盘点即将迎来重大启动的7大协议

原文作者:Ignas

原文编译:深潮 TechFlow

加密货币市场正在回暖,问题来了:我们应该投资什么?

像 MUBI 这样的某些代币展现了高额的回报,但需要敏锐的智慧和密切关注社区趋势以便及时投资。然而,还有其他代币可以在较长时间内提供较高回报,因为它们涉及到 Web3 技术创新的发展。这些项目让我们可以在价格上涨之前发现它,然后进行投资。

以下是我关注的 7 个即将迎来重大启动的协议列表。我会关注这些项目即将推出的内容,也会阐释我为什么感兴趣的原因。

1.Frax V3 和 Fraxchain

在非营利性稳定币评级机构的排名中,Frax 被评为 D 级(不安全)。

根据报告,Frax 的不安全是因为由波动性较大的 FXS 代币抵押、过度依赖中心化资产(USDC)以及核心团队对投票权和货币政策的显著控制而存在风险。

与 DAI 一样,FRAX 也在 USDC 脱钩期间失去了美元挂钩,但目前,Frax 通过 v3 实现了转变。

Frax v3 正在逐步推出,sFRAX 已经上线。sFRAX 年化收益率试图跟踪美国联邦储备银行的存款准备金余额(IORB)利率,使用 IORB 预言机。基本上可以称为链上的「无风险利率」。

当前年化收益率为 5.4% ,约有 2200 万 FRAX 抵押。

随着 Frax v3 的推出,FRAX 正在转向远离算法稳定币的制度,并过渡到 100% 抵押。FRAX 将通过 Chainlink 预言机和治理批准与美元挂钩。

然后是 BAMM(借贷 AMM)的推出。Curve 创始人 Michael 称 Frax 的 BAMM 为「自 crvUSD 以来 DeFi 领域最大的创新」。

BAMM 允许用户在没有预言机的情况下对任何代币进行杠杆操作。它在其生态系统内运作,内部管理资产价格和流动性,以防止坏账并确保偿付能力。BAMM 允许有效利用资本,并增加对 FRAX 的需求。详情请查看这个帖子。

老实说,我仍然不太清楚它是如何工作的,所以希望在更多细节出来时进一步深入了解。

还有 FXBs,这些债务效用代币在特定时间后可转换为 Frax。您可以以折扣价购买 FXB,然后将其转换为 Frax,获得低风险利润。

有趣的是,Frax 和 Maker 从不同的起点出发,但都在从 USDC 转向拥抱 RWA。RWA 允许协议远离基于杠杆的稳定币循环需求,提供更可预测的收益。

另一个两个协议(Frax 和 Maker)相同的点是它们都在推出自己的原生区块链链。

MakerDAO 正在探索分叉 Solana,但 Frax 正在构建一个混合 OP 和 zk Rollup,并将使用 frxETH 作为 Gas 代币(但潜在地所有 Frax 稳定币都将得到支持)。我为 Frax 在去中心化方面的创新举措而鼓掌,这使 Fraxchain 与其他 L2 区别开来。Fraxchain 已在测试网上,您可以在 Frax Telegram 这里尝试它的教程。

我为什么会看好这个项目?

Frax 正在构建一个优质的区块链生态,随着更多升级和技术创新,veFXS 代币也会有更高的价值。

这些发展需要时间,所以我相信目前的市场价格(FXS 的市值为 6.47 亿美元)还没有受到即将到来的 RWA+L2+BAMM 升级的影响,之后如果预期到这些事件,价格可能会上涨。

sFRAX 已经上线,Fraxchain 在测试网上,BAMM/frxETH v2 代码正在进行中,预计在 2-4 个月内完成。

2.Synthetix Andromeda 版本和消除 SNX 的通货膨胀

Synthetix 正在逐步升级到 V3,以解决多个项目痛点,但其中有两个痛点对我来说尤为突出:

多抵押品定价: V3 与抵押品无关,允许支持任何抵押品来支持合成资产。V2 只允许使用 SNX。这将增加 sUSD 的流动性和 Synthetix 支持的市场。

Synthetix 贷款: 用户现在可以向系统提供抵押品以生成 sUSD,而无需承担债务池风险,也无需支付任何利息或发行费用。

本月即将发布的 Andromeda 版本包括推出 Core V3 和 Perps V3 Base,使用美元作为抵押品。

以前,Synthetix 依赖于 sUSD,但添加 USDC 后,应能吸引更多用户和 LP。然而,USDC 用于前端集成,Synthetix 将其封装到 sUSD 中,用于后端 Synthetix 合约。

Andromeda 是 Base 的独家产品,也是后续的重要升级,因为它将测试对作为抵押品的 USDC 的需求、LP 的收益以及产生的费用 / 交易量。

多个 Synthetix 生态系统协议(如 Polynomial、Kwenta、Infinex 和 dHEDGE)已确认在 Base 上部署,因此 Coinbase L2 将有更多行动。

我为什么会看好这个项目?

Synthetix DAO 投票决定将在 Base 上赚取的手续费的 50% 用于回购和烧毁 SNX,因此如果手续费较高,就会给 SNX 带来上涨压力。

更重要的是,Synthetix 的创始人已经提议终止 SNX 代币的通货膨胀。

最初,通胀是用来激励认购和增加流动性的,但随着时间的推移,其效果越来越差。该提议认为,通过停止通胀使 SNX 通货紧缩,更符合网络未来的发展,包括潜在的新发展和主要抵押品的转变。

因此,Base 部署是对 SNX 的一次重要考验,我将密切关注交易量和项目方提出的消除通胀的建议。

3.Instadapp 中的 Fluid

我看好 Instadapp 生态系统。

该团队已经推出了多款产品,如 Instadapp Pro、Lite 和 Avocado,但最重要的产品即将推出。

Instadapp 结合了 Uniswap、Maker、Compound、Aave 和 Curve 的优点,正在改变 Fluid 的借贷和交易方式。

下面是我在 twitter 上发布的关于 Fluid 的主题,以下是主要创新的简要概述。

贷款人可以用 ETH 进行高达 95% LTV 的贷款,并将清算罚金降低到 0.1%

部分清算只清算恢复到健康状态所需的金额

流动性层整合了所有协议的流动性,因此用户无需在每次升级时移除流动性

智能债务和智能抵押,从您的抵押品中获利,或从产生的交易费用中减少债务。因此,交易员现在可以在您的债务之上进行交易,而不是通过手续费来增加您的债务,债务会减少。

DeFi Made Here 的另一篇博文讲述了他为何认为「Fluid 是 DeFi 领域自 Uni v2 向 Uni v3 过渡以来最大的创新」。

我为什么会看好这个项目?

显然,作为 Instadapp 的形象大使,我是有带有个人偏见的。但我们不能忽视 Fluid 的重大创新。有了 Fluid(和 Avocado),Instadapp 将从「中间件」协议(其他 DeFi 协议的聚合器)转型,INST 令牌的作用也将得到加强。

INST 将以类似于 Aave 等其他借贷协议的方式管理 Fluid。

Fluid 预计将于 12 月中旬推出,黑客可获得 50 万赏金,并将于 1 月中旬向公众推出。

4.Eigenlayer + LRT

如果你是我的忠实读者,你就会知道我为什么看好 Eigenlayer,但现在我们有了更详细的时间线。

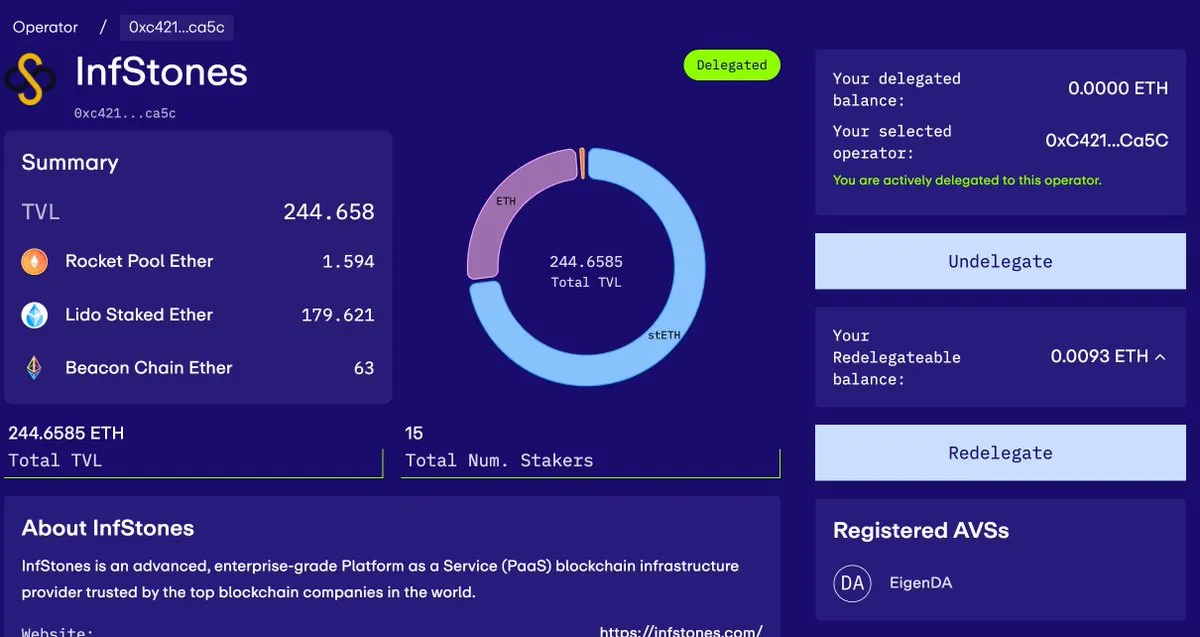

Eigenlayer 启动了第二阶段测试网络,为像您这样的 Restakers 提供了向运营商授权的机会。

这些运营商将验证主动验证服务(Actively Validated Services,AVS),这也是我看好 LRT(流动再质押)代币的基础。

现阶段,EigenDA 是第一个也是唯一一个 AVS。Rollups 可以整合 EigenDA 以提高吞吐量。

随着新的 AVS 的出现,我们将见证以太坊共享安全用例的扩展。下面是几个例子:

Ethos:以太坊重启 Cosmos 的枢纽

见证链: 勤勉证明防御和位置证明物理去中心化

Hyperlane: 链间消息传递(桥接),用于 Rollups 发行

Espresso Systems: 用于 Rollups 交易的去中心化排序器

Blockless: 网络中立应用(nnApps)的基础设施,可在任何 L1/L2 区块链网络中运行,不受特定区块链的限制。

多个 AVS 将推出自己的代币,以激励运营商和 Restakers 将 ETH 委托给它们。

但是,在决定支持哪种 AVS 时,情况就变得复杂了。作为 Restaker,您需要选择对 AVS 进行验证的运营商。

目前,测试网上有 107 个运营商,预计还会有更多运营商加入。那么,如何选择风险回报比最高的运营商呢?

这就是流动再质押代币(LRT)的用武之地。您可以将资金存入 LRT 协议,而不是直接通过 Eigenlayer 下注。然而,LRT 仍需要管理机构来选择运营商和管理风险。这意味着新的协议代币将空投并获得更高的收益。

有了 LRT,我们就有望获得以太坊定存收益(收益 5% )、AVS 的 Eigenlayer 再定存奖励(收益 10% )和 LRT 协议代币排放(收益 10% +)。在不考虑初始空投的情况下,ETH 的年收益率约为 25% 。

现在看哪个 LRT 协议会占上风还为时尚早,但似乎 Ether.fi 是领先的协议。

我为什么会看好这个项目?

再质押 + LRT 叙事,因为它具有我在探究项目中寻找的 3 个关键要素: 1)创新技术 2)铸造代币的机会 3)引人入胜的叙事。

我相信,再质押和实施 LRT 将使 ETH 成为有吸引力的资产,值得购买和持有。这反过来又会使 ETH 赶上 BTC 和另类币。不过,这并非是无风险收益!

不幸的是,我们还需要等待。第 2 阶段主网将于 2024 年上半年推出,第 3 阶段将于 2024 年晚些时候推出,届时将有更多的 AVS(真正的乐趣开始了)。

5.Uniswap V4

Uniswap V4 引入了「singleton」合约,将所有资金池(pool)合并在一个框架内,从而将创建资金池的 Gas 成本降低 99% ,并使多资金池交换更便宜。

事实上,您已经可以通过 Ambient Finance 尝试「singleton」合约的好处了。我总是惊讶于 Gas 费的低廉。

Uniswap v4 上榜的原因是「Hooks」,它使 Uniswap v4 更像一个平台。

Uniswap V4 中的 Hooks 本质上是可编程合约,可在流动性池生命周期的不同阶段发挥作用。这些 Hooks 可被视为「插件」,允许在资金池发生关键事件时执行定制代码。这可能包括链上限价订单、时间加权平均做市、将超出范围的流动性存入借贷协议、将 LP 费用自动复合到 LP 头寸等事件。

事实上,Instadapp 已经预告了一种无清盘借贷协议,使用 v4 Hooks 子,清盘罚金为 0% 。

我为什么会看好这个项目?

使用 V4 挂钩的 Uniswap 将成为 DeFi 的流动性中心,甚至比现在更强。要知道,协议在启动时都会面临流动性问题,但有了 Hooks,开发人员就可以使用 Uniswap 作为流动性,尝试并启动他们自己的协议 + 新托币。

这反过来又会给 Uniswap 带来更多的流动性,可能会吸引其他 DEX 的流动性。

由于 V4 将在商业许可证下推出,因此直到 2027 年才允许分叉。随着多个 dApp 在 Uniswap 上推出,Uniswap 可能会获得更多市场份额。希望 Uniswap DAO 和构建者社区能找到向 UNI 代币持有者分配价值的方法。

但我们必须等到 2025 年第一季度坎昆以太坊升级上线(其中包括 EIP-1153)之后: 瞬态存储,这对 Uniswap v4 降低网络成本至关重要。

也许在坎昆升级期间押注 UNI 是一个不错的短期策略。

更多信息,请点击此处。

6. Stacks 中本聪升级

我对 Stacks 的观点很简单,我最近在 X 上分享过。

Stacks 生态系统代币已经表现不错,主要有三大创新:

Stacks Nakamoto 发布: 将把 txs 速度从目前的 10 m-30 m 降低到 ~ 5 s

sBTC:非托管、信任最小化的 BTC 美元挂钩,允许智能合约写回比特币

BTCfi 的增长: Ordinals, BRC 20 等。

Stacks 预计 2024 年第一季度推出升级版。

最大的受益者可能是 Alex Lab,它是 Stacks DeFi 的流动性中心,提供 BRC 20 订单簿交易、BTC 和 BRC 20 与比特币之间的桥接以及 EVM 链。

我为什么会看好这个项目?

如果你读过我上一篇关于加密货币繁荣生态系统的三大因素的文章,你就会发现 Stacks 符合所有三个条件,因为用户的注意力和资金都集中在少数资产上,还有更多代币即将推出。

加密货币繁荣生态系统的三大因素:

技术创新

代币铸造机会

引人入胜的叙事

将交易速度降低到 5 s 并带来 BTC 流动性,再加上 BTCfi 的叙事,让我对 Stacks 的未来相当期待。

另外,与独特的价值主张相比,Stacks MC 的价格相对较低,但 Alex Lab 就像是 STX 的杠杆赌注。2025 年第一季度升级也正在路上。

7.单片式 L1 的增长:Fantom 2.0 升级版和 SEI V2

让我解释一下为什么要把 FTM 和 SEI 放在一起。原因有二:

首先,模块化与单片式扩展方法是本轮牛市中最有趣的叙事之一。越来越多的人对通过 L2 解决方案扩展以太坊感到失望。

问题包括对去中心化、安全性和更糟糕的用户体验的妥协,以及 L2(Blast) 用于发放空投的方法。

此外,L2 代币对投资者来说缺乏价值主张。最近来自财政部基金的 ARB「staking」显示了 L2 DAO 在代币经济方面的创造力的局限性。

随着安全性和网络混淆性的提高,未来的情况也许会有所改善,代币经济学也将随着真正的原生分权去中心化 L2 以及有望实现的收入共享而得到改善。

但在现阶段,即使有了 L2,交易费对于较低的交易额度来说也太贵了。我们需要 L3 或 L 4 。

但这些技术的变革可能不会在这轮牛市中出现。如果我们想要获得最大的安全性,我们最终将在以太坊上支付高昂的 Gas 费用,或者我们将通过第三方桥接器将资金从一个 L2 轮换到另一个 L2,从而去获得空投,因为没有人愿意在 Optimistic rollup 上等待 7 天的提款时间。

现在,单一区块链也有自己的问题。通过有限的节点数量或高昂的硬件成本对去中心化的妥协是最重要的。

但自从以太坊停止关注或者放缓 L1 的扩展后,以太坊的模块化设计能否在当前单体区块链改进去中心化之前解决这些问题呢?

这就是 Fantom 与 Fantom Sonic 升级的作用所在。它带来了每秒 2 k+ txs 和 1.1 s 的终结时间,无需分片或 L2。该团队的目标是新一代 dApp,如 GameFi。

我为什么会看好这个项目?

我看好以太坊,也看好 Solana,因为它是以太坊的主要竞争者。但是,Fantom 正在进行新的创新,以从单片机扩展叙事中获益。

明年春天,我希望能看到 dApps 真正在 Fantom 上构建,这将是最重要的后续因素。

然后是 SEI V2

我知道很多人都讨厌它。或者有些人甚至无法将 SEI 与 SUI 或 Aptos 区分开来。但我对 SEI(与 FTM 一样)保持开放的态度,因为它完全符合我对模块化与单体化发展的看法。

您可以阅读 SEI v2 的全部升级内容,但其中最重要的是

支持并行化的 EVM,这将有利于 dApp 生态系统的发展,因为开发人员可以将 EVM 区块链上的智能合约重新部署到 SEI 上。

390 毫秒的终结时间(已在主网上线)

12.5 k 的理论 TPS

我为什么会看好这个项目?

在上一轮牛市周期中,L1 速度是最重要的,但我认为这一轮牛市也会像上一轮一样爆发 L1 大战。

与 Fantom 一样,Sei 也是为扩展技术生态愿景而打造的,但它目前的市值是三者中最低的,而且直到 2025 年第三季度才会开始大量解锁代币。