Original article by Odaily Planet Daily ( @OdailyChina )

Author|Wenser ( @wenser2010 )

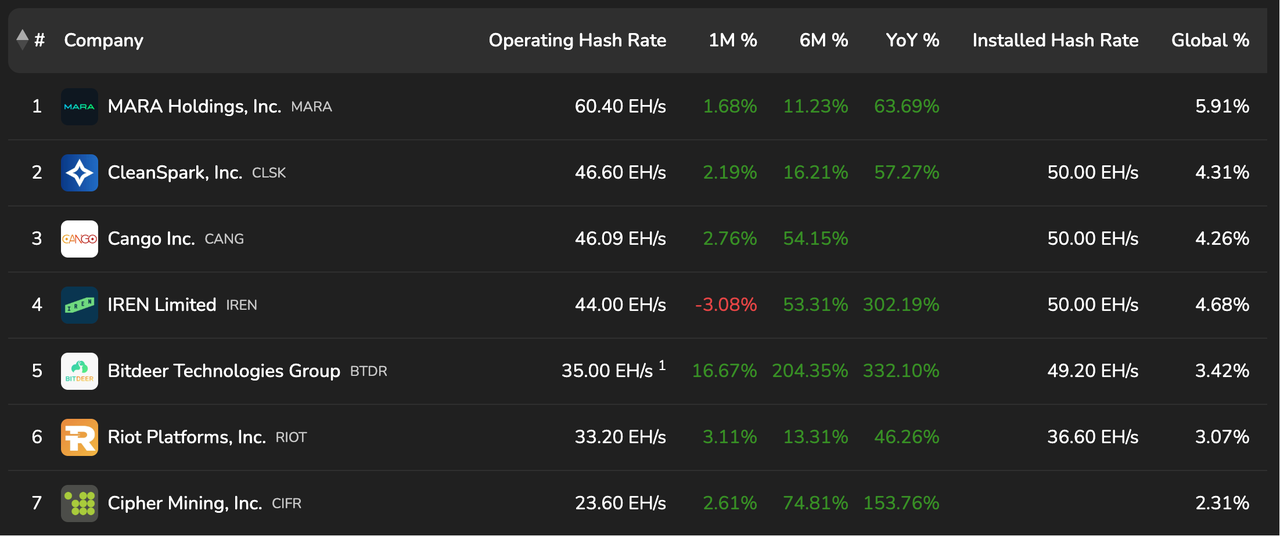

Benefiting from multi-billion dollar orders from internet giants like Microsoft, Google, and Amazon, the stock prices of crypto mining companies such as IREN and Cipher have recently surged. However, unlike these traditional mining companies that are focusing on transforming into AI data centers, one crypto mining company, ranked among the top three in global computing power, has chosen to quietly expand its energy services while maintaining its crypto mining business. This is the subject of our discussion today—the "new crypto mining company," Cango Inc.

On the first anniversary of Cango's business transformation, Odaily Planet Daily conducted another in-depth interview with Juliet Ye, spokesperson for the Cango team, lasting nearly two hours. The interview not only provided a deep understanding of Cango's past business transformation opportunities and current business structure, but also explored some of Cango's future development plans and industry assessments of crypto trends. The following is the full interview, with some content edited for better readability.

Note: The interviewer was Wenser, a reporter from Odaily Planet Daily, and the interviewee was Juliet Ye, Director of PR & IR (Investor Relations) at Cango.

Q1: What is Juliet Ye's story with Cango, and what is the current team composition of Cango?

A: I joined the company shortly before its IPO in 2018. At that time, Cango was a leading company in the traditional auto finance industry. Prior to that, I worked at the Wall Street Journal for 5 years, then joined a media and public relations firm, and finally chose to join Cango to start the second spring of my career. It is worth mentioning that although Cango only officially transitioned to the BTC mining industry last November and is a "new face" in the crypto mining circle, it is actually a mature company that has been established for 15 years (founded in 2010) and listed on the US stock market for more than 7 years (listed in 2018).

After the transformation, Cango divested its traditional auto finance services business, and the team size has been streamlined from a peak of 4,000 people to a current global team size of around 100 people, with a more "small but beautiful" organizational structure, mainly consisting of a Bitcoin mining operations team and the middle and back-office support departments of the listed company.

Q2: Has Cango's cryptographic transformation been completed?

A: Without a doubt, we have transformed into a full-fledged BTC mining company, and two landmark events can prove this:

Firstly, regarding business operations. In May of this year, Cango sold off all of its traditional auto finance-related businesses in the Chinese market. Currently, we have no business operations in China; our main business is BTC mining overseas.

Secondly, at the organizational level, a new management team, including CEO Peng Yu, joined the company in July of this year. The core team possesses extensive experience in the operation and investment of the digital currency industry. For Cango, the transformation into a Bitcoin mining company is a starting point, not an end point; we are moving towards a grander direction— becoming a comprehensive energy service solutions provider .

Q3: What prompted Cango to shift its focus to BTC mining?

A: The transformation stemmed from the keen insight of the original team at Cango. After its listing in 2018, the Chinese auto market experienced its first negative growth; coupled with the pandemic, the overall consumer market continued to shrink.

The original management team realized that transformation was imperative. In the following years, Cango explored both the new car and used car trading sectors, but failed to find a suitable second growth curve.

The key turning point was Cango's investment in Li Auto.

In 2018, despite skepticism from outsiders, Cango invested in Li Auto. In 2022, Cango completed the capital recovery of its investment in Li Auto, achieving a return of more than 6 times. As a result, Cango not only accumulated sufficient capital for transformation but also inspired the team to explore the new energy vehicle sector.

In 2023, during an inspection of energy projects in the Middle East, the original management team of Cango came into contact with the Bitcoin mining business by chance and realized that it could become the company's entry point into the new energy field. Ultimately, based on years of industry experience and risk assessment, they went all in with $500 million in funding to transform the company, which led to the emergence of Cango, a new cryptocurrency mining company ranked among the top three in the world in terms of computing power.

From the outside, Cango may seem like an outsider in the BTC industry, but in reality, "change" is ingrained in Cango's DNA, and every step of Cango's transformation is a choice made based on past experience.

Q4: Many cryptocurrency mining companies are transforming into AI data/computing power centers. What is Cango's view on this? Does it have any corresponding plans for the future?

A: Our intuitive feeling is that the crypto market's hot topics change very quickly, which is different from Cango's current pace. For us, completing the business transformation and maintaining stable operation of all businesses within a year is already quite an achievement .

Of course, we have also noticed that many traditional mining stocks have already been repriced thanks to the HPC (High-Performance Computing) concept. But for Cango, the principle has always been to prioritize business, focus on long-term healthy development, and not blindly chase after conceptual dividends.

Therefore, after ensuring a firm foothold in the BTC mining field, we can then demonstrate the feasibility of exploring directions such as AI HPC data centers through small-scale experimental projects.

At this stage, BTC mining remains the core business of Cango. Of course, we are also working hard to develop new businesses, including small-scale pilot projects in energy and AI HPC. These projects are currently in the process of being promoted and evaluated, and we look forward to officially reporting to everyone soon.

Cango's vision is to create a dynamic and efficient computing platform that enables on-demand switching between BTC mining and AI inference, maximizing the use of energy and infrastructure.

Q5: What is Cango's moat (or competitive advantage) in the BTC mining field?

A: First, the business divestiture was thorough. After selling its China business in May, Cango has completely left the traditional auto finance industry and focused on BTC mining, which can be described as a clean slate.

Secondly, the team is highly efficient and lean. The reduction from thousands to around 100 people has resulted in a significant improvement in organizational efficiency, making it more adaptable to the pace of the crypto industry.

Thirdly, our operations management team is professional. We have already established our own operations team to remotely monitor our mining farms and mining operations, preparing for a long-term transformation in the future. Our goal is not simply to compete on BTC mining hashrate, but to maintain a globally leading hashrate level while achieving the highest hashrate operational efficiency.

https://bitcoinminingstock.io/hashrate

Our past data also shows that the professionalization of our operations team has begun to bear fruit: In July (the first month of operation with 50 EH/s computing power), our computing power online rate was only 81%; in August, this figure had increased to 87%; and in the recently released October operations report, our computing power efficiency has reached 92%, which is at the leading level in the industry.

Fourthly, the operational logic. Cango adopts a dual leverage model of "mining without selling + BTC collateralized lending," paying monthly interest instead of the full electricity cost, resulting in higher capital efficiency and lower operating costs.

Q6: Based on the information above, Cango's stock price appears slightly undervalued. What are the possible reasons for this? What are the subsequent financing plans?

A: Judging from its stock price performance, Cango has indeed lagged behind other traditional mining companies recently. This is partly due to Cango's own choices, but there are also some objective reasons. Of course, despite this, Cango's stock price has still maintained an increase of more than 20% over the past year.

Stock price on November 5th

In terms of proactive selection, Cango, as a company with a real business background, will focus more on consolidating its business fundamentals first, and then releasing information to the market when all preparations are in place, rather than telling a story first, trying to make the stock price perform, and then passively realizing the gains.

Objectively speaking, unlike other established mining companies, Cango entered the crypto industry as a newcomer and challenger. Furthermore, our frequent expansion efforts inevitably draw scrutiny from the outside world. However, after witnessing our consistent monthly output, continuous share purchases, and ongoing communication with the outside world – all actions demonstrating our commitment to "promises made and promises kept" – the market's attitude is gradually changing. Building a strong relationship of trust takes time, but we have the patience and confidence. As a company that respects market principles, Cango can promise not to use any unconventional methods to inflate its stock price. All current market transactions and performance reflect the true state of the market. What we can do is ensure the stable operation of our core business while gradually implementing energy and AI-related projects, allowing the market to see our progress and build confidence.

As for specific financing plans, since our BTC mining business adopts a "light model," it does not require large-scale financing, as leverage is sufficient. However, to achieve the second step of development mentioned earlier, namely the development of energy and AI projects, we plan to seek financing from the capital market.

We have already initiated the corresponding financing preparations. Based on our progress in energy and AI projects, we will launch a financing round at an opportune time. The specific financing method will take into account various factors, with the interests of the company and its shareholders being the top priority.

Q7: Recently, some DAT holding companies have gradually reached a stalemate, with mNAV consistently below 1. What are the main reasons for this? What insights or plans does Cango have regarding balancing market capitalization and BTC holding value? As a company solely focused on BTC mining, how does Cango enhance its risk resistance capabilities?

A: In my opinion, the core reason is that some DAT companies have not focused on creating intrinsic value. Some bandwagon players—whose original businesses have nothing to do with cryptocurrency and will not be substantially tied to it in the future—are unlikely to generate sustainable value.

In contrast, Cango is not a pure DAT company, but a "crypto production and reserve enterprise"—mining BTC and storing the BTC in a treasury for reserves.

Our core strengths lie in the efficient use and allocation of computing power, as well as cost optimization. As BTC mining capacity is released, Cango's market capitalization will gradually align with its intrinsic asset value.

In balancing market capitalization and holding value, Cango, whose main business is mining, can "only hoard and not sell" while improving the utilization efficiency of its infrastructure, thereby achieving stable performance in data revenue and reasonable control of market expectations.

In short, the Bitcoin mined by Cango during this cycle is intended to serve as initial capital for the next cycle, and we believe in the long-term upward value of Bitcoin. Based on this reality, we are not currently engaging in any other active management of our Bitcoin reserves .

Regarding enhancing risk resistance, we remain convinced of BTC's status as "digital gold," and its role as a stable value anchor is more reliable. Other cryptocurrencies and gold reserves are not currently a priority for Cango, which has just completed its transformation. Of course, we do not rule out considering measures to enhance risk resistance and increase returns in the future when our balance sheet is more relaxed, but there are no such plans at this stage.

From a business perspective, Cango recognizes BTC as the best value benchmark currently available. We believe it can bring sustained returns to listed companies. This is our first step, and future expansion into the energy and AI HPC sectors will unfold on this solid foundation.

Q8: It's been a year since the transformation. What interesting things happened during the process that you can share with our readers?

A: Based on my personal experience, the most interesting thing is that people I used to connect with in the automotive industry have started asking me about the dynamics of the crypto industry. From the traditional auto finance industry to the crypto mining field, the industries they work in have undergone tremendous changes, yet they have become windows into understanding the crypto industry.

This has led us to a new observation— there is a certain "perspective difference" between the "inside" and "outside" of the cryptocurrency industry.

For a long time, the crypto industry has had a certain self-enclosed and exclusive nature, always feeling like it lingers outside the mainstream.

However, there is no natural barrier between TradeFi and DeFi; it's just that they didn't know much about each other before.

Cango's unique value lies in this: we possess both the industry experience and accumulated expertise of traditional sectors, as well as the gains and lessons learned during our own transformation, and we have our own ideas and convictions for the future. On the one hand, we can provide traditional industry businesses and practitioners with our perspectives and reference information; on the other hand, we are also indirectly sharing dynamic information about the cryptocurrency market and the entire industry with the outside world and traditional industries.

Therefore, it is clear that the future will inevitably involve the combination of TradeFi (traditional finance) and DeFi, and this integration will be a welcome one. It's not that the two will necessarily be isolated or separate; that's impossible. It will certainly be a fluid process.

Breaking down that "Berlin Wall" that never existed in the first place may be our greatest mission.

- 核心观点:灿谷转型BTC矿企并布局能源服务。

- 关键要素:

- 彻底剥离汽车金融业务。

- 采用只挖不卖加抵押借贷模式。

- 算力在线率达92%行业领先。

- 市场影响:为传统企业转型加密领域提供新范式。

- 时效性标注:中期影响