Sushi "scraping bones to cure poison", can it save itself successfully?

Sushi's self-help ushered in a new chapter.

At the beginning of last month, Sushi's new "chef" Jared Gray disclosed to the outside world for the first time that Sushi's treasury funds are only enough to last about another year and a half. In this regard, Jared proposed a temporary solution, intending to completely transfer the income that xSUSHI holders could have received through the commission of transaction fees to the treasury as an operational reserve.

Odaily Note: Regarding the ins and outs of this part of the story and the flow of funds, we are at"Funds are only enough for another year and a half, how can Sushi save itself?" "A detailed explanation has been made in an article, and interested friends can read it first.

After a month, Jared and the entire Sushi community have been discussing and promoting Sushi's self-help measures, and have given certain plans in terms of token economic model and product operation planning.

About the New Token Economic Model

On December 31, Jared announced the long-awaited new SUSHI token economic model.

It is worth mentioning that when Jared proposed the above temporary solution, he emphasized that this solution is only a stopgap measure. The key to Sushi’s ability to get out of the quagmire in the future is whether it can come up with a more sustainable new economic model and explore more many paths of development. Therefore, it is no exaggeration to say that this token economic model places the self-help expectations of the entire Sushi community.

According to Jared's disclosure,There are two main changes to the new token economic model. One is the distribution plan of transaction fees, and the other is the circulation and distribution plan of some SUSHI tokens that have not been unlocked.

First, let’s talk about the distribution of transaction fees. Previously, Sushi charged 0.3% for transactions on SushiSwap, of which 0.25% was owned by liquidity providers (LPs), and the other 0.05% was distributed to xSUSHI holders as system revenue.

Immediately in June 2021, Sushi proposed a new parameter Kanpai (meaning "cheers" in Japanese) for the 0.05% fee income. treasury income and enrich the treasury asset class to cope with the bear market that will come at any time.

Before Jared proposed an interim solution, Kanpai’s parameter was 10%, which means that the treasury will allocate 10% (0.005%), and xSUSHI holders will allocate 90% (0.045%), and the interim solution proposed by Jared before is exactly It is hoped that by adjusting the Kanpai parameters, the 0.045% fee income that originally flowed to xSUSHI holders will flow completely to the treasury.

In the new token economic model, there is a more dynamic and "balanced" change about this 0.05% fee income distribution. Specifically, xSUSHI holders will no longer participate in the distribution of this part of the income; while LPs will receive an additional part of the 0.05% income in addition to the 0.25% income, so as to obtain greater incentives; the remaining part of the income will be It will be used to repurchase and destroy SUSHI in the secondary market, and to expand the liquidity pool of SUSHI and other paired tokens, thereby improving the liquidity of SUSHI; the remaining part will flow into the treasury as future operating funds reserve.

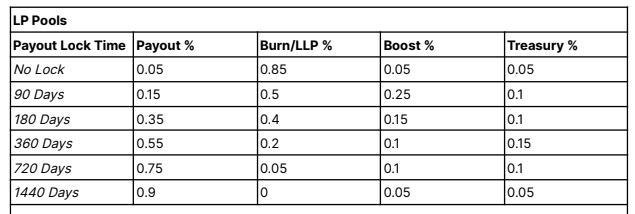

How the 0.05% fee income will be distributed in the above-mentioned multiple channels depends on the length of time that LPs lock up liquidity. Under the new model, LPs will have the opportunity to choose a fixed liquidity lock-up time (see the above table, the LPs distribution ratio is in the Payout column), and if they can maintain liquidity until the end of the time period, they can get a corresponding part of the income incentive. The longer the time, the greater the incentive ratio will be.

As can be seen,Under the premise of not affecting the user's transaction experience (increasing the handling fee) and not compromising the basic income of LPs (cutting 0.25% of the income), the new model has done a good job on how to allocate the 0.05% handling fee, the only source of continuous income. I have made great efforts, hoping to use this part of the funds to find a balance between liquidity incentives, SUSHI market improvement, and operating capital expansion.

The circulation and distribution of the unlocked part of SUSHI is the second main content of the model modification. Previously, Jared mentioned many times that the biggest problem with Sushi is that the circulation and distribution mechanism of SUSHI is too unhealthy. Simply put,The growth rate of circulating supply is too fast. In addition, compared with the original rewards that xSUSHI can obtain (converted from 0.05% fee income to SUSHI), LPs get too little incentives through the growth of circulating supply. There is an imbalance in incentives between the two - LPs are not sufficiently incentivized, and xSUSHI holders get "too much" rewards "too easily".Jared believes that this situation not only does not help the expansion of protocol liquidity, but also dilutes the value of existing SUSHI investors' positions and increases Sushi's operating costs.

to this end,The new token economic model hopes to control the velocity of circulation by introducing a pledge locking mechanism and a repurchase and destruction mechanism, with the ultimate goal of maintaining an annual inflation level of 1.5% -3%.

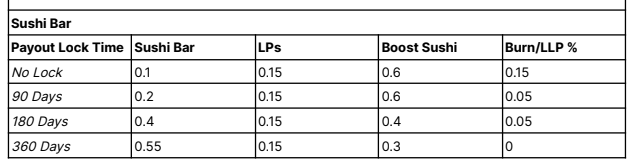

As for distribution,As mentioned earlier, xSUSHI holders will no longer receive 0.05% transaction fee income, but will instead receive incentives from the future circulation of SUSHI, from an absolute figure, the incentive range will be reduced to a certain extent, and different levels of rewards need to be obtained through different time pledges. The longer the pledge time, the more rewards will be obtained; The previous method of locking liquidity continues to share in future circulation growth rewards.

For LPs and xSUSHI stakers, the time requirements for locking and staking are soft time locks, which means that LPs and stakers can withdraw liquidity or cancel the stake at any time, but once they do so, they will be forced to forfeit the corresponding rewards and destroy it permanently.

Take a look at Sushi's new token economic model,It is not difficult to find that its core measure is to "cut" the rewards of xSUSHI holders, which is actually consistent with Jared's previous temporary solution in terms of thinking. In Jared's view, the group of xSUSHI holders who have absorbed unequal rewards has become the "vampire" of the entire Sushi ecology to a certain extent, and taking some funds from this part of the reward can increase the incentive level for LPs , can also support the price performance of SUSHI, and can replenish treasury reserves, which is the only way to help the agreement achieve long-term growth.

About product operation planning

In addition to the token economic model, Sushi recently announced its product operation plan for 2023.

According to Sushi CTO Matthew Lilley,The Sushi development team plans to temporarily put the development of Kashi, a lending platform, and MISO, a Launchpad platform, on hold.

However, the reasons for "abandoning" the two are different. Lilley said that the main reason for Kashi's abandonment is that the product design is flawed and lacks profitability, and the team is unable to take care of resources, while MISO is temporarily put on hold because it can't take care of it for the time being, but it does not rule out restarting and replacing it in the future. sex products.

After cutting these side projects, Sushi will focus on the DEX business itself in the future, and then SushiSwap will launch a centralized liquidity agreement similar to Uniswap v3, allowing LPs to set a specific price range to provide liquidity.

This change is not unexpected. Kashi did not cause too much splash after its launch, and TVL has not been able to make a breakthrough; as for MISO, it is unlikely that there will be too many IDO projects in the current market environment. For Sushi, who is deeply in the financial quagmire, if he wants to successfully overcome the difficulties, he must reduce all unnecessary expenses, concentrate all resources on the core business, and try to improve the competitiveness of the business.

Can self-rescue be successful?

Based on Sushi's recent progress, I personally tend to support Jared's series of actions after taking office.

Whether it is the change of the token economic model or the adjustment of the product operation strategy, these measures are targeted at three levels of goals: one is to increase the incentives for LPs, thereby expanding the liquidity of the protocol; the other is to control The circulation speed of SUSHI tokens improves the fundamentals of SUSHI in the secondary market; the third is to supplement the operating funds of the treasury as much as possible, and at the same time use the existing reserves in the most important places.

Previously, Jared mentioned that the key to Sushi's ability to get out of the quagmire in the future lies in whether it can come up with a more sustainable new economic model and explore more development paths.The role of the former is more to stabilize the situation, while the latter is the foundation of Sushi's long-term survival.

Judging from the current situation, the new token economic model and operational planning are expected to resolve some of the contradictions within the Sushi agreement to a certain extent, but considering the external market environment and competition pattern, Sushi is still under great pressure. On the one hand, Sushi, whose market share has shrunk to nearly 3%, is facing strong competitive pressure from rivals such as Uniswap. On the other hand, the continued downturn in DeFi has also slowed down the speed of capital inflows significantly.

For the current Sushi, the road ahead is still not optimistic.