Original author: Arjun Chand

Original compilation: Deep Chao TechFlow

AI x Crypto is a hotly discussed topic right now. It is one of the hottest investment themes in the current bull market.

Bittensor (TAO) is one of the leading projects in the AI narrative, both in terms of market capitalization and popularity. But recently, there has been some controversy on cryptocurrency Twitter about its usefulness, with some even calling it “vaporware” and a pointless act of decentralization.

However, every coin has two sides. While critics have misgivings about Bittensor and its design, well focus on its brighter side today.

There are a lot of cool things happening in the Bittensor ecosystem. We will highlight the most impressive subnets and look at DeFi projects that are growing in tandem with Bittensor and TAO.

Bittensor Introduction

BittensorIt aims to democratize the process of building AI-driven use cases by creating an open P2P marketplace where people can share and use machine learning models.

The key idea behind Bittensor is that it forms an interconnected machine intelligence neural network. Anyone can tap into this network and build subnetworks, which are specialized protocols that use this collective intelligence to power a wide variety of AI projects.

Currently, in the Bittensor ecosystem there are32 subnets, each subnet focuses on a unique use case. Examples include speech-to-text, image generation, AI-powered search engines, advanced trading strategies, and even fine-tuning large language models for other use cases.

For example, some of the insights in this article come fromCorcel, which is a user-friendly tool for subnet 18 in the Bittensor ecosystem, also known as the Cortex.t subnet. It is functionally similar to chatGPT, but it leverages the collective intelligence of the Bittensor networks machine learning models to provide the best response to user queries.

Bittensors subnet

Now, let’s take a look at some of the prominent subnets in the Bittensor ecosystem and their capabilities.

Subnet 6 — Nous Fine-tuning

Subnet 6Operated by the reputable Nous research team, it stands out in the Bittensor ecosystem. This subnet specializes in fine-tuning large language models (LLMs) using synthetic data from Corcel in subnet 18.

Each miner in subnet 6 takes the same synthetic data every day and uses it to fine-tune the LLM to obtain specific results. They employ their own strategies and techniques to achieve optimal performance on this data.

The key competitive element is the TAO reward. LLM has a lower “head-to-head loss” (meaning they make fewer mistakes) will receive a larger proportion of the TAO reward. This incentivizes everyone to do their best and continually improve their models to move up the leaderboard of the fine-tuned subnet.

This method of using new synthetic data to train LLMs is an improvement over traditional methods that rely on static datasets, because changing synthetic data forces LLMs to continuously adapt and learn, making them more adaptable to real-world scenarios.

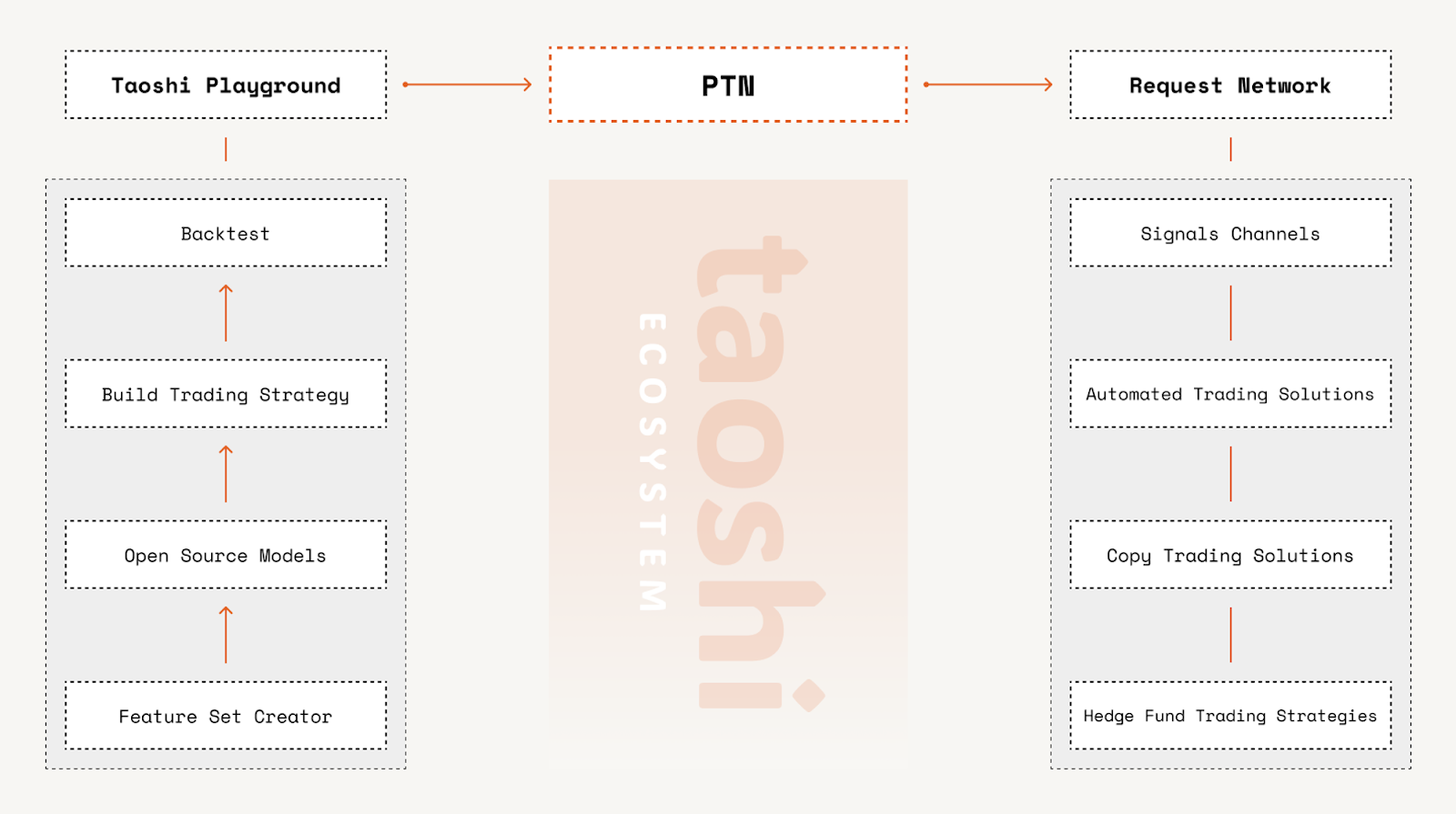

Subnet 8 — Proprietary trading network

Subnet 8, operated by τaoshi’s well-known Proprietary Trading Network (PTN), where top algorithmic traders deploy quantitative models to analyze the market and predict fluctuations in asset prices such as BTC and TAO. Based on its profitability, the best algorithm will win TAO rewards.

Miners who provide valuable trading signals are rewarded with TAO, validators receive 100% of the revenue from trading signal sales, and users gain insights that help them outperform the market.

Subnet 8 generating revenue is an important milestone for the Bittensor community, proving that a viable business can be built on Bittensor. This signal can attract new talent, users, miners, and validators, promoting growth and development of the entire ecosystem.

Subnets recently registered on Bittensor

As Bittensors popularity continues to grow, well-known teams from all sides of the ecosystem have shown strong interest in registering their own subnets on Bittensor. Notable examples include:

Subnet 3,MyShell TTS: Committed to democratizing access to top text-to-speech (TTS) models.

Subnet 5,Open Kaito: Committed to making Web3 information universally accessible, Kaito is committed to making Web3 information universally accessible, aiming to remove barriers and facilitate collective efforts to organize and interpret Web3s vast amounts of data.

Subnet 30,WomboAI: Home of WOMBO, a hugely popular app (downloaded over 100 million times) that empowers creativity with AI, turning simple ideas into animated images or generating artwork from a few sentences.

In addition, there are currently over 200 subnets in the testnet stage and waiting to be registered to the mainnet, each with unique goals and reward structures.

Since the number of subnets in the Bittensor ecosystem is currently limited to 32, competition is very fierce and the worst-performing subnets will be replaced by new ones after a one-week immunity period. This competition will only increase as more projects compete to build subnets on Bittensor. It will be fascinating to see how the subgrid landscape changes over the next few quarters.

Let’s move to the next part of this article by looking at the subnets on Bittensor: the Bittensor DeFi ecosystem.

Bittensor’s DeFi Ecosystem

The Bittensor DeFi ecosystem is taking shape in real time. Just six months ago, it didnt exist, but now there are more than ten applications offering financial products centered on Bittensor and its native token, TAO.

Lets take a look at some of these applications:

Tensorplex Stake(stTAO)

Tensorplex offers a range of products focused on decentralized artificial intelligence, built on top of networks like Bittensor. As an active participant in the Bittensor ecosystem, they offer a range of services, including Tensorplex Stream, which provides AI-generated summaries for podcasts, Twitter spaes, and news articles. Additionally, they are also active miners on the Bittensor subnet.

one of their productsTensorplex Stake, launched on Ethereum in February 2024, enables users to participate in staking on the Bittensor network and earn returns (currently over 16%).

Heres how it works:

Tensorplex Stake allows users to stake their wTAO and receive corresponding stTAO. stTAO represents your staking TAO and tracks staking rewards.

The underlying wTAO is bridged to the Bittensor network and staked with validators to earn rewards. This revenue will be returned to users on Ethereum.

This approach provides users on Ethereum with a convenient way to explore opportunities to earn income with TAO without having to bridge assets to Bittensor.

TaoPad: Building DeFi for TAO

TaoPadIt is the first launch pad focused on Bittensor, aiming to increase the value of TAO tokens and support the broader Bittensor network.

TaoPad’s launchpad enables new projects, particularly those focused on decentralized artificial intelligence, to launch via token sales.

TAO is the foundation of TaoPads design. Heres how it uses TAO to work:

Reward system: TaoPad distributes rewards to holders in the form of wTAO.

Launchpad Participation: TaoPad Launchpad allows users to participate in the launch of new projects using wTAO. This creates a use case for wTAO and promotes the growth of the Tao ecosystem by introducing new projects. To participate in the launch of a project on TaoPad, investors allocate a portion of their $wTAO to the projects funding pool. The larger the amount of wTAO a user commits, the more favorable the price they receive for the new project token.

TaoBank: Lending Agreement

TaoBankis a lending and borrowing protocol that runs on Ethereum and Arbitrum. It enables users to use wTAO as collateral to obtain interest-free loans with a loan asset of $taoUSD, a stablecoin softly pegged to the U.S. dollar and designed to keep volatility low.

For TAO holders, TaoBank provides the opportunity to unlock the liquidity of their holdings without selling, which is particularly attractive in bull markets. This functionality enables DeFi strategies such as looping, where users can leverage their loans to obtain additional TAO.

Interestingly, TaoBank was incubated by TaoPad and was, in fact, the first project on that launch pad. This is a great example of two Bittensor-focused projects collaborating to create new utility for TAO.

Tao Accounting System(TAS)

TASIt is a protocol that introduces token standards to the Bittensor network.

The first of many experimental token standards they launched was Tai Request for Comment (TRC-20), similar to the ERC-20 standard in the EVM ecosystem. TRC-20 establishes a unified set of rules for token creation, exchange, and governance on Bittensor, creating a standardized method for anyone to launch TRC-20 tokens.

TAS operates as a ledger system recording TRC-20 token balances, stored on their most recently registered subnet31. Soon, they plan to activate miners and validators on their subnet to keep these records accurate.

Once the TAS subnet is launched, anyone can easily deploy and trade TRC-20 tokens on Bittensor.

Currently, users can only participate by purchasing $TAS tokens and staking them to earn revenue and benefit from the TAO emissions allocated to the TAS subnet.

In addition, TAS provides a bridge for users to convert wTAO on Ethereum into tTAO (the wrapped TAO version of TAS), allowing them to transfer it to the Bittensor network or stake it for yield.

RivusDAO: Provide liquid pledge for TAO

RivusDAOProvides liquidity staking services for AI-centric blockchains including Bittensor. It introduces a liquidity staking mechanism for TAO via $rsTAO, enabling users to stake their wTAO on Ethereum and receive $rsTAO in return for staking rewards.

$rsTAOs vision is to integrate within DeFi applications in the ecosystem. For example, rsTAO can be used as collateral on Aave and other lending platforms.

Additionally, RivusDAO is developing a bridge to transfer assets from selected blockchains to Bittensor.

Hyperliquid: TAO’s perpetual contract

Hyperliquid has become the leading perpetual contract DEX, with over $100 billion traded since launch. It provides an excellent user experience for trading perpetual contracts on-chain and has become the platform of choice for many traders.

In February, Hyperliquid expanded its product line and launched $TAO, providing users with the opportunity to trade on TAO with leverage up to 5x. This new addition increases TAOs trading volume.

DeFi strategy surrounding TAO in the MultiversX ecosystem

Last month, Hatom Labs launched several DeFi products around TAO in its MultiversX ecosystem, aiming to increase the utility of TAO and integrate it into the DeFi platform.

The key DeFi features of TAO in the MultiversX ecosystem include:

Liquidity Staking: Users can stake their wTAO and receive swTAO, allowing them to earn income from their pledged assets.

loan:wTAO and swTAO can be lent on various markets. Currently, the annualized lending rates for these tokens are 45% and 36% respectively.

LP on xExchange: Users can provide wTAO in the wTAO/EGLD liquidity pool on xExchange.

LP on AshSwap: Users can provide wTAO in the wTAO/USDC liquidity pool on AshSwap.

Sturdy’s AI DeFi subnet on Bittensor

Sturdy is a lending protocol running on Ethereum and Mode as a money market with a two-layer structure, with independent lending pairs and aggregated vaults. These vaults are designed to store multiple loan pairs, designed to maximize yields and secure the best interest rates.

Currently, aggregated vaults rely on manual intervention or simple algorithms to determine deposit allocations, an approach that is both inefficient and centralized. To address these limitations, Sturdy launched a subnet on Bittensor.

On this subnet, miners can propose the best allocation strategy for the aggregate treasury and compete with each other to obtain TAO rewards. This way, users get better rates and the allocation process for aggregators becomes open and competitive.

While this is not exactly similar to the other DeFi opportunities in this article, it sets a precedent for other DeFi applications to leverage Bittensor to optimize their current products. Additionally, applications can leverage Sturdys subnets to optimize their operations without having to build their own subnets on Bittensor.

Conclusion

The Bittensor ecosystem is going through a period of growth and evolution, as can be seen from a noticeable increase in interest among well-known entities registering the subnet, to increasing user engagement with applications like Corcel.

The DeFi landscape in Bittensor is also expanding, although it is still in its early stages and currently only covers liquidity staking, bridges, and a few lending protocols. However, these are the foundations of any ecosystem.

Clear signs of registered subnets, increasing application participation, and an expanding DeFi ecosystem all indicate that the Bittensor ecosystem is poised to become a truly dynamic and innovative place, bringing new prospects to the AI and cryptocurrency space. and opportunities.