IOSG Ventures: Building an Institutional-Grade Credit Market for Polkadot Parachain Auctions with Fixed Rates

Original Author: Ray

Original source: IOSG Ventures

Original source: IOSG Ventures

background

Standing at the end of the 2-year bull run, in the past 5 years, DeFi has experienced the most rapid development in blockchain applications from scratch (from the most basic currency issuance & lending agreement MakerDAO in 2017 to 2021 A large number of The second layer of DeFi protocol emerges). We have observed that the basic narrative of DeFi has undergone phased changes: Inclusive Finance (financial products that allow everyone around the world to use without permission) >> Professional financial infrastructure (more solutions to institutional customers, professional players needs and pain points).

existexist"Rollup empowers a new financial system"

In the article, we also mentioned "One whale is worth ten thousand turtles: the 90-4 rule". As the most successful scenario (narrative, actual use, and commercial value) that Crypto has been verified so far, the data on the DeFi chain will not lie. Institutional customers / Giant whales are the most important customers of DeFi, and this trend will intensify and even become the biggest narrative of DeFi in the next 5 years.

Based on the above logic, we are optimistic that the positioning of DeFi in product iteration and business innovation will become clearer in the next round of Crypto cycle: Prioritize the various needs and needs of B-end customers (professional traders, financial institutions, giant whales) Questions, ready to serve/serve big money and more big money that will enter the market soon, this is also the more complex financial agreement in DeFi's Second Layer (the following icons are in red, such as: fixed-rate lending & derivatives, structured financial products , liquidity optimization protocol, etc.).

image description

DeFi Map; Image source: IOSG Ventures

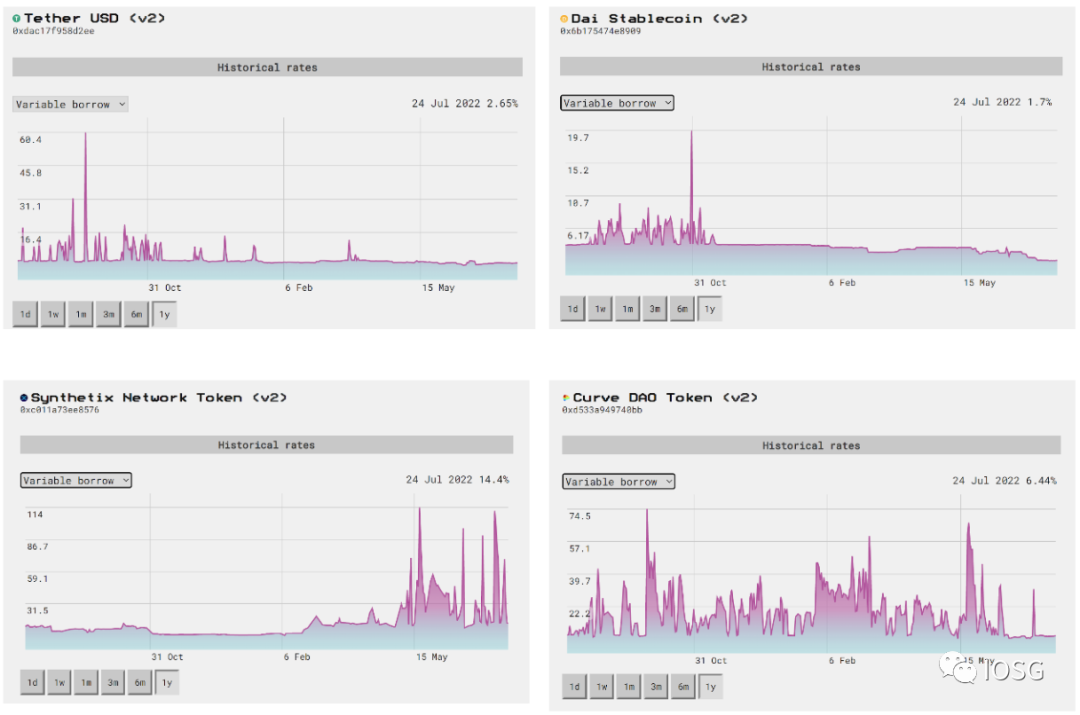

Among the Second Layer DeFi building blocks, fixed-rate loans and derivatives have always been projects. The most well-known ones in the lending agreement track are currently Maple Finance and Notional Finance, while more complex fixed-rate derivatives (such as credit default futures, interest rate market) there are also players such as Swivel Finance, Element Finance.

Some people may ask why professional financial institutions must have a fixed-rate lending agreement, but is it not possible to have a floating rate?

If we look back at the traditional financial market, the fixed income market is more than twice the size of the securities spot market. According to ICMA, as of August 2020, the overall size of the global fixed income market was approximately US$128.3 trillion.

image description

Image source: Swap.Rate

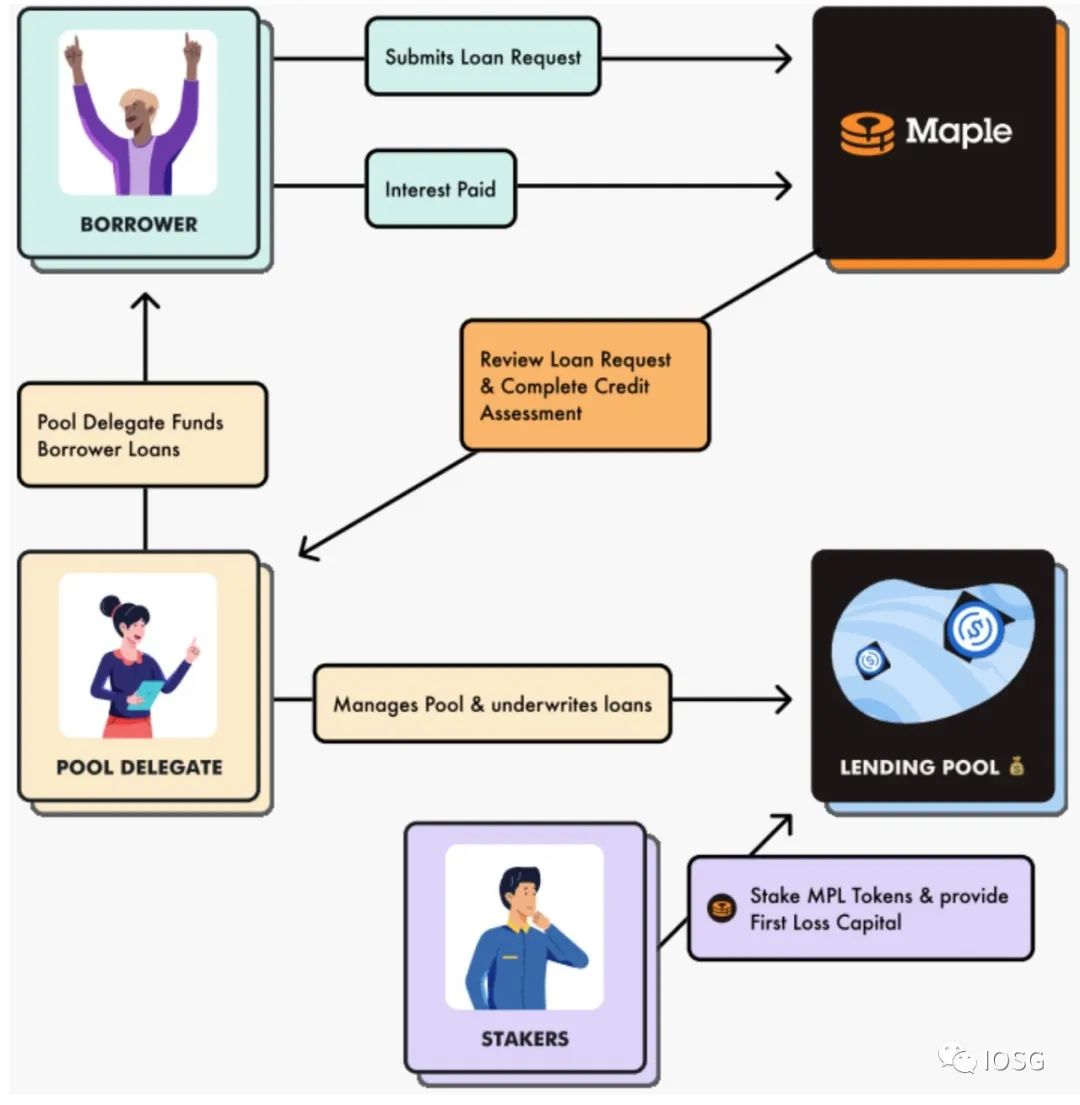

At present, Maple Finance, the leading project in the fixed-rate lending/credit market, has established a firm foothold in Ethereum. The fund pool manager has deposits of more than 700 million US dollars, and has issued a total of 1.5 billion US dollars in loans. The most special feature of its agreement is to ensure that the risk control can protect the interests of the lender under the condition that the user experience is relatively simple (by introducing multiple professional risk control third parties to participate in KYC, capital pool risk management and other roles). The biggest scenario of this agreement is to solve the problem of low efficiency of over-collateralized funds in the DeFi field for institutional customers, provide undercollateralized loan services and ensure transparency on the chain.

image description

Image source: https://dune.com/queries/876553/1530067

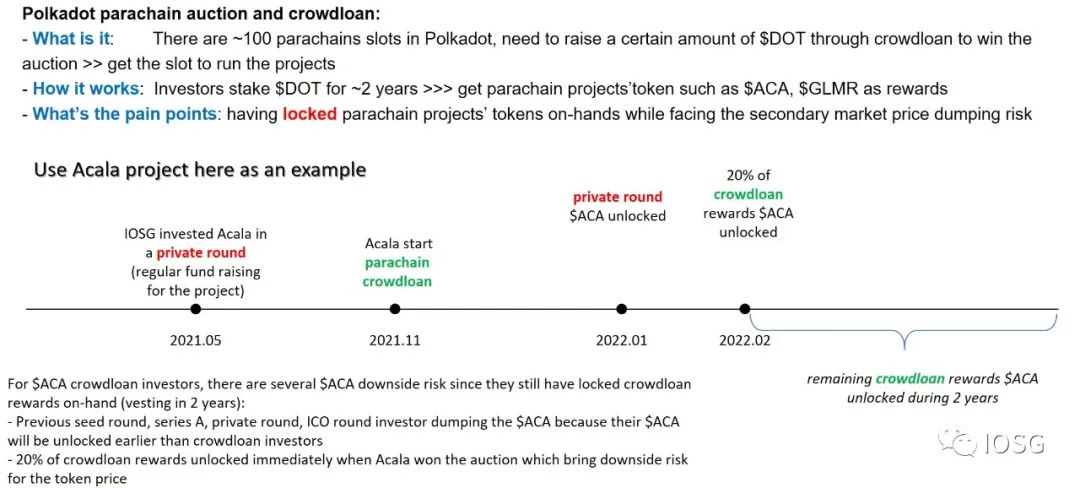

Grab the capital efficiency needs of giant whales and enter the Polkadot parachain market

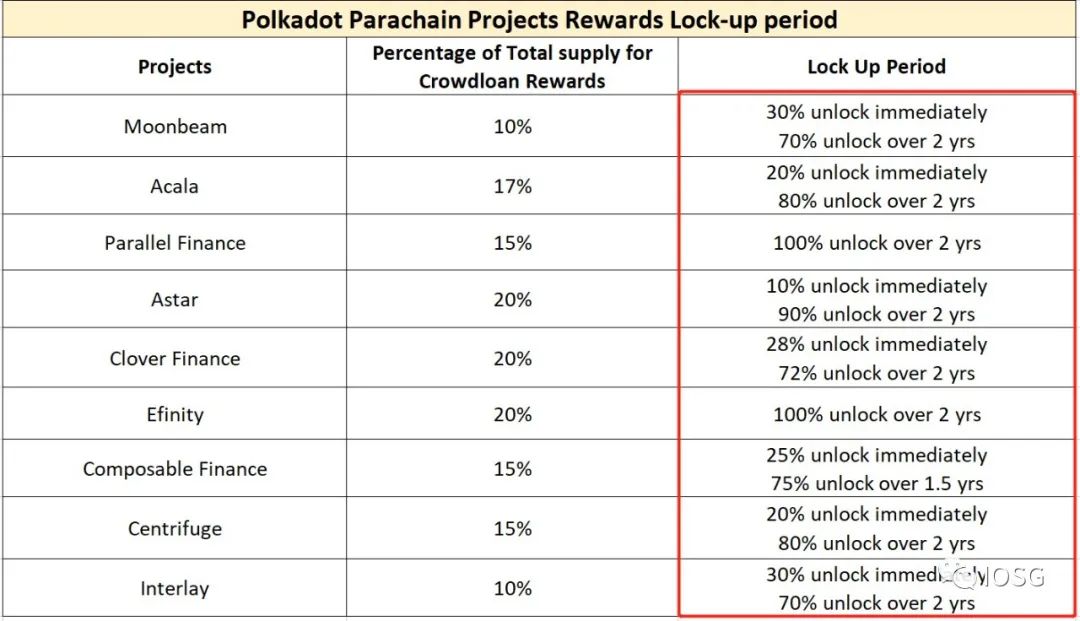

As the most important basic business model of Polkadot, up to now, the parachain auction has raised nearly 1.26 billion worth of DOT. In the parachain auction, institutional clients/giant whales currently account for a considerable proportion, and what they need to face is the parallel Chain reward tokens basically have a 2-year unlocking period. Before the tokens in their hands are unlocked, they need a hedging tool that can hedge the downside risk of the token price (there is currently a lack of such tools on the market, whether it is centralized or decentralized. chemicalized).

On the one hand, through the data on the chain, we can see that among the investors participating in crowd lending, giant whales still occupy the mainstream.

image description

According to the data on the Polkadot chain, we can find that an average of 50% of the funds of the top 9 winning crowd loan projects come from the accounts of giant whales (note: this does not take into account the opaque factors on the centralized exchange address chain), so we It can be seen that the giant whale is an important participant in the crowd loan.

image description

On the other hand, these investors will directly encounter liquidity problems in the crowd loan, because the unlocking period of the token rewarded by the crowd loan of most projects is about 2 years, and the tokens of many projects actually already have liquidity at the second level , which means that the unlocked tokens held by crowd loan investors need to hedge against the risk of price decline. (As shown below)

image description

Image source: IOSG

How to solve the problem / application scenario

Polkadot parachain crowdlending investors (especially institutional/whale investors) have the following two potential needs:

Lending out Altcoins (tokens of parachain projects): Lending out altcoins at a fixed interest rate

Decentralized Fixed Rate Market Player Comparison

image description

Image source: IOSG

Conclusion / Thoughts

In the past five years, we have seen that almost mainstream DeFi products are constantly swaying between serving institutional investors and ordinary users in terms of protocol design and market narrative, but facts have proved that even the most basic spot trading market, most The trading volume also comes from professional players rather than ordinary users, which has been proved by DeFi with good data. And when we look at the lending market, the same is true, and institutional customers occupy a dominant position.

The biggest narrative of DeFi in the next 5 years will still be institutional customers. The underlying reason is that DeFi users in the past 5 years are still people/money in the Crypto circle, and traditional big money has not yet come in. If friends who care about this matter can also find that the most OG DeFi circles have been emphasizing in the past year that they are not sacrificing decentralization, anti-censorship, security, and no need for trust. These are the core principles at the bottom of the decentralized financial infrastructure (especially after Terra, Celacius, Amber)

Between borrower and lende, a third-party risk control and identity verification system needs to be established separately. At present, the relatively best fixed-rate loan product for B-end users is still Maple Finance. In their platform, a "Pool Delegater" is set up to verify the identity and qualification of the borrower to check whether they are eligible to issue loans to the other party. loan.

image description

Original link