Musk ซื้อ Twitter และสถาบันชั้นนำเหล่านี้ก็จ่ายเงินให้เช่นกัน

เมื่อปลายเดือนที่แล้ว Musk และคณะกรรมการของ Twitter ได้บรรลุข้อตกลงในการซื้อ Twitter ในราคา 44 พันล้านดอลลาร์ (34.5 พันล้านปอนด์) และถือเป็นส่วนตัว ตอนนี้มีรายละเอียดเพิ่มเติมของการได้มา

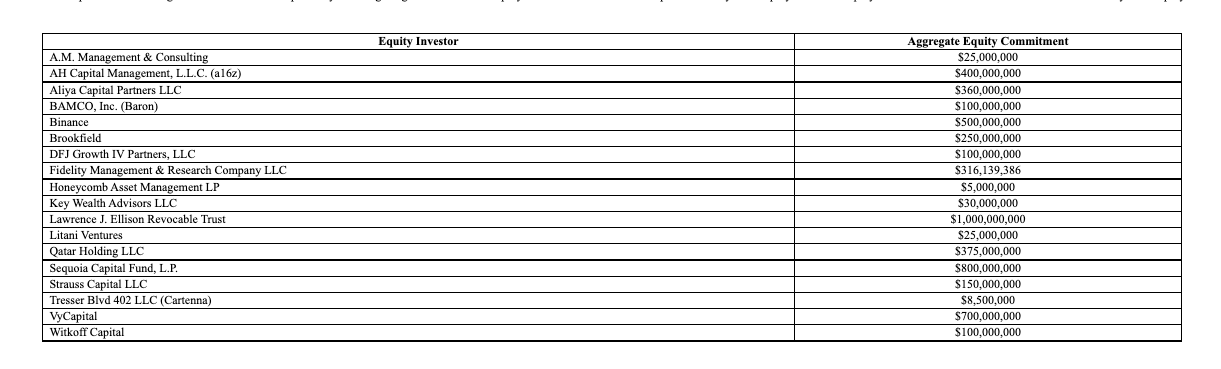

ในเอกสารที่เผยแพร่โดยสำนักงานคณะกรรมการกำกับหลักทรัพย์และตลาดหลักทรัพย์ของสหรัฐ (SEC) วันนี้ Musk ระบุว่าเขาได้รับจดหมายยืนยันจากสถาบันการลงทุนหลายแห่ง รวมถึง Sequoia Capital ด้วยภาระผูกพันทางการเงินรวม 7.14 พันล้านดอลลาร์สหรัฐ

รายชื่อนักลงทุนใหม่ประกอบด้วย: กองทุนผู้ก่อตั้ง Oracle Larry Ellison (1 พันล้าน), Sequoia Capital (800 ล้าน), Vy Capital (700 ล้าน), Binance (500 ล้าน), a16z (400 ล้าน) พันล้าน), Aliya Capital Partners (360 ล้าน), Fidelity (ประมาณ 320 ล้าน), Qatar Holdings (375 ล้าน), Brookfield (250 ล้าน), DFJ (100 ล้าน), Witkoff Capital (100 ล้าน)

นอกจากนี้ยังสามารถเห็นได้จากการลงทุนข้างต้นว่าโดยพื้นฐานแล้วนักลงทุนเป็นกลุ่มและทุนชั้นนำ และหลายคนมีตำแหน่งที่มั่นคงใน Crypto อย่างไรก็ตาม แม้แต่ผู้ก่อตั้ง Oracle ซึ่งลงทุนมากที่สุด ก็ไม่ได้คำนึงถึงสัดส่วนที่สูงของการได้มาทั้งหมด และนี่คือกลยุทธ์ของ Musk อย่างแท้จริง ช่องทางการเงินของ National Broadcasting Corporation แสดงความคิดเห็นว่า Musk และกลุ่มความร่วมมือนี้ร่วมมือกันเพียงบางส่วนเท่านั้น ซึ่งแสดงให้เห็นว่าเขากำลังมองหาพันธมิตรเชิงกลยุทธ์มากกว่าพันธมิตรด้านการลงทุนทางการเงินเพียงอย่างเดียว

ก่อนหน้านี้ เพื่อทำธุรกรรมการเข้าซื้อกิจการของ Twitter ให้เสร็จสมบูรณ์ Musk ได้สัญญาว่าจะจัดหาเงินทุนจำนวน 33.5 พันล้านเหรียญสหรัฐ โดย 12.5 พันล้านเหรียญสหรัฐจะได้รับจากการขายหุ้นของ Tesla และอีก 21 พันล้านเหรียญสหรัฐจะได้รับจากส่วนของการจำนอง และจะมอบให้กับบริษัทต่างๆ รวมถึง Morgan Stanley ธนาคารหลายแห่งให้กู้ยืมเงินจำนวน 13,000 ล้านดอลลาร์

ตอนนี้ ด้วยการจัดหาเงินทุนรอบใหม่นี้ Musk จะลดการขายหุ้นของตัวเองลงอย่างมาก และลดแรงกดดันในการขายหุ้นของ Tesla จากข้อมูลของ Reuters Musk ได้ขายหุ้นของ Tesla ไปประมาณ 8.5 พันล้านดอลลาร์ในเดือนที่ผ่านมา

การยื่นฟ้องของ ก.ล.ต. ยังแสดงให้เห็นว่าจำนวนเงินต้นรวมของสินเชื่อมาร์จิ้นที่ทำผ่านธนาคารเช่น Morgan Stanley ก่อนหน้านี้ลดลงจาก 12.5 พันล้านดอลลาร์เป็น 6.25 พันล้านดอลลาร์ นอกจากนี้ การเสนอซื้อหุ้น Twitter ยังเพิ่มขึ้นจาก 2.1 หมื่นล้านดอลลาร์สหรัฐฯ ก่อนหน้านี้เป็น 2.725 หมื่นล้านดอลลาร์สหรัฐฯ

เอกสารยังระบุด้วยว่าเจ้าชาย Alwaleed Bin Talal แห่งซาอุดีอาระเบียเป็นผู้ถือหุ้นรายใหญ่ของ Twitter หลังจากที่เขาเชื่อว่า Musk เสนอราคา 54.2 ดอลลาร์ต่อหุ้นสำหรับกลุ่ม"ไม่ตรงกันเลย"มูลค่าพื้นฐานของมัน ดังนั้นเขาจะรักษา 34.95 ล้านหุ้นหลังจากการแปรรูป

หุ้นของ Twitter เพิ่มขึ้น 2.45% ในการซื้อขายก่อนเปิดตลาดหลังจากข่าวการจัดหาเงินทุนใหม่ โดยเปิดตัวที่ 50.26 ดอลลาร์ต่อหุ้น ในขณะเดียวกัน หุ้นของ Tesla ลดลง 1% สู่ระดับ 943.25 ดอลลาร์ต่อหุ้น