USDT's fee-charging dispute: Tether's Plasma conspiracy

- 核心观点:Plasma是Tether主导的比特币侧链。

- 关键要素:

- 整合成熟技术实现零费用USDT转账。

- 通过验证者网络安全引入原生BTC。

- 瞄准跨境支付与比特币收益化市场。

- 市场影响:可能重塑稳定币结算格局。

- 时效性标注:长期影响

Original article by @BlazingKevin_, the Researcher at Movemaker

TL;DR

- Core positioning : Plasma is a Bitcoin sidechain supported by Tether, aiming to become the ultimate settlement layer for USDT and Bitcoin.

- Business motivation : Plasma's core goal is to help Tether recapture the billions of dollars in USDT transaction fees that are taken away annually by public chains such as Ethereum and Tron, thereby achieving a strategic upgrade from a "stablecoin issuer" to a "global payment infrastructure."

- Technology Strategy: Robust Combination : Plasma does not pursue high-risk new technologies, but instead integrates mature solutions that have been proven in the industry:

- USDT optimization : Utilize “account abstraction” technology (Paymaster) to achieve zero-fee transfers of USDT.

- BTC support : pBTC is introduced using the cross-chain bridge architecture of the validator network, and combined with LayerZero to solve the problem of BTC liquidity dispersion after cross-chain.

- Large application scenarios :

- Native BTC DeFi : Provides a safer and easier-to-use channel for institutions and retail investors to invest their Bitcoin holdings in DeFi protocols to earn returns.

- Real-world payments : With zero-fee USDT, we are targeting the two trillion-dollar markets of cross-border remittances and on-chain payroll.

- Challenging traditional finance : Launching Plasma One Neobank, offering high-interest savings and generous cashback on purchases, directly competing with payment giants like PayPal and Visa.

- Prospects and Challenges :

- Advantages : It has top-notch resources and background, a clear and grand narrative, and is based on the two core assets in the crypto industry (USDT and BTC).

- Challenges : It will face fierce competition from existing ecosystems such as Ethereum and Tron. User migration requires time and costs, and its financial products also face huge regulatory uncertainties.

A look back at the TGE craze

Plasma's mid-year subscription event provided a crucial window into its initial market traction. Its "deposit first, apply later" admission mechanism effectively selected users with sufficient financial resources and a high willingness to participate. The event attracted approximately $1 billion in capital within 30 minutes, demonstrating the market's high expectations for the project's value and strong participation consensus before its mainnet launch.

Plasma's subsequent partnership with Binance Earn, Binance's wealth management platform, marked another key market expansion. By launching a customized "Plasma USDT lock-up product," Plasma not only secured the endorsement of a top centralized exchange but also directly reached its vast user base.

The product's initial 250 million USDT quota was quickly subscribed within an hour, with subsequent issuances reaching the cap of 1 billion USDT. This data demonstrates the successful transmission of market demand from high-net-worth early adopters to the broader retail market. The product's dual-income structure—daily settled USDT income and post-TGE XPL token rewards—effectively balances users' short-term profit expectations with long-term holding incentives.

Last week's TGE itself was a phenomenal performance for Plasma. The project set an attractive and inclusive airdrop distribution strategy: each participant was guaranteed to receive at least 9,300 XPL tokens. Based on the recent high of $1.69, this translates to a minimum airdrop value of $15,700 USD. This high-value, wide-reaching airdrop model has established a solid foundation for the XPL token's value and fostered positive market sentiment.

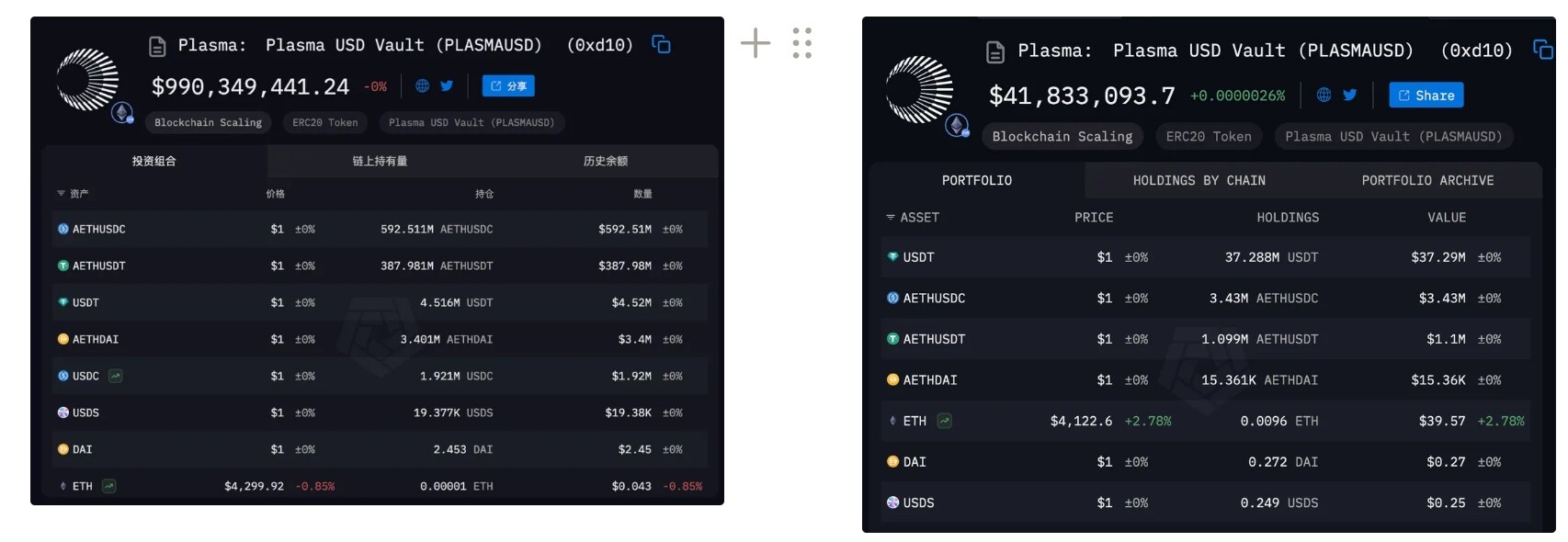

Analyzing capital flows before and after the TGE, we observe two distinct phases. Before the TGE, stablecoin deposits within the network primarily consisted of cross-chain wrapped assets such as AETHUSDC (approximately 60%) and AETHUSDT (approximately 39%). Following the TGE, this week's data shows a decline in total stablecoin deposits of nearly $950 million. This large-scale capital outflow should be considered normal and expected market behavior, primarily due to short-term funds initially invested for arbitrage purposes taking profits after achieving their objectives.

However, what deserves more attention is the strategic adjustment and capital structure optimization that followed. The departure of short-term speculative capital has made room for the entry of long-term strategic capital.

Plasma, Tether's main entry point for on-chain USDT settlement, collaborates with institutional liquidity providers such as Bitfinex, Flow Traders, and DRW to build a stable, efficient, deep, and resilient financial infrastructure for the network.

However, Plasma is working with Tether to introduce native USDT and is collaborating with liquidity partners such as Bitfinex, Flow Traders, and DRW. USDT on Plasma has increased from 4 million to 37 million in a week.

Plasma's mission: solving the core pain points of Web 2 and Web 3

Plasma boasts a strong strategic backing and precise market positioning. Its investment roster is truly top-tier, including Bitfinex (Tether's parent company), which possesses the strongest ecosystem synergies, Peter Thiel's Founders Fund, a leading tech investor, and Framework, a leading crypto-native venture capital firm. This unique investment portfolio provides Plasma with strong support in terms of capital, strategic alliances, and technological credibility, forming a crucial competitive advantage in its early stages.

Leveraging these resources, the project team launched its flagship application-layer product, Plasma One, in September of this year. Positioned as a "native digital bank" for stablecoins, Plasma One's core mission is to build a seamless bridge between traditional finance and the crypto world. By partnering with Signify Holdings to issue Visa-approved physical bank cards, Plasma One expands USDT's use cases beyond on-chain to tens of millions of offline and online payment terminals worldwide. Furthermore, by offering features such as zero-fee USDT transfers, an innovative "earn while you spend" account system, and up to 4% cashback on purchases, Plasma One precisely addresses the core pain points of existing crypto payment solutions and provides user incentives that rival those of leading fintech companies.

When assessing Plasma's long-term potential, we need to recognize that its tremendous initial success was no accident. Instead, it stemmed from its deep insight into and precise response to dual market pain points. We can deconstruct its core narrative from two perspectives: Web 2 (external market pull) and Web 3 (endogenous strategic drive).

1. Web 2 Perspective: Filling the Post-Legalization Payment Infrastructure Vacuum

From an external market perspective, a decisive macro catalyst was the passage of the US Genius Act in July 2025. This act historically recognized stablecoins as a legal payment tool alongside debit card networks and the ACH system. However, the passage of this top-level regulation has only highlighted the significant lag in underlying infrastructure. USDT currently primarily runs on general-purpose public blockchains such as Ethereum and Tron. These networks were not designed for high-frequency payment scenarios and suffer from three core flaws:

- Transaction cost friction : Users who transfer USDT must hold and pay gas fees denominated in volatile assets such as ETH or TRX, which increases the usage threshold and cost uncertainty for non-crypto native users.

- Performance bottleneck : The architecture of the general chain cannot meet the scalability required for future large-scale payments.

- Insufficient compliance : There is a lack of a compliance and authentication framework embedded in the protocol layer designed for institutional users.

In this context, Plasma’s strategic positioning is clear: to become a dedicated settlement layer built specifically for USDT, with Bitcoin network consensus as its security cornerstone, aiming to solve all the bottlenecks at the aforementioned infrastructure level.

2. Web 3 Perspective: Tether’s Business Model Evolution and Value Return

From an internal strategic perspective, Plasma is a key component in achieving a fundamental shift in the business model of its parent company, Tether. For a long time, Tether, as the issuer of USDT, despite possessing hundreds of billions of dollars in reserves and profiting from them, has largely captured the enormous network effect and transaction value it has created in the form of transaction fees on underlying public chains like Ethereum and Tron. This "market dividend" Tether has "gives away" represents a significant gap in its business model.

Therefore, Tether's core motivation for promoting Plasma is to achieve vertical integration across the value chain, reclaiming the economic benefits that have languished for years within its own ecosystem. This isn't just about reclaiming fee revenue; it's also a complete strategic transformation: evolving from a passive "stablecoin liability issuer" to a proactive "global payment infrastructure operator" with control over network rules and business models. Through Plasma, Tether aims to build a closed-loop ecosystem, bringing USDT issuance, circulation, settlement, and application scenarios under its control, thereby consolidating its business empire over the long term.

How much did Tether actually “lose”?

To understand the strategic imperative of Plasma, we must first examine the significant asymmetric value capture inherent in Tether's current business model. USDT's network scale has reached unprecedented heights, with a circulating market capitalization of $170 billion and annual transaction settlement volume reportedly exceeding that of PayPal and Visa combined. However, there is a fundamental disconnect between the operations of this massive on-chain economy and the core revenue model of its issuer, Tether.

Tether's current annual profit of approximately $13 billion comes largely from the 3-4% annualized return it earns from managing its reserve assets (primarily US Treasuries). While this profit is substantial in absolute terms, compared to the massive economic activity generated daily by the network USDT supports, this revenue model appears extremely passive and indirect. Essentially, Tether has created the most liquid core asset in the crypto world, yet fails to directly benefit from its circulation, a fundamental flaw in its business model.

This imbalance in value capture is specifically reflected in the huge external benefits that USDT creates for its host public chain.

Tether’s “losses” on Ethereum

In the Ethereum ecosystem, USDT is a cornerstone source of liquidity for DeFi. USDT-related transfers and smart contract interactions contribute nearly $100,000 in gas fees to the Ethereum network daily, steadily accounting for over 6% of Ethereum's total transaction fees.

This substantial and ongoing revenue is captured by Ethereum's validator nodes, becoming part of the economic incentive to maintain the security of the network. However, as the source of value creation, Tether does not receive any share of the proceeds.

Tether’s “losses” on the Tron network

This phenomenon of value spillover is even more extreme on the Tron network. By optimizing transfer costs and speed, Tron has successfully positioned itself as the primary retail payment and transfer network for USDT. USDT-related activities account for over 98% of the total transfer volume and gas consumption on the Tron network.

It's almost safe to say that the Tron network's trading activity and economic model are entirely built on providing "settlement outsourcing services" for USDT. Leveraging this highly integrated relationship, Tron generated nearly $2 billion in annual revenue in 2024 alone. This massive profit stems entirely from the massive demand for USDT, but it also doesn't directly transfer to Tether's balance sheet.

Strategic Conclusion: Plasma as the Inevitable Choice for Value Return

In summary, Tether's direct motivation for launching Plasma was to correct this long-standing imbalance in value distribution. Third-party public blockchains like Ethereum and Tron effectively limit Tether's full control over and rights to profit from the massive stablecoin economy it single-handedly created.

Therefore, the establishment of Plasma is the core of Tether's strategy to achieve "vertical integration of the value chain." Its fundamental purpose is to:

- Reclaiming income rights : USDT transaction fees, payment service fees, and related DeFi ecosystem income currently captured by networks such as Ethereum and Tron will be re-incorporated into its own system.

- Establish economic sovereignty : Get rid of dependence on third-party public chains and build an autonomous and controllable financial infrastructure with USDT as the native asset.

- Achieve business model upgrade : Expand from a single reserve management profit model to a platform-based business model that can capture value from multiple dimensions such as transactions, payments, and application development.

As Plasma's infrastructure matures, Tether aims to recapture the substantial market share it has ceded to external public chains over the years. This is not only a tactical move to address immediate pain points, but also a long-term strategic initiative to ensure its core competitiveness in the future digital economy.

Plasma's Two Fundamentals and Two Innovations

After clarifying Plasma's strategic intent, we analyzed its fundamentals. Plasma's overall architecture is built around two core pillars: 1) asset support, with USDT as the primary asset , and 2) native integration of BTC .

Therefore, any effective evaluation of Plasma’s technical fundamentals must center around two key questions:

- Regarding USDT : How does Plasma provide superior utility to other networks? Does its technical implementation create a sustainable competitive barrier that is difficult to replicate?

- Regarding Bitcoin : What trade-offs does its “native support” approach make in terms of decentralization and security? Are the trust assumptions it introduces industry-standard practices, or do they introduce new, untested risk models?

1. Core Network Architecture: The Cornerstone of Performance and Compatibility

Before diving into the application layer, let’s first look at the underlying network. Plasma employs two key architectural optimizations:

- Consensus Layer - PlasmaBFT : This is an original BFT consensus algorithm designed to significantly reduce transaction finality times. For a payment and settlement network, high-speed finality is fundamental to ensuring user experience and commercial feasibility.

- Execution Layer - Reth Client : Plasma uses Reth, a high-performance Ethereum client written in Rust. The core purpose of this move is to maximize the network's transaction processing capacity and execution efficiency while ensuring full compatibility with the EVM.

These two underlying optimizations do not exist in isolation; together they form a high-performance foundation that serves USDT’s high-frequency usage scenarios and maintains native BTC cross-chain security.

2. USDT Prioritization Strategy: Modular Applications, Not Technical Barriers

Plasma's approach to improving USDT's utility is to adopt the widely discussed and accepted "account abstraction" standard within the Ethereum community, specifically proposals EIP-4337 and EIP-7702. By integrating the Paymaster functionality within the account abstraction framework, Plasma enables key features such as zero-fee USDT transfers and allowing users to pay for gas using a variety of tokens, including USDT.

Our analysis thus far leads us to the conclusion that while these features significantly enhance the user experience, the underlying technology is not unique to Plasma. This is a typical modular design approach —prioritizing the adoption of cutting-edge, established, and consensus-building protocols rather than developing a closed system in-house. Therefore, from a fundamental technical perspective, Plasma's advantage in stablecoin functionality stems not from an insurmountable technological moat, but rather from the rapid and effective integration of existing advanced technologies.

3. BTC native support: Recombination and optimization of mature solutions

Any public chain that natively supports BTC will inevitably involve some form of cross-chain bridge. Plasma emphasizes that its cross-chain bridge solution avoids the drawbacks of a single centralized custodian and small, high-risk multi-signature wallets:

- Security model : Security is provided by a decentralized network of validators, each of which independently runs a Bitcoin full node.

- Asset Control : The treasury is not controlled by any single party, and BTC deposit and withdrawal operations must be collectively approved by a quorum of validators through threshold signatures.

A key difference between Plasma's approach and other general-purpose cross-chain bridges mediated by validator networks lies in its specialized nature. While validators in general-purpose cross-chain networks need to monitor multiple blockchains, Plasma's validator network focuses solely on monitoring interactions between the Bitcoin mainnet and Plasma's designated vault addresses. This theoretically reduces the system's complexity and attack surface.

Similar to USDT's strategy, Plasma's native cross-chain bridge is also a recombination of existing mature technologies . It achieves industry-leading practices in security without introducing disruptive innovation.

4. Liquidity Solution: Integrating the LayerZero OFT Standard

The pBTC generated after a successful cross-chain transaction will face the common problem of all wrapped BTC assets (such as WBTC): liquidity fragmentation . To address this, Plasma integrates LayerZero's fully homogenous token (OFT) standard. This standard allows pBTC to be treated as a single asset across all supported EVM chains, thus forming a unified, chain-independent liquidity pool.

Summary: A technical philosophy of "winning through stability"

Overall, Plasma's technical development strategy presents a clear two-layer structure :

- Underlying infrastructure : Optimize performance at the consensus and execution layers to ensure network efficiency and stability.

- Application and product layer : fully adopt a modular approach and integrate the best existing solutions in the industry, such as Paymaster's account abstraction, Axelar's validator network model and LayerZero's OFT standard.

Ultimately, we concluded that Plasma's fundamental strengths lie in its low risk and theoretical security , as it introduces no additional and potentially dangerous trust assumptions. However, its moat doesn't lie in the technology itself . Its core philosophy in development is to "win with stability, without lagging behind"—ensuring the absolute robustness of its technical architecture, making it a rock-solid platform that can't fail. This allows its true moat—the Tether-led ecosystem, its vast native liquidity, and its premier strategic partnerships—to fully function.

Market entry strategies for pBTC and USDT

After thoroughly evaluating Plasma's technical architecture, we need to further examine how its core assets will translate into actual market utility. Plasma's market entry strategy is highly focused on its two pillar assets: pBTC and USDT, targeting the Bitcoin yield market and the stablecoin high-frequency payment market, respectively.

1. Native BTC (pBTC): Targeting the “yield-based” trend of Bitcoin assets

pBTC's core value proposition is to provide Bitcoin holders with a secure and efficient channel to participate in the broader DeFi ecosystem, thereby activating the profit potential of this huge stock of assets.

Existing market verification and retail user opportunities:

Market demand for Bridged/Wrapped Bitcoin (BTC) is well-documented. Current data shows that over 242,600 BTC have been migrated to various smart contract platforms, of which 86.5% (approximately 209,800 BTC) are actively deployed in various DeFi protocols for yield. This demonstrates a strong desire among Bitcoin holders to seek returns. The fundamental market opportunity for pBTC stems from retail users who are skeptical of the security of previous wrapping solutions and require a more reliable means to:

- Use BTC as collateral or liquidity asset in DeFi protocols.

- Securely store BTC on an EVM-compatible chain with a more user-friendly experience and lower transaction costs.

Core Growth Engine: Asset Management for Institutional and Corporate Treasury

pBTC's potential growth lies in capturing the accelerating trend of institutional and enterprise Bitcoin adoption. As of now, the total amount of Bitcoin held by public and private companies worldwide has reached approximately 1.38 million, an increase of 833,000 Bitcoins since the beginning of 2025. This incremental data highlights the strong momentum of institutional adoption.

We predict that the asset strategies of these corporate holders will gradually evolve from the primary "passive holding" to the more mature "active treasury management".

During this evolution, the key challenge will be how to safely and compliantly generate additional returns on existing Bitcoin holdings. In this context, pBTC is positioned as an ideal institutional solution. Given that institutional users prioritize security when selecting infrastructure, Plasma's robust security model, based on a decentralized validator network and threshold signatures, as previously analyzed, will be its core competitive advantage in attracting this customer base.

2. Zero-Fee USDT: Seizing the High-Frequency Payment Vertical Market

Plasma's "zero-fee USDT transfer" achieved through account abstraction technology precisely targets two payment verticals that are highly cost-sensitive and have huge market sizes.

Cross-border payments and remittances:

Plasma aims to leverage the inherent low-cost and high-efficiency advantages of blockchain technology to disrupt the traditional cross-border remittance industry. The potential size of this market is enormous:

- Market size : According to statistics, there will be 200 million international residents in the world in 2023, forming a stable demand for remittances. In 2024, the total amount of remittances to low- and middle-income countries is expected to reach US$700 billion.

- Industry pain points : Intermediaries (banks and foreign exchange institutions) in the traditional model capture an excessive amount of value. For example, in the US-India remittance corridor, an average transaction cost of 4% means over $600 million in value is lost annually between senders and recipients. On-chain stablecoin payment solutions could theoretically return this value to users.

On-chain Payroll:

This is another enterprise-level application scenario with enormous potential. For example, in the US market, total payroll is projected to reach $11 trillion in 2023, with associated payment processing fees reaching $1.4 billion. For businesses with global, remote teams, using stablecoins for payroll can significantly streamline processes and reduce costs.

It's important to note that these application scenarios are not entirely new, having already been explored in numerous projects during the previous market cycle. The most fundamental difference between the current environment and the past lies in the clear shift in macro-regulatory policy , which has opened a window for compliant applications.

However, we must be aware that there is still a significant implementation gap between high-level policy approval and the willingness of medium-sized enterprises to actually adopt and obtain supporting, clear regulatory enforcement details. This requires project owners to make long-term and in-depth plans in terms of compliance, legal affairs, and enterprise solutions, in addition to technology.

Plasma's Strategic Value, Growth Flywheel, and Future Outlook

Plasma's strategic empowerment of USDT

From the current perspective (September 2025), Plasma's core value to USDT is multi-dimensional. First, in terms of geopolitical competition, it will serve as a key weapon to consolidate USDT's market leadership and counter competitors like USDC. Plasma is positioned as the Tether-to-C Terminal, the commercial and retail access layer for end users within the Tether ecosystem. Its core strategy is achieved through a two-pronged "killer weapon":

- Disruption of traditional finance (TradFi) : Through the Plasma One product matrix, it directly challenges the market position of traditional payment giants such as PayPal and Visa.

- Aggregation towards crypto finance (DeFi) : Leveraging its technical compatibility, it plans to integrate more than 100 mainstream DeFi protocols to siphon the native income of the crypto world into its ecosystem.

The core engine of the growth flywheel: Plasma One products and revenue aggregation

The Plasma One digital bank is the tangible product that realizes this strategy. Its offering of a 10% annualized return on passive savings and a 4% cashback debit card represents an extremely aggressive market penetration strategy. Under ideal regulatory conditions, this level of user incentives could significantly disrupt the traditional payment and savings markets, effectively capturing users and market share from existing systems.

The sustainability of these high returns stems from a sophisticated yield aggregation model . Plasma, with its full EVM compatibility, seamlessly integrates with the entire crypto infrastructure. Its explicit goal is to bring protocols with strong, sustainable yield generation capabilities, such as Aave and Ethena Labs, into its "yield landscape." In this way, Plasma abstracts the complexities of DeFi, acting as a yield aggregation layer. It channels the returns generated by external protocols (far exceeding the 4% Treasury yield generated by Tether's own reserve assets) back to Plasma One, subsidizing its high consumer incentives.

To optimize the user experience, Plasma also established a transaction fee subsidy channel through the Paymaster mechanism. This design shifts the network costs borne by users when interacting with DeFi protocols to the protocol parties, achieving a completely free interaction experience for end users. This is a decisive advantage for attracting and retaining large-scale retail users who are highly sensitive to costs.

The Grand Narrative and the End of Tether

From a macro perspective, Plasma's positioning is anchored in two of the most core and enduring pillars of the crypto industry: Bitcoin and stablecoins . By establishing USDT as the native gas token, building a seamless, cross-chain liquidity pool for pBTC, and balancing privacy and compliance considerations in its design, Plasma has established a strong strategic appeal.

Behind this is Tether’s ultimate strategic picture:

- Elevate USDT from a "guest asset" circulating on multiple chains to a "native clearing currency" on its own sovereign network.

- Transform the company's BTC reserves from passive balance sheet items to "productive assets" that can be actively managed within its own ecosystem.

- Ultimately, the USDT supply, currently scattered across more than a dozen different networks and totaling $150 billion, will be brought together into a unified clearing layer independently controlled by Tether .

Once this goal is achieved, all USDT transfers, exchanges, issuances, and redemptions will take place on Tether's "home turf." At that point, Tether will not only gain unprecedented pricing power and influence on the network, but will also naturally control the core fee collection gateway of this new financial infrastructure.

Risk Assessment and Conclusion

Despite the ambitious business vision, significant challenges remain between strategy and implementation:

- Competition Risk : Native crypto ecosystems like Ethereum and Tron will not sit idly by and watch their market share erode. The cost and inertia of user migration present significant resistance. Furthermore, traditional financial giants like PayPal and Visa will inevitably take countermeasures.

- Regulatory risk : This is the most critical uncertainty. Plasma One's 10% savings yield is highly likely to be scrutinized by regulators in major jurisdictions. If it is classified as an unregistered security or banking product, its core growth engine will be at risk of stagnation.

It can be concluded that Plasma's fundamentals as an infrastructure are top-notch. Building on the momentum of the hugely successful TGE, its next phase of growth will depend entirely on its ability to execute across three dimensions: enterprise adoption, institutional BTC treasury deployment, and large-scale user acquisition .

Plasma's growth ceiling is inherently tied to the future prospects of Bitcoin and stablecoins. By establishing itself as the intersection and optimal settlement infrastructure for these two core assets, Plasma's long-term value ceiling is, in a sense, the future of crypto finance as a whole.

About Movemaker

Movemaker, authorized by the Aptos Foundation and co-founded by Ankaa and BlockBooster, is the first official community organization dedicated to promoting the development of the Aptos ecosystem in the Chinese-speaking region. As the official representative of Aptos in the Chinese-speaking region, Movemaker is committed to building a diverse, open, and prosperous Aptos ecosystem by connecting developers, users, capital, and numerous ecosystem partners.

Disclaimer:

This article/blog is for informational purposes only and reflects the author's personal views and does not necessarily represent the views of Movemaker. This article is not intended to provide: (i) investment advice or a recommendation; (ii) an offer or solicitation to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. Holding digital assets, including stablecoins and NFTs, carries a high degree of risk and carries significant price volatility, potentially becoming worthless. You should carefully consider whether trading or holding digital assets is appropriate for you based on your financial circumstances. If you have questions regarding your specific situation, please consult your legal, tax, or investment advisor. The information provided in this article (including market data and statistics, if any) is for general informational purposes only. While reasonable care has been taken in preparing these data and charts, no liability is assumed for any factual errors or omissions contained therein.