SignalPlus Macro Research Report (20230925): U.S. stocks face the risk of a correction

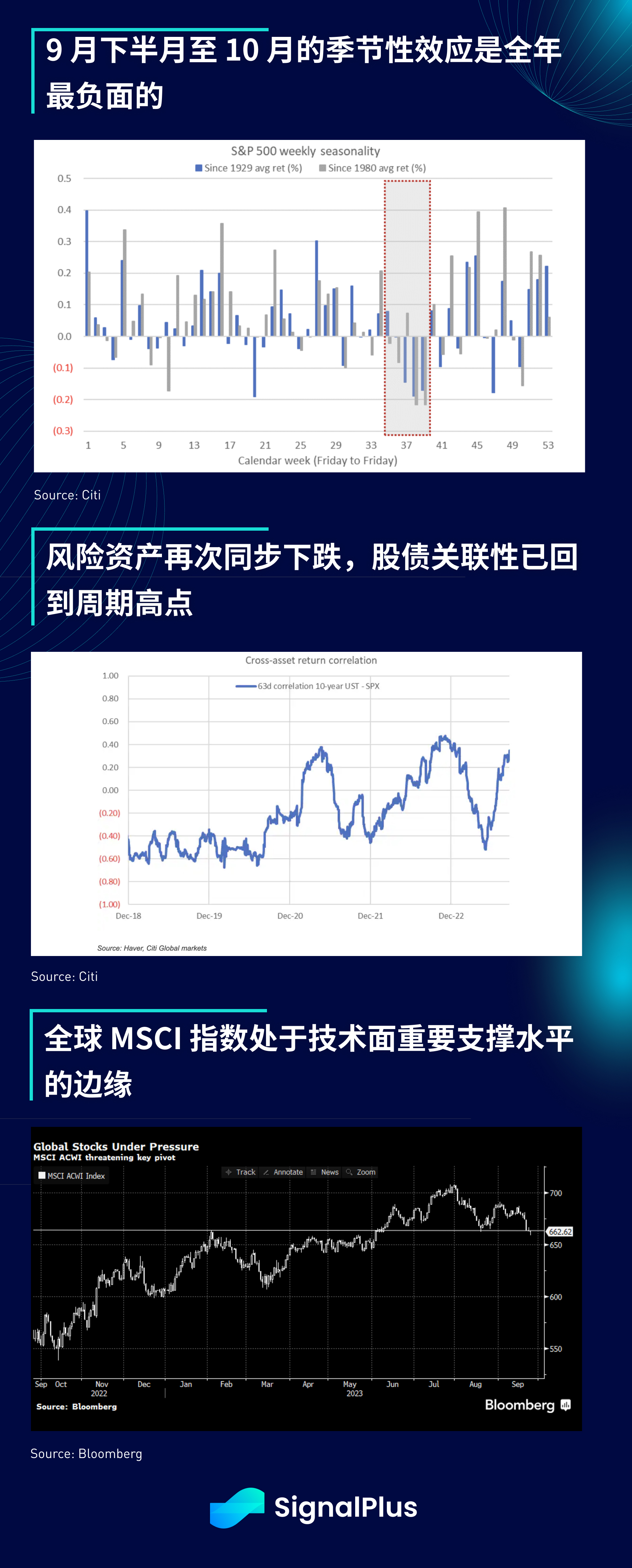

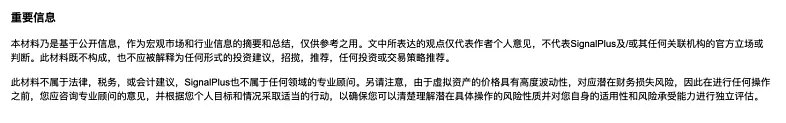

The negative seasonal effect was once again confirmed in late September. As cross-asset correlations increased, both bonds and stocks fell sharply this month. This wave of weakening risk assets driven by real interest rates put global stock markets at a technical level. On the edge of important levels, from a technical perspective, the gains so far this year are facing the risk of retrenchment after the stock market clearly fell below.

There was not much US economic data released yesterday, but the Dallas Feds survey showed that the employment index rebounded to 13.6, with 91% of companies saying that employment levels were the same or higher than before, while the working hours index also showed a similar increase; from next week To start, we will see a series of Fed survey results and PMI data releases, and we will pay close attention to whether Septembers non-farm payrolls data will continue this strong rebound amid the shadow of the government shutdown.

Furthermore, the current rise in yields is being driven by real yields rather than equilibrium inflation, meaning that this move is happening because markets are demanding higher real rates as a return on capital, not because markets are concerned about inflation. In anticipation of rising expectations (a concern that could be mitigated by a downward trend in actual data such as CPI/PCE), rising funding costs have a clear negative impact on the prices of different assets, which helps explain why bonds and stocks have fallen sharply over the past month suffered a decline at the same time.

The rise in U.S. dollar yields has led to a corresponding rise in the dollar exchange rate, creating further headwinds for financial conditions and especially for emerging market economies with dollar-denominated debt. Speaking of Asia, the crisis worsened again yesterday for China Evergrande Group, the developer that failed to The payment of 4 billion yuan of domestic bonds has added uncertainty to its debt restructuring plan. This news caused the US-listed Golden Dragon China Index to fall 1% overnight, and the weakness also spread to Asian trading hours.

On the central bank side, policymakers continue to apply pressure, with European Central Bank President Lagarde recently expressing a rather hawkish view. She said in a statement that future decisions will ensure that the ECBs key interest rate remains unchanged for as long as necessary. At the same time, the Federal Reserve Goolsbee reiterated in an interview with CNBC that inflation is still the biggest risk at present, and the Federal Reserve needs 100% commitment to achieve the 2% target, and the Federal Reserve will have to act according to circumstances to decide How much more policy restrictions are needed?

And the current environment is one in which the cap-weighted SPX has outperformed the equal-weighted index, which means that average equity investors have performed much worse than the index itself. In fact, many popular momentum and volatility strategies have performed worse this year. Not as good as the SPX, which also shows what a frustrating year it has been for most active managers.

The current SPX decline has pushed the market into negative gamma territory following the massive options expiration in mid-September, and volatility control funds appear vulnerable to being forced to sell after nearly a full year of substantial accumulation of exposure. ; In addition, from a valuation perspective, the rise in real interest rates has widened the gap with the SPX forward price-earnings ratio to the widest level this year. For risk assets, we still maintain our cautious (negative) view since late summer .

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com