2022, the cold winter of crypto market makers

Over the weekend, 134 FTX-related companies, including Alameda Research, formally filed for bankruptcy reorganization.

As one of the largest market makers in the industry, Alameda Research was also a gold-absorbing weapon in the hands of SBF in the past, but the final result proved that the rapid expansion of the team was based on an overly risky strategy, which also determined that the destruction was almost its inevitable end. Regarding how the team slipped into the abyss step by step,What Really Happened at Alameda Research? "There are more detailed records in the article, so I won't continue to expand here.

secondary title

First Cut of Winter: Terra Thunderstorm

As the title says,I personally tend to think that 2022 is the winter of market makers, but the beginning of the story is still in midsummer.

Just at the beginning of February this year, we also witnessed a highlight moment belonging to market makers. At that time, 120,000 ETH was stolen from Wormhole, Solana’s ecological cross-chain bridge. Although the stolen money could not be recovered, Jump Crypto, the leading market maker team with deep interests in Solana, announced that it would invest 120,000 ETH to fill the hole. This operation also allowed many people to see the "rich and powerful" of market makers for the first time.

But the good times didn't last long, and many market maker teams, including Jump Crypto, soon ushered in the first knife in 2022-Terra.

Here we need to briefly explain the business model of market makers. The main business of market makers is to provide liquidity and depth by buying and selling in cryptocurrency exchanges (especially CEX). Simply put, they are the counterparties of exchange users, ensuring that users can get quotation feedback for each transaction. Based on such a business model, firstly, market makers can obtain profits through the bid-ask spread, and secondly, they can also earn a certain commission provided by the exchange.

However, this model is not guaranteed. For market makers, if they want to earn stable spread income, the ideal state is that the two-way trading volume generated by the two-way quotation of buying and selling is just equal. However, this is difficult to achieve in reality. Affected by different market sentiments, the two-way trading volume will always be different, which will lead to the accumulation of some temporary token "inventory" in the hands of market makers. "Inventory" will be gradually consumed after the market direction reverses, but if the market continues to go unilaterally, the scale of "inventory" will continue to expand, resulting in certain book losses. In technical terms, this is called "inventory risk".

This is like our market making in AMM DEX. If the price of a certain trading pair changes after we invest 1:1 equal amount of market making funds, there will be a certain "impermanent loss", but this part of the "loss" Just need the price to return to its original position to eliminate. Although there are some differences between market making in the order book CEX and AMM DEX, the general logic is the same.

Theoretically speaking, as long as the assets in the "inventory" are not completely dead, with the reversal of market sentiment, the trading volume of both buying and selling will also reverse, and the "inventory" accumulated in the hands of market makers is expected to be gradually consumed, erasing floating losses It's just a question of how long it takes... You see, whatever you are afraid of will come.

The collapse of Terra dealt a heavy blow to many market makers. According to an analysis by Igor Igamberdiev, director of data research at The Block,Jump Crypto lost at least hundreds of millions of dollars in this incident (this is not a floating loss).

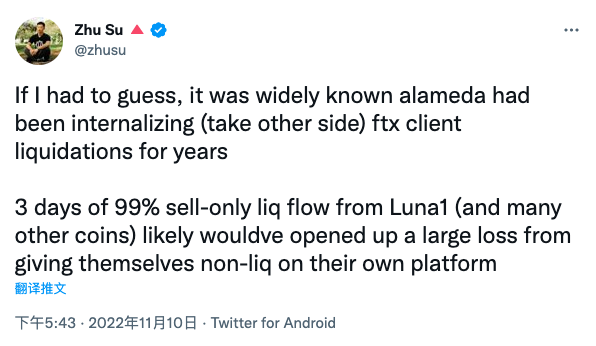

According to Zhu Su, co-founder of Three Arrows Capital,Alameda also failed to avoid this knife. Due to the unilateral sell-off for three consecutive days after Terra’s thunderstorm, Alameda is likely to have suffered huge losses because it provided liquidity to FTX.Some market views believe that this incident is the beginning of FTX helping Alameda fill the hole.

secondary title

Winter's Second Knife: FTX Black Swan

After Terra’s thunderstorm, FTX’s thunderstorm became the second attack on major market makers.

Different from the situation at the first knife, in addition to the more serious unilateral market in FTT, SOL and other assets this time, the closure of the FTX withdrawal channel also exacerbated the losses of the major market maker teams. Perhaps seeing the panic and doubts that permeated the entire market, this time the top market makers have more or less disclosed some losses.

Needless to say about Alameda’s situation, you can see his collapsed house as much as he built a tall building.

Although Jump Crypto admitted that it has risk exposure to FTX, it did not disclose the specific amount.Just to say that the exposure size is managed according to Jump Crypto's risk framework. It is worth mentioning that Kanav Kariya, the CEO of Jump Crypto, has been tweeting and updating Solana's ecological progress in the past few days, trying to alleviate the panic surrounding SOL... At this time, think about the agency's 12 Ten thousand ETH, somewhat embarrassing.

GSR also admitted that it was affected by the FTX incident, and the specific amount accounted for about a single-digit percentage of its cash balance, and this part of the loss will be borne by the company.

Oh by the way, there is also a heavyweight player.Wintermute, who lost coins twice this year due to address issues (one 20 million OP, one $160 million), also tweeted that some funds were indeed trapped in FTX, but the scale was within the agency’s risk tolerance range.

secondary title

Will there be a third knife?

Judging from the current trend, FTX may not be the last CEX to fall in this round. From as small as AAX to as large as Crypto.com, more exchanges are suffering from liquidity doubts. Although in terms of scale, even if these exchanges really fall, it is difficult to cause a huge impact like FTX, but for those who have been "bruised and bruised" As far as the market makers in the market are concerned, it is obviously worth questioning whether they can withstand another toss.

Based on this situation, it is expected that most market makers will reduce their risk exposure due to risk control considerations. First, they will try to withdraw funds from some exchanges with unknown liquidity conditions, and second, they will reduce their risk exposure in some long-tailed exchanges. Market-making capital investment on assets. As a result, small and medium-sized exchanges will suffer greater liquidity pressure, and the transaction slippage and volatility of long-tail assets will also increase.

Perhaps, this will lead to some new events beyond expectations.