IOSG Ventures: After the Ethereum Shapella upgrade, the dynamic competitive landscape of the staking market

Original author: Jiawei, IOSG Ventures

TL;DR

Shapella releases liquidity, the withdrawal pressure has eased in the near future, and the long-term is optimistic about the pledge rate;

Original author: Jiawei, IOSG Ventures

Shapella releases liquidity, the withdrawal pressure has eased in the near future, and the long-term is optimistic about the pledge rate;

Driven by events, price war-oriented and differentiated target customers, the Ethereum staking market will present a dynamic competitive landscape;

The influx of institutional investors helps to diversify the Ethereum validator set;

introduction:

Although the staking track has a long history, with the changes brought about by some important events, it may still impact the existing pattern, and thus bring hidden investment opportunities.

introduction:

Source:Dune Analytics@hildobby

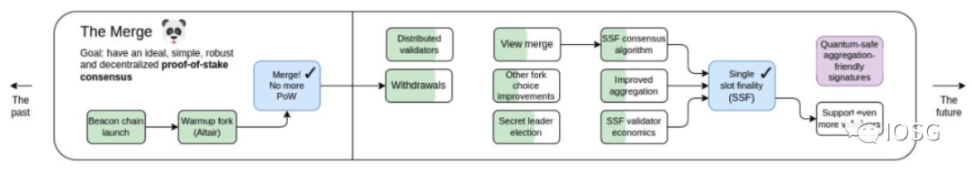

After Ethereum transitioned to PoS last September, two important protocol upgrades followed this year: Shapella and Cancun. The former is mainly to support the withdrawal of validators, so that the Ethereum pledge can be closed-loop; the latter will introduce Data Blob as an early foreshadowing of data sharding.

Source:Dune Analytics@hildobby

We are now a little over a month away from the successful implementation of Shapella. Due to the activation of withdrawals, there are some turning points in the market. The author writes this article mainly to put forward some ideas on the Ethereum pledge track based on the recent observation of the primary market, and to discuss the investment opportunities in this track.

Source:Dune Analytics@hildobby

We take a quick look at the market conditions. Since the activation of Beacon Chain's pledge in December 2020, Ethereum pledge has developed well. As of writing this article, more than 600,000 verifiers and about 20 million pledged Ethereum (over 36 billion U.S. dollars at the current price) have been accumulated. Network pledge The rate is close to 17%.

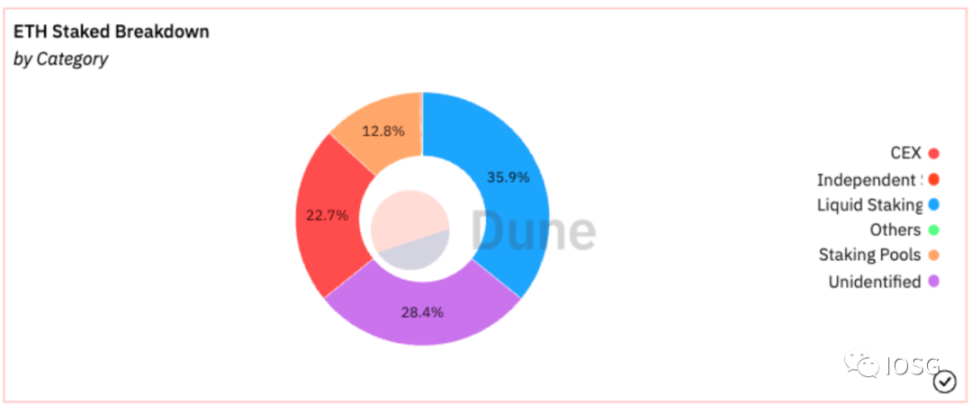

Currently, liquid staking accounts for 35.9% of all staking categories, with Lido alone taking 31% of the entire staking market. After large withdrawals from CEX such as Kraken and Coinbase, CEX still occupies 22.7% of the market share.

As Shapella activated the exit channel for staking, it inevitably generated market selling pressure. From the figure above, we can see that after Shapella, the outflow of ETH is significantly more than the inflow. Withdrawal pressure was quickly eased, and the net inflow of ETH so far has exceeded 1 million. This is basically consistent with Shapella’s previous market predictions. Due to the release of liquidity, the author believes that Ethereum pledge is still an attractive asset management target in the medium and long term, so the increase in the pledge rate continues to be optimistic.

Post-Shapella — The Ethereum staking market will present a dynamic competitive landscape

Lido currently dominates the entire staking market, mainly due to its first-mover advantage and the moat built around the head effect. But I don’t think Lido will be the end of the liquid staking track, or the entire staking track. Shapella is the tipping point and the basic premise for other staking protocols to compete with Lido.

Source:Dune Analytics@hildobby

This chapter mainly discusses event-driven, price war and target customer differentiation.

event driven

Some direct or indirect external events may lead to changes in the pledge market structure.

For example, the custody and pledge services provided by centralized exchanges once occupied more than 40% of the market share in 2021, but with the development of liquid pledge, its market share has been squeezed and has recently shown an accelerated trend. We speculate that it may be due to the following two points:

Source:Nansen

1. After the downfall of FTX in November last year, users' trust in centralized and custody solutions has declined.

Price War

2. In February of this year, under the regulatory pressure of the SEC, Kraken announced the termination of staking services to US customers, resulting in its withdrawal operations and further causing users to worry about staking service providers in specific jurisdictions.

Source:GSR

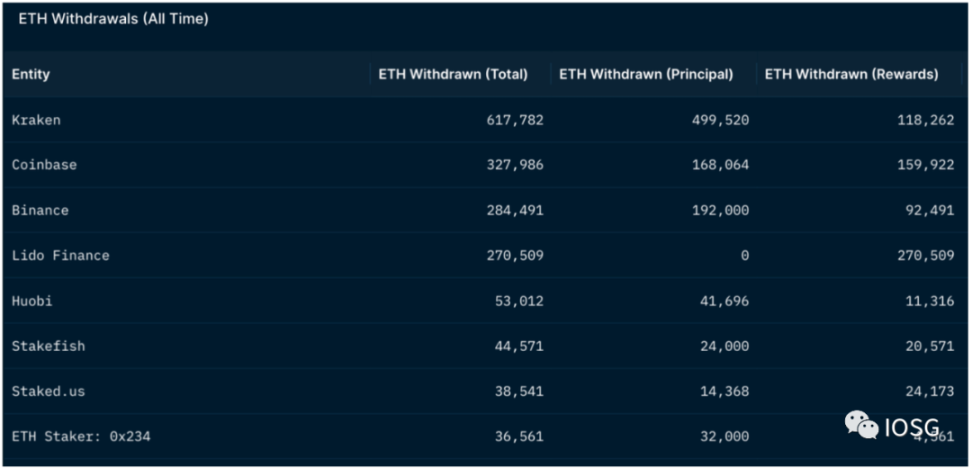

After Shapella, early staking users were able to withdraw and switch to other staking services - the top three entities in the withdrawal queue are all centralized exchanges reflecting this.

Under the free market with sufficient liquidity, the business logic under the traditional business model is reflected. Due to the high degree of homogeneity in the staking market, competitive advantages are naturally reflected in factors such as price differences. Users can now withdraw funds from the original staking service and freely choose other platforms, and the competition among staking service providers will become more intense.

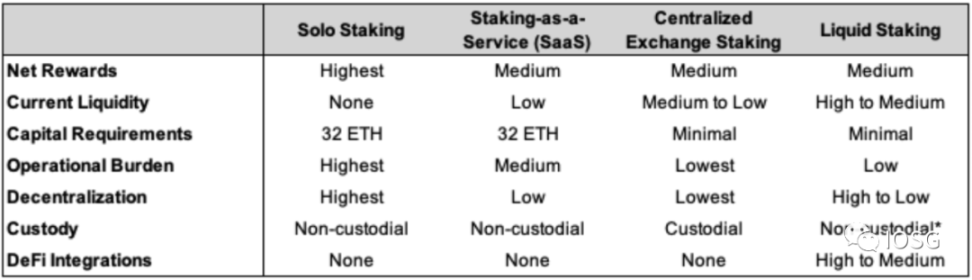

For example, since SaaS platforms focus on institutional users, while Solo Staking has a higher threshold for ordinary users, basically the latter two in the table are the main choices. The pledge of centralized exchanges charges higher service fees and is opaque at the same time. The advantage of liquidity staking lies in its good liquidity. As mentioned above, stETH can almost be used as a hard currency to interact on most mainstream DeFi applications, and can even be directly exchanged for ETH without waiting for the withdrawal queue. Users will flexibly consider the options of different pledge schemes.

Source:ultrasound.money

Going a step further in the field of liquid staking, Puffer offers lower entry barriers for node operators and lower staker fees than competitors Lido and Rocketpool. Among them, Puffer only charges 2.5% of the fee for stakers, which is 1/4 and 1/6 of Lido and Rocket Pool. Assuming that the rewards are similar (currently, the rewards of each protocol are about 5%, which is almost the same), the amount of handling fees may be one of the factors that determine the user's choice.

At the same time, the degree of integration of LST in various DeFi protocols is also a consideration. This represents an implied LEGO yield.

Source:Messari

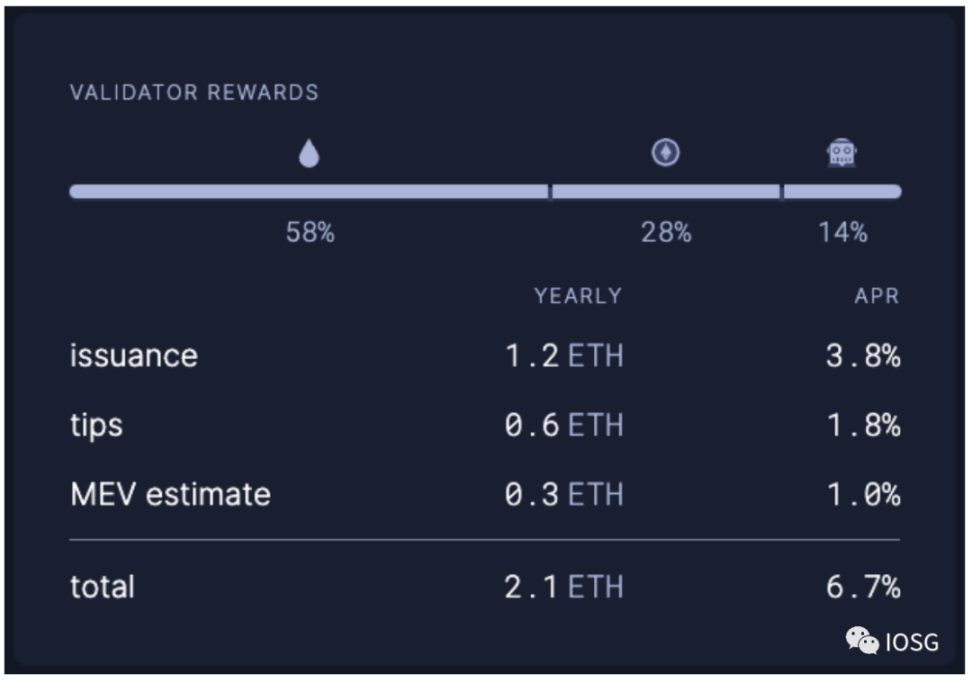

In terms of staking income, the staking income of Ethereum is composed of consensus layer rewards and execution layer rewards, and the former decreases with the addition of more verifiers. The latter is a dynamic yield, composed of Tips and MEV, directly related to the activity of the Ethereum network. The total revenue of using staking services depends on the proportion of these rewards shared by service providers and users. For example, stakefish shares 80% of the execution layer rewards with users.

In order to meet the needs of competition, node operators can share as much revenue as possible from the execution layer and increase the APR of the protocol to attract users. Restaking mentioned below is also one of the ways to increase APR.

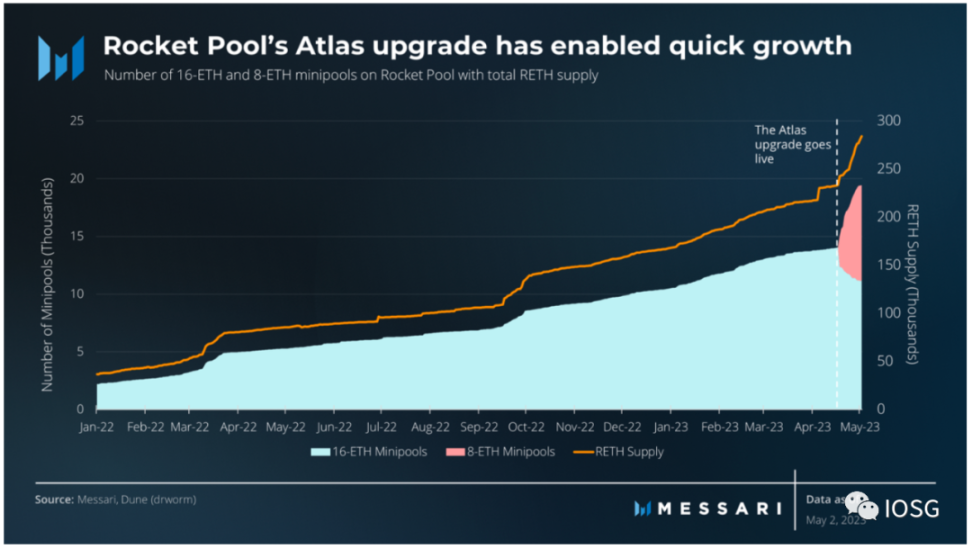

On the node operation supply side, Rocketpool launched the Atlas upgrade when Shapella was upgraded. Compared with the previous 16 ETH, the current node operator only needs to invest 8 ETH to run the verification service, further reducing the node operator’s preparation time. Barrier to entry (running two 8 ETH Minipools provides 18% more rewards than running one 16 ETH Minipool). The graph above shows that the activation of Atlas resulted in some protocol growth for Rocketpool.

Differentiation of target customers

In the field of liquidity staking, unlike protocols such as Lido and Rocketpool that target crypto-native users (To C), Alluvial has launched an enterprise-level liquidity staking solution (To B) in cooperation with staking service providers such as Coinbase and Figment.

After Shapella, the exit channel for staking Ethereum has gradually become clear, which may arouse the interest of traditional financial institutions in liquid staking. Ethereum liquidity staking as an asset allocation strategy means having ETH exposure representing the industry Beta, an annualized staking yield of about 5%, and the additional income of LST in DeFi. If we consider the benefits of Restaking, it may make the cumulative return of Ethereum staking more than 15%.

However, traditional institutions need to do due diligence on counterparty risks and complete a series of compliance procedures such as KYC/AML. At this stage, encrypted native liquidity staking protocols such as Lido cannot meet such needs. Because liquid staking protocols such as Lido are permissionless on the user end, there is no audit or inspection of assets entering Lido, and assets are commingled; traditional institutions are highly sensitive to this.

One way is to adopt enterprise-level liquidity staking solutions like Alluvial, and the other is to provide non-LST liquidity solutions by external partners.

Source:Vitalik Buterin

Looking beyond the staking itself, the Ethereum validator set provides the underlying trust that supports its ecosystem, and the influx of institutional investors helps to diversify the Ethereum validator set, increase game play, and improve stability.

DVT will improve the robustness and stability of the Ethereum verification set

Source:rated.network

On the roadmap, there are still two major changes after Ethereum completes The Merge: one is to activate the withdrawal of pledged Ethereum in Shapella, and the other is to include EIP-4844 in Cancun to provide more data space for Rollup. Compared with the above two points, DVT (Distributed Validator Technology) has relatively little impact on user perception, but is crucial to the robustness and stability of the underlying infrastructure.

Before implementing DVT, generally a single node corresponds to a single validator. When running the validator, inactivity or slashing may occur due to network failure or configuration errors in the objective environment, thus missing rewards. DVT introduces node clusters to maintain a single validator (many-to-one), for example, as long as the active node threshold of 5/7 is met, verification is performed, eliminating the possibility of a single point of failure.

From a data perspective, Rated provides ratings for each pledge service provider based on dimensions such as Proposal Effectiveness, Attestation Effectiveness, and Slashing Record. The overall Effectiveness level of Ethereum validators is about 96.9%, which has not yet reached the ideal level.

Since becoming a Node Operator of Lido requires DAO governance approval, while becoming a Node Operator of Rocketpool does not require permission, it is speculated that the nearly 2% difference in ratings between the two may be due to the varying capabilities of Node Operators.

Source:clientdiversity.org

It is foreseeable that DVT, as the underlying infrastructure, will become the industry standard for the staking track in the future, but it has little perception from the perspective of ordinary users.

epilogue

Source:David Hoffman

In addition to DVT, the diversity of consensus and execution layer clients is equally important.

epilogue

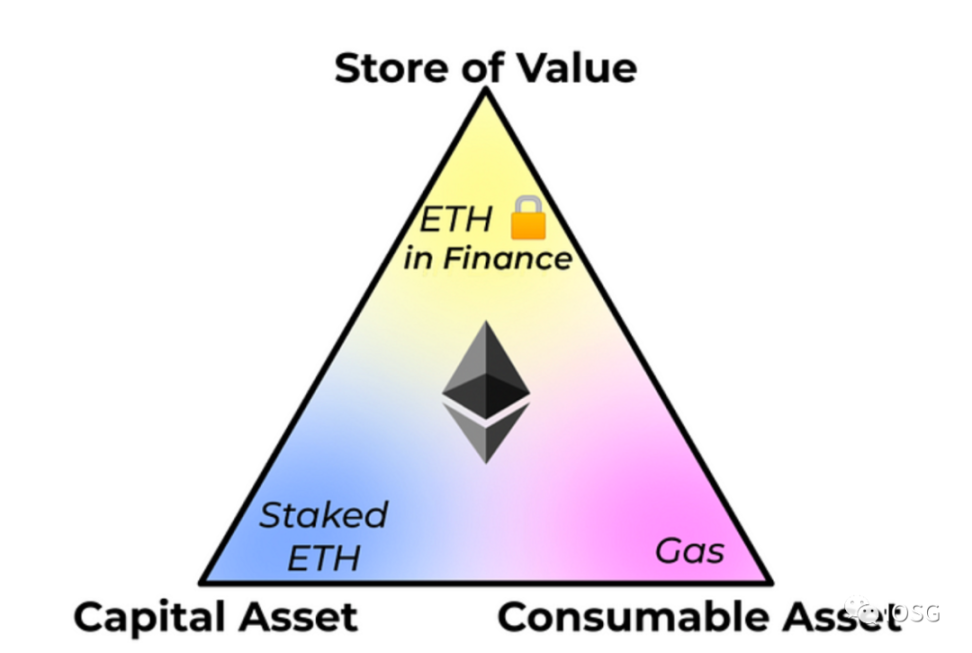

In 1997, Robert Greer proposed three asset classes:

1. Capital assets: assets that can generate value/cash flow, such as stocks, bonds, etc.;

2. Convertible/consumable assets: able to be consumed, burned or converted at one time, such as oil, coffee;

Source:Jon Charbonneau

3. Store of value assets: value persists in time/space and is scarce, such as gold and bitcoin.

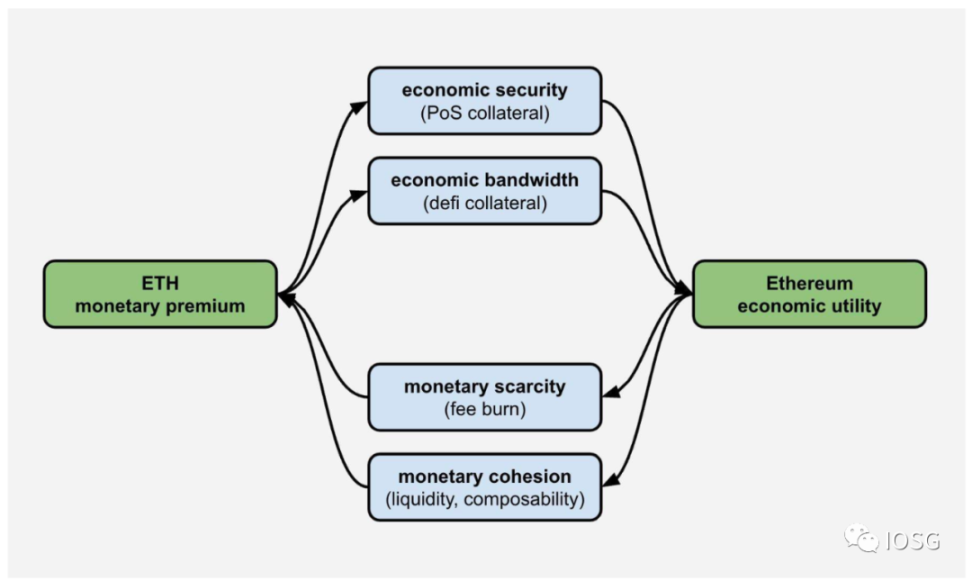

David Hoffman pointed out in 2019 that Ethereum can serve as the above three assets at the same time: pledged ETH as a capital asset, Gas as a consumable asset, and ETH locked in DeFi as a value storage asset.

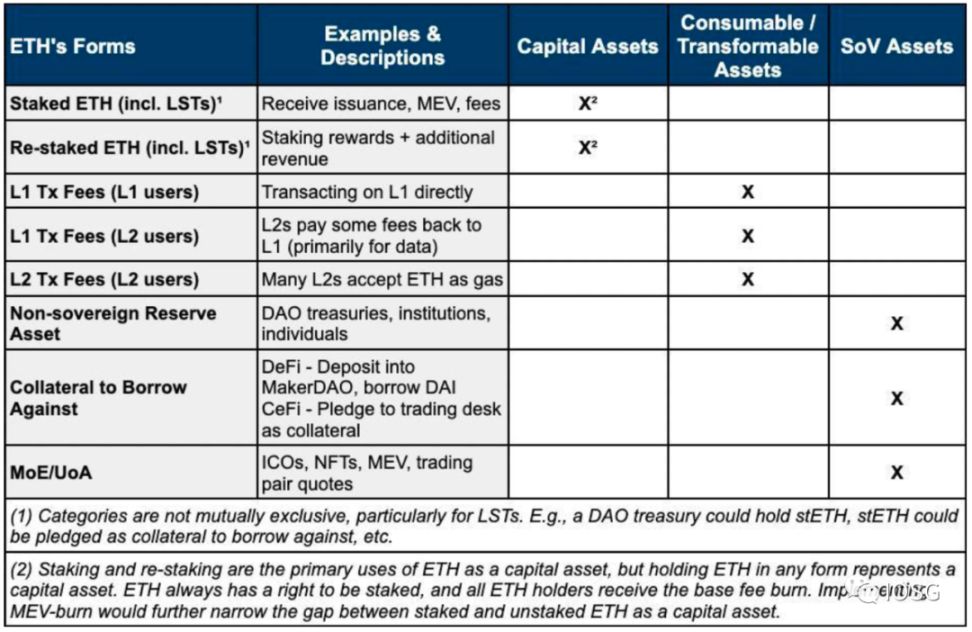

In February of this year, Jon gave a more detailed breakdown in the above table:

1. Pledged or re-pledged ETH, including liquid pledged tokens such as stETH, which represent assets that can generate value/cash flow, as capital assets;

Source:Justin Drake

2. The Gas expenses of Layer 1 and Layer 2, as well as the DA expenses of Layer 2 in Layer 1, can be consumed and burned at one time as consumable assets;

3. DAO treasury and other reserve assets, Ce/DeFi collateral, and NFT transactions, MEV pricing, token transaction pairs, etc. are used as accounting units and exchange media respectively, and the value persists in time/space as value storage assets.

Reference

https://www.gsr.io/reports/a-guide-to-ethereum-staking/ https://blog.stake.fish/ethereum-consensus-and-execution-layer-rewards/

https://blog.obol.tech/what-is-dvt-and-how-does-it-improve-staking-on-eth ereum/

https://consensys.net/blog/ethereum-2-0/what-is-staking/

https://www.galaxy.com/research/insights/how-to-watch-shanghai-the-completion-of-ethereums-merge-upgrade/