Original author: CoinGecko

Original translation by: AididiaoJP, Foresight News

Since 2020, the rise of digital asset treasury companies has become one of the most iconic developments in the cryptocurrency space. While media attention has largely focused on ETFs, meme coins, and next-generation DeFi protocols, DATCo has quietly emerged as a powerful new force in the market.

So how did DATCo grow from a fringe corporate experiment into a powerful force spanning Bitcoin, Ethereum, and various altcoins, with a scale of $130 billion?

This article will guide you through understanding how digital asset treasury companies have become star companies in this cycle.

summary

- Publicly traded companies began including cryptocurrencies in their reserve assets in 2017, and the rise of Strategies has brought pure-play DATCo into the spotlight.

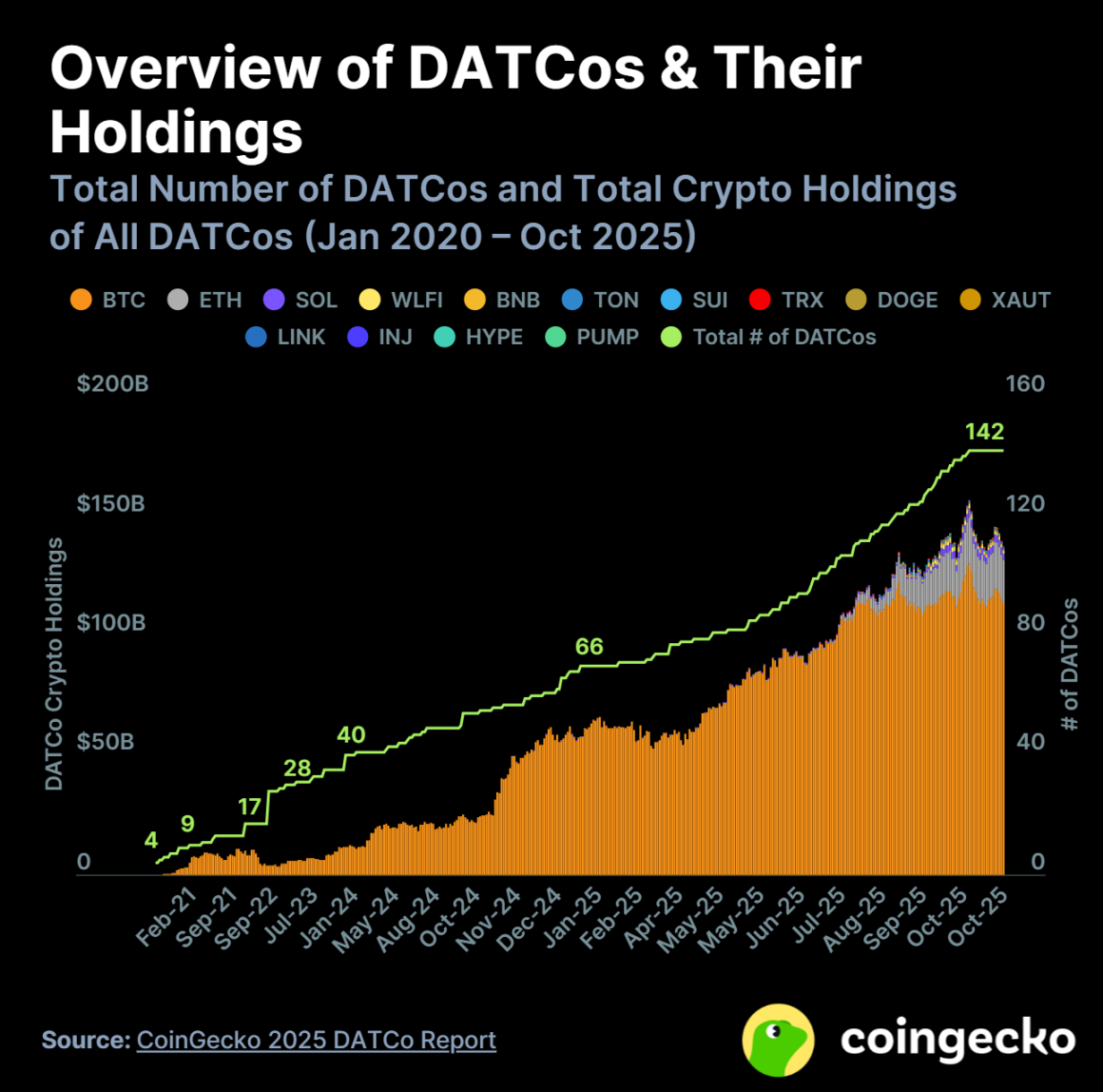

- The number of DATCos surged from 4 in 2020 to 142, with 76 of them scheduled to be established in 2025.

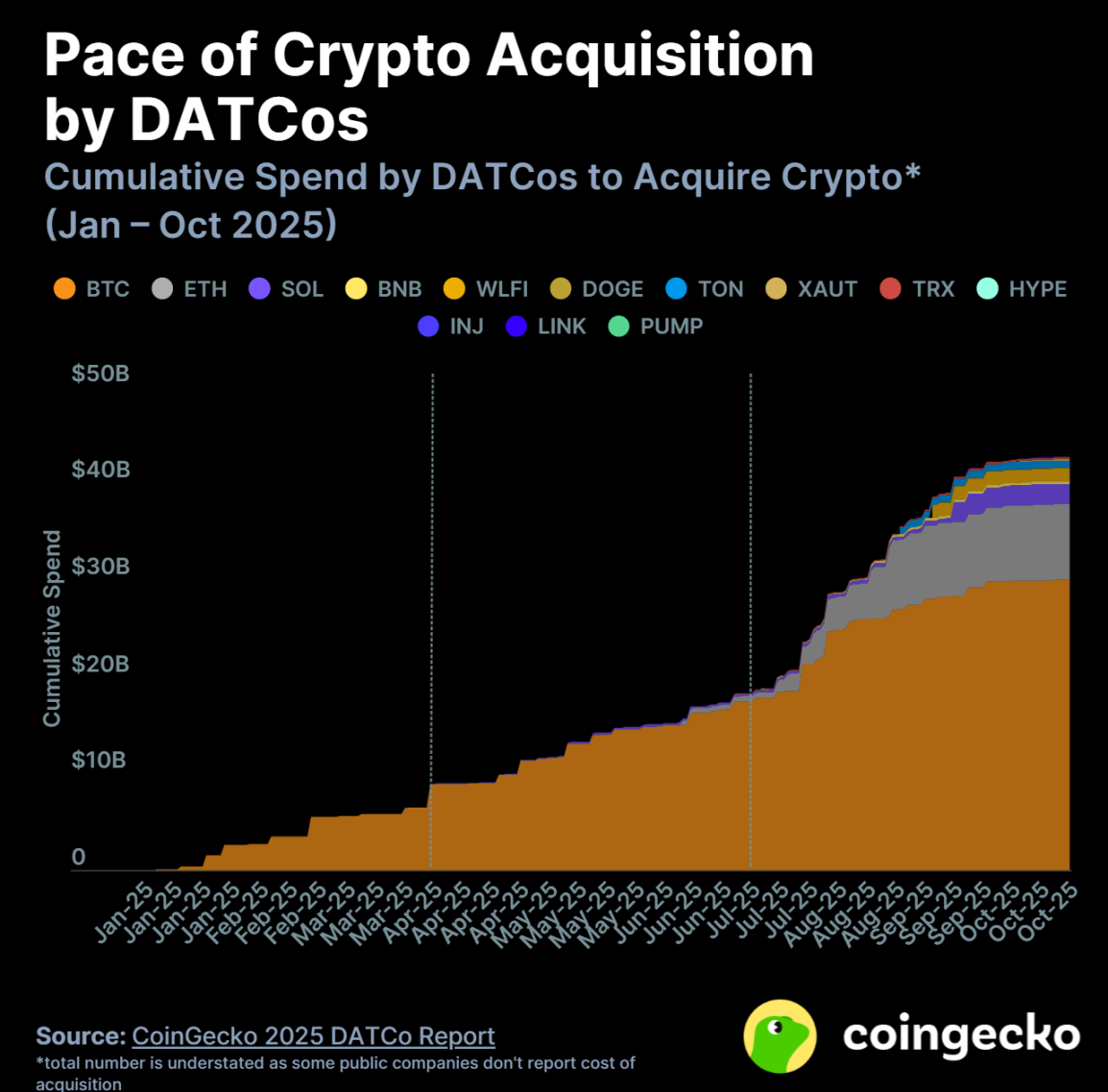

- DATCo will invest a total of $42.7 billion in 2025, with more than half of it occurring after the third quarter.

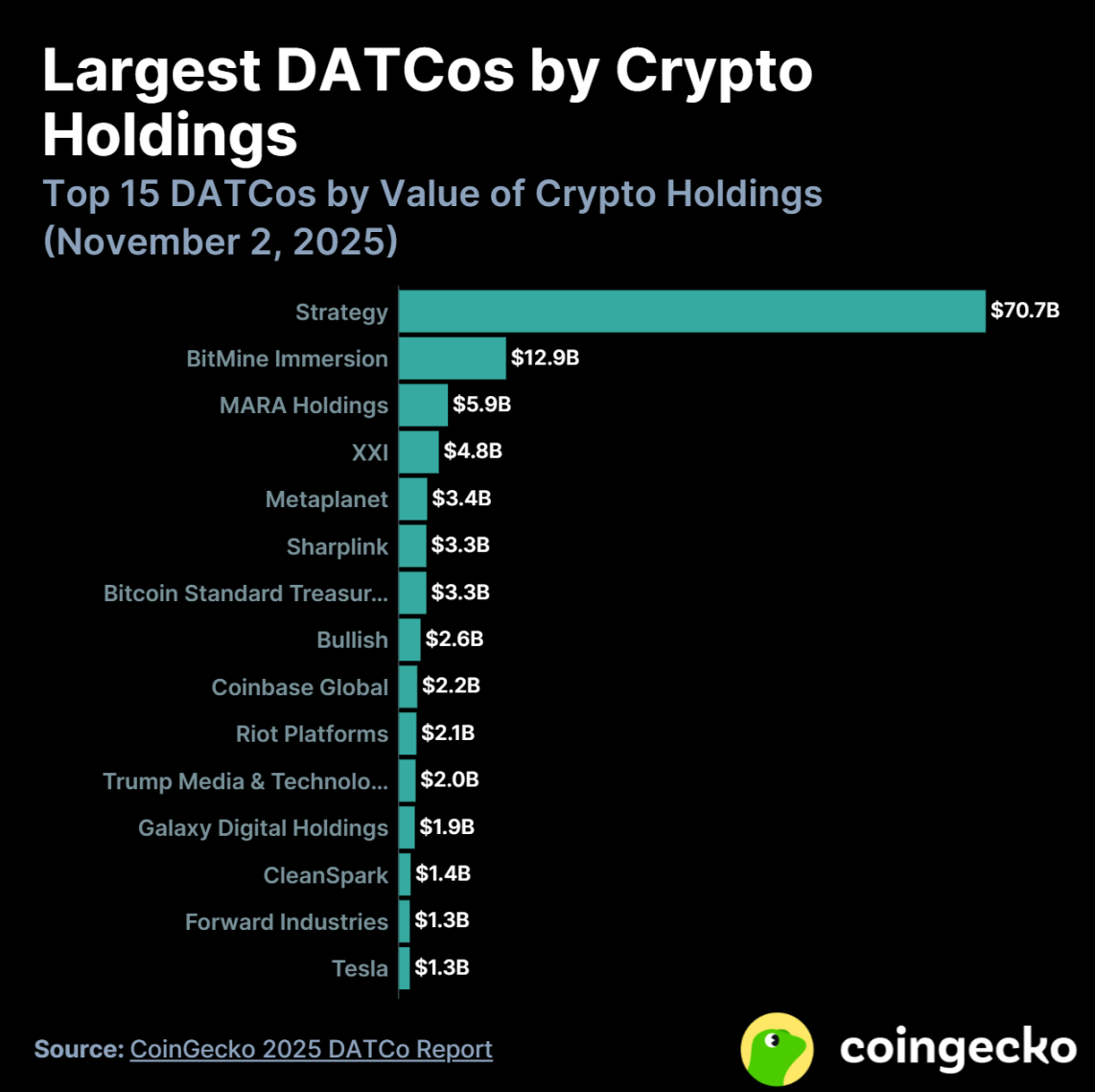

- Strategy dominates the space, holding $70.7 billion in assets, representing approximately 50% of the total value of all DATCo crypto assets.

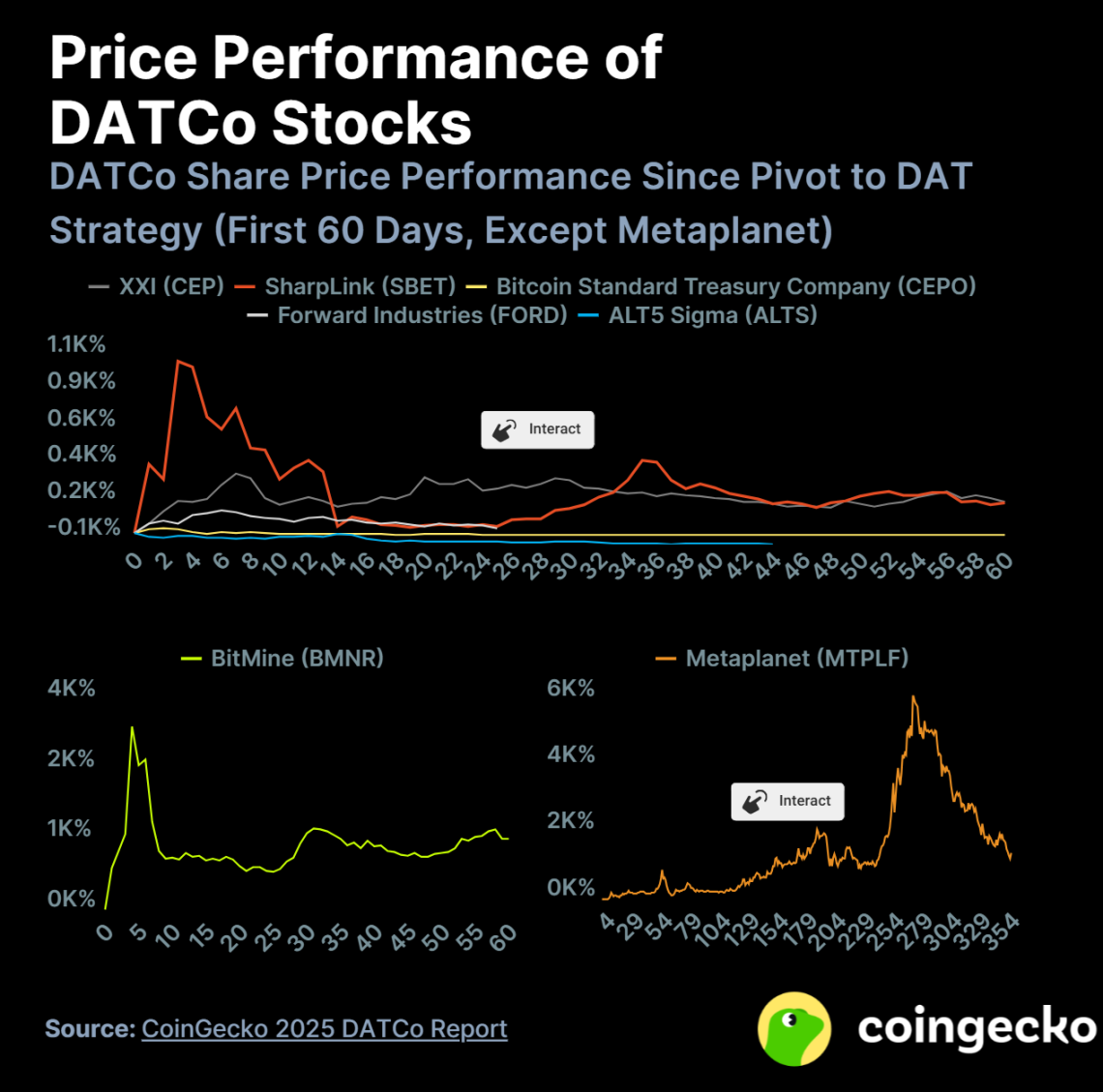

- DATCo stocks surged in the first 10 days (for example, BitMine rose by 3,069%), followed by a general pullback.

The rise of Strategy has brought pure-play DATCo into the spotlight.

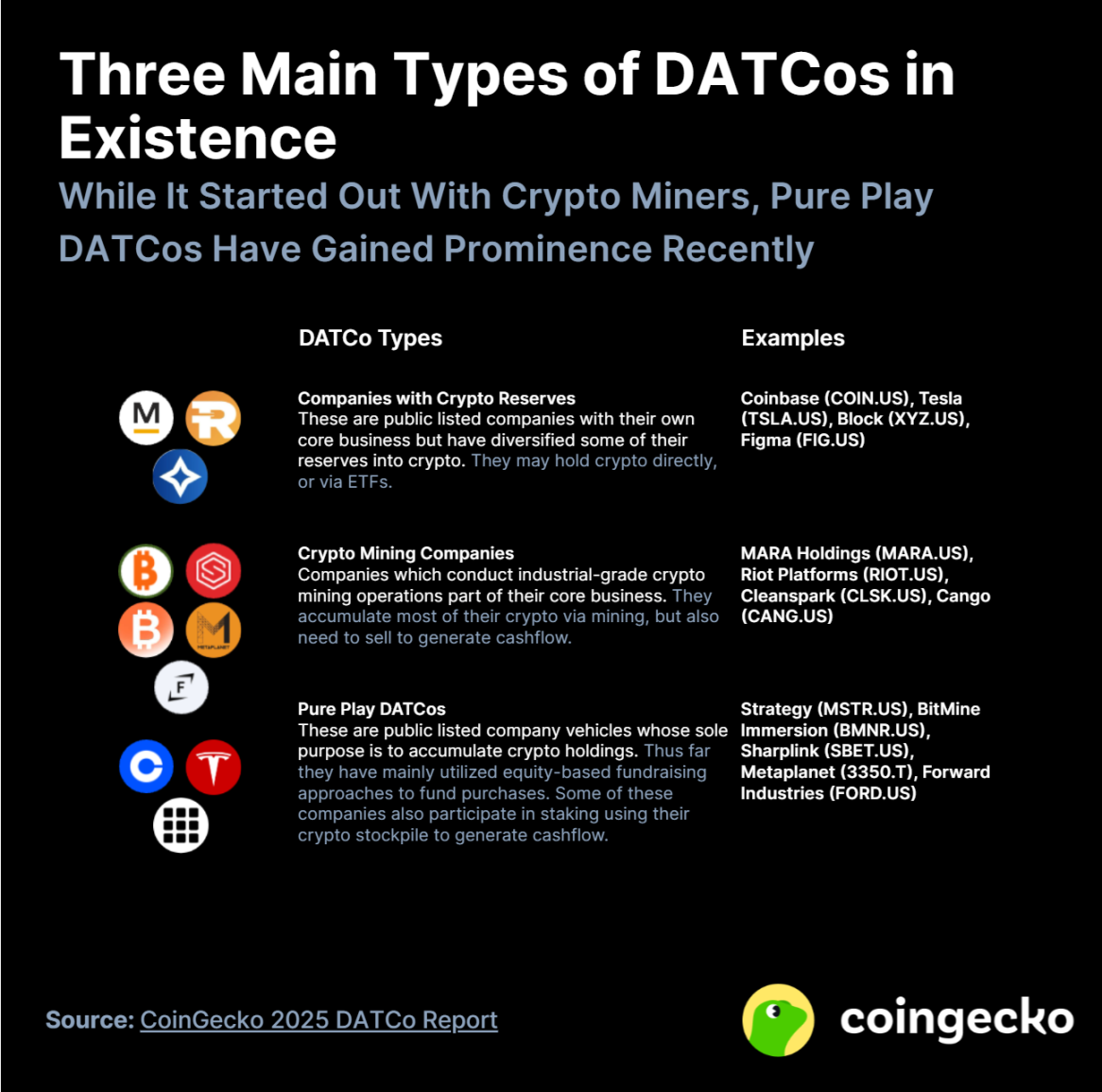

Digital asset treasury companies first emerged in 2017, initially primarily consisting of publicly listed cryptocurrency mining companies. Strategy became the first pure-play DATCo in August 2020, subsequently sparking a wave of similar companies.

In late 2023, the U.S. Financial Accounting Standards Board introduced accounting standards for cryptocurrencies, allowing DATCo to measure its crypto assets at fair value and recognize any gains or losses. This policy significantly improved the performance of DATCo's balance sheet.

In addition, US President Trump's friendly attitude toward cryptocurrencies and the surge in the price of crypto assets such as Bitcoin have jointly driven a large influx of Wall Street funds into the field, including DATCo.

Against the backdrop of weak fiat currency performance, many listed companies whose main business is not cryptocurrency have begun to include crypto assets in their reserve strategies to hedge against the risk of currency devaluation.

As of October 2025, DATCo had a total of 142 companies, of which 76 were established in 2025.

The first DATCo was Hut 8 Mining Corp., a Bitcoin mining company that went public on the Toronto Stock Exchange in November 2017. Between 2017 and 2020, cryptocurrency mining companies were the dominant form of DATCo. Then, in August 2020, Strategy emerged as the first pure-play DATCo.

As of the end of October 2025, the total value of all crypto assets held by DATCo reached $137.3 billion, more than doubling since the beginning of the year (+139.6%).

Of the 142 DATCos, 113 (79.6%) hold Bitcoin as a reserve asset, while 15 hold Ethereum and 10 hold Solana. In dollar terms, Bitcoin accounts for 82.6% of all crypto assets held by DATCos, followed by Ethereum (13.2%) and Solana (2.1%).

In terms of geographical distribution, the United States has the most DATCos, with 60, accounting for 43.5%; Canada and China follow with 19 and 10 respectively. Although Japan only has 8, it is worth noting that it has the fifth largest DATCo, Metaplanet, which is also the largest DATCo outside the United States.

DATCo will invest a total of $42.7 billion in 2025, with more than half of it occurring in the third quarter.

In the third quarter of 2025, cryptocurrency DATCo spent at least $22.6 billion on new asset acquisitions, marking its largest quarterly expenditure to date. Of this, altcoins contributed $10.8 billion, accounting for 47.8%. Since the beginning of 2025, DATCo's total spending on crypto asset acquisitions has reached at least $42.7 billion.

Bitcoin DATCo is the largest buyer, having purchased at least $30 billion worth of BTC since the beginning of 2025, accounting for 70.3% of all DATCo crypto asset purchases.

Ethereum's DATCo is the second-largest buyer, reporting purchases of at least $7.9 billion in 2025. The majority of these purchases occurred in August, with at least $7.1 billion worth of ETH acquired in that single month, coinciding with Ethereum's price reaching an all-time high of $5,000.

Solana, BNB, WLFI, and other assets accounted for 11.2% of DATCo's purchases in 2025. This percentage is expected to rise as more altcoins are added to the reserves. However, Bitcoin and Ethereum remain DATCo's preferred assets for now.

Strategy accounts for approximately 50% of the total value of all DATCo crypto assets.

Strategy leads all other DATCos by a wide margin with $70.7 billion in Bitcoin holdings. Among the top 15 DATCos, only three are altcoin DATCos: BitMine Immersion (2nd), Sharplink (5th), and Forward Industries (14th). It's noteworthy that all three only transitioned to DATCo status after June 2025, demonstrating the rapid pace of their asset accumulation.

Of the top 15 companies, seven are pure business-oriented DATCos, while cryptocurrency mining companies make up only three.

Of the five publicly traded companies holding cryptocurrency reserves, four of them, excluding Tesla, are engaged in cryptocurrency-related businesses.

Currently, Strategy holds 3.05% of the total Bitcoin supply; BitMine Immersion holds 2.75% of the total Ethereum supply; and Forward Industries holds 1.25% of the total Solana supply.

DATCo stock surged in the first 10 days, followed by a general pullback.

Most DATCo stocks experience a rapid rise in price within the first 10 days after announcing a transformation, usually followed by a pullback after reaching the peak.

Some companies' stock prices even increased dozens of times in 10 days, with BitMine Immersion achieving a return of 3,069%.

The only exception so far is Metaplanet, whose stock price rose by about 100% in the first 10 days, but then took 269 days to reach its peak return of about 6,200%.

Most DATCo stocks experienced significant volatility before the official restructuring, typically benefiting only early buyers or insiders. This has sparked controversy, and the U.S. Securities and Exchange Commission and the Financial Industry Regulatory Authority are conducting insider trading investigations.

However, these rallies are often unsustainable, with most DATCo stocks falling sharply within days of their transformation. For example, ALT5 Sigma's stock price plummeted 71% 44 days after its transformation. Its WLFI holdings have also performed poorly, declining 56% since its IPO.

- 核心观点:数字资产财库公司成为加密市场重要力量。

- 关键要素:

- DATCo数量从4家激增至142家。

- 总加密资产规模达1373亿美元。

- Strategy持有707亿美元占主导地位。

- 市场影响:推动机构资金大规模流入加密市场。

- 时效性标注:中期影响