Whales are collectively defecting from BTC and switching to ETH. Is a new king emerging?

- 核心观点:巨鲸资金正从比特币转向以太坊。

- 关键要素:

- 多个巨鲸抛售BTC,换仓ETH。

- ETH现货ETF资金流入强劲。

- 财库公司大幅增持ETH。

- 市场影响:或推动ETH上涨,BTC承压。

- 时效性标注:中期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

In the early morning hours of August 25th, the price of Ethereum surpassed $4,900, setting a new all-time high. However, the euphoria of ETH holders was ruthlessly interrupted by a sharp drop in Bitcoin's price. Bitcoin's price briefly plummeted below $111,000, a 24-hour drop of 4.3%, sending the entire market into a brief panic. In contrast, while Ethereum and Solana were also under pressure, their daily declines were limited to around 5%, demonstrating relative resilience and strong liquidity.

According to @CryptoDJ 04 , the trigger for Bitcoin's rapid decline stemmed from an address marked as HTX Origin: Hot Wallet . This address, through Hyperliquid, collectively sold 24,110 Bitcoins, valued at approximately $2.6 billion. Simultaneously with the Bitcoin sales, another associated account purchased 416,598 ETH, valued at $2 billion, and simultaneously went long on 135,263 ETH. Furthermore, while frantically buying ETH, the operator gradually liquidated its long ETH positions. In other words, the operator simultaneously executed a "maximum swap" operation: heavily selling BTC while simultaneously investing heavily in ETH .

The identity of this operator remains a mystery. On-chain tracking by institutions like Arkham indicates that the wallet was previously linked to an old HTX (Huobi) deposit address, but the true owner remains anonymous. Speculations suggest that it may be Justin Sun and his associates, assets disposed of by Chinese authorities, or an early Chinese Bitcoin holder. However, given the aggressive nature of the operation, it seems more likely that Justin Sun's funds or early Bitcoin whales are strategically rotating their holdings, rather than simply engaging in a "judicial auction."

What is more noteworthy is that in the past week, multiple Bitcoin whales almost simultaneously transferred their chips to Ethereum, and a "position switching wave" was quietly forming in the market.

- [Ancient Bitcoin Whale] : Sold 19,663 BTC through two entities, cashing out approximately $2.22 billion for 455,672 ETH. Of this, approximately 279,000 ETH, valued at $1.13 billion, was staked. The whale still holds BTC on HyperLiquid and plans to continue exchanging it for ETH. He holds 176,616 ETH on-chain, valued at approximately $832 million.

- [Seven Years of Dormant Whale] : An OG address that received 100,784 BTC seven years ago recently emerged from dormancy. On August 22nd, it sold BTC and simultaneously purchased 62,914 ETH in spot trading, establishing a long position of 135,265 ETH. This address has already taken profits on some of its long ETH positions, and on the evening of the 25th, it staked 269,485 ETH, valued at $1.25 billion, to the ETH2 beacon chain. This stake surpasses the 231,000 ETH held by the Ethereum Foundation, the top four ETH holder, and reduces the gap between exits and entries on the Ethereum PoS network to 260,000 ETH.

- Another Bitcoin OG transferred 6,000 Bitcoin (approximately $689.5 million) to purchase Ethereum. This address has now accumulated 278,490 Ethereum (approximately $1.28 billion) at an average price of $4,585, and holds a long position of 135,265 Ethereum (approximately $581 million).

These are just a few of the cases tracked on-chain, with more rotations occurring quietly behind the K-line charts. The collective exodus of whales reveals a structural shift in capital flows: the logic behind long-term Bitcoin holdings is being reevaluated, while the value of Ethereum's asset allocation is being revalued.

Data Perspective: Ethereum's Rise and Bitcoin's Weakness

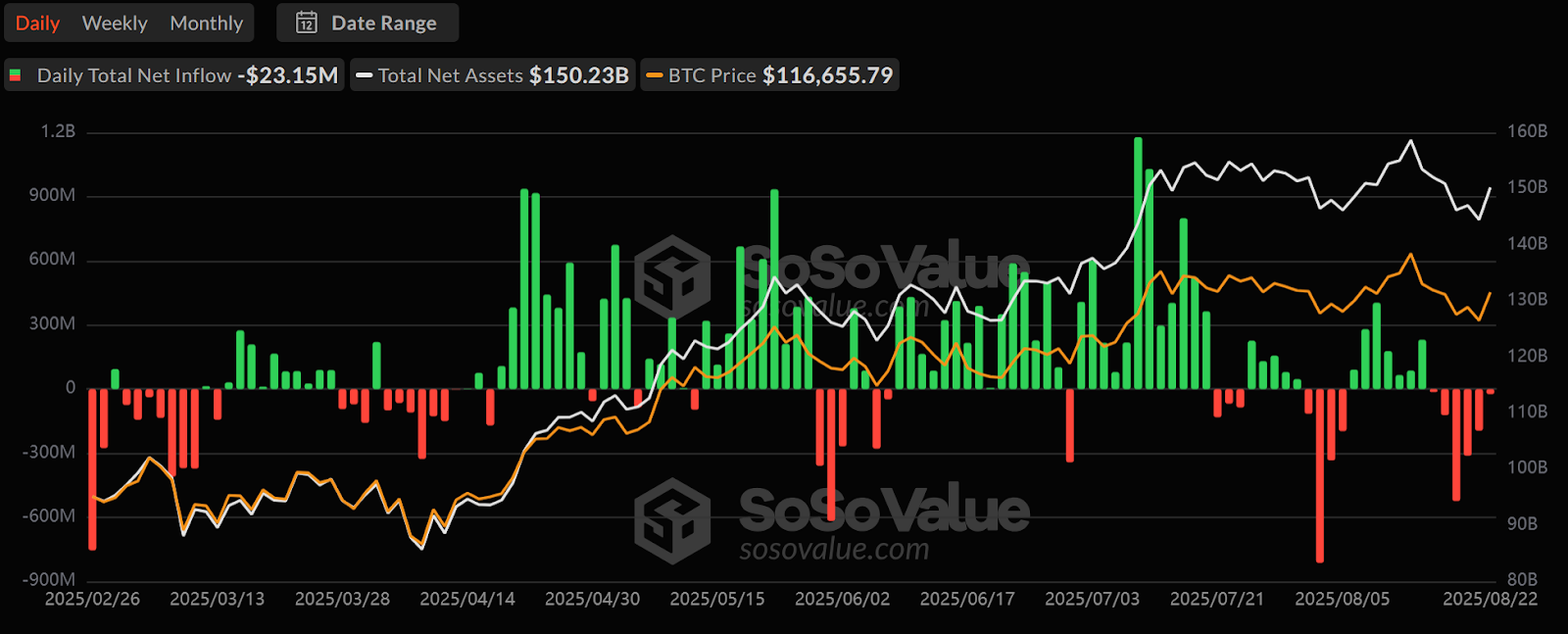

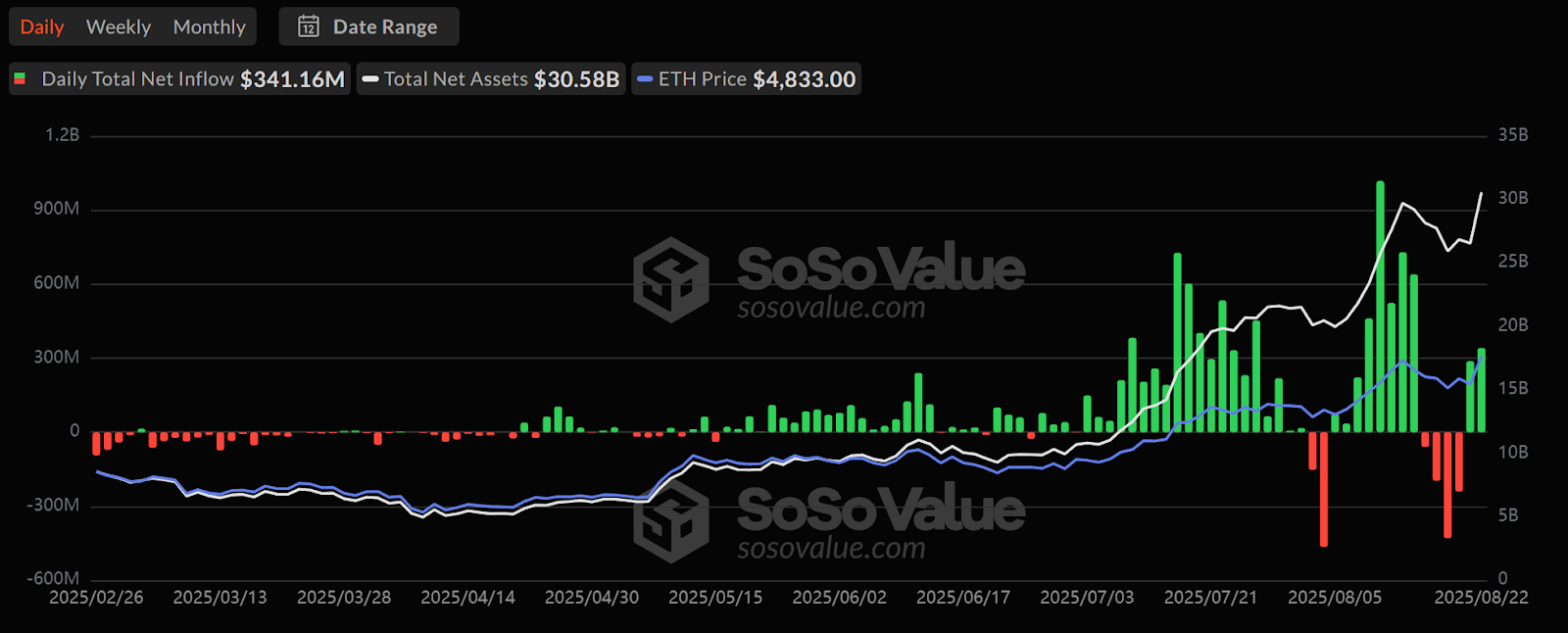

Spot ETFs are a key indicator of market sentiment in this cycle. Over the past month, Bitcoin spot ETFs have seen slightly weak inflows, and recently experienced net outflows for six consecutive days, significantly cooling market enthusiasm. In stark contrast, Ethereum spot ETFs have performed exceptionally well, receiving continued large inflows and becoming the market's new favorite.

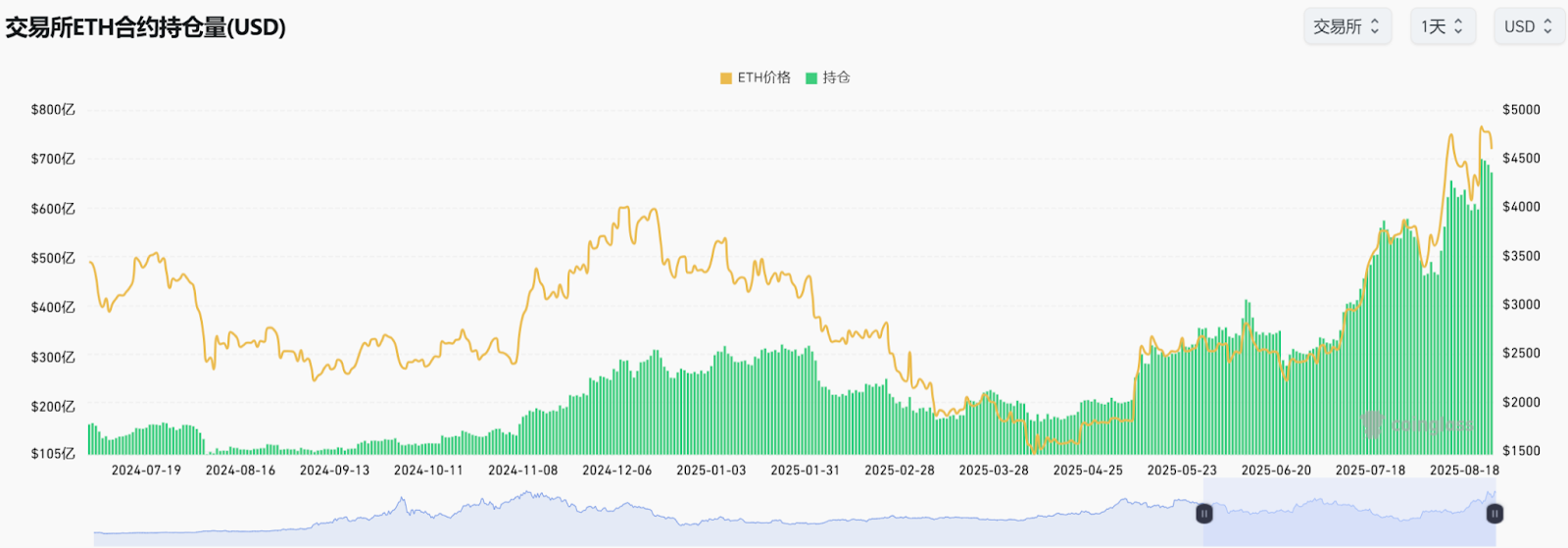

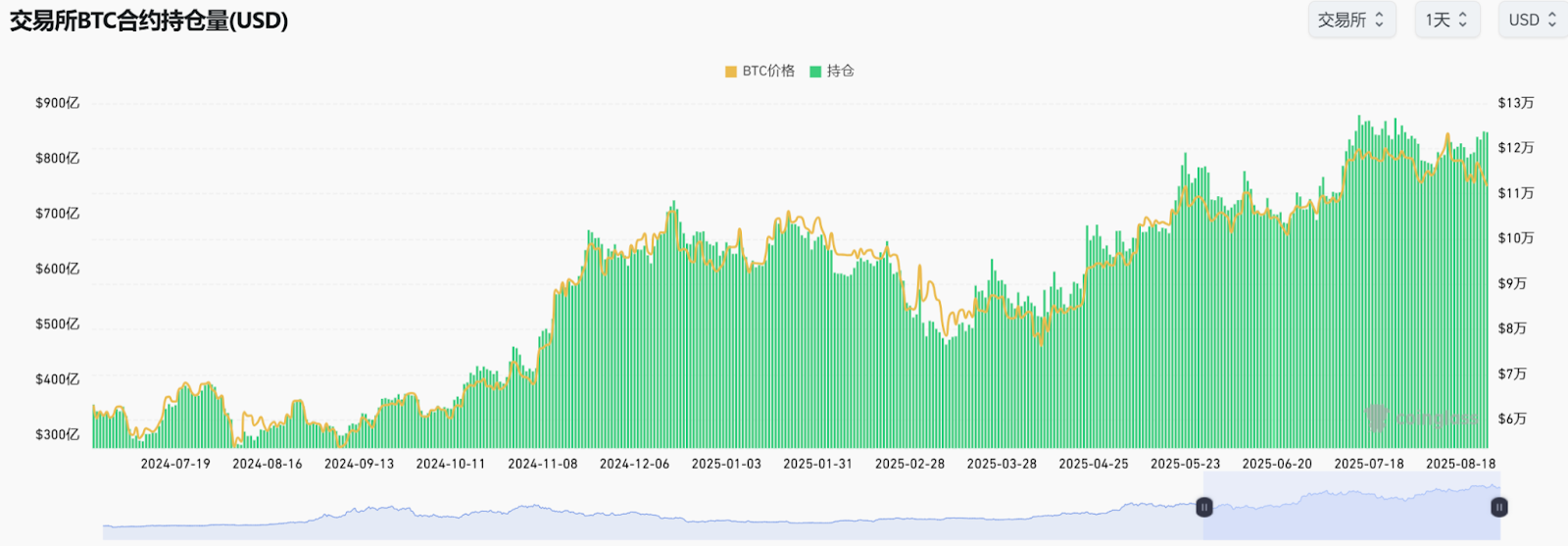

Exchange contract open interest further supports this trend. Currently, Ethereum contract open interest has risen to $67.4 billion, gradually approaching Bitcoin's $84.7 billion. More notably, Ethereum contract open interest has increased by over 20% this month, setting a new record high. Meanwhile, Bitcoin contract open interest has declined slightly compared to the previous month.

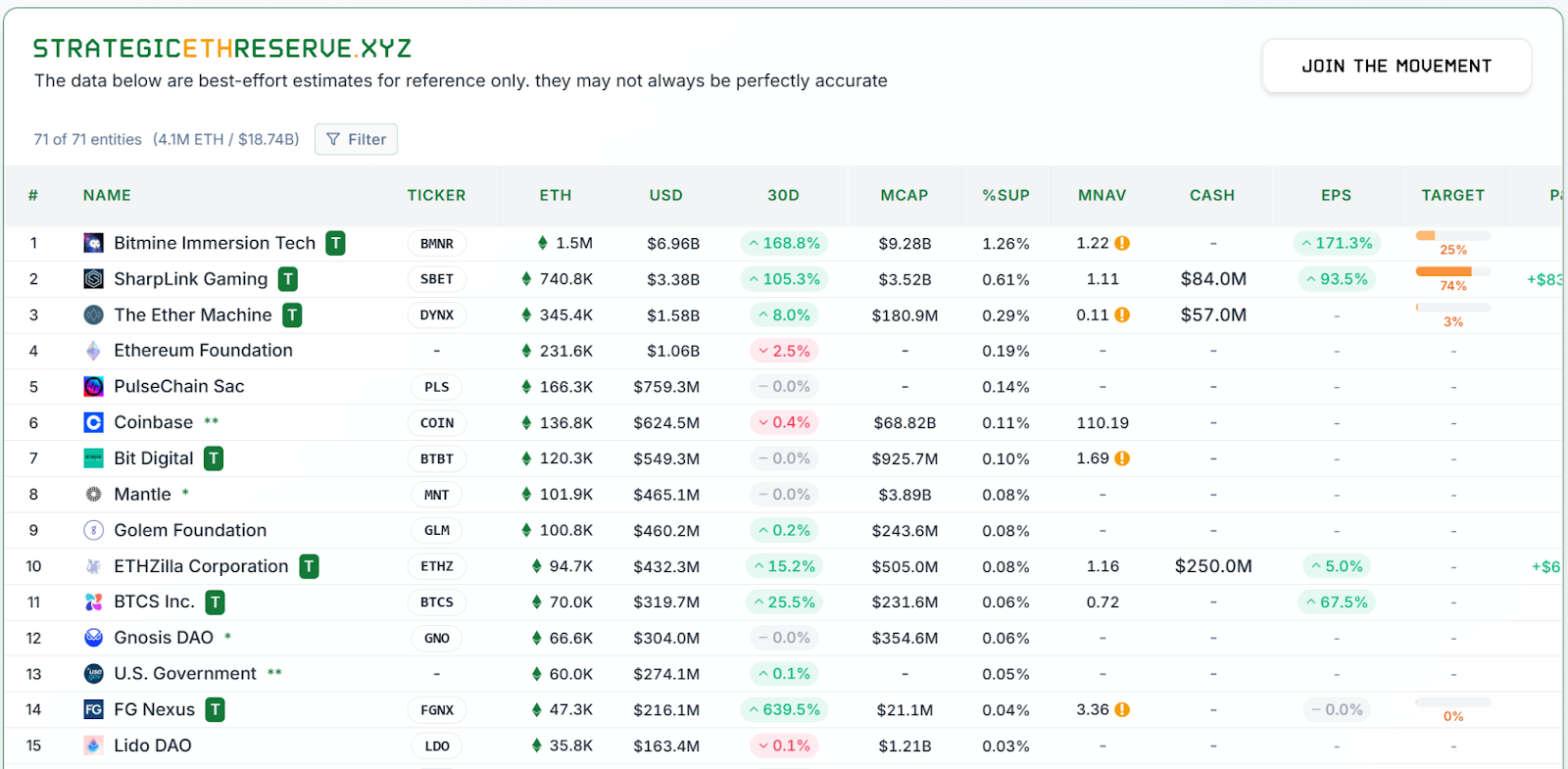

The strategic deployment of treasury companies has been a significant driver of Ethereum's price appreciation. SharpLink and Bitmine have recently engaged in a "strategic arms race" for Ethereum, significantly increasing their holdings through multiple rounds of funding exceeding $100 million. Their holdings have surged by 168% and 105%, respectively, to $6.96 billion and $3.38 billion, respectively.

Looking at Bitcoin, Strategy, a pioneer in Bitcoin treasury, has seen its purchases shrink significantly in the past two weeks, from thousands of coins in the past to just a few hundred.

Although KindlyMD, a new member of the Bitcoin reserve camp, purchased 5,765 BTC worth $640 million on August 19, its overall amount pales in comparison with the wave of ETH treasury increases.

Capital Logic: Why Ethereum?

Ultimately, behind this rise and fall is a shift in narrative and capital preferences.

Bitcoin has long held the throne of cryptocurrencies as "digital gold." Its decentralization, scarcity, and inflation resistance have made it a top choice for risk-averse investors. However, as established investors cashed out and new investors remained reluctant to enter the market in significant numbers, Bitcoin's upward momentum stalled.

Ethereum's logic is different. The addition of Treasury Inc. not only injects new momentum into Ethereum at the financial level, but also adds a new narrative logic to Ethereum, gradually giving it the institutional potential to transcend a single crypto asset .

Why did Wall Street capital choose to bet on Ethereum instead of Bitcoin? CryptoQuant analyst CryptoMe offers a unique perspective: Strategy, a pioneer in Bitcoin treasury, holds 3.3% of all BTC . However, founder Michael Saylor controls 45% of the company's voting rights with just 10% of the shares . Wall Street is clearly unwilling to further increase Strategy's wealth concentration.

Ethereum's holdings, by contrast, appear much more dispersed. BitMine Chairman Tom Lee's personal stake is far less significant than Saylor's absolute influence. BitMine subsequently received investments from PayPal co-founder and Silicon Valley venture capitalist Peter Thiel, as well as Ark Investment, owned by Cathie Wood, known as "Wood Sister" and the "female Warren Buffett." The former acquired a 9.1% stake in BitMine, while the latter subscribed to approximately 4.77 million shares. Meanwhile, companies like SBET, ETHZ, and GAME have also been increasing their holdings, gradually institutionalizing and decentralizing Ethereum's capital narrative.

Market view: Turning cautious in August

On August 20th, on-chain analyst Boris Vest stated that based on an analysis of Binance's fund flows, Bitcoin prices could face selling pressure in the next one to two weeks. Data shows that Binance's net Bitcoin inflow has turned positive, while outflows have decreased. This trend suggests that Bitcoin is in a distribution phase. Furthermore, Binance's trading reserves continue to grow, indicating that investors are selling their Bitcoin to exchanges for profit. Boris Vest noted that Binance's massive trading volume plays a crucial role in influencing the cryptocurrency market. Therefore, as new buyers enter the market, whale sales often put significant selling pressure on Bitcoin prices. Bitcoin's current weakness is confirming his view.

Tom Lee, the new chairman of BitMine and a believer in Ethereum, was even more blunt in a recent interview: "I think the probability of Ethereum's market capitalization surpassing Bitcoin is extremely high, perhaps even reaching 50%. This is like the US dollar's departure from the gold standard in 1971."

Of course, there are also dissenting voices. Adam, a macro researcher at Greeks.live, believes that a cascade of liquidations has driven BTC from a high of $114,000 to $110,000, rapidly shifting sentiment from cautious optimism to bearish concerns. Despite the dramatic volatility, traders remain divided, with some believing $110,000 is Bitcoin's bottom, while others anticipate further declines. However, most agree that this volatility is the result of the liquidation of excessive leverage .

Matrixport reports that while institutional funds largely retreated during the summer, Ethereum continued to attract inflows, while Bitcoin ETFs may see net outflows for the fifth consecutive month. This month's outflows are expected to be approximately $1.2 billion, the second-highest on record, behind only February's $3.5 billion. While seasonality may be fleeting, it serves as a reminder that the direction of capital flows is as important as seasonality. After maintaining a bullish stance in July, we shifted to a cautious stance in August.

The current market is indeed under pressure due to a severe drop in investor trading confidence. However, a consensus is emerging: funds are flowing out of Bitcoin and continuously increasing their investment in Ethereum. Despite this, the current market still requires vigilance.

From a more rational perspective, while Powell's slightly dovish tone briefly sparked a surge in risk assets, it quickly retreated from its highs. While the "Bitcoin rotation leading to market weakness" was the trigger, the real catalyst was the cooling of sentiment after the "overly consistent optimism." Powell's words read more like a conditional response to recent revisions to employment and inflation than an endorsement of a path for rate cuts this year. The uncertainty surrounding the ultimate outcome of interest rates hasn't dissipated; it's simply been priced in by the market with a more optimistic risk premium, leading to a necessary "reversal" in trading.

Conclusion

The dynamics within the current crypto market are quietly evolving, adding new footnotes to this round of adjustments. Bitcoin remains the cornerstone of the crypto market, but now it is more like one end of a seesaw, representing existing capital and old narratives, while Ethereum is gradually becoming the other end, receiving new capital and new narratives. The market's center of gravity is gradually shifting, and the seesaw is gradually tilting amid repeated selling pressure and accumulation of positions.

Ethereum may not have had its own “Salvador moment” yet, but it is gradually moving towards its own institutionalized moment.