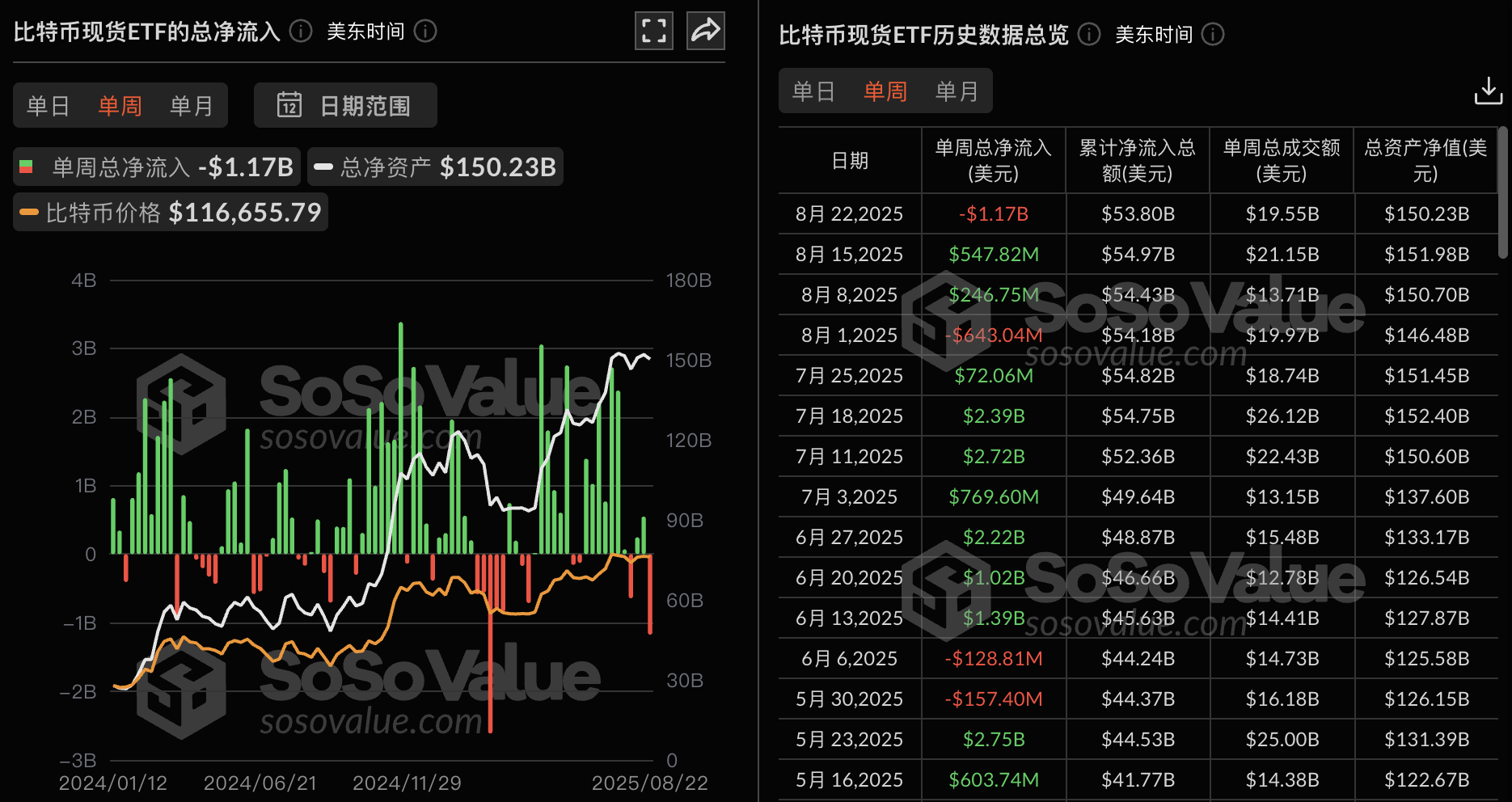

According to SoSoValue data from Odaily Planet Daily, Bitcoin spot ETFs saw a net outflow of US$1.17 billion during last week's trading days (August 18 to August 22, US Eastern Time).

The Bitcoin spot ETF with the largest weekly net inflow last week was VanEck ETF HODL, with a weekly net inflow of US$26.41 million. The current historical net inflow of HODL is US$1.19 billion; followed by Franklin Bitcoin ETF EZBC, with a weekly net inflow of US$13.49 million. The current historical net inflow of EZBC is US$295 million.

The Bitcoin spot ETF with the largest net outflow last week was Blackrock's Bitcoin ETF IBIT, with a weekly net outflow of US$615 million, the second highest in history. Currently, IBIT's total net inflow has reached US$58.06 billion; followed by Fidelity ETF FBTC, with a weekly net outflow of US$235 million. Currently, FBTC's total net inflow has reached US$11.72 billion.

As of press time, the total net asset value of the Bitcoin spot ETF was US$150.23 billion, the ETF net asset ratio (market value as a percentage of the total market value of Bitcoin) reached 6.45%, and the historical cumulative net inflow has reached US$53.80 billion.