60 Days of Listing: How Bitcoin ETFs Affect the Encryption Industry

This article comes fromCoingecko, original author: Benjamin Hor

Odaily Translator |

Odaily Translator |

Bitcoin proponents have been fighting for mainstream acceptance for more than a decade.

It has been more than eight years since Cameron Winklevoss and Tyler Winklevoss started applying for a Bitcoin ETF (BTC ETF) in 2013, The first BTC ETF ProShares Bitcoin Strategy ETF ($BITO) in the United States finally got the approval of the SEC this year and landed on the New York Stock Exchange (NYSE) on October 19.

Now that BITO has been on the market for more than 60 days, let us deeply analyze how this innovative product affects the encryption industry.

secondary title

How does a BTC ETF work in the US?

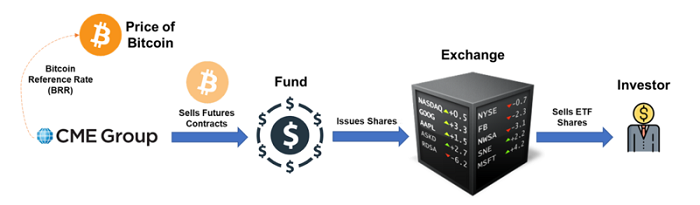

Although BITO and other subsequent-based BTC ETFs track the price of Bitcoin, they are actually derivative-based ETFs—that is, Bitcoin futures ETFs, which do not actually hold Bitcoin in the fund. More specifically, the fund buys and holds standardized, cash-settled Bitcoin futures contracts traded on the Chicago Mercantile Exchange (CME). CME Group is usually the first choice for BTC ETFs in the US due to its strong liquidity and being one of the few exchanges to have regulatory approval from the Commodity Futures Trading Commission (CFTC) for BTC futures contracts.

Above image source: CoinGecko Research

In the case of BITO, the fund adopts the purchase method of rolling futures, which means that the ETF will roll over the futures contracts on a monthly basis. In fact, most funds like it because it's the futures contract with the shortest time to maturity on CME Group.

secondary title

How will the BTC ETF affect the crypto market?

One of the most obvious impacts of the BTC ETF is that Bitcoin has been "embraced" by traditional institutional investors, as well as retail investors who may have been too risk-averse before to try or find out the private key. From this perspective, The SEC’s approval of a BTC ETF is significant. After years of being ambiguous about BTC ETFs, the SEC now has a “seal of approval” that will certainly be critical to wider adoption of BTC in the future.

Source of above chart: TradingView

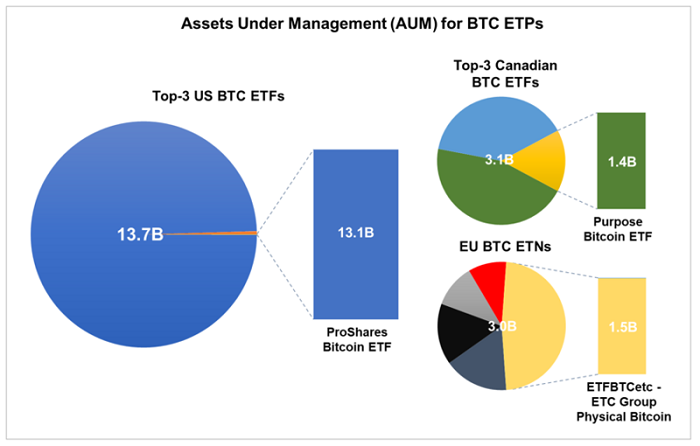

From the above picture, it can be clearly seen that although BTC ETFs in the United States have been on the market for a short period of time, there are significant differences in regional demand. After all, the United States has the largest ETF market in the world, and its scale will account for the total global asset management in 2020. (AUM) (approximately $5.6 trillion).

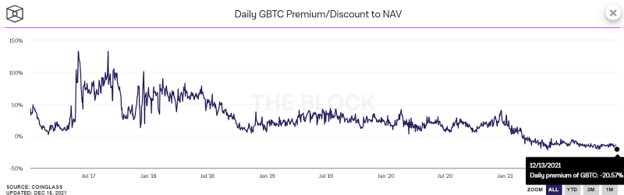

In addition to the positive news of regulatory approval, the success of the BTC ETF can also be attributed to the growing appeal of Bitcoin and cryptocurrencies among the investor community. Additionally, compared to other products such as the Grayscale Bitcoin Trust (pictured above), BTC ETFs have minimal trading slippage due to the ETF’s own build/redemption mechanisms that help keep prices At a level close to its net asset value. In any case, this price difference should be seen more as a function, after all, if other variables are introduced in the derivatives-based BTC ETF, price equilibrium seems to be difficult to achieve.

secondary title

Derivatives-Based BTC ETFs Exacerbate Mispricing Effects

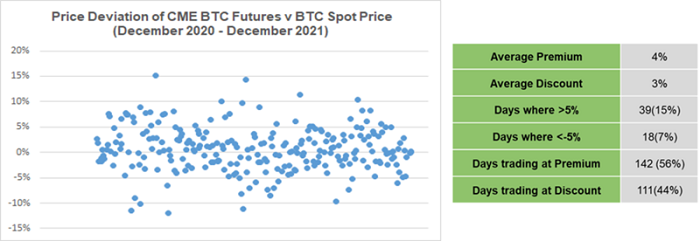

For BITO and other US BTC ETFs, due to the "rolling purchase" model, it means that regardless of the price, they must sell and buy new futures contracts when the existing BTC futures contracts are about to expire. In other words, these BTC ETFs must bear a premium or discount for any price differences known as “contango” and “backwardation,” which occur when futures contracts with longer maturities are priced higher than Contango occurs when futures contracts with shorter maturities expire. Conversely, backwardation occurs when futures contracts with longer maturities are priced lower than futures contracts with shorter maturities.

If we look at the closing price deviation of the CME BTC futures contract, we can see that this indicator tends to be large and occurs frequently, as shown in the above chart (Source: TradingView).

Contracts are generally more speculative and cheaper when they are further from maturity. And the closer to expiration, the higher the price usually becomes because of the higher certainty premium. Since BTC ETFs traditionally sell their contracts closer to expiration at the end of the month (CME futures expire on the last Friday of each month) to make room for the next batch of futures contracts, the futures contracts are more likely.

secondary title

Impact on Bitcoin Spot Price

The impact of ETFs on the spot price of Bitcoin does exist, but it is impossible to fully summarize it. The main reason is that there are many market variables that affect the spot price of Bitcoin.

Of course, we can also analyze and evaluate according to the basic mechanism of ETF.

Spot ETFs can be thought of as access to Bitcoin. Just like how a business works, the wider the marketing channel, the greater the potential for distribution. In this case, spot ETFs offer traditional investors greater distribution opportunities. In turn, this leads to higher demand, which translates into further acquisitions of Bitcoin (as the underlying asset of the ETF) and pushes up its price.

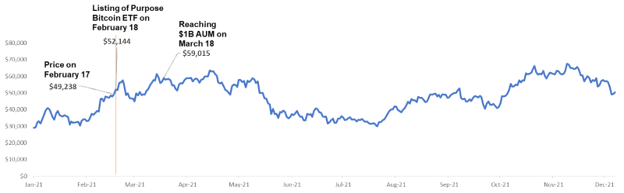

If we look back at Canada’s first spot BTC ETF: BTCC (pictured below, source: Coingecko), the situation seems to be very similar to what was described above.

According to data provided by Eric Balchunas, a senior ETF analyst at Bloomberg, the closing price of Bitcoin rose by $3,000 one day after the launch of BTCC. At the same time, the transaction volume of BTCC on the first day was as high as $200 million. A month later, the total assets under management of the BTC ETF reached $1 billion, which means that in just 1 month, $1 billion worth of Bitcoin was "locked" in the ETF.

But it's worth remembering that on March 18, 2021, Bitcoin's market cap was around $1.1 trillion. Considering price-influencing variables such as liquidity, slippage, macroeconomic factors, etc., accumulating $1 billion worth of Bitcoin in one month is highly unlikely to be the only reason for the price increase, so it is more reasonable to assume that the first BTC ETF listing is drove the market up.

Futures ETFs, on the other hand, are quite different. For ETFs based on bitcoin futures like BITO, they do not actually buy physical bitcoins, so they cannot directly push up the price of spot bitcoins.

However, as we saw with BTCC, ETFs are great "marketing tools", especially when the US is in the "game".

Above image source: CoinGecko

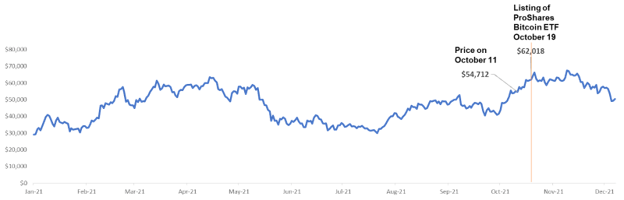

In the week before BITO's listing (October 11-18), due to rumors that the US Securities and Exchange Commission will approve the first US BTC ETF, the price of Bitcoin rose sharply during this period, rising from $54,700 to $61,600, The increase was as high as 12.6%. After BITO was listed on October 19, 2021, the price of Bitcoin closed at $62,000, and 2 days later at $66,200, a record high.

However, aside from the FOMO-inducing effect, it is worth noting that futures ETFs can indirectly affect prices. If there is a significant difference between spot and futures prices, traders can employ a cash arbitrage trade (also known as a basis trade), which involves shorting/longing BTC futures contracts while simultaneously buying and selling Bitcoin, that is, the arbitrageur can Take advantage of pricing inefficiencies to generate risk-free profits.

secondary title

final thoughts

final thoughts

It is undeniable that for the crypto community, BTC ETF (whether spot/futures) is a well-deserved historic milestone, because it shows that Bitcoin has successfully passed regulatory scrutiny, at least now it is part of a globally recognized exchange-traded product.

On the other hand, many are still trying to push the SEC to approve spot BTC ETFs, as other countries like Canada and even Brazil have approved spot BTC ETFs, but due to concerns about potential fraud and manipulation in the cryptocurrency space However, the US Securities and Exchange Commission did not respond positively to the spot Bitcoin ETF.