SignalPlus Macro Research Report Special Edition: FOMC meeting preview

Yesterday was a holiday in Japan, and the beginning of the week seemed relatively calm, but the next few days will be very busy, with a series of central bank meetings including the Federal Reserve / Bank of England / Bank of Japan / Swiss National Bank / Norges Bank / Riksbank. Come on stage.

Reuters reported that,The European Central Bank will begin discussions on how to eliminate trillions of euros of excess liquidity in the banking system, and raising reserve requirements may be a first step, Affected by this, the euro rebounded from its lows for the second consecutive day. This will be a major move to reverse the effects of more than a decade of quantitative easing. As inflation in the euro area remains high, this is after ten consecutive interest rate hikes. based on further policy tightening.

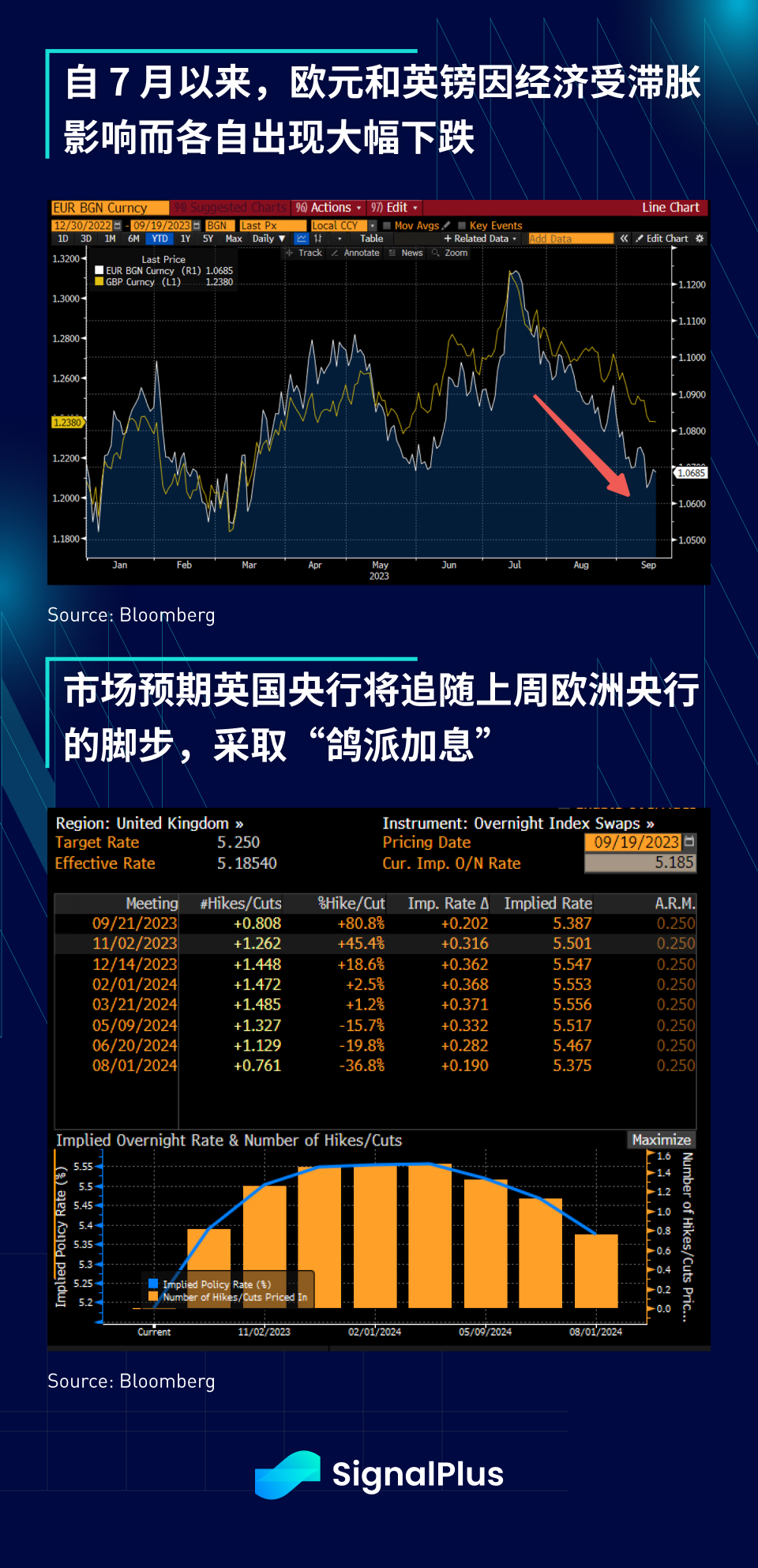

As for the Bank of England, the market expects that the probability of raising interest rates by another 25 basis points at this Thursdays meeting is about 75%, and the latest CPI data will be released before the meeting (the overall index is expected to increase by 7.0% year-on-year), however, similar to the European Central Banks actions last week, the market expects the Bank of England to again adopt a dovish interest rate hike. Since the highs in July, both the euro and the pound have fallen sharply, and the market will pay attention to Governor Baileys comments. As for the guidance on the terminal interest rate, the current terminal interest rate before the end of the year is around 5.5%.

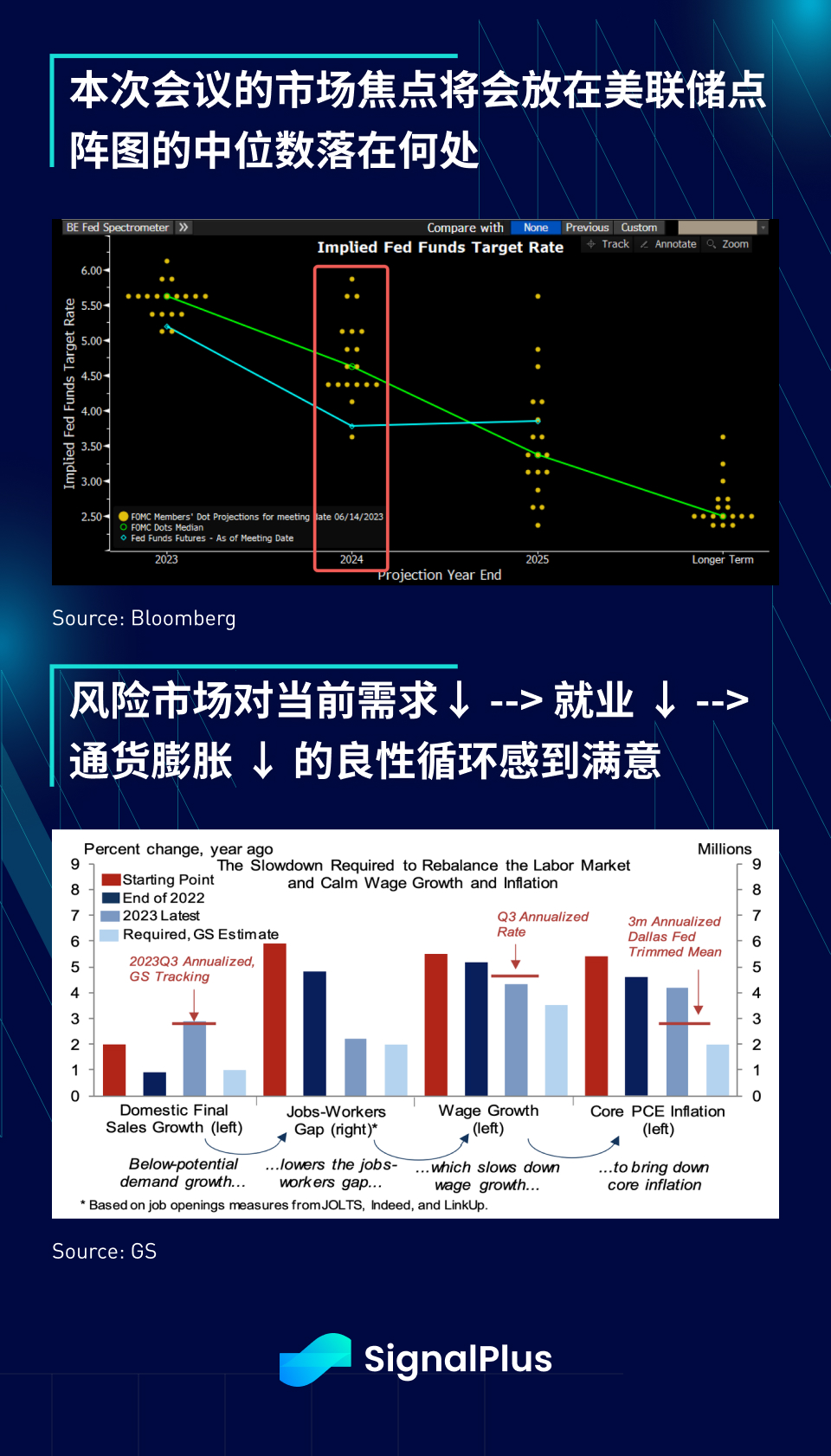

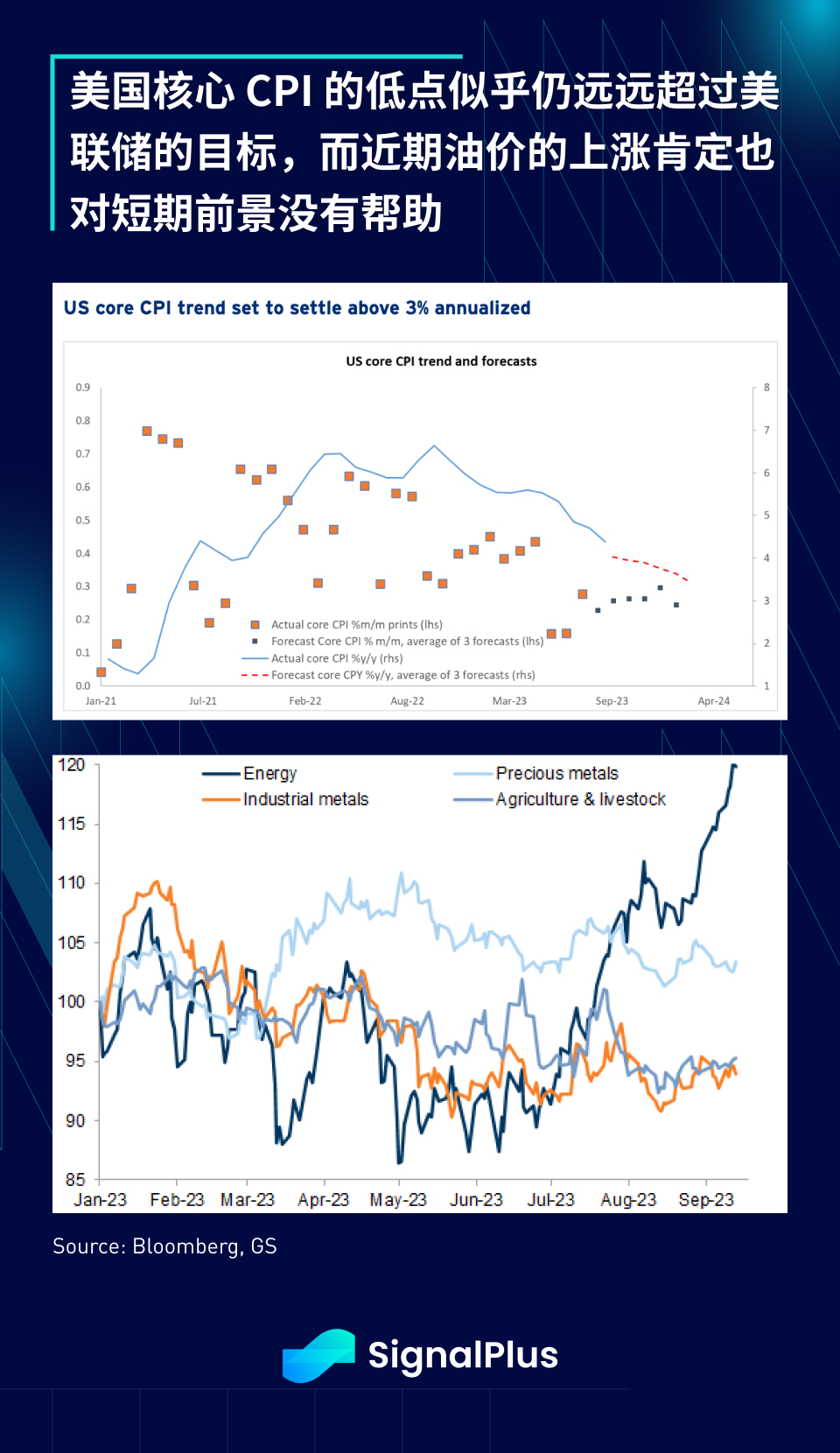

On the FOMC side,The market has widely expected a pause in interest rate hikes at this meeting, but the key lies in the Feds dot plot, especially the midpoint of the dot plot in 2024 and beyond.; To take a step back,Markets are currently optimistic about the Feds outlook as inflation appears to be moderating as part of a virtuous cycle of slowing demand → narrowing labor gap → slowing wage growth → falling core CPIAlthough economic growth is slowing, it is not enough to trigger a recession, and the buffer from consumer balance sheets is enough to alleviate concerns about any major economic downturn.

After experiencing the final trough in the fourth quarter,GDP growth is expected to rebound to around 2% in 2024, driven mainly by a pickup in investment spending and residential investment, offsetting the impact of still weak manufacturing and the lack of fiscal stimulus;in addition,It is expected that the drag on GDP from fiscal and monetary policies will be completely over before the end of this year., so as long as the Fed does not try to unexpectedly push up terminal interest rates in 2024, the market is quite satisfied with the economic outlook, and the Fed still has a lot of ammunition to use if the situation calls for it.

On the other hand, by all metrics,The trough in U.S. core CPI appears to be above 3% annualized, well above the Feds long-term target of 2%, while the recent rebound in oil prices has also increased short-term upside risks.;in addition,Since the mid-2010s, market expectations for the “long-term” neutral interest rate appear to have been permanently revised upwards, especially after the epidemic, the interest rate indicator rose to a ten-year high of 4% in 10 y 5 y, while the average level in the previous decade was only 2.5%.

Therefore, although the benchmark interest rate has risen by more than 5%, financial conditions are still relatively loose, and we believe that the Fed is likely to try again the hawkish skipping rate hike strategy, which will be reflected in Chairman Powells remarks and the dot plot. Subtle changes are conveyed discreetly.

As always, we will analyze and provide our views following the FOMC meeting on Wednesday afternoon (ET). I wish you all good luck with your trading this week!

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web 3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends .

SignalPlus Official Website:https://www.signalplus.com