Weekly Editors' Picks Weekly Editors' Picks (0813-0819)

"Weekly Editor's Picks" is a "functional" column of Odaily.On the basis of covering a large amount of real-time information every week, a lot of high-quality in-depth analysis content will also be released, but they may be hidden in the information flow and hot news, and pass you by.

Now, come and read with us:

Now, come and read with us:

invest

invest

The most potential project in the encryption industry? Hear what these 15 top investors have to say

Cosmos is on the rise, institutional lending is taking off, user authentication is changing, and Web3 social networking is coming. The article also brought potential projects such as Toucan Protocol, Farcaster, Notifi, Portabl, Axelar, Blowfish, Maple Finance, Cosmos, Railgun, Sudoswap, etc.

From on-chain data analysis, where are we in the encryption cycle?

The article starts with three key trend indicators: geographic flows, investor types, and market sentiment. The decline in the willingness of large investors to accumulate holdings may have had an impact on the crypto market crash in the second quarter. If historical data is any guide, sentiment has rarely been this negative, suggesting an attractive position for long-term holders.

Crypto Trader Ansem: Trends and Core Narratives in the Next Phase of the Crypto Market

A review of 10 niche but powerful encryption research tools

start a business

start a business

Conversation with the founder of Terra: I bet everything, but this time I lost

"I plan to spend a long time here building projects. If my thesis is correct, then I think what I will do in the next 20 years will be more meaningful than what has happened in the past 6 weeks."

a16z: Learning from Web2 social network, why should we pay attention to status equality?

Most social networks are skewed towards high status inequality (high Gini coefficient) by default, which will make it difficult to retain newcomers. And fluidity with high status is key to any viable social network, even if your goal isn't to grow your overall user base.

DeFi

How to capture the early dividends of the Move language?

The Move language has the characteristics of programming assets as first-class citizens, security, flexibility, and composability; the ecological development of the public chain using the Move language is still in its infancy, and there are not many interactive options; many well-known investment institutions have already deployed in advance with Meta With the public chain in the background, traditional financial institutions are entering the market; according to the ecological expansion, testnet progress and valuation of Aptos and Sui, it is necessary to continue to pay attention to the future direction and market performance of the two.

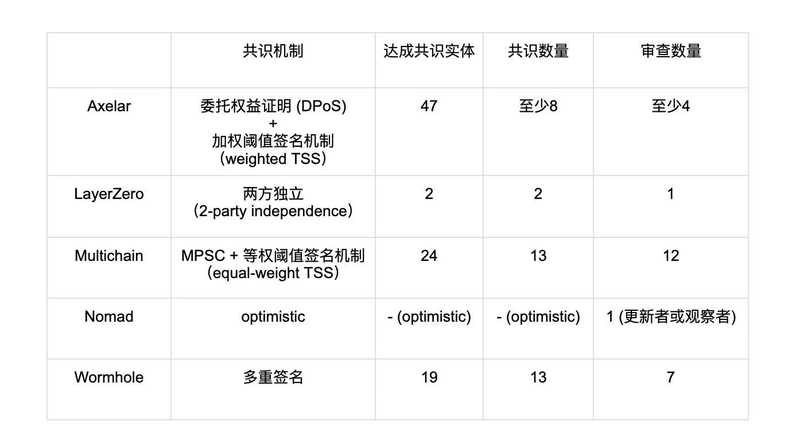

Fundamental Insights: An article to understand the cross-chain trading market

Pure aggregator projects are designed to be very lightweight, but hard to charge.

The cross-chain DEX with built-in swap has its own transaction liquidity on each connected blockchain, which is enough to form a strong commercial moat. But the establishment process is difficult.

Cross-chain DEX based on side chain is also a good business model, the problem is that building L1 is much more difficult than application.

Talking about how to prevent the centralized attack of Tornado Cash from five levels

From the perspective of decentralized protocol users, BanklessCZECH Lianchuang Rixcian proposes solutions to deal with relevant sanctions from five levels:

1. The domain name of the Tornado Cash website is blocked - TheShake is a solution based on the Handshake protocol, which is a P2P domain name system. Using their Beacon browser, the browser will convert the Handshake domain name to the corresponding IPFS address in the background.

2. Infura and Alchemy turn off support for RPC calls to Tornado Cash from the front end - Dapps provide users with custom RPC settings; set up a node provider in Metamask that won't block your transactions; self-running nodes; choose another provider Or Pocket Network; nodes run by the local crypto community.

4. USDC is frozen in the Tornado Cash contract - use a truly decentralized Stablecoin (such as RAI).

Web 3.0

secondary title

Interview with Niu Fengxuan of Yunjiu Capital: Web3 family bucket from the perspective of capital and metaverse in the context of Web3

Web3 is developing very fast, largely because the bottom layer is interoperable, which can be understood as everyone is on the same database and on the same open computing platform. Co-write codes and create new things together, so the transmission of information is very fast, and it faces the global market. However, from the perspective of traditional finance, rapid fluctuations and fluctuations are definitely unreasonable, and the valuation corresponding to the number of users is definitely unreasonable. So the industry is still fluctuating wildly.

Ethereum and scaling

The underlying interoperability of the blockchain enables NFT to open up any other application in essence, or the association gives NFT a special added value, which is a direction worth exploring in the next cycle. NFT has become a key connection in the series of games, and it has become the key to the next game or the secondary development of others. Incentives for games should be given to core value creators, not to every user indiscriminately. There are at least dozens of teams around the world working on SocialFi. Many teams are actually doing similar things, but they haven’t verified whether the product fits the market at the user level.

Ethereum official website: About mergers, you need to know these points most

Bankless Report: The Best Investment Strategies for the Ethereum Merger Process

New ecology and cross-chain

Understand the relationship between Layer2 and ETH2.0 in one article

New ecology and cross-chain

In the past three months, Solana has the most daily on-chain transactions, Cardano has the highest cumulative transaction fees, Tron has the most daily active addresses, and Tron has the highest amount of DeFi lockups.

For hackers, the huge TVL of cross-chain bridges is more attractive than ordinary protocols. Some time ago, several large-scale attacks were not related to the bridging logic of the protocol, but to smart contract vulnerabilities and operational negligence. Even with the most well-written code, with the best security audits, as the number of connected blockchains and enabled functionality grows, there are bound to be bugs that get missed. Security will be where the gap between cross-chain bridges will widen, and it must also be the number one function that every cross-chain bridge should prioritize.

DAO

secondary title

The author's proposal for this is: Polygon decentralizes its own governance rights on the basis of Matic token holders, and then the founders will hand over the power of smart contract management keys to Matic token holders, effectively transferring control Power is handed over to "Polygon DAO". However, this requires migrating to the new Polygon smart contract, which is very difficult and costly (somewhat ideal and unconvincing).

hot spots of the week

secondary titlehot spots of the week,In the past week, the Tornado Cash DAO has proposedFight against U.S. sanctions through legal meansIt was later closed due to its inability to fight against the United States),, Acala was hacked (Event full reviewAcala attacker address aUSD destruction proposal passed, a total of about 1.288 billion pieces,, the HUSD/3CRV liquidity pool once tilted,, the official saidHUSD unanchored, the official saidShort-term liquidity issues due to closure of some market maker accounts, which is now resolved,

BitGo Plans to Sue Galaxy Digital for Pulling Out of Acquisition Agreement, and claim compensation of US$100 million;,Do KwonIn addition to making investors very profitable, the level of Ethereum "killers" is limited

Institutions, large companies and top projects,Admitted to being "Rick Sanchez", an anonymous member of the failed algorithmic stablecoin project Basis Cash;Institutions, large companies and top projects,Huobi responded that it has not yet formed any plan for the transfer of major shareholders’ shares,, the company operates normally,Gemini will launch Staking business in the United StatesVitalik predicts the merger will happen around September 15,, the exact date depends on the hashrate, the Ethereum Foundation said,The estimated date of mainnet merger may have an error of up to a weekThe initial version of Ethereum fork project ETHW CoreCompound is ready to launch a new version transitioning to multi-chainrelease, including disabling the difficulty bomb, etc.,Compound is ready to launch a new version transitioning to multi-chain,, will first deploy the USDC market on Ethereum,Monero Has Completed Hard Fork Upgrade

NFT and GameFi fields,, designed to enhance the web with a range of new privacy-preserving features;With "Editor's Picks of the Week" series

With "Editor's Picks of the Week" seriesPortal。

See you next time~