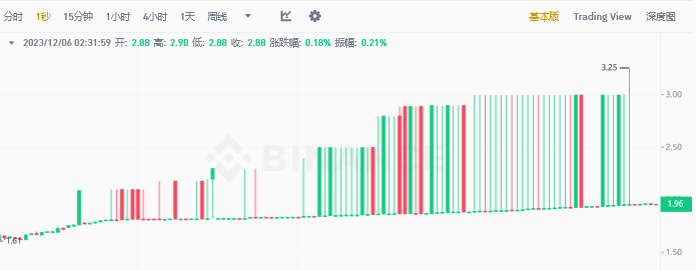

นับตั้งแต่จดทะเบียนใน Binance AEUR มีเสถียรภาพประมาณ 1.08 USDT (ณ เวลา 11:00 น. ของวันที่ 6 ธันวาคม อัตราแลกเปลี่ยน EUR/USD อยู่ที่ 1.0791) แต่เมื่อเวลาประมาณ 1:45 น. ของเช้านี้ AEUR เริ่มเพิ่มขึ้นฝ่ายเดียว โดยเพิ่มขึ้นสูงสุดในรอบแรกแตะ 3.156 USDT (เทียบเท่ากับ 2.9 ยูโร)เพิ่มขึ้นเกือบ 200%。

เคไลน์ดิสโก้

หลังจากคลื่นลูกแรกของแนวโน้มขาขึ้นสิ้นสุดที่ 2:02 AEUR ก็เริ่ม โหมดตีกลับ อีกครั้ง โดยแกว่งไปมาระหว่างประมาณ 1.9 USDT ถึง 1.07 USDT ซึ่งสามารถขึ้นลงได้มากกว่าสิบครั้งต่อวินาที ครั้งที่สอง กราฟระดับแนวโน้มเป็นดังนี้ ดังที่แสดง (ข้อมูล ณ เวลานี้ยังไม่สอดคล้องกับสภาวะเรียลไทม์เมื่อคืนนี้)

โอกาสในการเก็งกำไรที่พระเจ้ามอบให้?

เนื่องจาก Binance ได้แสดงรายการคู่การซื้อขายหลายคู่สำหรับ AEUR จึงมีความเป็นไปได้ที่จะมีการเก็งกำไรในกรณีที่ราคาผันผวนอย่างรุนแรง ภาพด้านล่างแสดงราคาคู่การซื้อขายที่เกี่ยวข้องในเวลาประมาณ 2 นาฬิกา ตัวอย่างเช่น 1 BTC มูลค่า 44,000 USDT สามารถแลกเปลี่ยนเป็น 26,000 AEUR และ 26,000 AEUR สามารถแลกเปลี่ยนเป็น 51,000 USDT โดยมีราคาที่แตกต่างกันอย่างมาก

เมื่อคืน ปริมาณการซื้อขายของคู่การซื้อขาย BTC/AEUR สูงถึง 28 BTC ใน 1 ชั่วโมงจริงหรือมีบางพื้นที่สำหรับการเก็งกำไร。

ทำไม AEUR ถึงพัง?

ณ ขณะนี้ เจ้าหน้าที่ของ Binance ยังไม่ได้เปิดเผยสาเหตุของสถานการณ์ที่ผิดปกติของ AEUR และมาตรการจัดการที่เกี่ยวข้องคือ เนื่องจากราคาของ AEUR มีความผันผวนอย่างมาก ธุรกิจการค้าของคู่การซื้อขาย AEUR ถูกระงับ ซึ่งไม่ส่งผลกระทบต่อธุรกิจการฝากและถอนเงิน” ตามสถานการณ์เมื่อคืนนี้ Odailyเก็งกำไรดังต่อไปนี้:

ตามที่กล่าวไว้ข้างต้น ราคามาตรฐานของ AEUR ควรอยู่ที่ประมาณ 1.08 USDT (อัตราแลกเปลี่ยน EUR/USD อยู่ที่ 1.0791) และหลังจากคลื่นลูกแรกของการล่มสลายที่เพิ่มขึ้น ขีดจำกัดล่างของช่วงความผันผวนบนและล่างของเส้น K ก็อยู่ต่ำกว่าเช่นกัน 1.08 USDT ในขณะที่ขีดจำกัดบนอยู่ที่ 1.9 USDTมีความเป็นไปได้ที่โปรแกรมผู้ดูแลสภาพคล่องจะป้อน 0 น้อยกว่าหนึ่งตัวและเปลี่ยนจาก 1.09 USDT เป็น 1.9 USDTซึ่งนำไปสู่การทำธุรกรรมหลายสิบครั้งต่อวินาทีระหว่างจุดราคาทั้งสองในที่สุด

ในช่วงระยะเวลาตั้งแต่การยกเลิกการเชื่อมโยงจนถึงการระงับการซื้อขาย คู่การซื้อขาย AEUR/USDT มีการซื้อขายรวม 11 ล้านดอลลาร์สหรัฐ จากข้อเท็จจริงที่ว่า 50% ของปริมาณการซื้อขายเสร็จสมบูรณ์โดยผู้ดูแลสภาพคล่อง การขาดทุนต่อคำสั่งซื้อ อยู่ที่ 0.82 USDTผู้ดูแลสภาพคล่องอาจสูญเสียเงิน 3 ล้านเหรียญสหรัฐ。

แน่นอนว่าความจริงยังคงอยู่ที่ทุกฝ่ายจะต้องสอบสวนและเปิดเผยต่อไป อย่างไรก็ตาม ประสิทธิภาพที่ไม่เสถียรของ Stablecoin ใหม่ดังกล่าวจะเกิดขึ้นในการแลกเปลี่ยนหลักๆ เช่นกัน ไม่ว่าจะเป็นข้อผิดพลาดในการดำเนินการด้วยตนเองโดยผู้ดูแลสภาพคล่องหรือความลึกของคู่สกุลเงินไม่เพียงพอ เหตุการณ์ดังกล่าวเกิดขึ้นได้ยากใน ตลาดการเงินแบบดั้งเดิมที่มีโครงสร้างพื้นฐานที่สมบูรณ์

อัพเดทความคืบหน้าของสถานการณ์

หลังจากเวลา 16.00 น. ของวันที่ 6 ธันวาคม ตามเวลาปักกิ่ง Binance ได้ออกแผนติดตามผลสำหรับเรื่องนี้ประกาศ,พูดจะช่วยทีมงานโครงการ AEUR ในการจ่ายค่าตอบแทนที่เหมาะสมให้กับผู้ใช้ที่ได้รับผลกระทบตามแผนที่เกี่ยวข้องแผนการจ่ายผลตอบแทนมีดังนี้:

ช่วงผู้ใช้ค่าตอบแทน:

ในช่วงเวลาตั้งแต่ 01:41:16 น. ของวันที่ 6 ธันวาคม 2023 (เวลาเขตแปดตะวันออก) ถึงเวลา 02:31:59 น. ของวันที่ 6 ธันวาคม 2023 (เวลาเขตแปดตะวันออก) (ต่อไปนี้จะเรียกว่าระยะเวลาการชดเชย) ผ่านทาง AEUR/ USDT ผู้ใช้ที่ซื้อ AEUR สำหรับคู่การซื้อขายสปอต BTC/AEUR, ETH/AEUR และ EUR/AEUR และไม่สามารถขาย AEUR บนแพลตฟอร์มสปอต Binance ได้สำเร็จ ก่อนเวลา 02:31:59 น. ของวันที่ 06 ธันวาคม 2023 (เวลาเขตแปดตะวันออก) ;

การชดเชยจะดำเนินการสำหรับตำแหน่ง AEUR ที่ซื้อสุทธิโดยผู้ใช้ที่เกี่ยวข้องในช่วงระยะเวลาการชดเชยที่ราคา AEUR ของแพลตฟอร์มสปอต Binance เวลา 01:41 น. ของวันที่ 06 ธันวาคม 2023 (ตามเวลาเขตแปดตะวันออก) (เช่น: 1 AEUR คือ 1.07999 USDT ).

วิธีการคำนวณค่าตอบแทน:

การคืนเงินสำหรับผู้ใช้ที่มีสิทธิ์รายเดียว = (ปริมาณการซื้อสุทธิ AEUR ของผู้ใช้ * ราคาซื้อเฉลี่ย AEUR ของผู้ใช้) – (ปริมาณการซื้อสุทธิ AEUR ของผู้ใช้ * 1.07999 USDT)

จำนวนการซื้อสุทธิของผู้ใช้ AEUR = จำนวนรวมของ AEUR ที่ซื้อบนแพลตฟอร์ม Binance Spot ในช่วงระยะเวลาการชดเชย - จำนวนรวมของ AEUR ที่ขายบนแพลตฟอร์ม Binance Spot ในช่วงระยะเวลาการชดเชย

ราคาซื้อ AEUR เฉลี่ย = รวม USDT เทียบเท่าของ AEUR ที่ซื้อบนแพลตฟอร์ม Binance Spot ในช่วงระยะเวลาการชดเชย / จำนวนรวมของ AEUR ที่ซื้อบนแพลตฟอร์ม Binance Spot ในช่วงระยะเวลาการชดเชย

ตัวอย่าง:

ผู้ใช้ A AEUR จำนวนการซื้อสุทธิ = (100 - 10) AEUR = 90 AEUR

ราคาซื้อเฉลี่ยของผู้ใช้ A AEUR = (100 AEUR / 26, 000 AEUR) * 43, 600 USDT / 100 AEUR = 1.6769 USDT

ในช่วงระยะเวลาการชดเชย ผู้ใช้ A ซื้อ 100 AEUR ผ่านคู่การซื้อขายสปอต BTC/AEUR เมื่อราคาถึง 26,000 AEUR จากนั้นขาย 10 AEUR ผ่านคู่การซื้อขายสปอต BTC/AEUR เมื่อราคา BTC สูงถึง 30,000 AEUR ยิ่งไปกว่านั้น เมื่อผู้ใช้ A ซื้อ AEUR ราคาของ BTC คือ 43,600 USDT

ดังนั้น จำนวนค่าตอบแทนทั้งหมดที่ผู้ใช้ A จะได้รับ = (90 * 1.6769 USDT) - (90 * 1.07999 USDT) = 53.7219 USDT

การออกค่าตอบแทน:

ผู้ใช้ที่มีสิทธิ์จะได้รับการชดเชยโทเค็น USDT ก่อนวันที่ 9 ธันวาคม 2023 ผู้ใช้สามารถไปที่บัญชี >ศูนย์รางวัลดูและแลก;

โทเค็นทั้งหมดมีอายุ 30 วันนับจากวันที่ออก ผู้ใช้ที่มีสิทธิ์จะต้องรับโทเค็นก่อนวันหมดอายุ