Wall Street's calculations: What will they buy from Ripple for $500 million?

- 核心观点:Ripple获巨额融资,估值达400亿美元。

- 关键要素:

- Fortress、Citadel领投5亿美元。

- 公司转型推出稳定币RLUSD。

- 持有347亿XRP,价值超800亿。

- 市场影响:提振支付赛道,推动稳定币应用。

- 时效性标注:中期影响。

Original author: Seed.eth

Original source: BitpushNews

In November 2025, Ripple Labs announced a new round of strategic funding of $500 million, boosting the company's valuation to $40 billion. This was the crypto finance company's first public fundraising in six years and its largest capital injection since its Series C funding round in 2019.

More importantly, the capital faction behind this round of financing is extraordinary: two Wall Street giants, Fortress Investment Group and Citadel Securities, led the investment, along with well-known institutions such as Pantera Capital, Galaxy Digital, Brevan Howard, and Marshall Wace.

For those who have heard of Ripple, this can be considered a "comeback"—is this still the same Ripple that was once mired in SEC lawsuits and even considered a "zombie company"?

From "storytelling master" to "compliance disaster zone"

Founded in 2012, Ripple is one of the oldest projects in the crypto world. Its core technology is the XRP Ledger, a decentralized ledger designed specifically for cross-border payments. Ripple develops its payment and clearing system based on this technology. Its token, XRP, was a global phenomenon in 2017-2018, ranking among the top three in market capitalization, second only to Bitcoin and Ethereum.

However, as the price of the cryptocurrency plummeted and the facts of the "inflated" partnership came to light, Ripple's narrative of "bank-grade partnerships" began to collapse.

During this period, Forbes published an article pointing out that Ripple's core business model may be a "pump and dump" scam: Ripple uses its massive holdings of XRP to buy partnerships, creating a false sense of prosperity, and uses vague statements to circumvent regulations. Its ultimate goal is not to truly promote the technology, but to inflate the value of the tokens it obtains for free through marketing and hype, so that company insiders can eventually cash out and profit.

In December 2020, the regulatory hammer fell.

The U.S. Securities and Exchange Commission (SEC) has sued Ripple for "unregistered sale of securities," accusing it of illegally raising more than $1.3 billion through XRP.

This is the most important regulatory battle in the crypto industry.

The lawsuit triggered a devastating chain reaction: major exchanges such as Coinbase and Kraken quickly delisted XRP; long-term partner MoneyGram terminated its cooperation; and the price of XRP plummeted by more than 60% in the following month. Ripple not only suffered business damage but was also completely blacklisted from compliance.

Strategic transformation

This protracted legal battle, which lasted for several years, cost Ripple nearly $200 million in legal fees, but it also bought them crucial breathing room and some favorable court rulings, giving them valuable time for strategic transformation.

In 2024, it officially launched RLUSD, a stablecoin pegged to the US dollar, focusing on compliance and targeting financial institutions for payments and settlements. Unlike USDT and USDC, RLUSD is not intended to be a stablecoin between exchanges, but rather to attempt to enter traditional credit card and cross-border clearing systems.

In 2025, Ripple announced partnerships with Mastercard, WebBank, Gemini, and others to use RLUSD for real-time credit card settlements, becoming the world's first on-chain stablecoin to be integrated into the card network system.

This not only opens up B2B channels for stablecoin applications, but also paves the way for Ripple to connect with the real financial world.

To build a complete on-chain financial capability, Ripple carried out a series of targeted acquisitions between 2023 and 2025:

- The acquisition of Metaco provided institutional-grade digital asset custody technology, laying the foundation for serving large financial institutions.

- The acquisition of Rail provided access to a stablecoin issuance and management system, accelerating the launch of RLUSD.

- Acquiring Hidden Road completes the final piece of the puzzle in terms of institutional credit networks and cross-border clearing capabilities.

Through these acquisitions, Ripple's system capabilities have expanded from simple cross-border payments to a full-stack financial infrastructure encompassing stablecoin issuance, institutional custody, and cross-chain clearing.

The truth behind the 40 billion valuation

On the surface, Ripple's transformation path seems to be getting wider and wider.

But veterans in the capital market see a completely different picture.

To understand the true logic behind this funding round, one must see the essence of Ripple: a massive "digital asset treasury."

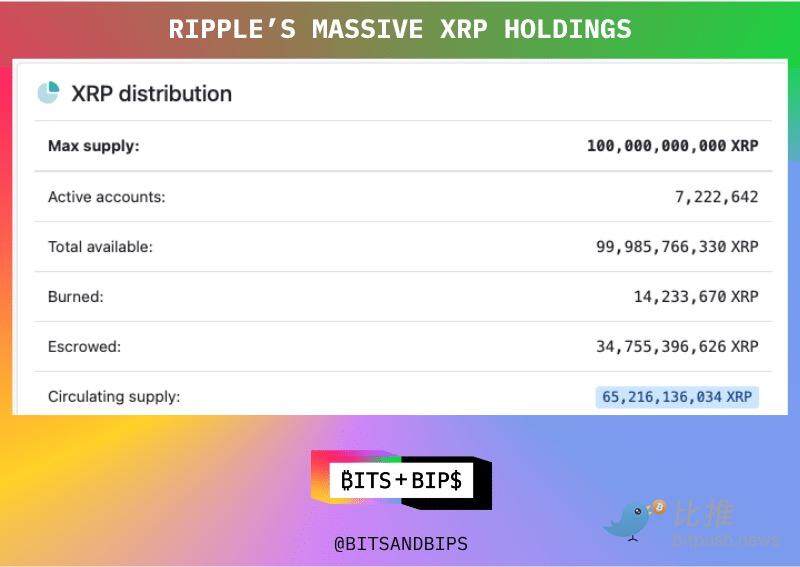

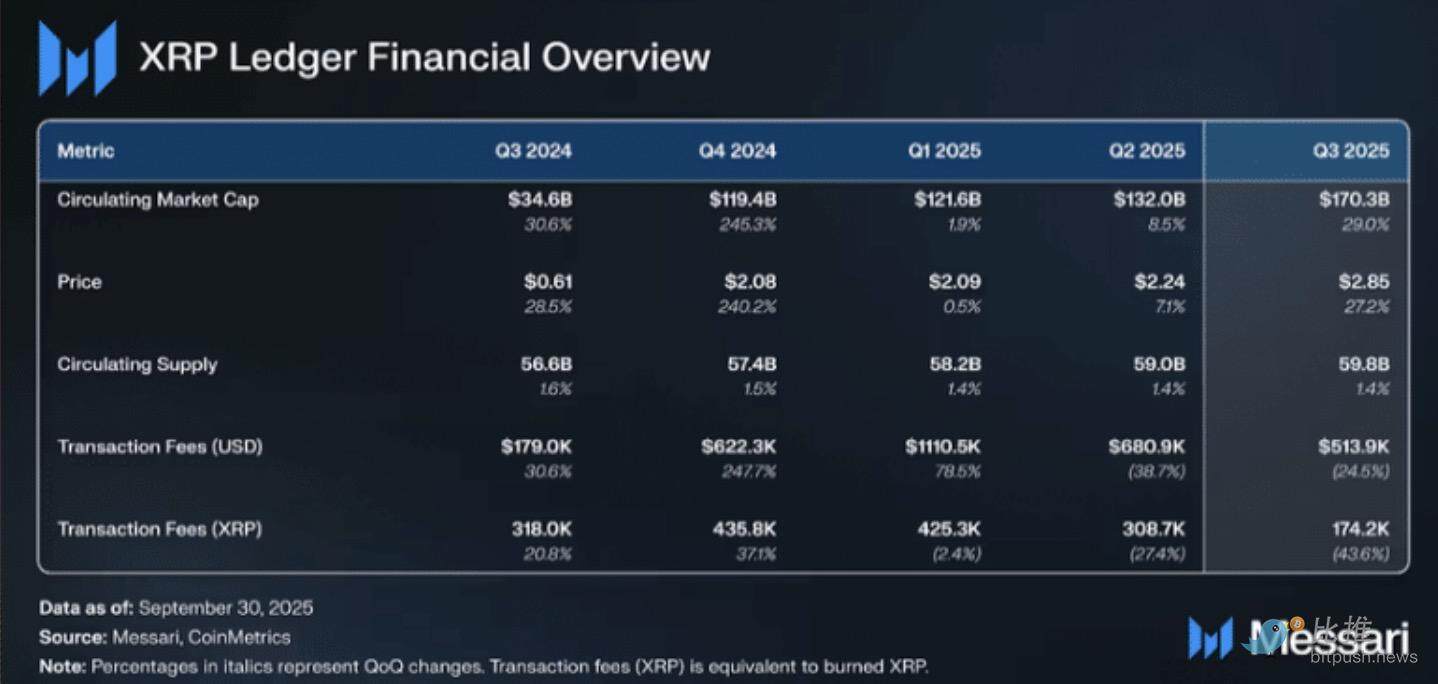

At XRP's genesis, 80 billion of the 100 billion tokens were entrusted to Ripple for custody. As of now, the company still holds 34.76 billion tokens, with a notional value exceeding $80 billion at market price—twice its initial funding valuation.

According to several venture capitalists, the $500 million deal is closely related to the purchase of Ripple's XRP holdings, and it is likely that the purchase was made at a price far below the spot price.

From an investment perspective, investors are essentially buying an asset at 0.5 times mNAV (market capitalization to net asset value). Even with a 50% liquidity discount applied to XRP holdings, the value of these assets remains in line with the company's valuation.

"Even if they can't successfully build a business themselves, they can simply buy another company," a person familiar with the matter told Unchained.

One venture capitalist stated, "This company has no value other than holding XRP. Nobody uses their technology, and nobody's interested in it on the network/blockchain."

Another community member stated, "Ripple's equity itself may not be worth much, certainly not $40 billion."

One participant revealed the real logic: "The payment sector is too hot right now, and investors need to bet on multiple horses in the sector."

Ripple is just one example—a horse that may have mediocre skills, but has an extremely abundant supply of XRP.

For Ripple, this is a win-win situation:

- Solidify valuations: "Officialize" the $40 billion valuation of the private equity market, providing a pricing benchmark for early investors' exits.

- Avoid selling pressure: Use cash from financing to make acquisitions to avoid the impact of selling XRP on the market.

Ripple co-founder Chris Larsen's personal wealth also jumped to approximately $15 billion.

From this perspective, Ripple's story becomes a classic financial story: about assets, valuation, and liquidity management.

From the SEC dock to Wall Street boardrooms, Ripple's journey is a microcosm of the crypto industry's shift from idealism to realism. If Ripple represented the pinnacle of "narrative economics" in the past, then today it demonstrates how projects can achieve a "soft landing" by relying on their raw capital strength when the tide recedes.