Weekly Editors' Picks Weekly Editors' Picks (0430-0506)

"Weekly Editor's Picks" is a "functional" column of Odaily.On the basis of covering a large amount of real-time information every week, a lot of high-quality in-depth analysis content will also be released, but they may be hidden in the information flow and hot news, and pass you by.

Now, come and read with us:

Now, come and read with us:

Investment and Entrepreneurship

Investment and Entrepreneurship

Tips for Finding Alpha in Nansen "Whaling"

It is very suitable for the introduction of tools and methodologies for individual investors.

“Projects need to have vesting unlock periods. During this period, they cannot sell shares and cash out options. Personally, I will not buy within 2 weeks after vesting, even if it is a good basic project."

How to capture opportunities in Web3?

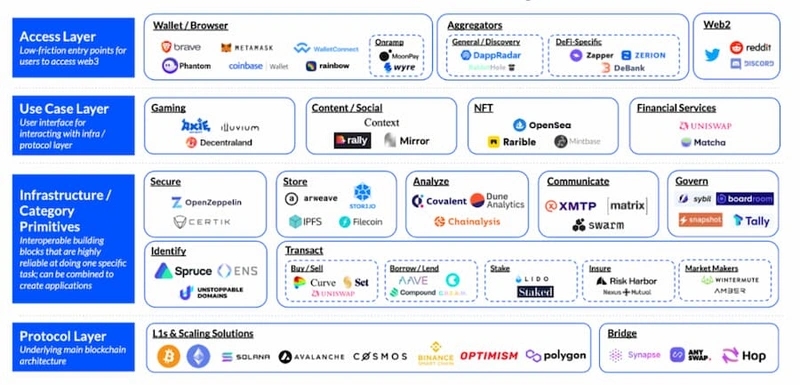

The article is not long, and the focus is on clarifying the stack and its roles for Web3.

DeFi

Maintainers, creators, creators, and participants serve in the above-mentioned corresponding Web3 stacks: network operators all over the world are the cornerstone of the underlying architecture of Web3.0, ensuring the normal operation of multiple networks, and generally serving the protocol layer; creators are the strongest brains of the application layer (smart contract layer & use case layer), continuously injecting new vitality into the industry; creators rely on the UGC platform in the use case layer to create content, convert the content into digital assets and thus Realization; Participants can enjoy the early development dividend of Web3 through access layer tools, and also get rewards through their contributions to the ecology.

Delphi Digital: Common arguments against veTokens and possible ways to improve veTokens

The author developed another veToken model method based on an in-depth study of the Curve/Convex relationship. This alternative is to illustrate a hypothetical token through a program called "GOV". The proposal aims to reduce centralization while still maximizing veToken's core attributes: rewarding the longest and most dedicated participants , does not eliminate contributors who cannot afford the liquidity risk in the traditional veToken economy.

In-depth analysis of the application of interest rate derivatives in cryptocurrencies: interest rate swaps and interest rate futures

Unlike traditional markets, AAVE's interest rate does not depend on the price of the underlying asset, but on the availability of liquidity. When assets are mostly available, interest rates are low to encourage borrowing. When assets become scarce, interest rates increase to encourage repayment of borrowings and increase deposits in liquidity pools.

NFT, GameFi and Metaverse

NFT, GameFi and Metaverse

Otherside: Connect everything

The cooperation with Animoca and OpenSea will bring bonus to Yuga Labs metaverse and game layout. In addition, Otherside is also focusing on land reuse value and practicality, rather than using land as idle assets. Yuga Labs' top-quality Collection occupies more than 20% of the market value of the entire NFT market. The right to speak of these IPs will serve as Yuga Labs' weapon to build a world based on identity.

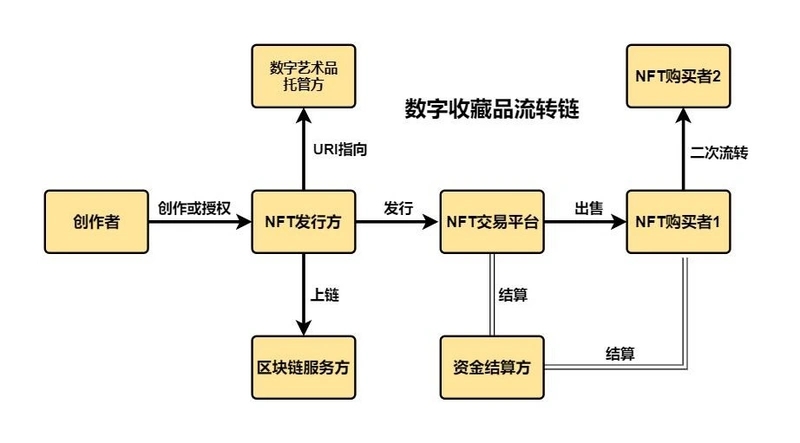

Write to entrepreneurs in the field of digital collections in China, friends who are more familiar with the industry suggest reading directly from "1.3 The value and legal attributes of NFT".

"The negotiability and scarcity of NFT seem to be brought about by the private key of the core structure, which is very similar to virtual currency." The dual structure of NFT determines that when we get NFT, we only get the key , does not necessarily mean that we get a surface picture of what the code contains. From a legal perspective, the "uniqueness" and "non-homogeneity" of NFT are realized by a specific combination of data, and the possession of a specific set of data by a person forms a specific set of "quasi-property" legal relationships . The value of NFT largely depends on how the project party operates and what kind of marketing ideas it adopts.

image description

my country's NFT market industry chainThe general form of domestic NFT digital collections is the direction of digital cultural creation, NFT+blind box, NFT+copyright transaction. The regulation of my country's NFT industry mainly lies in the prevention of hype risks, restrictions on exchanges, confirmation of NFT rights and copyright protection. The author further analyzes the regulatory situation and specific precautions for domestic NFT platforms and NFT service providers.》《There are three good NFT data reports this week, recommended reading: "》、《Five sets of interesting data conclusions in the NFT "Census" (Q1 version 2022)》。

Ethereum and scaling

Numerical reading of the status quo of the NFT market: blue-chip NFT collections remain strong

Ethereum and scaling

Ouyi Research Institute: Ethereum 2.0 program and progress research reportA complete introduction to the Ethereum 2.0 plan and progress, and also hints at the implementation risk and competition risk of Ethereum 2.0.》。

For more recent trends, you can read "

Ethereum Core Developers Meeting: Merger Update

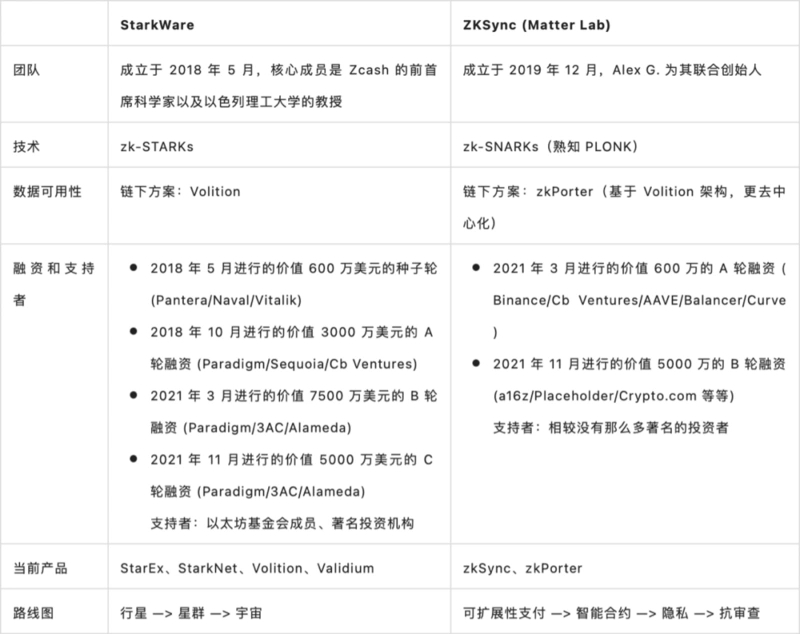

Zonff Partners Research: 4-word long essay captures the value of the ZK Rollup era

Currently, Optimistic Rollup is more mature, and most people agree that ZK Rollup will be a more efficient and cost-effective expansion solution in the future. The ZK Rollup solution can bring some unique advantages, such as privacy protection, retention scalability, and the realization of cross-chain applications, but its application is still accompanied by some risks, such as liquidity fragmentation, communication difficulties, and technical obstacles. Combination row reduction and centralization risk, etc. One of the main problems that restricts the development of ZK Rollup is the compatibility of Ethereum EVM. After L2 matures, the protagonists of the industry must come from fields that can become killer applications, including games, entertainment, social networking, and virtual reality.

New ecology and cross-chain

New ecology and cross-chain

This article first gives a general introduction to the background, financing history and progress of the Arbitrum team, and then summarizes the projects worthy of attention in the Arbitrum ecosystem from cross-chain bridges, DeFi, NFT, games, and Arbitrum-supporting infrastructure and tools.

DAO

secondary title

The authors argue that as more investment DAOs enter the market, investment DAOs expand their operational focus as they face increasing competition. Today's investment DAOs have been able to secure funding purely based on the breadth of their network and the reputational signals they provide to other investors. In the next phase, the incubating DAO will play a key role in exploring the maze of ideas that emerging markets become "homebrew computer clubs" for various ecosystems. In the third stage, DAO can also evaluate venture capital from the perspective of services, rather than purely financial functions, so that projects can obtain funds and value-added services from investors while paying a price in ownership dilution.

hot spots of the week

secondary titlehot spots of the weekIn the past week, the Fed willbase rate hike50 basis points,NasdaqThe CEO stated that he is interested in cooperating with encryption companies and is evaluating the regulatory environment and institutional needs.Asset management giant VanEck1000 community NFTs will be airdropped,BuffettStill not optimistic about Bitcoin, saying "I will not buy all Bitcoins sold at $25",LFG buys about $1.5 billion in BTC, currently the seventh largest holder,a16z plans to go to IndiaStartups invest $500 million, and Musk plans to maketwitter goes public again, Musk willCoinbaseLater called it "substitutable", APE fell below 16 USDT for a short time,V GodIndicates that the new currency information will not be released on Twitter, and all information will be transferred to the official website announcement page.V GodClaiming that Musk's takeover of Twitter had a morale effect,

Hop ProtocolBinance, a16z, Sequoia, Oracle, Fidelity, etc.Joined the "Musk Acquisition of Twitter" funding ranks;Launch of Native Token HOP, Aurora CEO AnnouncesRainbow bridgesuspension due to unusual activity,

Fei protocol suffers reentrancy attack, with a loss of nearly $80 million;Otherside is officially on sale,OpenSea,at the same timecause controversyWith "Editor's Picks of the Week" series

With "Editor's Picks of the Week" seriesPortal。

See you next time~