幣圈人最大的空投是元寶給的

- 核心觀點:文章透過對比騰訊「元寶」AI的現金紅包活動與當前Web3項目空投的現狀,指出Web3空投已從早期用戶福利演變為一種高成本、低確定性的增長工具,其核心問題在於缺乏兌現承諾的能力與有效的用戶留存策略。

- 關鍵要素:

- 市場背景:全球金融市場與加密市場在1月底至2月初經歷大幅下跌,比特幣跌破75000美元,單日爆倉額創紀錄,導致投資者情緒低迷。

- 案例對比:騰訊「元寶」投入約10億人民幣(約1.4億美元)進行無門檻現金紅包活動,而Web3項目Infinex空投導致深度參與用戶面臨巨額虧損,凸顯了回報確定性的巨大差異。

- 行業演變:Web3空投從Uniswap時期的暴富敘事,轉變為當前項目方獲取數據、尋求退出的工具,「被反擼」成為常態,用戶付出與回報嚴重失衡。

- 本質差異:Web2大廠用現金和法律約束確保承諾兌現,而Web3空投依賴未來可能貶值的代幣,且規則多變,增加了用戶的不確定性和風險。

- 留存挑戰:空投能短期拉動用戶增長,但長期留存依賴產品市場契合度與用戶體驗,許多Web3項目在空投後面臨用戶流失問題。

- 改進方向:內部觀點指出,空投的核心應圍繞提升留存,需要市場、產品等多方聯動;Web3項目更需思考代幣之外的產品功能如何留住用戶。

Original | Odaily (@OdailyChina)

Author|Golem (@web3_golem)

"xxx sent you a cash red envelope!"

After the Yuanbao cash red envelope campaign began on February 1st, many long-dead project/research groups have completely transformed into "grab Yuanbao wool" mutual aid groups.

Transitioning from a distinguished crypto trader to a red envelope "wool-pulling" party is also a helpless move for those in the crypto circle.

Starting January 31st, global financial markets plummeted. Previously surging precious metals rapidly crashed, with spot silver nearly wiping out its year-to-date gains, and spot gold once falling below $4500. The crypto market fared no better. Bitcoin broke below the $75,000 support level on February 2nd, touching a low of $74,604. ETH fell to a low of $2,157.14, and SOL even lost the $100 level, touching a low of $95.95.

According to Coinglass data, the total liquidation amount in the crypto market on January 31st reached $2.5615 billion, setting a record for the highest single-day liquidation volume since the "10/11 crash." Therefore, "too devastated to speak" has become the true psychological state of many in the crypto circle (like the suddenly silent Yi Lihua).

For those in the crypto circle who just experienced a bloodbath, grabbing Yuanbao red envelopes, while a drop in the bucket for recouping losses, still provides some psychological comfort, offering a temporary escape from the harsh market reality.

Jokes in group chats

Crypto Airdrops: From Swallowing Losses to Passionate Rights Protection

Saying Yuanbao's cash red envelopes are the biggest airdrop for crypto enthusiasts today is not a gimmick.

The cash amount Yuanbao can distribute to each user isn't large, mostly ranging from a dozen to several dozen RMB. However, its value lies in its simple interaction and being truly cost-free. Users only need to spend some time recruiting people and systematically experiencing product features to receive cash red envelopes, with short task cycles enabling quick returns.

In contrast, airdrops from crypto projects are primarily distributed in token form. Real profit only materializes when the tokens are sold. While the nominal amount received is often much larger than Yuanbao's, after deducting costs for time, research, opportunity, slippage, and the potential risk of being stuck with worthless tokens, how much remains?

A user who accompanied Infinex for 406 days feels this deeply. On January 31st, the decentralized perpetual contract trading platform Infinex announced its TGE and airdrop claim. The project team successfully cashed out, but the community was collectively "reverse-rug-pulled."

"Ten Million is a Cat" (X: @RXu107) is a typical example of being reverse-rug-pulled. On February 1st, he posted that he spent over $11,900 (approximately 82,000 RMB) participating in this project (4400 U for NFT, 7500 U for public sale) and deeply accompanied the project as a community member for 406 days. However, on TGE day, not only did he fail to recover his costs, but his paper loss also exceeded 100,000 RMB (2900 U + 11,284 INX tokens yet to be unlocked).

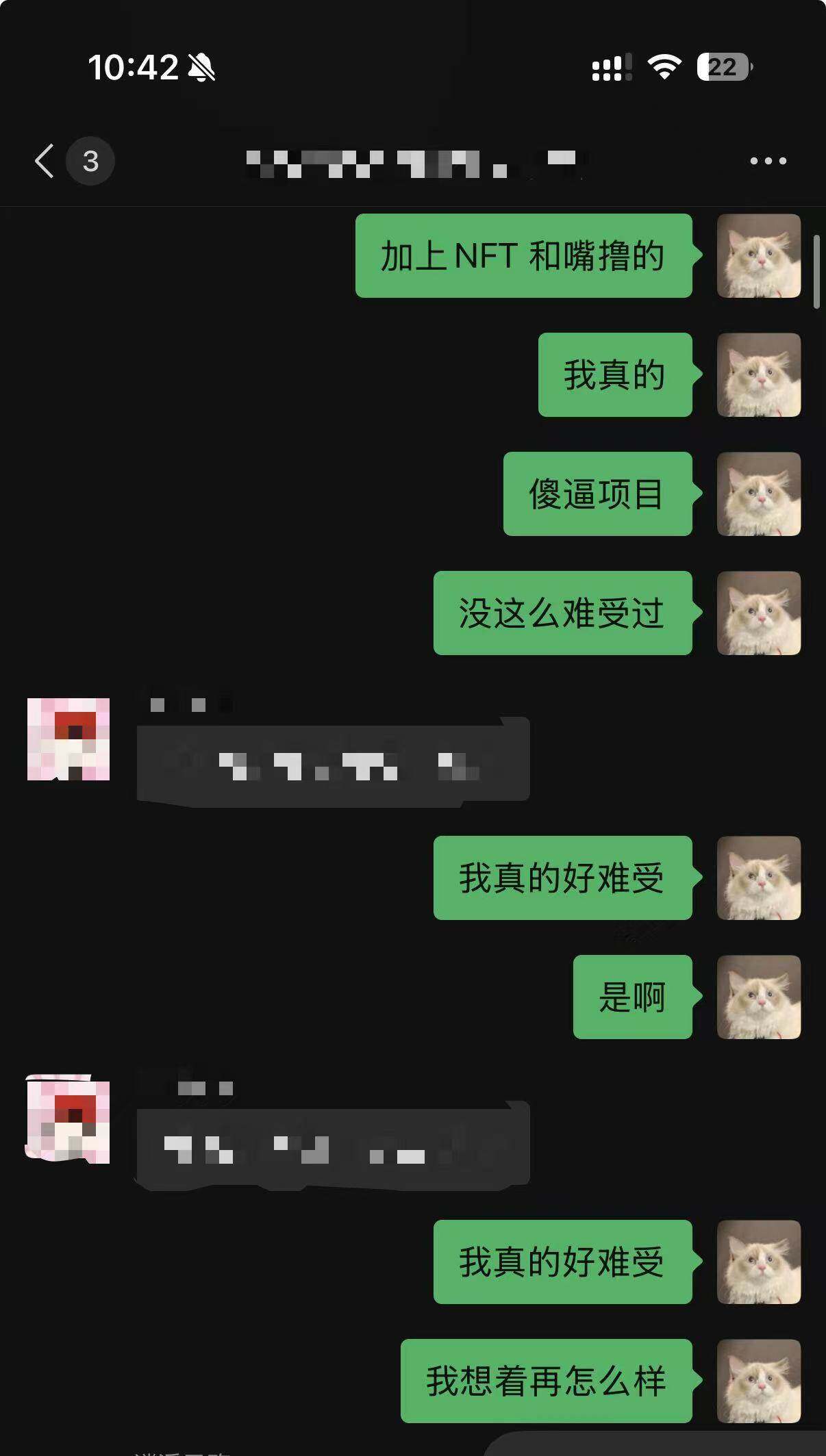

Faced with the reverse rug pull, the blogger had no choice but to repeatedly express his distress to friends.

The blogger reverse-rug-pulled by Infinex expresses distress to a friend

Infinex's fully diluted valuation at TGE was only $150 million. The total investment in Yuanbao's New Year red envelope campaign is approximately $140 million when converted to USD. What does this mean? It's equivalent to Tencent directly buying Infinex at its maximum valuation and giving it away for free to the entire nation.

Faced with the pain of being reverse-rug-pulled and deceived, most in the community choose the same approach as "Ten Million is a Cat" – swallowing the loss silently. However, some choose to stand up and confront the project team.

Crypto blogger Ice Frog (X: @Ice_Frog666666) is a typical representative. He started by airdrop farming, but ironically, in 2025, Ice Frog was either protecting his rights over airdrops or on the way to do so. He is currently still negotiating with the prediction market project Space (Odaily Note: Space raised $20 million in a public sale, with the team privately taking $13 million) and has even taken legal measures.

Web2 Can Afford Airdrops, Web3 Can't Keep Its Promises

The most ironic point is that today's imbalance between "input and return" in crypto airdrops is not due to the "moral decay" of any single project, but the result of a whole set of structural changes in the industry.

In 2020, Uniswap opened the era of crypto project airdrops. Since then, major airdrops ("big wool") kept coming. Stories of getting a car, buying a house, or reaching "A8" wealth level from airdrops attracted batch after batch of people into the airdrop farming track, presenting a beautiful picture of an "industry on the rise."

But by 2025, this changed. Exhausted market narratives, weak primary financing, and insufficient secondary buying pressure meant airdrops were no longer about sharing the future with early users, but more like mortgaging the future for present data, creating an exit path for the project team itself or securing the next funding round. Thus, major airdrops disappeared, small ones shrank, and "being reverse-rug-pulled" became the industry norm.

So-called airdrops are essentially rebranding advertising budgets as reward pools, bypassing third parties to directly establish growth relationships with users. Whether it's the 1 billion RMB from Web2's Yuanbao or the fixed airdrop allocation in a Web3 project's tokenomics, the underlying logic is the same.

But the difference is that Web2 giants use cash to buy user certainty, while Web3 offers token rewards as a potentially fulfillable promise. This results in the same tactic leading to two different fates.

The certainty of Yuanbao's cash red envelopes comes from cash flow and constraint mechanisms. Tencent's strong cash flow ensures Yuanbao "can afford to give," and constraint mechanisms under mature law ensure Yuanbao "cannot renege." Coupled with the "simple and mindless" barrier-free interaction, users naturally perceive it as a "welfare."

In contrast, crypto enthusiasts not only pay costs (like capital, time, effort) several times higher than Web2 wool-pulling, but also worry about being sybil-attacked, token unlock periods, and ever-changing airdrop rules. The most ironic part is that the final reward might still be less than Yuanbao's.

Therefore, today's crypto airdrops have long degraded from direct growth incentives to promises with constantly deferred, or even unfulfilled, obligations. If this situation doesn't change in 2026, user retention will be sacrificed along with it.

From User Acquisition to Retention: Airdrops' Utility Can Only Support the First Half at Most

Using airdrops for user acquisition has always been the most common and direct tactic in the business world to compete against strong rivals.

Tencent invested 1 billion RMB in cash to support Yuanbao because its rival Doubao is formidable enough – by the end of 2025, Doubao was the first AI product in China to surpass 100 million daily active users. The same applies to Web3. In the prediction market track, Polymarket dominates. To compete for users, projects like Opinion, predict.fun, and Limitless also adopted points airdrops for user acquisition, directly pulling users into their products.

In the short term, airdrops indeed create a massive user influx entry point. But in the long run, what determines user retention remains factors like product-market fit, user experience, and ecosystem synergy. In Web3's commercial history, there's no shortage of projects that were bustling before the airdrop but deserted afterward. Therefore, both Web2 and Web3 face the same "post-airdrop problem": how to retain users.

A decade ago, Tencent, a company adept at imitation and then surpassing, used "WeChat Red Packets" to push WeChat Pay into a national-level entry point, proving its deep familiarity with the "acquisition → retention → habit" chain. Whether they can recreate Yuanbao's miracle in the same way today is debatable, but they at least have ample experience in "how to convert airdrops into retention."

To this end, Odaily contacted a Yuanbao insider, asking how Web3 project airdrops should improve from a product perspective. The answer was pragmatic:

"As one of the internet companies with the largest market cap, Tencent's practices may not be directly applicable to Web3 projects. But the core of user acquisition methods like airdrops is still improving retention. This requires a series of post-airdrop synergies. For instance, PR and marketing need to think about how to further propagate the gameplay, and the product side also needs to take more actions to achieve this."

From a Web3 practitioner's perspective, focusing solely on traffic tactics feels shallow. What product features, beyond the token, can truly retain users is worth more careful consideration.