Lazy Money Management Guide | Binance Plsama USDT Deposit Promotion Still Available; Earn and Earn Points with USD.AI (August 27th)

- Core point: Multiple platforms provide high-yield stablecoin investment opportunities.

- Key elements:

- Binance Plasma USDT deposits have an annualized return of 36.5%.

- The USD.AI Pendle pool has a maximum APY of 29.25%.

- The Cap Protocol provides a 12.75% return when it goes online.

- Market impact: Attract funds to flow into the DeFi financial market.

- Timeliness annotation: short-term impact.

Original | Odaily Planet Daily ( @OdailyChina )

Author|Azuma ( @azuma_eth )

This column aims to cover the current low-risk return strategies based on stablecoins (and their derivative tokens) in the market (Odaily Note: code risks can never be ruled out), to help users who hope to gradually expand their capital scale through U-based financial management to find more ideal interest-earning opportunities.

Previous records

New opportunities

Binance Plasma USDT Deposit Campaign

Binance opened the final Plasma USDT deposit activity yesterday with a quota of US$500 million. The deposit limit for a single account has been reduced to 10,000 USDT. Currently, there is still a certain share of this activity, and interested users may consider depositing.

Let's do a quick calculation of the rate of return. This event will provide a total of 1% (100 million) of XPL tokens as incentives. The current pre-market price of XPL on Binance is $0.5681, corresponding to a prize pool size of approximately $5,681. Based on a total deposit limit of $1 billion, the rough annualized rate of return within the deposit period (60 days) is approximately 36.5% (including a 2% base USDT return). Assuming the XPL price doesn't fall sharply, the rate of return is still very attractive.

USD.AI secures additional investment from YZi Labs, offering both Pendle revenue and points.

In the previous issue, we mentioned USD.AI, a stablecoin protocol that provides credit for AI. The project has completed a $13 million financing round led by Framework Ventures, with participation from Bullish, Dragonfly, Arbitrum, and others.

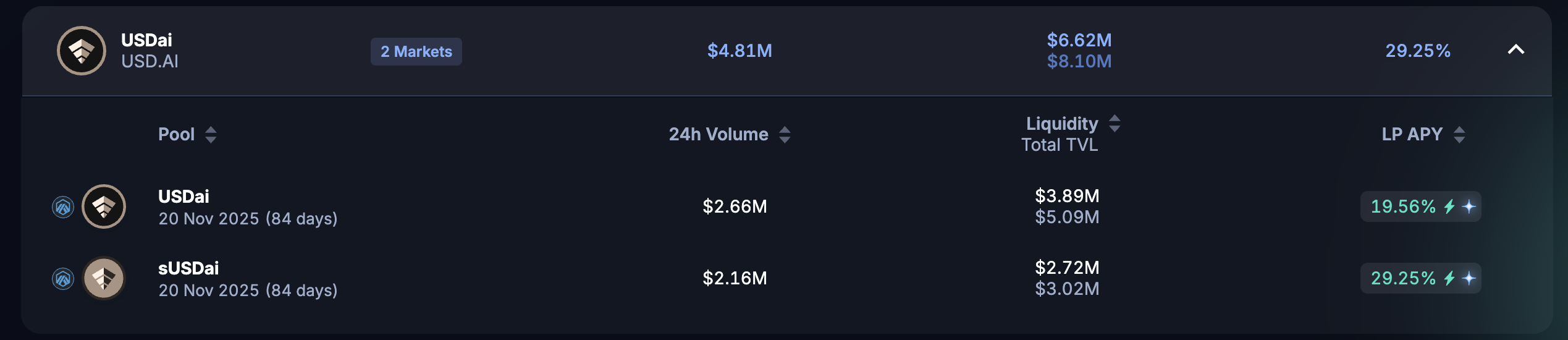

Last week, USD.AI officially launched on Arbitrum, allowing users to exchange USDC for USDai or stake it for sUSDai (earning 7.38% APY). USD.AI also integrated with Pendle at launch. Currently, LPs in the Pendle USDai pool can earn up to 19.56% APY (base APY 15.78%) and 25x the points earned. LPs in the Pendle sUSDai pool can earn up to 29.25% APY (base APY 23.19%) and 12x the points earned.

Earlier today, USD.AI announced another investment from YZi Labs. While the amount was undisclosed, it is expected to generate further interest in the protocol. Currently, USD.AI has deposited $72.41 million of its $100 million TVL limit, so users interested in depositing may want to do so soon.

Cap is officially launched

On August 19, Cap, a yield-generating stablecoin that raised $11 million in funding, officially launched. Users can now deposit USDC on the Ethereum mainnet to redeem cUSD to begin accumulating protocol points (caps); or pledge cUSD for stcUSD to earn a 12.75% yield. In short, there is no yield for points, and no yield for points. However, given that the protocol has just been launched, holding cUSD will result in a 20-fold increase in points, and the points have not yet been overly diluted, so saving points may be a better strategy.

For a detailed analysis of Cap's mechanisms, see " How does Cap build a self-sustaining stablecoin? " In short, amidst the fierce competition in the stablecoin market, Cap's unique profit and risk allocation mechanism is innovative and poised to become a dark horse in this space.

Euler Finance launches EulerEarn

Euler Finance announced today the launch of its simple income product EulerEarn. Users only need a single deposit to obtain various advanced strategy returns managed by Euler DAO. Euler Finance will also provide 50,000 USDC as a short-term incentive.

Currently, EulerEarn's deposit APY is 11.71% . Although it is not too high, it is simple and convenient.