NFT“人口普查”(2022年Q1版)中的五组有趣数据结论

本文来自 CoinGecko,原文作者:Dillon Yap,由 Odaily 星球日报译者 Katie 辜编译。

2021 年 8 月,NFT 总交易额达到高峰(超过 50 亿美元),开启了“NFT 热夏”。自那以后,市场略有下降,但 NFT 仍然是最热门的词汇之一,并继续成为加密世界内外的头条新闻。

NFT 正在两极分化。一小部分人承诺相信其基础技术,更多的机会主义者试图利用其资金上的优势,而其他人则在这个新数字时代中大声疾呼。那么,人们对 NFT 的真实感受是什么?

CoinGecko 在推特上进行了一项 “NFT 民意调查”(采集到 871 个样本),更深入地了解拥有 NFT 的玩家的画像,包括他们的行为、动机、倾向、偏好、知识和与 NFT 相关的认知。以下是 5 个主要调查结论。

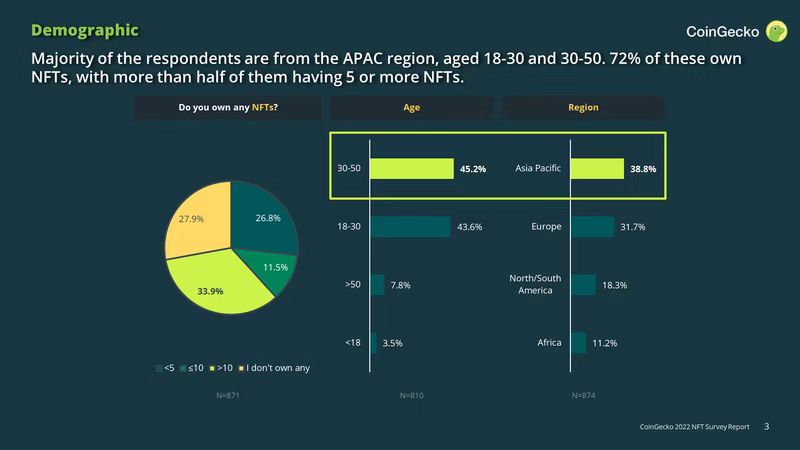

1. 大部分受访者来自亚太地区,年龄段在 18-30 岁及 30-50 岁;其中 72% 的人有 NFT,超过一半的人有 5 个或以上 NFT。

受访者中,30-50 岁占 45.2%,18-30 岁 占43.6%。

地域上,亚太地区受访者采用 NFT 的比例最高,为 38.8%,与我们之前的 Axie Infinity 调查结果相似。另一项独立调查也证实了这一点,该调查还发现菲律宾、泰国和马来西亚是 NFT 的主要采用国。欧洲紧随其后,是第二大地区(31.7%),而北美/南美则远远排在第三(18.3%)。

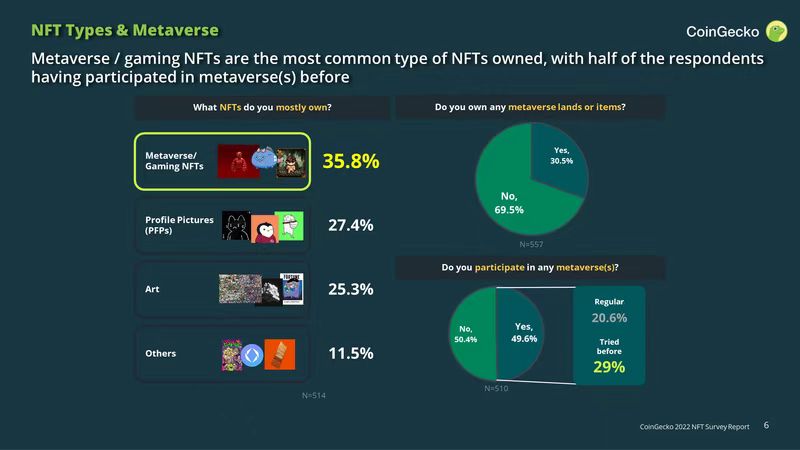

2. 元宇宙/游戏 NFT 是最常见的 NFT 类型,一半的受访者之前曾参与过元宇宙。

属于元宇宙/游戏类型的 NFT 占 35.8%,其次是 PFP NFT 占 27.4%,加密艺术 NFT 占 25.3%。

大约一半的受访者以前参与过元宇宙,其中只有 20% 被归类为“常客”。

元宇宙预计在未来 2 年将成为 8000 亿美元的市场,对大多数人来说,游戏似乎是最有可能的 NFT(及其他加密货币)切入点。

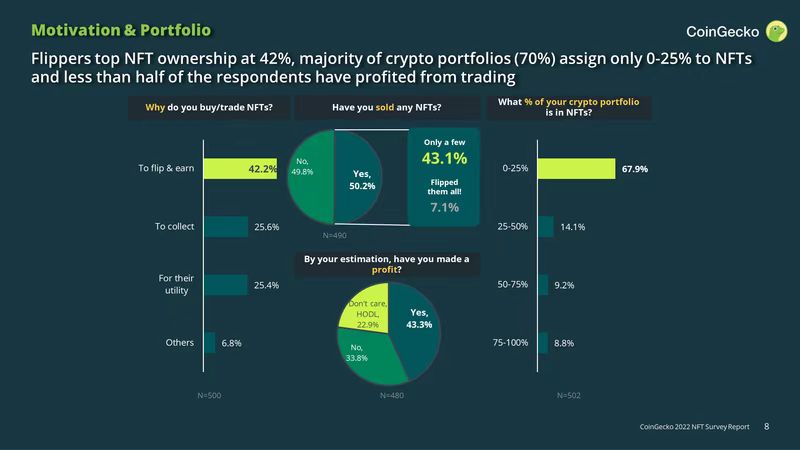

3. Flipper(鲨鱼)持有 NFT 的比例最高,为 42%,大多数加密货币投资组合(70%)只持有 0-25% 的 NFT,不到一半的受访者从交易中获利。

在购买动机上,低买高卖”是 NFT 购买的驱动力,占 42.2%;“收集”和“为了 NFT 的效用”的 HODL 心态约占 50%。(这与“你是否出售过 NFT” 的问题比例一致,只有一半的NFT回答“是”。 )

不到一半的受访者(43%)从 NFT 交易中获利,而 23% 的受访者选择了继续持有,不考虑从 NFT 中获利。

假设我们只考虑“是”和“否”之间的比率,大约 57% 的“选择不持有”(non-HODLing)的交易员在 NFT 中获利,这可能是大多数 NFT 老手精通交易的标志。

有趣的是,NFT 只占大多数加密投资组合的一小部分,其中近 70% 的投资只包含 0-25%的 NFT。

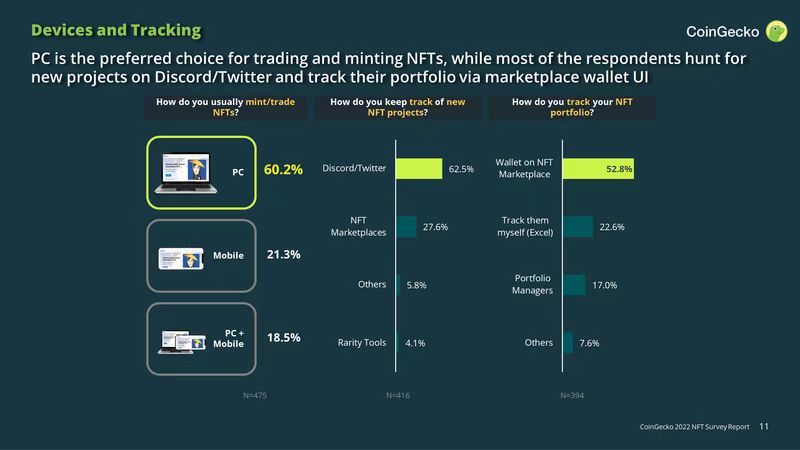

4. 电脑端是交易和铸造 NFT 的首选,而大多数受访者在 Discord /推特上寻找新项目,并通过钱包跟踪他们的投资组合。

60% 的 NFT 用户更喜欢在 PC 端上铸造/交易 NFT,只有 21% 的用户使用移动设备。PC 端的主导地位可能是由于其在操纵 NFT 铸造/交易的时间敏感性方面的优势,尤其是当钱包移动应用程序操作与 PC 应用程序相比仍比较不顺手的原因。

超过 60% 的用户通过 Discord 和推特跟踪新项目,这些项目的信息是零散的。尽管如此,Discord 和推特似乎仍然是偶然发现新出炉项目的最佳选择。存在诸如 NFT 分析工具 Rarity Tool 之类的聚合器平台,但使用率较低(4.1%),这可能是由于更新的滞后时间(早期访问白名单的差异),或者覆盖范围不完善。

超过一半的用户通过钱包界面跟踪 NFT 投资组合,而不是更结构化的方法(如投资组合经理、Excel)。

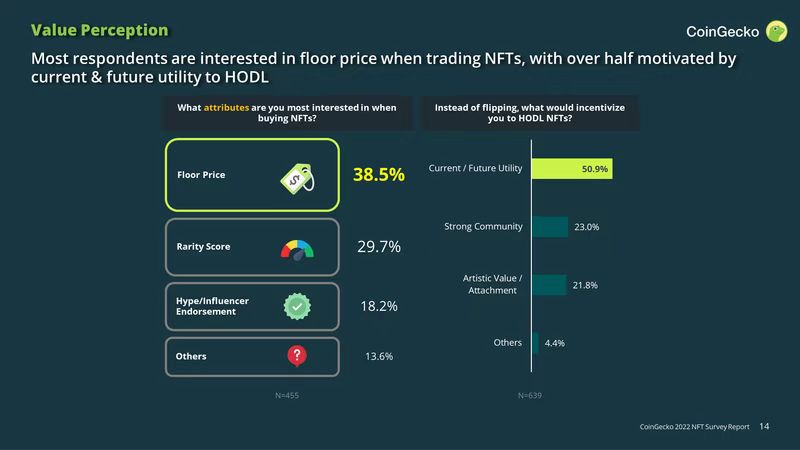

5. 近 40% 的受访者在交易 NFT 时最感兴趣的是地板价,其中一半人将当前/未来的效用作为 HODL 的主要原因。

当被问及促使他们进行 NFT 交易/购买的因素时,38.5% 的受访者认为“地板价”是最重要的。同样,这也符合我们之前关于 NFT 交易动机的问题,即约 40% 的 NFT 选择 “flip & earn”(“低买高卖”)。地板价是一个常用的衡量标准,用来衡量一个 NFT 系列的价格可承受性和潜在的上涨空间。

而因为稀有性和名人背书原因购买 NFT 的比例则分别为 30% 和 18%。

除了为了盈利,一半的受访者(50.9%)认为 NFT 当前或未来的效用是他们选择 HODL的主要动机,只有 23% 和 21.8% 的人选择“强大的社区”和“艺术价值/情感寄托”。根据我们的调查,NFT 的拥有者似乎更看重那些被认为能提供最“实用”价值的 NFT,而不是诸如美学等无形的品质。最近的 NFT 项目也趋向于具有某种形式的实用性(例如独家访问、未来空投),而不仅仅是“链上的 jpeg”。

结论

了解 NFT 玩家的交易动机很有趣。游戏和元宇宙 NFT 被 Axie Infinity 推向聚光灯下,成为最受欢迎的 NFT 类型。大多数受访者自认为是为了从 NFT 中快速获利的投机者。但与此同时,多数人(51%)仍表示有兴趣持有,要么是为了收藏,要么是为了潜在效用。总而言之,这并不是一个纯粹的投机市场。

在 2022 年第一季度,NFT 的交易量有所下降,但与此同时,RTFKT 和 Bored Ape Yacht Club 建立的大型合作伙伴关系也实现了明显飞跃。在这一点上,NFT 的最终发展方向仍是每个人的猜测。但就像其他加密货币,NFT 世界仍然充斥着欺诈和价格波动。对于那些正在考虑涉足 NFT 的人,我们敦促你们永远 DYOR(自己做研究)。

(免责声明:我们承认推特“民意调查”不是进行调查的最佳选择。因此,请将调查结果视为加密推特社区使用情况和对 NFT 态度的指标。)