加密交易员Ansem:加密市场下阶段趋势与核心叙事

原文作者:Ansem

原文编译:Amber,Foresight News

在过去的一周多的时间里,传统金融市场在美国通胀压力有所减轻的背景下出现了一些积极的信号,而加密货币市场也「追随」其迎来了阶段性的复苏。

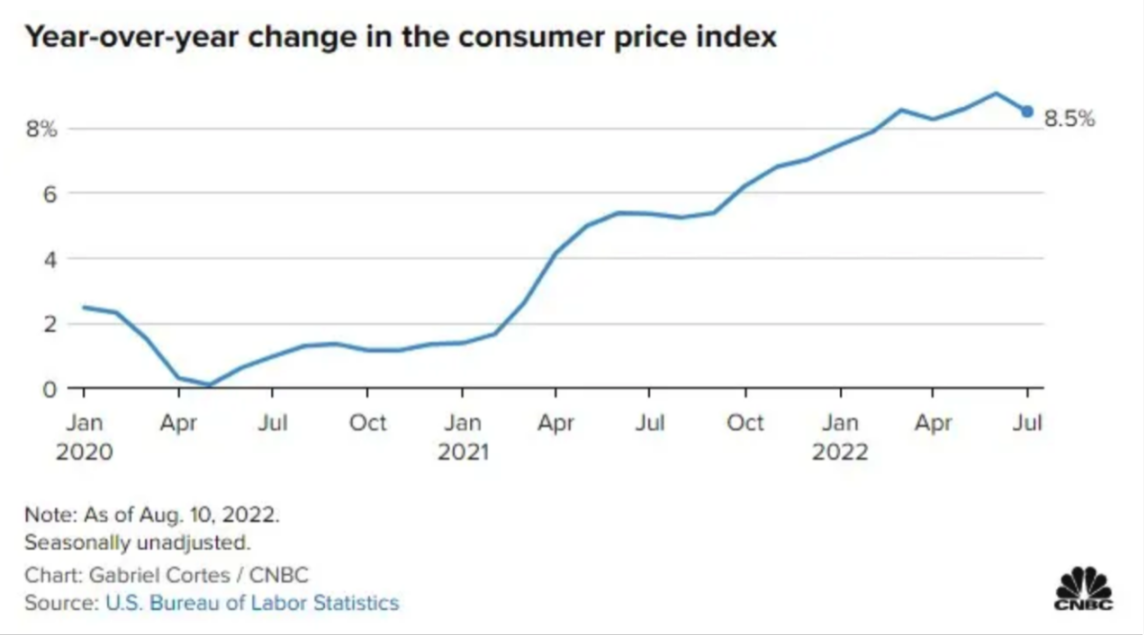

7 月美国 CPI 数据录得 8.5% 水平低于市场预期。

而一个月前公布的前值创出了 9.6% 的创纪录高点,数据发布时大多数市场参与者都会如此糟糕的数据发布后金融市场出现的猛烈反弹感到惊讶,但实际上这是因为市场对于「数据不会更差了」进行的前瞻性定价,而从结果上来看,这种看似与当期数据背离的判断是准确的。不过至于 CPI 究竟能否就此迎来拐点,我们只能继续观察下去。

如果从纯粹的「财富破坏」角度来看,今年相比于加密货币历史上任何一个周期的熊市都更加猛烈。Luna 在 5 月份的暴雷事件直接从加密货币市场中抹去了 600 亿美元的总市值,并进而在整个生态中造成了一系列的连锁反应。比特币和以太坊价格的快速跳水导致对冲基金 Three Arrows Capital 遭遇危机,6 月加密市场总市值再度跌去 100 亿美元,多家规模很大的加密领域 CeFi 机构破产,市场经历了一轮狂风骤雨般的去杠杆。

如果从好的方面来看,那就是我们几乎不可能再在短期内看到如此大规模的抛售潮了,此外这种事件发生后形成的底部往往会成为未来强有力的支撑。本文并不是交易指导,只是通过市场上的蛛丝马迹寻找市场下一步走向的大概率结果。

宏观金融市场和 BTC500

今年大部分时间里,加密货币与传统金融市场的相关性达到了一个史无前例的水平。传统金融市场在美联储收紧货币政策和通胀境况愈发严峻的背景下持续承压,而加密货币市场则是在下跌趋势看似已经接近尾声时因为连续的黑天鹅事件而再度遭受重创。不过随着市场逐渐趋于平稳,风险偏好正在逐渐回归,而加密市场同样也已经出现了一些回暖的迹象。不过我认为接下来的一段时间里行情还会有一个横向震荡的阶段,尤其是对于比特币来说,反弹可能要比那些叙事更加清晰的山寨币来的更晚一些。

从技术分析的角度来看,标普 500、纳斯达克和纳斯达克 100 最近都在其周线图上恢复了看涨结构,目前价格已经突破了最近一轮加速下跌启动前的高点位置。相比于 4 月的那一波反弹行情而言,当下这波上涨的强度和图形层面上的「收获」都更加清晰。

虽然从日线图上来看目前价格走到了一个强阻力区域附近,二季度高点一线附近首度触及时行情有可能走出新一轮的回调,不过这次回调有可能带来绝佳的上车机会。不过至于是否是起跳前的最后一次深蹲需要取决于这轮回调的强度,标普 500 指数如若能够守住 4080 一线,那么上涨势头将得以延续,不过一旦该位置失守,那么本轮反弹预计将就此宣告终结。

市场一直在盼着鲍威尔能够把那个难以捉摸的「软着陆」搞定,美联储当下仍处在高利率、高债务以及高通胀的困境下走钢丝,任何货币政策上不慎的处理都可能会造成严重的负面影响。近期的反弹得益于强劲的就业数据和有所下滑的 CPI 数值,只有这些数据保持向好的势头,美联储才能在货币政策的调整上获得更大的灵活性。不过像欧元区能源危机恶化、俄乌冲突升级甚至中国的台海问题等等风险事件都很难被提前定价,这些仍然会为市场添加不确定性。不过当下大多数人对于不断变化的经济状况仍然保持着相对乐观的态度,多数人并不认为 08 年那场全球性的金融危机会重现。

值得一提的是,美国 7 月就业数据表现抢眼,虽然市场对于就业状况的定价效率不高,毕竟多数观点认为就业好转会导致美联储在加息上更加激进。但是我认为一旦市场开始正常定价就业指标的变化,那么通胀很可能会受到健康的就业状况影响而迎来拐点。

重要事件:

8 月 25 日:杰克逊霍尔年会

9 月 2 日:8 月非农就业数据

9 月 13 日:8 月 CPI

9 月 15 日至 16 日:ETH 合并

9 月 22 日:美联储议息会议

在美联储下一次议息会议到来前,我们还有一个大约 4-5 周的时间窗口,在这期间行情很可能走出先跌后反弹的表现,并以此来提前消化以太坊合并和美联储利率决议等重大风险事件的影响。如果下个月非农和 CPI 数据仍然表现良好,那么回调预计不会很强。不过由于今年整个金融市场非常情绪化,因此在这种不确定性仍然很高的阶段,一定需要保证自身的流动性。未来一段时间里行情预计将给出一些更明确的指向性信号,这种时候我们需要做的就是相信自己的判断并坚定执行。

图表、叙事和其他有趣的东西

以太坊

ETH 自一个月前 CPI 出现下滑以来一直占据整个加密市场的领跑位置,以太坊不仅跑赢了比特币,近期表现也明显优于各大公链以及其他市值靠前的大盘币种。近期只有与合并相关的一些代币能够跟上以太坊的节奏,比如 OP、Lido 以及 GMX 等等。

我认为二层相关的代币在合并周期中更具关注价值,因为 Rollup 需要更高的活跃度来帮助以太坊获得更高的市场定价,而 OP 已经很好地印证了这一判断,Arbitrum 未来预计也会走上相同的道路。

此外,当下以太坊是加密货币市场大玩家们在合并中可以用于下注的唯一流动性资产,因此当前阶段以太坊拥有比比特币好得多的叙事。另外一点在于,加密市场的独立性正在上升,最近这波反弹行情走出后,目前市场出现了非常明显的分化,一众山寨币截止今天甚至都还没有收复 Luna 暴雷后第一波反弹的高点,相比之下比特币和以太坊的状况要好上不少。这种比特币和以太坊引领下跌但最后「只有」山寨币遭受毁灭性打击的剧情,之前并不多见。

盘面上来看,我认为低于 1800 美元的以太坊都是值得买入的,当然如果价格再度出现快速跳水并且击穿 1650 一线的话,我们在抄底时机的选择上需要更慎重,一旦如此行情可能会再度下探 1000 美元整数关口。不过只要 1650 一线支撑不破,那么在 9 月中旬合并落地的时候,以太坊收复 2000 美元几乎是板上钉钉的事情。

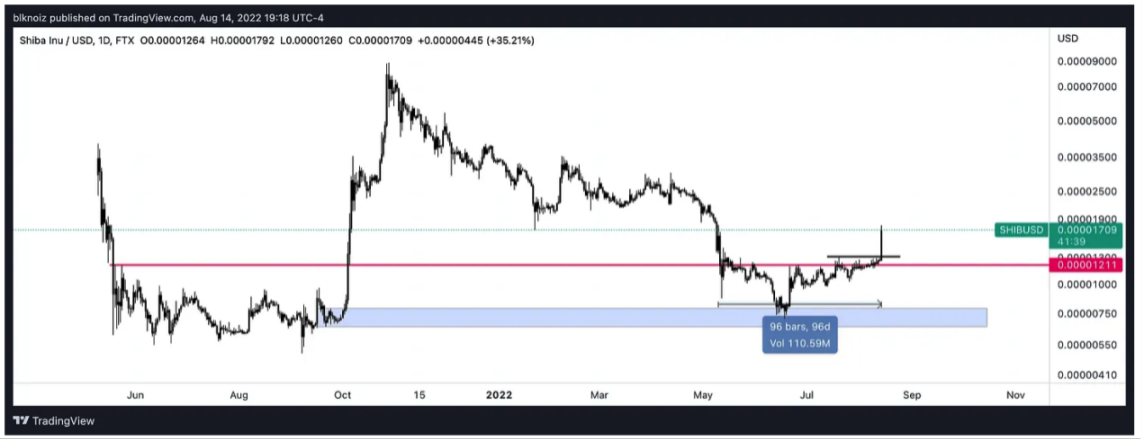

DOGE & SHIBA INU

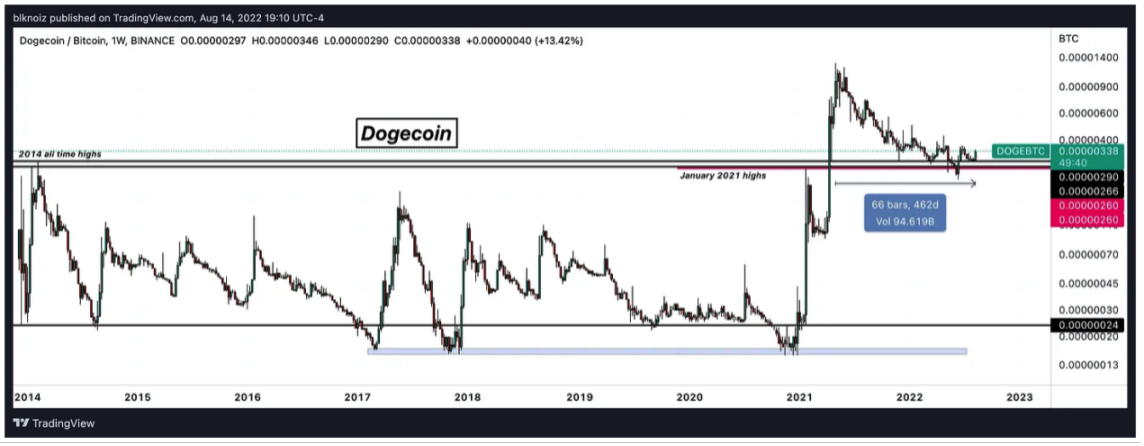

上周六我收到了 SHIB 突破阻力位置的行情异动提醒,DOGE/BTC 开始走平意味着我们即将迎来市场的新一轮选择,要么熊市反弹中山寨币的最后一波轮动,要么新一轮爆发式行情会很快到来。结合市场近况我认为后者发生的可能性会更高。

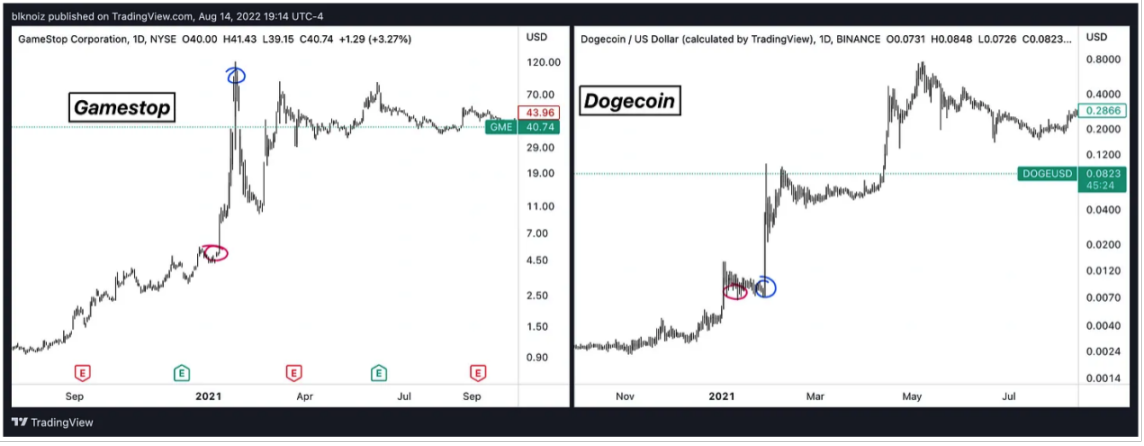

如果你回顾一下加密货币市场并不算久的历史你会发现,DOGE/BTC 是一个可以用于判断散户入场的神奇指标。在过去一周左右的时间里,因为包括 AMC 在内的几个散户抱团的股票讨论热度的上升,WallStreetBets 这个曾经在 2021 年初的那一轮行情中一夜蹿红的 Reddit 社区又活跃了起来,如果你经历过 2021 年初的市场,相信对于 GameStop 和狗狗币的故事一定不会陌生。目前狗狗币生态中还有了一个狗狗链,让狗狗币可讲的故事又多了一层。Shiba 和狗狗在加密技术创新、DeFi 或者元宇宙游戏等方面几乎没有任何底层支撑,驱动其上涨的几乎完全是 Meme、社区 FOMO 情绪以及加密原生资本属性等因素。不过狗狗币在每一轮加密市场的行情出现之前总能够提前抢跑。不过历史也并不一定会完美重演,这波上涨也有可能仅仅是牛市反弹过程中的山寨轮动而已。

技术图形上来看也非常简单,行情在迫近去年夏天的低点后实现了止跌反弹,并且已经突破了最近几个月震荡所处的箱体上沿,不过如若行情在短时间内再度跌回至这个箱体内部将是一个糟糕的信号,因此短期内对于这个刚刚被突破,由阻力转为支撑的位置回踩确认时的表现至关重要。

而谷歌趋势的变化和币价高度相关,每次价格除顶都伴随着谷歌搜索趋势的峰值,从这一点来看,目前狗狗币还没有来到要逆转涨势的位置,市场对其关注度还相对很低。

Solana

Solana 是 2021 年我最喜欢的加密货币,作为之前公链竞赛中除 BNB 以外的另一个胜出者,一度引领了上一个市场周期,随着以太坊过渡到模块化网络架构并将大部分执行转移到 Rollup 上,Solana 将成为在一层上直接处理所有事务的代表性公链。Solana 在发展的过程中经历了很多坎坷,其非常低的网络使用成本对于普通用户仍然非常具有吸引力,Solana 生态 NFT 的蓬勃发展也印证了这一点。不过也正因如此,网络经常会被机器人滥用而导致了不止一次的宕机崩溃。为了让 Solana 能够更进一步,他们必须要让 DeFi 应用发展起来,目前 Solana 上的 Drift 以及 Friktion 已经取得了一些成绩。除此以外 Solana 上目前还没有任何高 TPS 的游戏类应用,该网络能否像雪崩的子网一样能处理高频的小额交易非常重要。

Solana 最近一次网络升级中实施的 Quic/Qos/ 本地化费用市场将有助于防止网络流量高峰期的拥堵状况,为用户提供更好的用户体验。我很愿意把这个升级称作 Solana 2.0,官方给出的补丁版本号是 1.10.32。Quic 是验证器使用的协议,该协议将允许块生产商对限制机器人进行评级,并处理 UDP 无法实现的拥塞。本地化费用市场将像以太坊上的收费市场一样运作,但费用不是在整个网络上受到全球影响,而是特定于正在被限制的部分,因此该规范之所以成为可能,因为 Solana 的运行时允许并行交易处理。例如,在 ETH 上,每当流行的 NFT 铸造进行时,就会把整个网络的 Gas 费推升,而 Solana 上的费用只会对与该特定铸造互动的用户激增,允许网络的其余部分继续运行,没有停顿。质押加权的服务质量确保节点有权获得相当于您质押的交付给领导者的数据包的百分比,这不允许持有高百分比或根本没有质押的机器人超过其他人。这些更改现在在主网上广播逻辑,因此我们将在未来几个月内看到这些更改是否对网络的性能产生重大影响。

技术分析方面,一旦 48.5 美元一线被有效突破,将快速打开上方空间,短期内回踩 40-42 支撑区域不破将是最理想的买入机会,不过如若上周低点 39.15 一线被跌破,那么需要注意防范新一轮快速下跌的风险。

Chilliz

Chilliz 一直是实现现实世界消费者市场最成功的加密团队之一。他们是一家专门针对体育和娱乐公司的金融科技提供商,他们的一些著名的合作项目包括巴塞罗那足球俱乐部、尤文图斯、UFC、13 支 NFL 球队等。许多体育俱乐部现在通过他们的 Socios.com 应用程序拥有自己的 CHZ 相关代币,该应用程序允许球迷与他们最喜欢的球队互动。该应用程序尚未在美国上线,但计划很快推出。最近,他们宣布与巴塞罗那足球俱乐部合作,详细说明了他们 1 亿美元的投资,以帮助支持他们的 NFT 和元宇宙计划,自 8 月初以来,CHZ 的表现一直非常强势,跑赢了大多数 ERC20 代币。

目前,CHZ 作为 ERC-20 令牌存在,粉丝们用于在 Socios.com 上购买在其侧链 Socios 上运营的关联团队的粉丝代币。今年晚些时候,他们将推出自己的公链 Chilliz 2.0,这将是一个一站式平台,供团队通过各种分散式应用程序与粉丝互动。如果他们能够在美国市场有效地复制他们的成功,他们就几乎可以实现对于大多数 NFT x 粉丝 x 体育市场的垄断了。

CHZ 近期走出了一波强势反弹,目前已经突破了过去近一年左右下跌的趋势线阻力,上方强阻力需要看到 0.30 美元左右,只要价格守稳 0.15-0.17 支撑区域不破,那么上涨势头暂时无虞。

XMON

Sudoswap,被 Sisyphus 恰当地称为 NFT 市场的 Uniswap,是一种试图使您的 jpegs 更具流动性的 AMM。在过去的一年里,NFT 可以说是加密市场新人上手的最佳选择,但除非你眼光毒辣,否则很难在 NFT 市场中一直取得成功。

Sudoswap 允许用户更有效地交易 NFT,用户能够创造性地构建不同的池,并在上面有自己的专用曲线。sudoSwap 不是每次交易时都会收取费用的中心化市场,而是完全去中心化且不收取任何费用的平台,为用户提供了更简单的买卖方式。这样做的主要障碍将是流动性是否转移,过去一个月左右该平台的数据增长趋势看起来不错。鉴于它只上线了大约 30 天后销量就已经达到了 OpenSea 约十分之一的水平,一旦市场热度回归,尤其是更多游戏道具类型的 NFT 被用户放入该平台流通的话,sudoswap 未来的成长空间仍然相当可观。

一些思考

我认为市场最糟糕的时候已经过去了,以太坊合并前我们不太会看到新的低点了,不过我们还是需要进行风险对冲,比特币在短期内缺乏新的叙事以及市场表现仍然欠佳的近况无疑是当下最适合的可用于对冲做空的资产。虽然比特币有一群忠实的信徒,但是这些人购买比特币往往只关注特别长的周期,并不会在意短期内的波动。目前宏观金融市场的状况仍然不够好,不过一旦经济衰退的焦虑情绪开始减弱,市场上的流动性会很快回归。而一旦市场出现向好迹象,那么跟进的最佳选择实际上是狗狗币、链上期权以及一些 MEME 山寨币。当然,我也很喜欢 Chilliz,因为他提供了人们和自己喜欢的球队建立联系的最佳机会,我会非常愿意为自己喜欢的球队推出的链上资产买单。无论经济状况如何,人们总是喜欢竞技体育。我之前也关注了 StepN,但是并没有做太多研究,也没有搞清楚他的模型是否可持续。所以到目前为止我还没用过这个 App。我认为元宇宙赛道仍然充斥着 alpha,因为这个赛道仍然没有被深入挖掘,但是我并不打算在这里做过多展开,读者们可以多关注一下这个赛道的新项目。

在过去的两个月里,Lido Finance、OP、GMX、FOLD 等与合并相关的币种表现很好,不过接下来这些币会迎来考验,以太坊合并一旦顺利完成进而导致大规模减产,有可能会导致这类资产集体回调。接下来 9 月 Arbitrum Odyssey 的重启值得重视,而像最近这轮牛市中表现很好的 LINK 和 SNX 等看似已经度过了熊市最艰难的阶段逐渐开始复苏。不过当下现货买入以太坊可能是风险最低的选择,如果你想要更保险的选择,那么就请多去在二层上进行交互,并等待新项目未来公布发币计划。

即将到来的杰克逊霍尔年会预计将会让市场对于未来美国经济数据的解读思路更加清晰,也会给出一些美联储货币政策调整的前瞻性信号,这都是接下来必须要关注的重点。

重点关注的主流资产:ETH、SOL

重点关注的 MEME:SHIB、DOGE

具有较高上限的资产:CHZ

中等上限的可关注资产:XMON

用于风险对冲的选择:BTC、APE

观察列表:SNX、LINK、LDO、FOLD、GMX、SYN、SCRT、UNI、AAVE、IMX、OSMO、DPX、MATIC、BTRFLY

展望未来

当前市场关注的重点是将在第四季度到来的以太坊合并,不过我们还是应该进一步拓宽思维。考虑到宏观金融市场仍然具有很大的不确定性,因此我并不认为现在能够预判到美股接下来会如何发展。我们没必要去猜测 CPI 的具体数值,不过我们可以通过一些细节去分析美联储可能做出的反应和决策。如果我们真的能够重新迎来牛市或者至少迎来一轮更大规模的熊市反弹,那么我们需要应对的板块轮动将和 2021 年的市场状况完全不同,一旦趋势发生改变,我们需要尽快找到真正具有长期潜力的新的热点赛道。

未来市场值得关注的叙事:

Sol 2.0 与本地化帐户费用市场

Optimistic Rollups v2: Arbitrum Nitro 和 Optimism Bedrock

privDeFi: Aztec Connect, Secret Network, Penumbra, Mina + zkApps

sudoSwap & 图狗

跨链安全

应用链间的账户互操作性

链上期权的兴起

zkEVMs: Scroll vs. zkSync vs. Starknet vs. Polygon Hermez

新公链: Aptos & Sui

xApps & 跨链通讯: CCIP vs. Stargate vs. Synapse Chain vs. Connext vs. Wormhole vs. IBC

Celestia & Sovereign Rollups

dyMension and RollApps vs. Rollups

模块化执行 rollups / FuelVM

链游: Aurory, Illuvium, Treeverse, Strange Clans

EIP 4844

总的来说,我认为我们处在一个不错的窗口,未来一个月左右市场预计还会保持在一个比较好的状况之中,一旦宏观金融市场的大环境进一步改善,我们就必须要及时抓住上述这些新的叙事。