SignalPlus Daily Morning News (20230314)

Dear friends, welcome to SignalPlus Daily Morning News. SignalPlus Morning News updates macro market information for you every day, and shares our observations and opinions on macro trends. Welcome to track and subscribe, and follow the latest market trends with us.

Dear friends, welcome to SignalPlus Daily Morning News. SignalPlus Morning News updates macro market information for you every day, and shares our observations and opinions on macro trends. Welcome to track and subscribe, and follow the latest market trends with us.

The SVB incident has gradually settled, and various sources have confirmed that many depositors have withdrawn their deposits in full yesterday, but its knock-on effect on other banks and macro assets has just begun. Here's a quick summary of some of the most shocking moves in the market over the past 2 trading days:

- 100-150 bps down in 2023 fed funds curve pricing.

- The market's forecast for the FOMC in March shifted from a 60% chance of a 50 basis point rate hike to a 30% chance of no rate hike. Due to systemic risk concerns, many investment banks (including Goldman Sachs) have changed their forecasts to see March No rate hike.

- The 2-year yield saw its biggest 3-day drop since the global financial crisis.

- The September Eurodollar contract moved nearly 100 basis points (!!!!!!) in a single day, breaking almost all records, second only to the 1987 Black Monday crash.

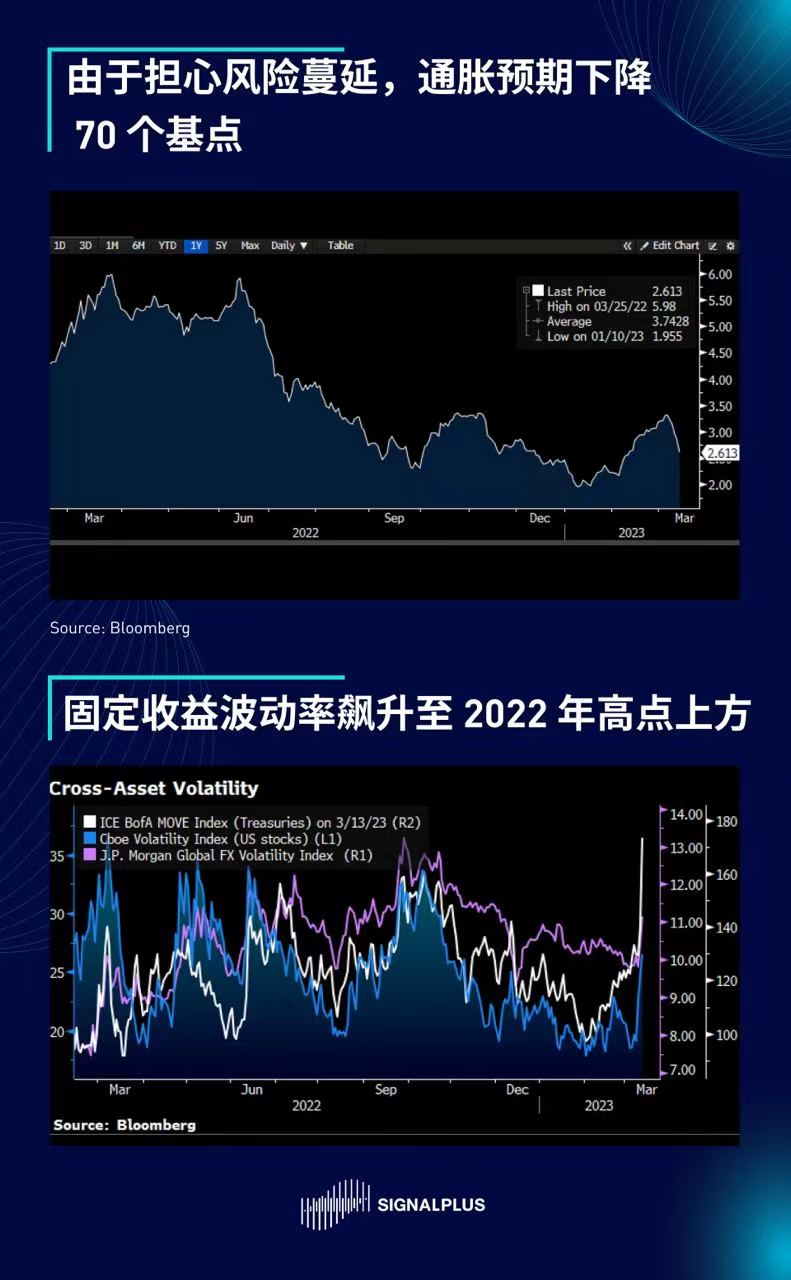

- 1-year inflation break-evens down 70 basis points.

- Yield-implied volatility surged above 2022 highs, near its peak since the global financial crisis.

- First Republic Bank stock plummeted 60% on Monday, and the U.S. regional bank index has corrected -20% in the past 3 trading days.

As we have mentioned in our past 2 features, we believe that the concerted action of the relevant authorities can successfully stop the bank run, but shareholders and bondholders will bear huge losses. First Republic Bank is the latest casualty of this wave of crises, Investors worried about unrealized losses in its portfolio and a high proportion of unprotected deposits sent its shares plummeting 60%. Also we would like to remind readers that the new financing program BTFP should not be considered as QE or TARP as it will not increase the money multiplier, it is really just a loan and not an asset swap:

- Relative to deposits, banks currently hold a portfolio of US Treasuries/government agency bonds/MBS with a funding cost of around 2% of what is paid to depositors (federal funds - 300bps).

- The asset portfolio incurred losses due to interest rate hikes, and unrealized losses appeared on the HTM/AFS account.

- Depositors withdraw deposits.

- Banks whose Tier 1 capital ratio is lower than required, but unable to obtain financing from the market, and have to bear huge losses in selling securities, can use the BTFP program to obtain liquidity from the Federal Reserve at the cost of federal funds + 10 basis points.

- The bank's financing cost rose by 310 basis points at this time, and the net income fell, but the liquidity gap was made up, and the funds received were only used to fill the hole in the reserve fund.

- After depositors withdraw their deposits and transfer them to large banks or invest in money market funds, the deposits remain illiquid.

- This approach will not increase the velocity of money, it is more like liquidity loans in Japan in the 1990s to keep ailing businesses and banks alive, rather than buying assets directly.

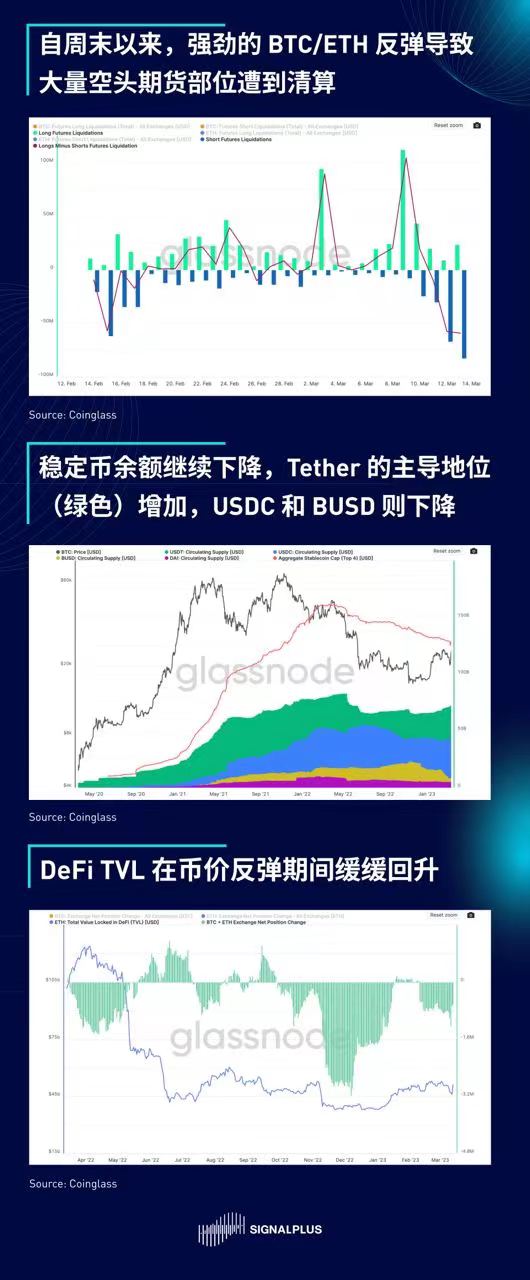

In terms of cryptocurrency, although the three major cryptocurrency entry banks in the United States have all disappeared, both BTC and ETH have rebounded sharply. The claims of cryptocurrencies as an alternative store of value appear to be resurfacing following the overnight collapse of compliant, well-capitalized and regulated banks. In addition, although the DeFi TVL has picked up, the balance of stablecoins continues to decline. It is foreseeable that due to the blow to the channels of entry and exit of fiat currencies, the crypto market may turn back to currency-based. Finally, on volatility, realized volatility and volatility momentum have picked up as spot prices jumped, but implied volatility struggles to sustain buying as sellers emerge quickly, as overall TradFi risk sentiment appears to be in short-term Both may be more negative, and the market is still skeptical about how long the encrypted spot trend can last.

If you want to receive our updates immediately, welcome to follow our Twitter account @SignalPlus_Web 3 , or join our WeChat group (add a small assistant WeChat: chillywzq), Telegram group and Discord community to communicate and interact with more friends.

Website: https://www. signalplus. com/