Hyperliquid once again exposed to whale manipulation: XPL rose 200% before the market opened, and short positions were liquidated, reaping $46 million.

- 核心观点:Hyperliquid平台机制缺陷致巨鲸操纵XPL价格。

- 关键要素:

- 单一预言机定价易被操纵。

- 无大额订单限制致价格插针。

- 巨鲸联合获利超4600万美元。

- 市场影响:引发对去中心化合约平台信任危机。

- 时效性标注:短期影响。

Original | Odaily Planet Daily ( @OdailyChina )

By Wenser ( @wenser 2010 )

Early this morning, the on-chain derivatives platform Hyperliquid once again became a hot topic: a whale manipulated the pre-market price of XPL (Plasma token), causing a large number of short positions to be liquidated, resulting in losses of tens of millions of US dollars.

Hyperliquid, a popular platform for futures traders and crypto whales, has consistently achieved record trading volumes due to its convenient user experience and deep liquidity. However, its platform's depth and liquidation mechanisms have long been criticized. Previous incidents, such as "a whale's forced liquidation caused a $4 million loss on HLP" and "JelliJelli's large short position leading to Hyperliquid's 'cable-pulling' approach," have plunged the platform into a decentralization crisis. The recent XPL price manipulation incident serves as another wake-up call for Hyperliquiquid. In this article, Odaily Planet Daily will explore the development trends of on-chain futures platforms, focusing on the XPL whale's manipulation of the market to liquidate short positions.

XPL Market Manipulation Incident: 4 Major Insider Addresses, Cumulative Profits Exceed $46 Million

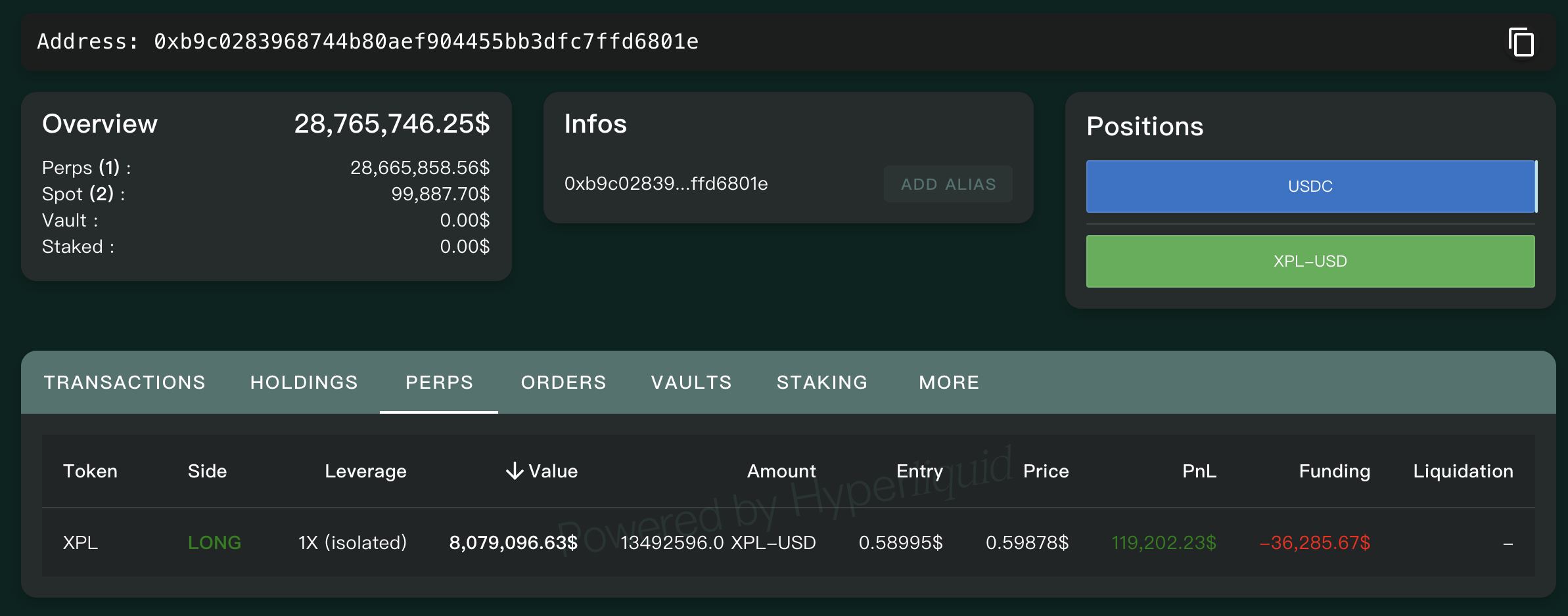

Around 6:00 AM today, MLMpublished a post revealing a thrilling "whale long order harvesting" incident on the Hyperliquid platform. Address 0xb9c0283968744b80aef904455bb3dfc7ffd6801e opened a long position of millions of XPL tokens, making a whopping $16 million in a single minute. Subsequently, the pre-market price of XPL surged to $1.80 within two minutes, a sudden increase of over 200%, triggering a series of short position liquidations. At that time, the address still held a long position of 15.2 million XPL tokens, valued at $10.2 million. As of press time, the address still held a 100% long position in XPL, with its holdings down to 13.5 million XPL tokens, valued at $8.08 million, representing a net profit of approximately $120,000.

Since this address transferred ETH to Justin Sun’s address 5 years ago, the market speculated that this address might be an address related to Justin Sun.

Position information of Hyperliquid platform, the instigator

XPL surged over 200% in a short period of time

As time goes by, more on-chain information is gradually made public:

According to statistics from on-chain analyst Ai Yi, there are four major addresses suspected of participating in the XPL hedging attack, with a cumulative profit of US$46.1 million. Among them:

- The address 0xb9c…6801e is the main driving force. It has been accumulating long orders in small amounts since August 24th. At 05:35 this morning, a large amount of buying pushed out the short orders.

- Addresses 0xe41...858c7, 0x006...2a78f, and 0x894...00779, which cooperated with the liquidation of profit-making addresses, completed long position accumulation between August 22 and 26, and closed their positions at the short-term peak of XPL.

The following are the correlations between the addresses: 0xe41...858c7 and 0x006...2a78f share the same funding source. The former's Debank username is silentraven, who made over $10 million in profit from a long position in HYPE in May of this year. While 0xb9c...6801e has no direct financial connection to the above two addresses, they all share the same commonality: margin is obtained through Debridge and their trading practices are similar. 0x894...00779 is relatively independent, with margin originating from Binance. It may be related to the above three addresses, or perhaps it was a lucky move that coincided with a profit-taking opportunity during the XPL rally.

Thus, a crypto whale, leveraging the pre-market XPL market, successfully completed a $46 million "reverse harvest." The whale's ability to exploit XPL's short positions by temporarily driving up prices through long positions is largely due to the Hyperliquid platform's pre-market trading mechanisms. Consequently, market criticism has been directed at Hyperliquid.

Hyperliquid's platform mechanism sparks controversy again: a single oracle for pre-market trading, with mark price as the sole indicator.

According to a comment by steven.hl, founder of Yunt Capital, "The reason (the XPL liquidation incident) occurred in the pre-market period is a combination of factors, including: 1) there is only one oracle that determines the market price (i.e., the pre-market perpetual contract itself); 2) the sparse order book allows for temporary market manipulation; and 3) many people hedge their risk through hedging, making it easy to predict where large liquidations will occur (i.e., the Hyperliquid platform)."

In addition, user @nauhcner also commented and explained : "In the isolated market, short position holders have been maintaining short positions (but when the margin in their accounts is less than 300% of the required margin to avoid liquidation (because the XPL price has increased by about 3 times), that is, the increase in XPL price makes their short position losses greater than the margin, eventually leading to liquidation."

It is worth mentioning that the XPL price manipulation incident is similar to the problems reflected in previous incidents such as "Whales actively transferring leverage losses to HLP" and "Hyperliquid forced liquidation of JELLYJELLY" - the focus of the problem is:

1. Unlike hybrid oracle prices, on-site indicators, and platform index prices that aggregate data from multiple CEXs, Hyperliquid pre-market contracts only have mark prices (i.e., prices dynamically displayed on a single platform contract);

2. The Hyperliquid platform does not impose order restrictions on large-scale leveraged long or short orders, leaving a "loophole" for whales to manipulate market prices for profit. Even a 1x hedged short order cannot escape liquidation due to the huge amount of long buying.

These multiple incidents collectively reflect problems with the leverage settings and contract depth of the Hyperliquid platform, and the ones who bear the cost are the "victims" in the incidents - those traders who chose to hedge and open short positions on the platform because of their trust in the Hyperliquid platform.

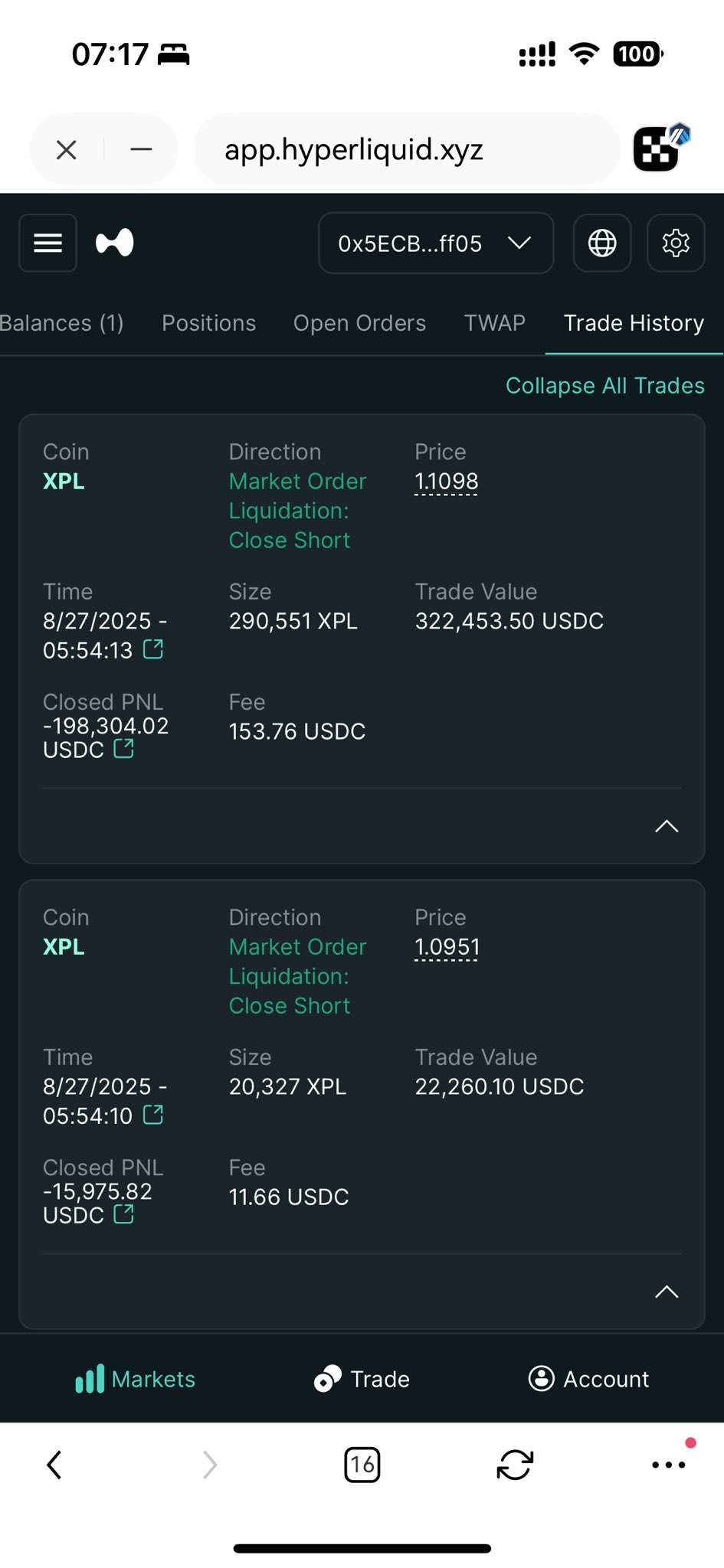

According to trader Aoke Quant Captain Oak (@aoke_quant), his partner's position on Hyperliquid was liquidated at the highest point of US$2 million; trader Andy (@AndyJYGood 68) posted that when he woke up, his hedging short position was liquidated for US$200,000, and some group members lost US$1.38 million.

"Screenshot of the victim"

CBB (@Cbb 0 fe), a trader who previously launched the "Open Whale Hunting Operation," alsoposted , "I initially thought my hedging on @Hyperliquid was smart. I set up a 10% XPL position with a 1x short position and used a lot of margin to cover the risk of liquidation. However, I ended up losing $2.5 million. I will never touch the pre-market quarantine market again."

According to LookonChain monitoring , the victim 0xC2Cb's XPL short position was also completely liquidated in this incident, with a loss of up to US$4.59 million.

It is worth mentioning that, perhaps because WLFI and XPL are ranked as the two "king-level projects" in recent times, after the XPL price manipulation incident, or perhaps affected by the XPL serial liquidation incident, WLFI briefly rose above US$0.42, which can be regarded as another magical event in the circle.

Looking back at the post "Explanation of the Decentralized Attributes of the Hyperliquid Platform's Margin Mechanism" previously released by Hyperliquid platform founder Jeff, one can only say that it is regrettable. Whether Hyperliquid can subsequently make targeted improvements to price manipulation, margin liquidation, contract prices, etc. will be the key to determining whether Hyperliquid can continue to dominate the on-chain contract market.

Finally, at present, the XPL price manipulation incident has not affected the price of HYPE. Its price even briefly reached US$50, setting a new historical high. What is amusing is that BitMEX co-founder Arthur Hayes, who previously said during the "Hyperliquid JELLY liquidation incident" that "let us stop pretending that Hyperliquid is decentralized" and "bet that HYPE will soon return to the starting point", has become a "loyal fan" of HYPE. Recently, he also said in a speech at the WebX venue that HYPE is expected to achieve a 126-fold increase .

It has to be said that in the volatile crypto market, price represents everything in many cases.