SignalPlus Macro Research Report (20231117): The U.S. economy slows down, but asset prices remain strong

Yesterdays macro market roughly continued the trend of the previous day. Although more data showed that the U.S. economy may slow down more significantly in the short term, asset prices remained strong; the number of initial jobless claims in the U.S. rebounded by 13,000 to 231,000 last week people, the highest level since August. As the job market continues to cool, the number of continuing claims for unemployment benefits has also increased for eight consecutive weeks, reaching the highest level since November 2021.

Other data are also weak. U.S. industrial production fell 0.6% month-on-month in October, the weakest data in the past year. Capacity utilization, manufacturing output and automobile sales all declined; the NAHB housing market index also fell 6 points in November. to 34, falling for four consecutive months and the lowest since November last year.

On the stock side, although the overall index rose slightly, Walmart management warned that as consumers tightened their spending, sales price increases have stalled and may even reverse (i.e. deflation) in the next few quarters. The company pointed out that at the end of October Walmart shares fell 9% yesterday after two weeks of deeper sales declines and a more cautious view of consumers than 90 days ago, echoing concerns from other retailers such as Target and Home Depot.

In addition, Alibaba suddenly announced that it would suspend its cloud business spin-off plan, saying that the decision was due to the expansion of U.S. restrictions on Chinas chip exports. This statement caused investors to be extremely worried about the prospects of the companys grand plan, causing the stock price to fall by 10%. Management announced that it will focus on existing business growth and will pay a total annual dividend of US$2.5 billion for the first time. This is relatively rare for technology companies and may set a relatively pessimistic tone for the Chinese and Hong Kong stock markets, offsetting the recent leadership between China and the United States. part of the optimism brought about by the high-level meeting.

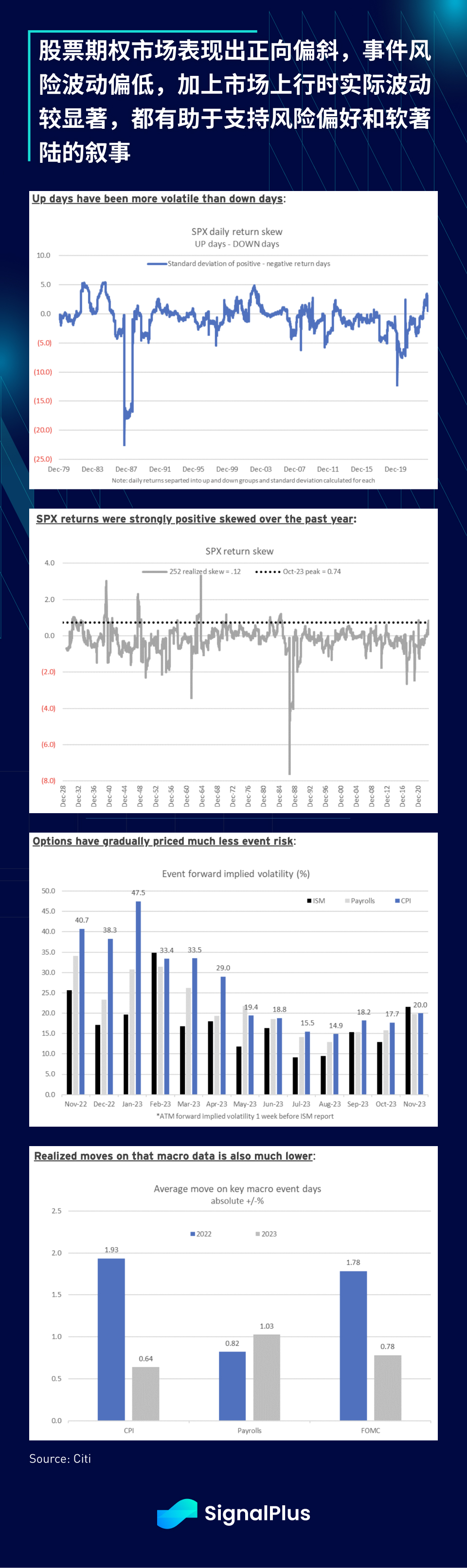

Nonetheless, the U.S. stock options market continues to paint a healthy outlook for the stock market, with low volatility skew, more significant actual moves on up days than down days, and low realized volatility and event risk, indicating investors are embracing the soft side. Landing prospects, with a calmer attitude, this narrative is expected to continue for the foreseeable future as long as trends in the job market and consumer spending remain unchanged. Therefore, stock market bears may have to hibernate for a while longer, and soon It may have to wait until after the end of the year.

On the cryptocurrency front, an interesting chart from Bloomberg shows that the recent rally has been driven primarily by Asia (South Korea), while the U.S. is still trying to regain control of the cryptocurrency narrative; will Asia continue to drive cryptocurrency development in the coming year? ? Or will the tables turn once spot ETFs are approved? let us wait and see...

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com