Author | @arndxt_xo

Compiled by Odaily Planet Daily ( @OdailyChina )

Translator | Dingdang ( @XiaMiPP )

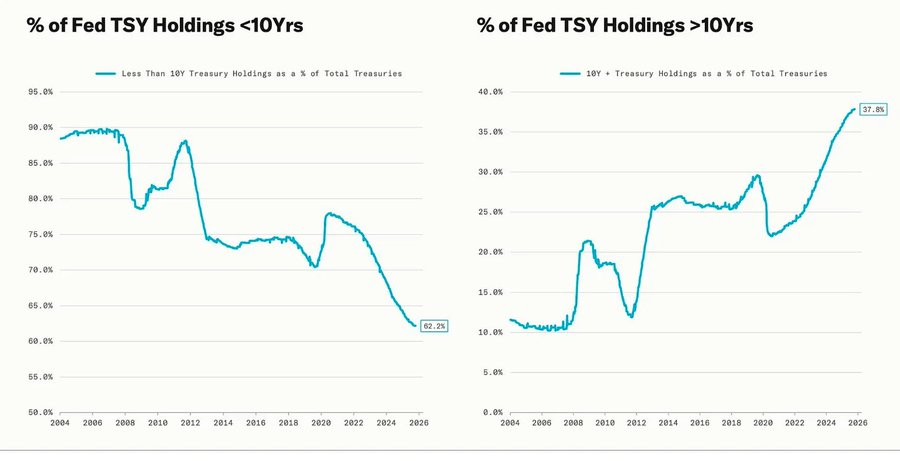

The sharp pullback coincided with the quantitative easing (QE) cycle—when the Federal Reserve intentionally extended the maturity of its holdings of assets in order to suppress long-term yields (this operation is known as "Operation Twist" and QE2/QE3).

Powell's metaphor of "driving in the fog" is no longer limited to the Federal Reserve itself, but has become a reflection of the current global economy. Policymakers, businesses, and investors alike are all groping their way forward in an environment lacking clear vision, and can only rely on liquidity reflexes and short-term incentive mechanisms.

The new policy framework exhibits three characteristics: limited visibility, fragile confidence, and liquidity-driven distortions.

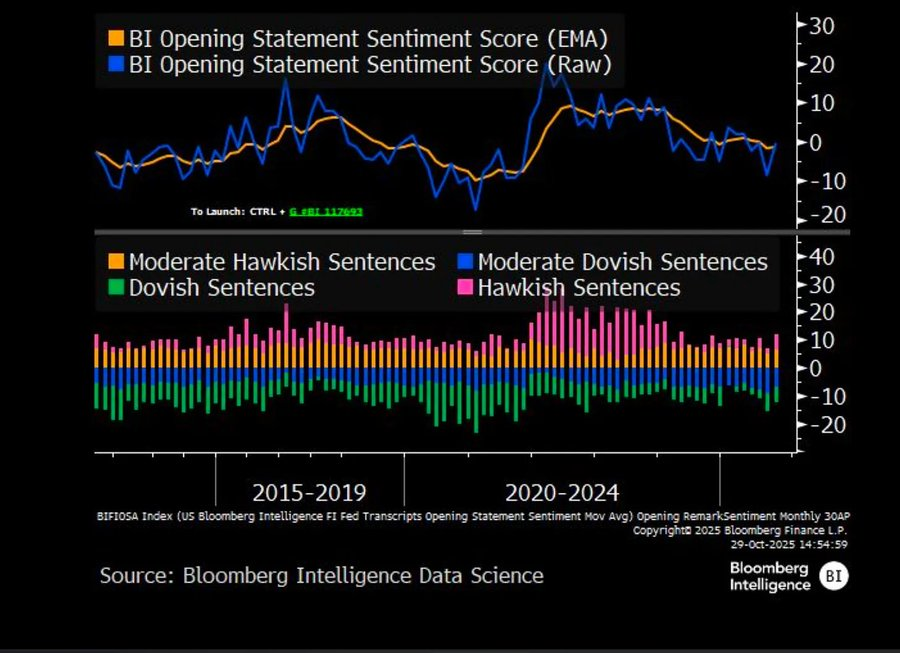

The Federal Reserve's "hawkish rate cut"

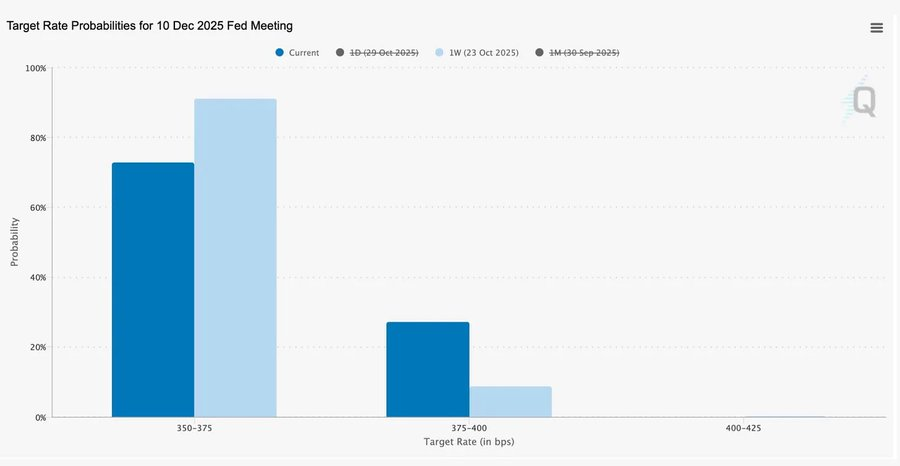

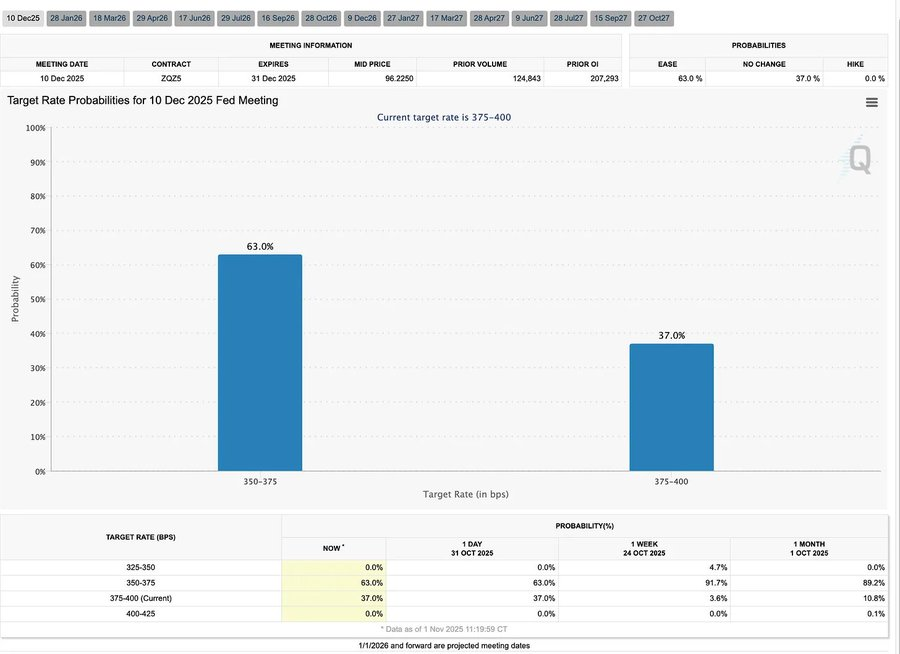

This 25-basis-point "risk management" rate cut, which lowers the interest rate range to 3.75%–4.00%, is less a sign of easing and more a way of "preserving options."

With two diametrically opposed opinions, Powell sent a clear signal to the market: " Slow down—visibility has disappeared ."

Due to the data gap caused by the government shutdown, the Federal Reserve was essentially operating "blindly." Powell's hint to traders was very clear: whether interest rates would be announced in December was still uncertain. Expectations of a rate cut quickly subsided, the short-term yield curve flattened, and the market was digesting the shift from "data-driven" to "data-deficient" caution.

2025: The Hunger Games of Liquidity

The central bank's repeated interventions have institutionalized speculative behavior. Today, asset performance is determined not by productivity, but by liquidity itself —a structure that leads to ever-increasing valuations while credit to the real economy weakens.

The discussion further expanded to a sober examination of the current financial system: passive centralization, algorithmic reflexivity, and retail options frenzy.

- Passive funds and quantitative strategies dominate liquidity, and volatility is determined by position size rather than fundamentals .

- Retail investors' call option buying and Gamma squeeze in the "Meme sector" create synthetic price momentum, while institutional funds flock to the increasingly narrow range of market leaders.

- The host called this phenomenon a “financial version of the Hunger Games”—a system shaped by structural inequality and policy reflexivity that forces small investors toward speculative survivalism.

2026 Outlook: The Boom and Hidden Concerns of Capital Expenditure

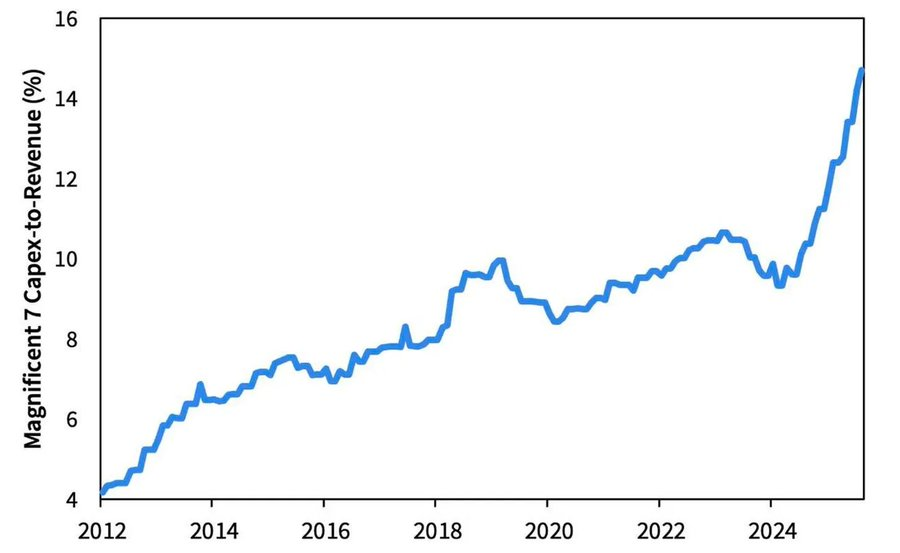

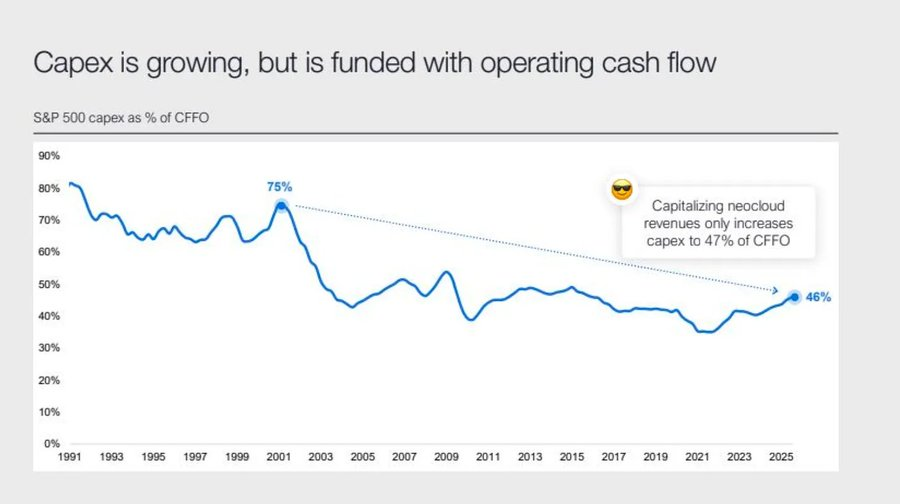

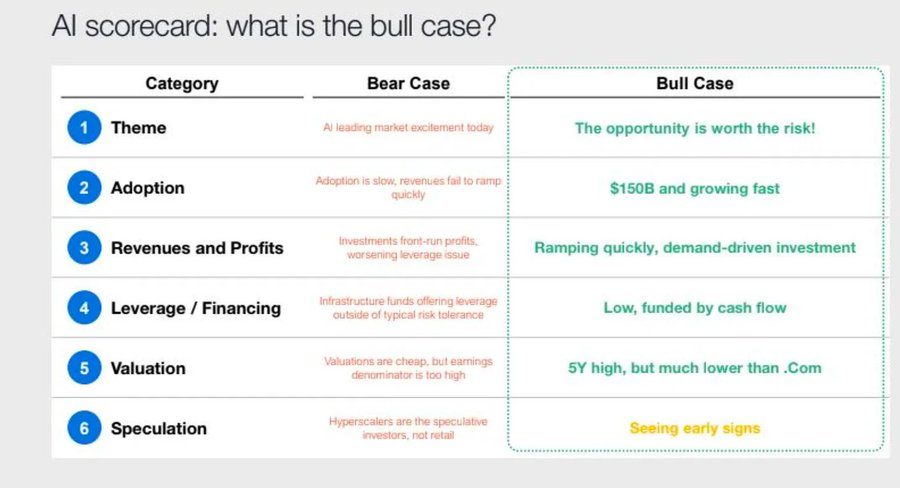

The AI investment wave is driving "big tech" into a post-cycle industrialization phase—currently driven by liquidity, but facing leverage-sensitive risks in the future.

Corporate profits remain impressive, but the underlying logic is changing: the former "asset-light cash machine" is transforming into a capital-intensive infrastructure player .

- The expansion of AI and data centers initially relied on cash flow, but is now turning to record debt financing —such as the oversubscribed $25 billion in bonds by Meta.

- This shift means pressure on profit margins, rising depreciation, and increased refinancing risks—laying the groundwork for a turnaround in the next credit cycle.

Structural Commentary: Trust, Distribution, and Policy Cycles

From Powell's cautious tone to his final reflections, a clear theme runs throughout: the centralization of power and the loss of trust .

Almost every policy bailout has reinforced the largest market participants, further concentrating wealth and continuously weakening market integrity. The coordinated operations of the Federal Reserve and the Treasury—shifting from quantitative tightening (QT) to purchasing short-term Treasury bills (Bills)—have exacerbated this trend: liquidity is abundant at the top of the pyramid, while ordinary households are suffocating under the weight of stagnant wages and soaring debt.

The most critical macroeconomic risk today is no longer inflation, but institutional fatigue . The market appears prosperous on the surface, but trust in "fairness and transparency" is eroding—this is the true systemic vulnerability of the 2020s.

Macro Weekly Report | Updated November 2, 2025

This issue covers the following:

- Macroeconomic events this week

- Bitcoin popularity index

- Market Overview

- Key economic indicators

Macroeconomic events this week

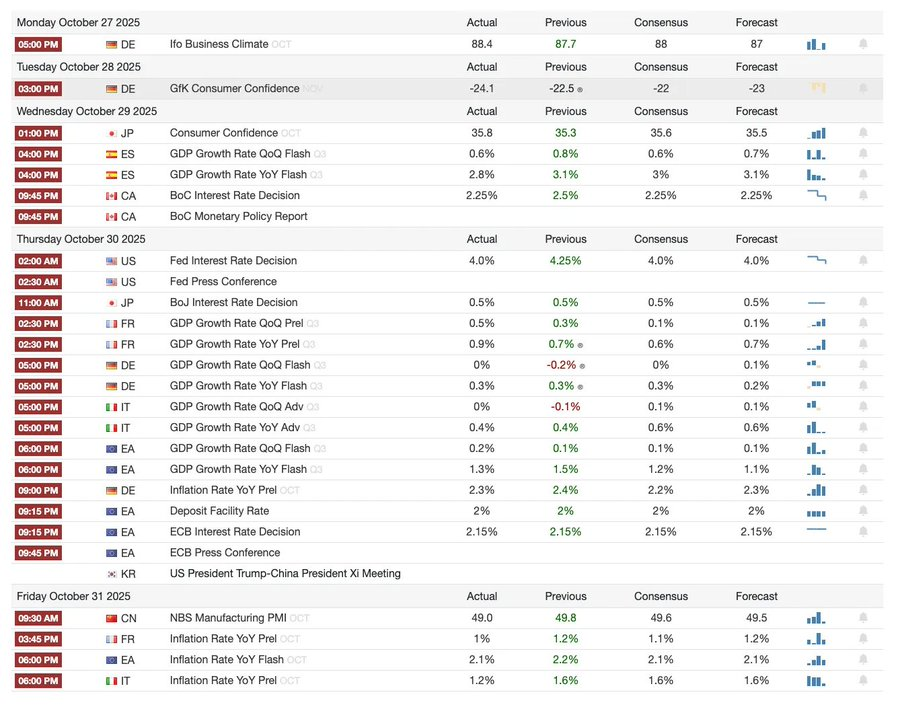

Last week

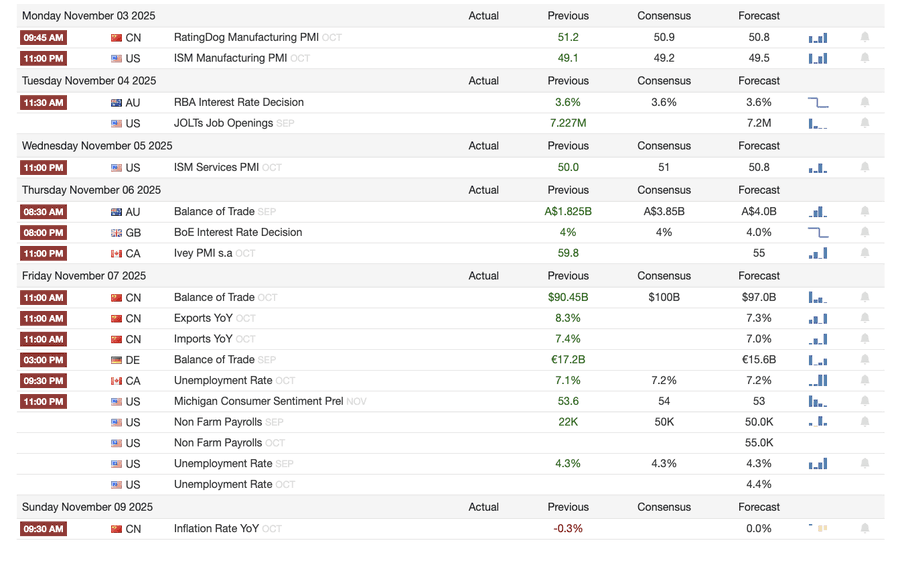

next week

Bitcoin popularity index

Market Events and Institutional Dynamics

- Mt. Gox has extended the repayment period to 2026, with approximately $4 billion worth of Bitcoin still frozen.

- The Bitwise Solana ETF broke records by managing $338.9 million in its first week, even as the SEC remains deadlocked on approval.

- ConsenSys plans to IPO in 2026, with underwriters including JPMorgan Chase and Goldman Sachs, and a target valuation of $7 billion.

- Trump Media Group launches Truth Predict – the first prediction market created in partnership between a social media platform and Crypto.com.

Upgrading financial and payment infrastructure

- Mastercard is acquiring crypto infrastructure startup Zerohash for up to $2 billion.

- Western Union plans to launch its stablecoin USDPT on Solana in 2026 and has registered the WUUSD trademark.

- Citibank and Coinbase have partnered to launch an institutional-grade 24/7 stablecoin payment network.

- Circle launched the Arc public beta, attracting more than 100 institutions, including BlackRock and Visa.

Ecosystem and Platform Expansion

- MetaMask has launched multi-chain accounts supporting EVM and Solana, and will soon add Bitcoin support.

Global and Regional Dynamics

- Kyrgyzstan launched a stablecoin backed by BNB; meanwhile, Trump pardoned CZ, paving the way for Binance's return to the US market.

- The US SOL spot ETF (excluding seed funding) saw inflows of $199.2 million.

- Japan has launched a fully compliant yen stablecoin, JPYC, with a target issuance size of $650-700 billion by 2028.

- Ant Group has registered the "ANTCOIN" trademark, quietly returning to the Hong Kong stablecoin market.

- The disruption of AWS and Microsoft cloud services has caused market chaos, with conflicting accounts from both sides.

- JPMorgan's Kinexys blockchain has completed its first tokenized transaction for a private equity fund, further driving institutional adoption.

- Tether has become one of the major holders of U.S. Treasury bonds, with holdings of $135 billion and annualized returns exceeding $10 billion.

- Metaplanet has launched a share buyback program to address declining net assets.

- Trading activity in privacy assets is rising, with ZEC prices breaking through 2021 highs, but this week's gains still lag behind DASH.

- Sharplink deployed $200 million worth of ETH on Linea to earn DeFi yields.

- With sports betting becoming a hot sector, Polymarket plans to officially launch its product in the United States at the end of November.

- Securitize announced that it will go public through a $1.25 billion SPAC merger.

- Visa adds support for payments using four stablecoins and four blockchains.

- 21Shares has submitted an application for a Hyperliquid ETF, bringing more crypto funds to the market.

- KRWQ has become the first Korean won stablecoin issued on the Base blockchain.

Market Overview

The global economy is transitioning from inflation risks to confidence risks— future stability will depend on policy clarity rather than liquidity .

Global monetary policy is entering a phase of limited visibility . In the US, the FOMC cut interest rates by 25 basis points to 3.75%–4.00%, revealing widening internal divisions. Powell hinted that further easing is "not a certainty." The ongoing government shutdown prevents policymakers from accessing crucial data, exacerbating the risk of policy miscalculations. Weak consumer confidence and a slowdown in the housing market indicate that market sentiment, rather than stimulus measures, is influencing the trajectory of a "soft landing" for the economy.

Among the G10 countries: the Bank of Canada completed its final interest rate cut, the European Central Bank maintained its rate at 2.00%, and the Bank of Japan cautiously paused its policy. The common challenge facing all parties is how to curb economic growth amid persistent service sector inflation. Meanwhile, China's PMI fell back into contraction territory, indicating weak recovery, sluggish private demand, and signs of policy fatigue.

Coupled with political risks, a US government shutdown threatens the normal operation of welfare programs and may delay the release of key data, thereby undermining confidence in fiscal governance. The bond market has already begun to digest expectations of declining yields and slowing economic growth, but the real risk lies in the collapse of institutional feedback mechanisms—data delays, policy hesitation, and declining public trust intertwined, ultimately leading to a crisis.

Key economic indicators

US Inflation: Moderate Recovery, Path Becomes Clearer

The rebound in inflation is primarily supply-driven, rather than demand-driven. Core pressures remain under control, and weakening employment momentum gives the Federal Reserve room to continue cutting interest rates without triggering a rebound in inflation.

- September inflation was 3.0% year-on-year and 0.3% month-on-month, the fastest pace since January this year, but still lower than expected, reinforcing the narrative of a "soft landing".

- The core CPI, excluding food and energy, rose 3.0% year-on-year and 0.2% month-on-month, indicating a stable price base.

- Food prices rose 2.7%, with meat prices rising 8.5%, impacted by agricultural labor shortages caused by immigration restrictions.

- Utility costs rose significantly: electricity prices increased by 5.1% and natural gas by 11.7%, mainly driven by energy consumption in AI data centers—a new driver of inflation.

- Inflation in the services sector fell to 3.6%, the lowest level since 2021, indicating that the cooling labor market is easing wage pressures.

- The market reacted positively: stocks rose, interest rate futures reinforced expectations of interest rate cuts, and bond yields remained generally stable.

US Demographics: A Critical Turning Point

With net migration turning negative, economic growth, labor supply, and innovation capacity all face challenges.

The United States may be facing its first population decline in a century . While births still outnumber deaths, negative net immigration has offset a projected increase of 3 million people by 2024. The U.S. is facing a demographic reversal, not due to declining fertility rates, but rather a policy-driven sharp drop in immigration. Short-term impacts include labor shortages and rising wages; long-term risks focus on fiscal pressures and slowing innovation. Unless this trend is reversed, the U.S. may follow in Japan's footsteps with its aging population—slower economic growth, rising costs, and structural productivity challenges.

According to AEI's forecast, net migration will be -525,000 people in 2025, marking the first time in modern history that it will be negative.

- According to data from the Pew Research Center, the number of foreign-born people will decrease by 1.5 million in the first half of 2025, mainly due to deportations and voluntary departures.

- With labor force growth stagnating, industries such as agriculture, construction, and healthcare are facing significant shortages and wage pressures.

- 28% of young Americans are immigrants or children of immigrants. If immigration were to drop to zero, the population under 18 could decline by 14% by 2035, exacerbating pension and healthcare burdens.

- 27% of doctors and 22% of nursing assistants are immigrants. If supply declines, automation and robotics in the healthcare industry may accelerate.

- Innovation risks: Immigrants have contributed 38% of Nobel Prizes and about 50% of billion-dollar startups. If this trend reverses, the US innovation engine will be damaged.

Japan's exports rebound: a recovery under the shadow of tariffs

Despite being dragged down by U.S. tariffs, Japanese exports rebounded. September exports rose 4.2% year-on-year, the first positive growth since April, mainly driven by a recovery in demand in Asia and Europe .

After months of contraction, Japanese exports rebounded, rising 4.2% year-on-year in September, the largest increase since March. This rebound highlights that despite new trade frictions with the United States, regional demand remains strong and supply chains have made corresponding adjustments.

Japan's trade performance suggests that external demand from Asia and Europe has begun to stabilize despite U.S. tariffs on automobiles (its core export category). The rebound in imports indicates a modest recovery in domestic demand, driven by a weaker yen and a restocking cycle.

prospect:

- Exports are expected to gradually recover, driven by the normalization of intra-Asian supply chains and energy prices.

- Continued protectionism in the United States remains a major obstacle to maintaining export momentum in 2026.

Related reading: " Why is the upcoming quantitative easing a bubble-making machine? "

- 核心观点:政策不确定性加剧市场流动性依赖。

- 关键要素:

- 美联储鹰派降息25基点。

- 政府停摆致经济数据缺失。

- 被动资金主导资产估值膨胀。

- 市场影响:加剧投机行为与结构性风险。

- 时效性标注:中期影响