Weekly Editors' Picks Weekly Editors' Picks (0226-0304)

"Weekly Editor's Picks" is a "functional" column of Odaily.On the basis of covering a large amount of real-time information every week, a lot of high-quality in-depth analysis content will also be released, but they may be hidden in the information flow and hot news, and pass you by.

Now, come and read with us:

Now, come and read with us:

invest

invest

Messari: Are Bitcoin and Ethereum risky assets in the current market?

Good topic. The article unfolds one by one from the perspectives of correlation, interest rate changes, changes in the inflation system, and market cycles. “BTC and ETH behave less and less like risk assets in normal times, and BTC in particular exhibits a price pattern similar to value stocks in environments with stable or falling yields. Nonetheless, when the sell-off occurs, the cryptocurrency’s Trends are in line with the riskiest parts of the market. During these downturns, builders continue to build and network activity remains strong. As the market develops, this will likely increase use cases and overall cash flow, resulting in shorter downturns, even if In a broader macro bear market."

Raising $1 billion, these 5 major investment directions of encrypted venture capital Electric Capitall are worthy of attention

At the end of the year and the beginning of the year, there were many research and judgment articles by institutions betting on the track. The value of this article is to further refine the key points of "business characteristics" in the five major directions:

DAO——Performance-based talent recruitment system, governance aggregator, mechanism for improving distributed decision-making, compensation and reward mechanism, DAO discovery platform, recruitment platform, treasury management;

NFT - pricing mechanism, infrastructure supporting NFT as a productive asset, NFT discovery platform, NFT financial derivatives, creator guild, vertical secondary market, physical to digital bridge;

DeFi - DeFi development on non-Ethereum chains, cross-chain revenue opportunities, simple entry for complex strategies, new liquidity guidance mechanism, payment flow and vesting;

Expand the access path of Web3 - encrypted games with interoperable backends, mobile DeFi experience, multi-chain wallets for verifying contracts, and products that help fiat currency users earn cryptocurrency.

Interview with Polychain: How to expand the fund from 4 million to 5 billion US dollars in 6 years

Carlson-Wee's success lies not only in his ability to find the most promising DeFi startups, but also in his willingness to invest huge sums in them. Decentralization and democratization may be ideal for DeFi, but Carlson-Wee is very responsible when it comes to decisions that can affect returns on Polychain. He didn't hesitate to use the firm's powerful voting power to ensure that the interests of his partners came first. Early in his crypto career, he realized that entrepreneurs with a strong vision for the future were funded and rewarded the most, not those with quick reflexes or quick followers.

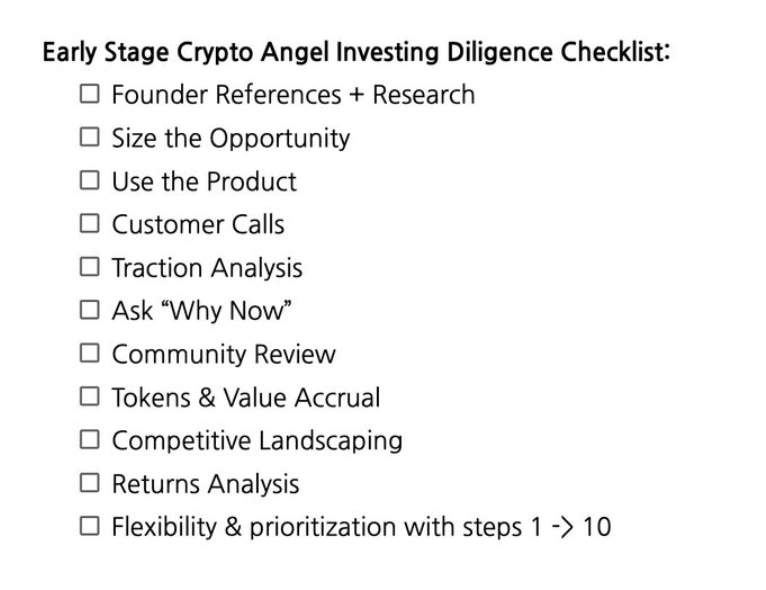

In the fast-moving crypto world, DeFi is yesterday's bubble. NFTs and the metaverse are the next bubble that Carlson-Wee wants to surf. “The internet generation cares more about avatars and avatars than clothes and cars. As we transition to a digital lifestyle and eventually to a fully internet-native metaverse, NFTs become artifacts all around us.”Paradigm Partners: 11 Steps to Conducting Investigative Research on Early-Stage Crypto ProjectsCondensed into the picture below ↓, in addition, the chain catcher translated an interview with the founder of Paradigm: "

Never predict the ultimate winner, only focus on projects that provide value to users and developers

", the content is somewhat scattered and general.

DeFi

In addition to Coinlist, you should also know about new platforms

Taking Curve and Sushi as examples, talk about the DeFi pedestal theory"the feedback"The DeFi pedestal theory is derived from the fat protocol theory. Compared with financial Lego blocks, the term pedestal is more about creating value, while the latter is more about capturing value. A closed loop of incentive structure (like Sushiswap's) may misplace the direction of supply expansion, which in turn will cause the death of the DeFi protocol. And the key difference with a semi-fixed release plan like Curve is that you remove your own self-interest

the feedback

, seeking direction directly from the economy offered by the release program. Its supply expansion is not dictated by those with Curve's best interests at heart. In the case of Dock, the distinction between protocol and application is less binary and more of a lineage, and Curve is closer to the protocol side of the lineage. That is, Curve is more like Ethereum, with an open circulation system.The last part of the article uses BTRFLY as an example to describe how to turn Lego into a pedestal.》、《A must-have guide to DeFi mining in the crypto bear market》。

NFT, GameFi and Metaverse

5 Ways to Earn Fixed Rate Income on DeFi

NFT, GameFi and Metaverse

Whale Report: Insights into the trading patterns and habits of well-known NFT collectors

Pranksy owns many CryptoKitties, Avastars and virtual lands. Dingaling has a diverse collection portfolio that includes almost every top NFT item. Wilcox prefers to focus on Larva Labs, a brand that has the whales divided. These collectors love metaverse realms—whether they own digital lands or voxel avatars. They also support new projects and gain exposure in projects that support them.

NFT financialization: How can holders maximize their benefits?The article maps the current NFT financialization landscape, discusses the strengths and limitations of existing NFT liquidity approaches, defines NFT price tiers, and typical characteristics of these tiers.Amber Group issued a large and comprehensive report on NFT: "

《The arrival of the NFT "Cambrian", a comprehensive interpretation of the development status and trends of the NFT market", it will be more helpful for friends who want to understand the panorama.A list of the necessary NFT analysis tools for GaowanA complete collection of practical tools necessary for NFT gold diggers

Web 3.0

secondary title

Multicoin Capital: How NFTs Rebundle the On-Chain Value of Music《NFT music has always been a sub-field that I am not sure about. I always feel that the characteristics of NFT and the dissemination of music works are somewhat contradictory. This article is not long but concise. "Record labels actually finance the development of the vast majority of music, even though the vast majority of it is unprofitable. Artists trade most of their economic growth for the certainty of near-term income." Messed up the distribution. Encrypted services help disintermediate, allow participants to share risks, broaden the imagination space for the fan economy, and reshape the distribution of royalties.Mint Ventures is in the data research report

Panoramic interpretation of the Web3 music track: market background, commercial value, outbreak path and investment opportunities

"It is stated that the Web3 music industry does not have the conditions for an outbreak similar to DeFi for the time being. It still needs to look forward to the maturity of the user base and community concept, but the technical preparations are already relatively mature.

"The core business model of this industry is copyright. At present, the overall income of musicians is not high. It is determined by the increasingly fierce market competition and the industrial structure dominated by Internet platforms. The unlimited supply of music works is facing increasingly scarce entertainment. Time and attention, most of the music is reduced to zombie works that no one cares about and few clicks, which is the inevitable fate under the cruel market competition. The NFTization of Web3 and music media cannot change this fact.”

Ethereum and scaling

Ethereum and scalingbarnabe.substack.comTo be honest, it is a bit difficult to read. Please refer to the part of the text that involves Chinese-English translation errors

New ecology and cross-chain

New ecology and cross-chain

Talking about EVM compatibility: Why are non-EVM public chains embracing EVM?

hot spots of the week

hot spots of the week

In the past week,us treasury departmentIn the past week,Officially Incorporates Digital Currency Regulations into Sanctions Guidelines Against Russia, Ukrainian Officials,andAccept cryptocurrency donations,andConfirmation that the airdrop will be issued to the donor address”,, and later "after careful consideration,Ukraine Flag NFTUkraineUkraineRussiaand sanctioned by SWIFT etc.RussiaBoth have high premiums,Russian BTC Mininglargely unaffected,solidarity, donation, sanction, under the flames of war between Russia and Ukraine, the encryption community has made choices;Total cryptocurrency market capitalization,back to $2 trillion,People's Bank of ChinaCME Group (CME)Said that it will continue to maintain a high-pressure crackdown on virtual currency trading hype,eBayMicro bitcoin and ethereum options will be launched,Charles SchwabMay accept cryptocurrency payments, financial services giantCharles SchwabPlan to launch encrypted ETF products;DoodlesBillboard and Universal Music GroupCo-launched ChartStars, an NFT project based on the Flow blockchain,Publish Space Doodle NFT,Offchain LabsPortal

With "Editor's Picks of the Week" seriesPortal。

See you next time~