When the price of Ethereum and its micro-strategies fluctuates drastically, how can we make steady progress in the options market based on mNAV?

- 核心观点:期权策略可对冲以太坊DAT模式风险。

- 关键要素:

- ETH高波动性降低融资成本。

- PoS质押收益提供稳定器。

- mNAV溢价加速飞轮效应。

- 市场影响:提升机构风险管理能力。

- 时效性标注:中期影响。

Original article by @BlazingKevin_, the Researcher at Movemaker

With Ethereum breaking through 4868, it officially reached a new all-time high. Looking back at the market trends over the past two weeks, Ethereum experienced a roller-coaster ride from 4788 to 4060 to 4887, with a 15% drop and a 20% gain occurring within 10 days. The stock prices of Ethereum MicroStrategies, the institutions driving this round of Ethereum's rally, have also experienced a roller-coaster ride.

If your portfolio includes Ethereum and its leveraged institutional stocks, and you foresee wide fluctuations around all-time highs, utilizing derivatives to mitigate account drawdown risk is becoming increasingly important. Even if you're a long-term "buy and hold" investor, you might not want to experience another extended downturn in Ethereum, as Bitcoin did last year.

Options, as nonlinear financial derivatives, provide an effective solution for managing this price risk. By purchasing put options, you can set a price floor for your ETH or related crypto-equity holdings, thereby protecting the value of your portfolio during significant market declines. Furthermore, by constructing more complex options portfolios, you can even profit from market consolidation or minor fluctuations.

How to go long on mNAV if you are optimistic about further expansion of the flywheel?

Ethereum's DAT Ponzi scheme continues

The DAT (Digital Asset Treasury) strategy has helped Michael Saylor's company reach a market capitalization of over $100 billion, surpassing even Nvidia's growth over the same period. This strategy involves raising funds from the public market by issuing company securities (such as stocks or bonds) and then using the funds to massively increase crypto holdings. The goal is to create a virtuous cycle of "fundraising -> coin purchases -> rising coin and stock prices -> further fundraising."

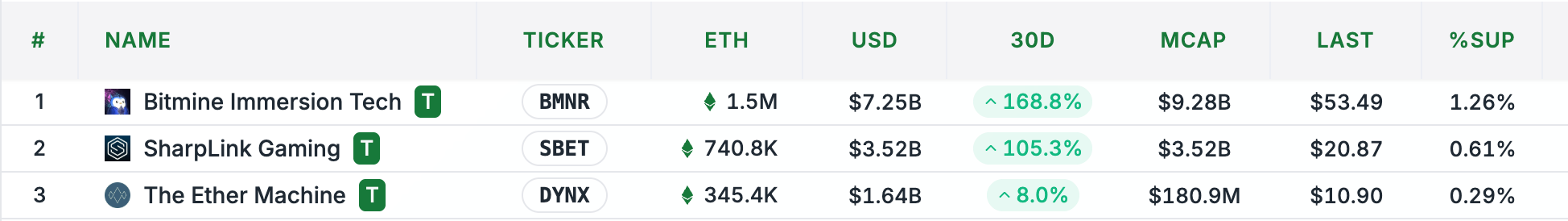

Companies like Sharplink Gaming (SBET) and BitMine (BMNR) are trying to replicate and upgrade this model, and Ethereum’s unique properties may make this flywheel turn faster and more steadily.

The DAT model is essentially an arbitrage game between long-term asset growth rates and financing costs. Its success presupposes that the long-term compound annual growth rate (CAGR) of the underlying asset (such as ETH) must be significantly higher than the company's cost of capital. However, the Ethereum Treasury is unique in that it doesn't simply copy Bitcoin's playbook, but rather cleverly leverages three unique characteristics of the Ethereum ecosystem, injecting unprecedented driving force into this flywheel model:

1. Volatility becomes a catalyst for financing

Traditionally, high volatility typically implies high risk. However, in the DAT model's financing instruments—particularly convertible bonds (CBs)—Ethereum's significantly higher historical and implied volatility than Bitcoin's presents a distinct advantage. This high volatility is a significant draw for hedge funds that rely on volatility trading (such as those engaging in gamma trading). Consequently, ETH treasury companies can issue convertible bonds on more favorable terms (higher valuations), reducing financing costs. Volatility, in this context, ceases to be a pure risk and becomes a "bait" to attract specific institutional investors, providing cheaper and more abundant fuel for the flywheel.

2. Native income provides an endogenous “stabilizer”

Bitcoin treasuries (such as MSTR) that pay bond interest or preferred stock dividends essentially rely on issuing additional shares in the market to generate cash, a practice that is highly dependent on market liquidity and stock price stability. Ethereum's PoS mechanism, on the other hand, endows ETH with inherent productivity—staking and re-staking can generate stable and substantial native returns. This means that ETH treasury companies can use this revenue to cover the interest costs of their financing instruments, significantly reducing their reliance on the market.

3. The mNAV premium acts as an accelerator for the flywheel

The market capitalization to net asset value (mNAV) ratio is a key metric for measuring treasury company valuations, reflecting the market's expectations of their future growth potential. Because ETH's native yield mechanism can continuously increase the number of ETH per share without relying on additional financing, the market naturally values ETH treasury companies at a higher mNAV premium. The higher the mNAV, the stronger the flywheel's growth and acceleration effects.

The correct way to go long on mNAV when ignoring the price fluctuations of individual tokens

If your current strategy is bullish on mNAV and you believe Ethereum may experience a pullback, then an options strategy that ignores the price fluctuations of individual tokens is most appropriate. For example, using BMNR as an example, you might think that simply going long on 10,000 BMNR and shorting 10,000 ETHA would be a simple hedge. However, this is actually a poor hedging strategy.

When going long on mNAV, we need to consider the intrinsic value per share of BMNR, SBET, ETHA, etc. This is the actual number of ETH units behind each share. This can be considered the "net asset value" of the instrument denominated in ETH.

Calculation method: ETH content per share = total ETH holdings / total number of issued shares

For ETHA, the calculation process is as follows: First, the indicative basket quantity of ETHA for a given day is calculated by multiplying the estimated net asset value (NAV) of the next day by the number of shares in each basket (40,000), and then dividing it by the CF benchmark index on that day.

According to https://www.ishares.com/us/products/337614/ishares-ethereum-trust-etf, 40,000 shares correspond to 302.56 Ethereum.

302.57/40000=0.00756 ETH

That is, 1 ETHA = 0.00756 ETH

For BMNR, its calculation process is as follows:

Outstanding shares: 173,496,950 shares

ETH held: 1,570,000

That is, 1 BMNR = 0.00904 ETH

After determining the “ETH content” of the two assets, the next step is to calculate the hedge ratio:

BMNR:ETHA =0.00904:0.00756 = 6:5

Based on the closing price: 1 ETH = 4840

The intrinsic value of 1 BMNR is: 0.00904*4840 = 43.75

BMNR's closing price is 53.49

BMNR mNAV = 53.49/43.75 = 1.22

Using the same algorithm, we can calculate SBET’s mNAV: 168,866,724 shares outstanding, 740,800 ETH. This gives us: 1 SBET = 0.00438 ETH.

Based on the closing price: 1 ETH = 4840

The intrinsic value of 1 SBET is: 0.00438*4840 = 21.19

SBET's closing price is 20.87

SBET mNAV = 21.19/20.87 = 1.015

The hedging ratio of SBET to ETHA is: SBET:ETHA = 0.00438:0.00756 = 11:19

SBET's mNAV is smaller than BMNR's. When Ethereum nears its all-time high, there's a significant chance of a pullback or wide range fluctuations. Following the strategy outlined in the title of this section, we remain optimistic about the continued positive mNAV flywheel, meaning that SBET or BMNR won't fall below their intrinsic value before maturity. However, we don't want to risk a sharp decline in net asset value (NAV) from Ethereum. Therefore, we should anticipate a larger decline in ETH than either SBET or BMNR. Going long on the one with the smaller mNAV between SBET and BMNR minimizes risk.

Take 250905 as an example:

We should operate the same ratio of SBET short put and ETHA long put: SBET sell 20.5 put*19 to get the premium of $2,888

The decline based on SBET's intrinsic value is: 3.2%

The price of ETHA after the same drop is: 35.39

The closest strike price is 36, so ETHA buys 35 PUT*11 and pays a premium of $1,507

Premium income: $1,381

If mNAV rises or remains unchanged, premium income is earned. However, if SBET's decline exceeds that of Ethereum, meaning mNAV decreases, losses will occur. Given SBET's current premium level, this scenario suggests the premium is underwater, potentially putting DAT's growth on hold.

Therefore, the strategic rationale for this strategy should be: The current Ethereum rally is not over, meaning mNAV should steadily rise, but the expectation is that Ethereum will experience a short-term correction. Therefore, the goal is to go long on mNAV, ignoring price fluctuations of individual stocks and coins. Of course, this strategy also has its drawbacks. If ETH plummets, the market may anticipate the "flywheel of secondary issuance has failed," and SBET's stock price will often fall even more sharply than ETH. In such an extreme scenario, the seller's exposure to the put option would suffer a significant loss, while the ETHA put option would not provide sufficient hedging. Alternatively, if market sentiment turns negative (due to expectations of secondary issuance failure or a prolonged ETH correction), the premium could potentially dip below zero and continue to decline.

When the token-share issuance causes the premium to drop, how should one short mNAV?

For companies like SBET and BMNR, whose core business model is to hold and increase their ETH holdings, their stock price performance depends not only on the price of ETH but also on the company's own capital operations. The core of these is the cyclical model of financing the purchase of more ETH through the issuance of new shares. In a bull market where ETH prices continue to rise, this model appears to create value, but it hides the continuous dilution of existing shareholders' equity. This dilution effect is mathematically inevitable and will ultimately undermine the logic of "eternal growth."

The core mechanism of equity dilution

To truly understand the logic behind equity dilution, we can begin with a quantitative analysis framework. The fundamental premise is that a share issuance means that the assets of the same company are divided among more shares. Unless the market ideally remains neutral (i.e., willing to accept the additional supply while maintaining the valuation), the relative equity of existing shareholders will inevitably be weakened. The essence of new capital inflow is the redistribution of value among shareholders.

Initial settings:

- Company Holdings : Assume the company's assets are a $200 million portfolio of AI startups with no debt, so the net assets (NAV) are $200 million.

- Market capitalization : The market values it at $250 million, representing a 25% premium. This premium may stem from the market's enthusiasm for the AI sector or high expectations for the company's investment acumen.

- Share capital size : set to Q shares.

- Net assets per share (NAV) : $200/Q.

- Price per share : $250/Q.

The market is willing to pay $1.25 for every $1 of assets held by the company. This 25% premium is the "fuel" that can start the subsequent share issuance cycle.

First additional issuance:

- Financing Scale : The company decided to raise $100 million through a new share offering, all of which will be used to invest in new AI projects. To maintain market price stability, the additional offering must be conducted at the current share price of $250/Q.

- Number of new shares (M) : M = US$100 million ÷ (250/Q) = 0.4 Q shares.

- Total amount of new share capital : Qnew=Q+M=Q+0.4 Q=1.4 Q shares.

- Total new assets : Anew = US$200 million + US$100 million = US$300 million.

- New net asset value per share : NAVnew = $300 million ÷ (1.4 Q) ≈ $214.29/Q. Compared with the original 200/Q, the intrinsic value per share has indeed increased.

- New market value (assuming the stock price remains the same) : Market value new = (250/Q) × 1.4 Q = US$350 million.

- New premium : Premium new = (350 million ÷ 300 million) − 1 ≈ 16.67%.

On paper, net assets per share increased, the share price remained unchanged, and the company's market capitalization increased significantly. However, in reality, the original 25% premium was diluted to 16.67% .

How value transfer occurs:

The newly added $100 million in assets are now jointly owned by all shareholders (new and old). The old shareholders' shareholding ratio has dropped from 100% to Q/1.4 Q≈71.43%.

Their equity in the $300 million in new assets is approximately $300 million x 71.43% = $214 million. While this represents a $14 million increase over their initial $200 million in assets, they lose a portion of their claim to the original high premium. For their $100 million, the new shareholders not only acquired $100 million in assets but also enjoyed a portion of the company's overall market premium "for free," effectively entering the market at a discount.

If the loop continues:

Assuming the company continues to use this strategy, raising funds each time equal to 40% of its current market capitalization:

- After the first round : assets of RMB 300 million, market value of RMB 350 million, premium of 16.67%.

- Round 2 : Refinancing of 140 million (40% of 350 million), total assets will become 440 million, and the new market value (if the stock price remains unchanged) will reach 490 million, and the premium will be further diluted to about 11.36%.

- After the third round : the asset scale continues to expand, but the premium will continue to decline.

As the number of rounds increases, the premium will approach 0. Eventually, when the additional offering price can only be equal to the net asset value per share:

- Net assets per share no longer increase . For example, if assets are K and share capital is P, then additional shares can only be issued at a price of K/P. If 0.3K is issued, the number of new shares is 0.3P. The new assets are 1.3K, the new share capital is 1.3P, and the net assets per share is (1.3K)/(1.3P) = K/P, exactly the same as before the additional issuance.

- The "magic" of the additional issuance has lost its power . Without the premium, the additional issuance no longer has the superficial effect of increasing net assets per share, and the relationship between new and old shareholders has become a pure zero-sum game.

Why this effect is inevitable:

- The market will not always cooperate : investors will conduct valuation analysis, and once they realize that the company's growth depends solely on external transfusions rather than endogenous profits, the premium given by the market will shrink rapidly, causing the stock price to fall, thus undermining the premise of "issuing additional shares at market price."

- Dilution is an arithmetic necessity : Unless a company can generate a return (g) on new capital that is significantly above the market average, and that return consistently outperforms the dilution of its equity, dilution is a mathematical necessity from the perspective of long-term shareholder value.

Ultimately, while the process of secondary offerings may be overshadowed in the short term by the halo of "asset size expansion" and "rising underlying asset values," its core function is the gradual transfer of equity from existing shareholders to new shareholders, who then share in the company's accumulated value and premium at a lower cost. The larger the financing size relative to market capitalization, the more rapid this dilution effect.

Short mNAV strategy: BMNR is expected to rise less than ETHA due to dilution from the additional issuance.

Based on this, what strategy should you develop? First, we believe the bull market will continue, so this is an aggressive protection strategy for BMNR's upcoming share issuance.

We believe that its stock price performance is weaker than Ethereum itself, and a strategy that can hedge against Ethereum price fluctuations and purely short its mNAV is needed.

Simply shorting BMNR and going long ETHA is a directional bet, but not precise enough. To precisely short mNAV, we need to utilize options and hedge strictly according to its intrinsic value per share (denominated in ETH).

Step 1: Calculate intrinsic value per share

We need to reuse the previous calculations to determine the “Net Asset Value” (NAV) of both assets denominated in ETH.

- ETH content of ETHA: According to the iShares official website data, 1 ETHA ≈ 0.00756 ETH

- BMNR’s ETH content: Based on the amount of ETH it holds (1,570,000) and the number of outstanding shares (173,496,950), 1 BMNR ≈ 0.00904 ETH

Step 2: Determine the Hedge Ratio

In order to remove the impact of ETH price fluctuations in transactions, we must calculate the hedge ratio based on their "ETH content".

Hedge Ratio:

BMNR:ETHA=0.00904:0.00756≈1.2:1≈6 : 5

This means that, in terms of intrinsic value, 6 shares of BMNR are approximately equal to the value of Ethereum represented by 5 shares of ETHA .

Step 3: Build an option strategy to short mNAV

Our goals are to:

- Betting on BMNR's price performance underperforming its intrinsic value.

- Hedge against ETHA price fluctuations.

Therefore, the correct operation should be to buy the put option of BMNR and sell the put option of ETHA .

- Buy BMNR PUT : This is the core of our strategy. If the BMNR stock price falls, or rises less than expected, this position will profit.

- Selling ETHA PUTs : This is where the hedging and funding costs come from. We sell ETHA PUTs and collect the premium, expressing our belief that ETHA will not underperform BMNR. This operation hedges against the overall downside risk of the ETH market. If ETH doesn't fall significantly, this position will profit from the premium collected.

Take option 250905 (expiring on September 5, 2025) as an example:

Assuming current prices: BMNR = $53.49, ETHA = $36.5 (based on $4840/ETH * 0.00756)

We should operate according to the ratio of 6:5 :

- Buy BMNR PUT : Choose a strike price close to at-the-money, for example, buy 6 lots of BMNR $53 PUT . The premium paid is $5.00 per lot, for a total outlay of $5.00 * 100 * 6 = $3,000 USD .

- Sell ETHA PUT : Again, choose a strike price close to at-the-money, for example, sell 5 lots of ETHA $36 PUT . The premium received is $4.20 per lot, for a total profit of $4.20 * 100 * 5 = $2,100 USD .

Net Cost : Total Cost of Strategy = Premium Paid - Premium Received = $3,000 - $2,100 = $900 USD

This is a net-payout strategy, so the maximum loss is the $900 paid.

Profit and loss analysis of the strategy

- Profitability scenario (mNAV decline) :

- BMNR's increase is smaller than ETHA's : ETH's 10% increase pushes the price of ETHA from $36.5 to $40.15. Theoretically, BMNR should have risen from $53.49 to $58.8. However, due to the expected dilution from the secondary offering, BMNR only rose to $55. At this point, while your BMNR put resulted in a loss, the loss was smaller than the gain from the ETHA put (which had become out-of-the-money). This shift in relative value resulted in a profit for the entire strategy portfolio.

- BMNR fell more than ETHA : ETH's retracement of 5% sent ETHA's price plummeting to $34.6. Theoretically, BMNR should have fallen to $50.8. However, market panic caused mNAV to shrink, and BMNR fell to $48. At this point, the value of your purchased BMNR put increased significantly, exceeding the loss from the sold ETHA put, making the strategy profitable overall.

- Loss scenario (mNAV increases or remains unchanged) :

- BMNR outperforms ETHA (mNAV expansion) : Market sentiment is surging, and ETH rises 10%, but BMNR, as a high-beta asset, rises 20%. At this point, the BMNR PUT becomes deeply out-of-the-money, valued at zero. The sold ETHA PUT also becomes valued at zero, resulting in a net loss of the entire $900 investment.

- ETH plummets : If the price of ETHA plummets (for example, falls below $30), the sold ETHA $36 PUT will result in a huge loss, which may exceed the profit from the BMNR PUT, resulting in a loss for the overall strategy.

Each strategy has its own approach, and there's no perfect solution. However, once you've made your assessment of the current market environment, the corresponding options combination will mitigate risk or provide additional rewards if your judgment is correct.

About Movemaker

Movemaker, authorized by the Aptos Foundation and co-founded by Ankaa and BlockBooster, is the first official community organization dedicated to promoting the development of the Aptos ecosystem in the Chinese-speaking region. As the official representative of Aptos in the Chinese-speaking region, Movemaker is committed to building a diverse, open, and prosperous Aptos ecosystem by connecting developers, users, capital, and numerous ecosystem partners.

Disclaimer:

This article/blog is for informational purposes only and reflects the author's personal views and does not necessarily represent the views of Movemaker. This article is not intended to provide: (i) investment advice or a recommendation; (ii) an offer or solicitation to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. Holding digital assets, including stablecoins and NFTs, carries a high degree of risk and carries significant price volatility, potentially becoming worthless. You should carefully consider whether trading or holding digital assets is appropriate for you based on your financial circumstances. If you have questions regarding your specific situation, please consult your legal, tax, or investment advisor. The information provided in this article (including market data and statistics, if any) is for general informational purposes only. While reasonable care has been taken in preparing these data and charts, no liability is assumed for any factual errors or omissions contained therein.