UST declares war on DAI, is the new Curve War imminent?

On April 2, Ezaan, a member of Terraform Labs, put forward a new proposal in the community, suggesting the introduction of a new "gold standard" 4pool for stablecoin liquidity.

Specifically, 4pool will be a new Curve liquidity pool composed of UST, FRAX, USDC, and USDT. Terra and Frax Finance will use Curve to concentrate their stablecoin liquidity into 4pools in major ecosystems. According to the plan, 4pool will initially be tested on Fantom, Arbitrum and the Ethereum mainnet.

Who is the finger pointed at?

Although in the content of the proposal, Ezaan did not directly mention DAI, and did not use some too drastic statements, but in essence,This can almost be seen as a positive declaration of UST (including FRAX, of course) against the current decentralized stablecoin leader DAI.The reason for saying this is to start with the status quo of the stablecoin track and the role Curve plays in it.

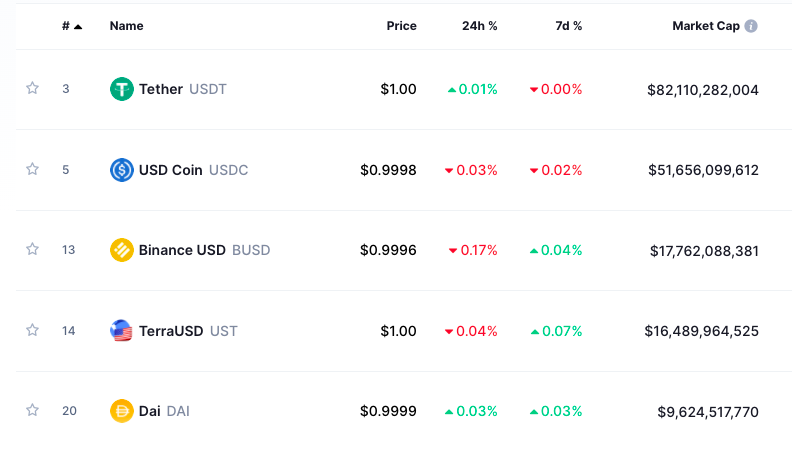

According to CoinMarketCap data, the total circulating supply of DAI and UST as of the date of publication is 9.6 billion and 16.5 billion, respectively(Odaily Note: The supply of FRAX has also reached 2.7 billion), in terms of absolute quantity, UST has overtaken DAI and become the largest decentralized stablecoin. However, the main position of UST is still concentrated within the Terra ecosystem. In Ethereum and many other EVM-compatible ecosystems, DAI still occupies a larger market share for a long time.

In this 4pool proposal, Ezaan clearly pointed out that the purpose of the proposal is to expand the market share of UST in Ethereum (and other EVM-compatible ecosystems), so it is self-evident who the target is.

Where does Curve war start?

So, what role does Curve play here? Most readers who are familiar with DeFi must have heard of "Curve War". Simply put,This is why major DeFis have tried various methods to accumulate the governance token veCRV in order to compete for Curve liquidity incentives, so as to control the incentive weight of CRV.

If you are not familiar with related concepts, I suggest you read this article first.Moat or Trojan Horse? Curve War Escalates to Battle of CVX »。

As one of the absolute leaders in DeFi, the stablecoin exchange agreement Curve (of course Curve is also working on the non-stablecoin business) will use CRV inflation to motivate liquidity providers within the agreement. However, unlike other protocols, in Curve’s economic model, the token with direct governance utility is not CRV, but veCRV obtained after staking CRV, which can directly determine the liquidity incentives of each pool in Curve.

Within Curve, how many CRV incentives each liquidity pool can obtain must be determined by veCRV voting, so whoever controls more veCRV can obtain greater incentives for pools related to their own interests , so as to provide higher APY and APR, and improve the liquidity status of related pools.

Currently, the "gold standard" of stablecoin liquidity within Curve is 3pool (ie 3crv), which consists of DAI, USDC, and USDT. After entering Curve, other stablecoin projects often need to form liquidity transactions with 3pool assets Yes, it is paired in the form of X (a stable currency) + DAI + USDC + USDT.

What Terra's 4pool wants to do (although it is not stated clearly) is to seize the market share of 3pool, or even replace the latter's market position, thereby kicking DAI out of the "gold standard" and pushing UST and FRAX into it. So how exactly does this work?The answer is simple - the market has the final say, and whoever has the largest liquidity scale can win this potential war in a substantial sense.

So how to expand liquidity?The answer is also very simple - veCRV.

Let's revisit this logic:

1. 4pool needs to seize the market size of 3pool;

2. This means that 4pool needs to expand the liquidity scale of the stablecoin portfolio;

3. This in turn means that 4pool needs to attract more liquidity funds;

4. This means that 4pool needs to provide higher returns;

5. This means that 4pool needs more veCRV to get more CRV incentives for 4pool related pools;

6. Although there is no movement yet, if 4pool becomes popular, 3pool (DAI) will definitely not sit still;

7. 3pool's counterattack obviously also needs to fight for more veCRV;

secondary title

Who has a better chance of winning?

In the proposal, Ezaan mentioned that Terra and Frax (don’t forget this helper) are the two largest agreements holding CVX, CVX is the governance token of Convex, and the latter has successfully mastered a large amount of veCRV through matryoshka staking and growth incentives , has become a pivotal role in the entire Curve ecosystem. At the same time, Terra and Frax are also the two largest incentive parties for Votium (the nesting doll of Convex).

Therefore, Terra and Frax did not decide to "destroy" DAI on Ethereum without a whim, but they really hold a lot of strategic chips.

Leaving aside these bargaining chips on the table, Curve War is not just a contest of form, but also a contest of capital thickness. Terra’s recent wave of “BTC crazy buying” has just bought a wave of bull market , its strength is evident.

From the perspective of MakerDAO (DAI), after several years of being a lonely peak, the rise of competitors has obviously brought a certain sense of crisis to the agreement.

In the past month, the MakerDAO community has mentioned several times that it hopes to change its token economic model in order to rectify the burden and revitalize it. In a recent proposal, a16z even made the design himself... Well, the name of a16z has come out, and the power behind DAI is of course not to be underestimated.

secondary title

Who is reaping the benefits of the fisherman?

Although this "war" has not yet started, we can already try to find some potential profit targets. The following are some of my personal views.

Take a closer look at the participants in the whole story,Curve and its governance-related roles in the ecology will most likely be the one to reap the benefits. The more intense the fight between the two sides, the happier Curve will be, because on the one hand, this can bring greater activity to the liquidity pool of the entire agreement, and on the other hand, it will also increase the market demand for veCRV and its source CRV.

In the same way, for CVX, which is bundled with part of the governance functions of veCRV, and its governance tokens that are further layered with Matryoshka protocol, the market demand for these tokens will also increase as the battle heats up.

Of course, so much talk from above is all after Ezaan's proposal can be passed. If it doesn't pass, just treat me as nonsense.

——————————

Disclaimer: The author and editor of this article both hold CRV and CVX, and have interests.