Decoding Hong Kong Monetary Authority Documents: The Strict and Flexible Stablecoin Regulation

- 核心观点:香港推出严格稳定币监管框架。

- 关键要素:

- 2500万港币资本金门槛。

- 100%+超额抵押储备要求。

- 严格私钥管理和KYC规定。

- 市场影响:提升稳定币合规门槛。

- 时效性标注:中期影响。

Original author: David, TechFlow

Hong Kong is accelerating the pace of stablecoin legislation.

On July 29, the Hong Kong Monetary Authority released the consultation summary and guidelines of the "Guidelines on the Supervision of Licensed Stablecoin Issuers", the consultation summary and guidelines of the "Guidelines on Combating Money Laundering and Terrorist Financing (Applicable to Licensed Stablecoin Issuers)", and two system explanatory documents, providing detailed implementation details for the stablecoin regulatory system that will take effect on August 1.

Previously, the Hong Kong Legislative Council officially passed the Stablecoin Ordinance on May 21, establishing a licensing system for fiat currency stablecoin issuers.

From the passage of the regulations to the release of supporting guidelines and then to its formal implementation, Hong Kong took less than three months to complete the "last mile" of the stablecoin regulatory system.

What is the relationship between so many files?

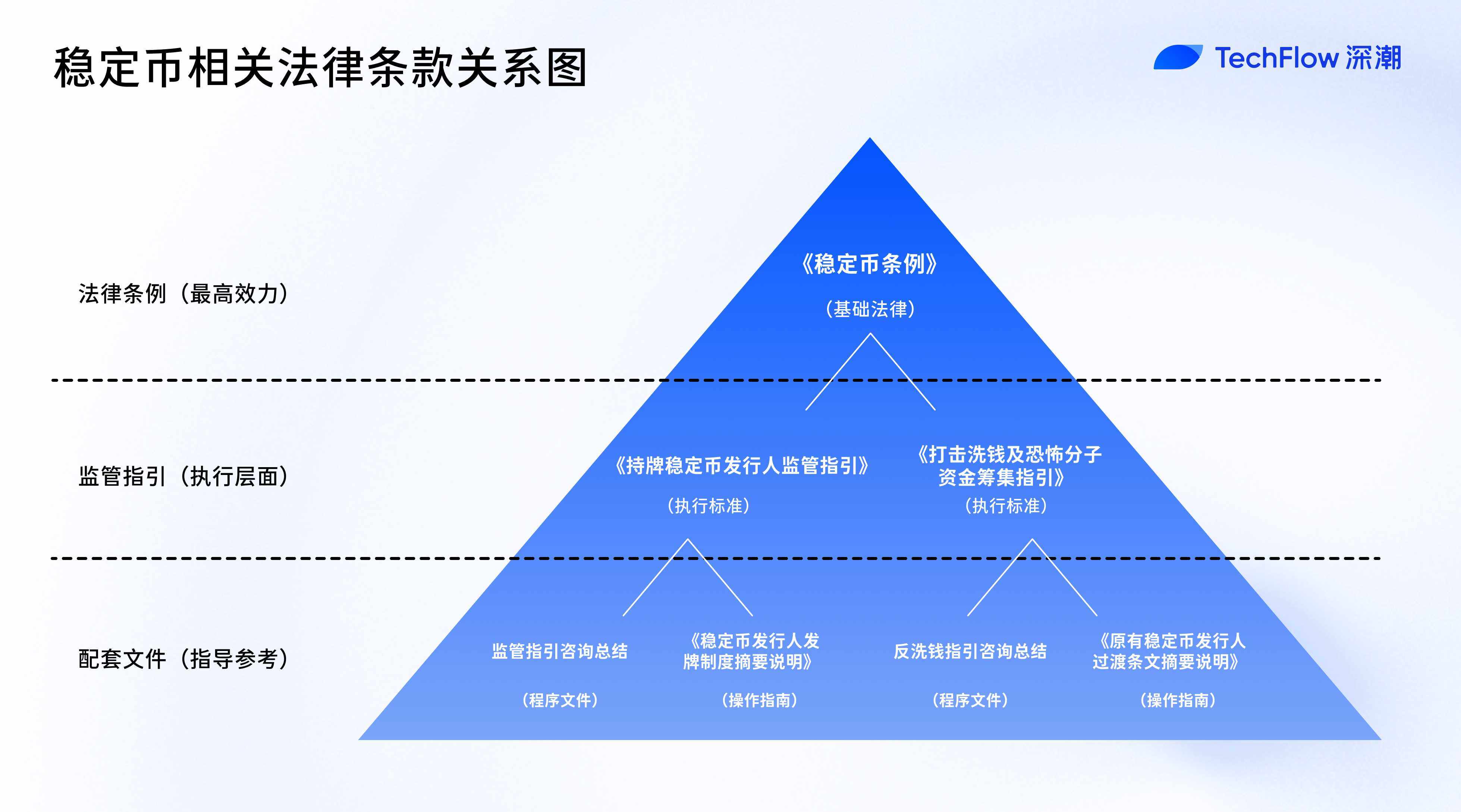

As can be seen from the above, this complete regulatory system consists of one regulation (the Stablecoin Regulation), two sets of guidelines (and their consultation summaries) and two explanatory documents , forming a complete chain from the legal basis to the implementation details to the operational guidelines.

Specifically, the entire file system includes:

- 1 foundational law : Stablecoin Regulation (issued in May)

- 2 sets of regulatory guidelines : "Guidelines for the Supervision of Licensed Stablecoin Issuers" and "Guidelines for Combating Money Laundering and Terrorist Financing"

- 2 consultation summaries : recording the public consultation process and the HKMA’s response to the two sets of guidelines

- Two explanatory documents : "Summary of the Licensing Regime for Stablecoin Issuers" and "Summary of the Transitional Provisions for Existing Stablecoin Issuers"

The Stablecoin Regulations, at the top of the pyramid, serve as the foundational law, establishing the legal status and basic framework for the stablecoin licensing system. Two sets of regulatory guidelines, acting at the implementation level, translate the principles outlined in the Regulations into specific operational standards and compliance requirements. These guidelines have quasi-legal force and must be strictly adhered to by licensed institutions.

As a procedural document, the consultation summary does not have direct legal effect, but it records the regulator's response to market opinions and helps market participants understand the regulatory intent and considerations behind the formulation of the guidelines.

The two explanatory documents are at the level of explanation and guidance, providing market participants with institutional understanding and application guidelines, helping potential applicants better understand regulatory requirements and application procedures.

In simple terms:

The regulations are responsible for "setting the rules" - determining fundamental issues such as what a stablecoin is, who can issue it, and basic regulatory principles;

Regulatory guidelines are responsible for "setting standards" - specific technical provisions such as capital adequacy ratios, risk management requirements, and information disclosure standards;

The explanatory document is responsible for "pointing out the path" - operational issues such as how to apply for a license, how to arrange the transition period, and how regulators enforce the law.

Regulatory Guidelines for Licensed Stablecoin Issuers: The Strict and Flexible Principles Behind the HK$25 Million Threshold

The HKMA released six documents at once. For ease of reading, we'll focus on the core implementation document: the "Guidelines for the Supervision of Licensed Stablecoin Issuers." This document details the specific compliance requirements for issuers, which are crucial to the interests and operational procedures of market participants.

If the Stablecoin Ordinance is the foundation for Hong Kong to issue stablecoins, then this 89-page "Guidelines for the Supervision of Licensed Stablecoin Issuers" is more like the bricks and tiles filling in this building.

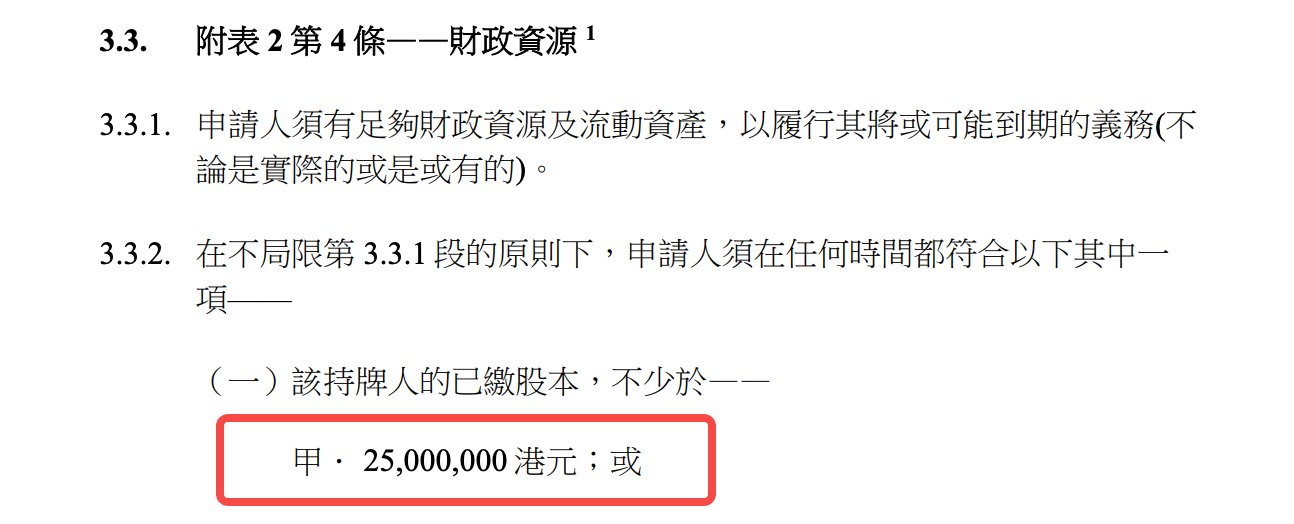

From the capital threshold of HK$25 million to the 12 specific requirements for private key management, the HKMA has outlined a regulatory framework that is both strict and pragmatic in an almost "meticulous" manner.

Entry threshold: Not everyone can play the game

The minimum capital requirement of HK$25 million (approximately US$3.2 million) is mid-to-high for global stablecoin regulations. By comparison, the EU's MiCA regulation sets a minimum capital requirement of €350,000 for electronic money token issuers, while Japan's requirement is ¥10 million (approximately US$75,000). Hong Kong's threshold is clearly carefully considered—ensuring sufficient financial strength for issuers without completely shutting out innovators.

But capital is only the first hurdle. More noteworthy is the "fit and proper person" requirement.

The regulatory guidelines devote an entire chapter to detailing seven major considerations: from criminal records to business experience, from financial status to time investment, even the directors' "external positions" must be taken into consideration... In particular, the requirement that independent non-executive directors must account for at least one-third of the board of directors directly targets the governance standards of listed companies.

This means that issuing a stablecoin in Hong Kong requires not only money but also the right people. A Web 3 startup comprised of tech geeks may need to significantly overhaul its governance structure and bring in professionals with traditional finance backgrounds to meet regulatory requirements.

Even stricter are the restrictions on business activities. Licensees must obtain written consent from the HKMA before engaging in any "other business activities." This essentially positions stablecoin issuers as " specialized institutions," similar to traditional payment institutions or e-money issuers . For projects hoping to build a closed-loop "DeFi + stablecoin" ecosystem, this undoubtedly signals the need to reconsider their business models.

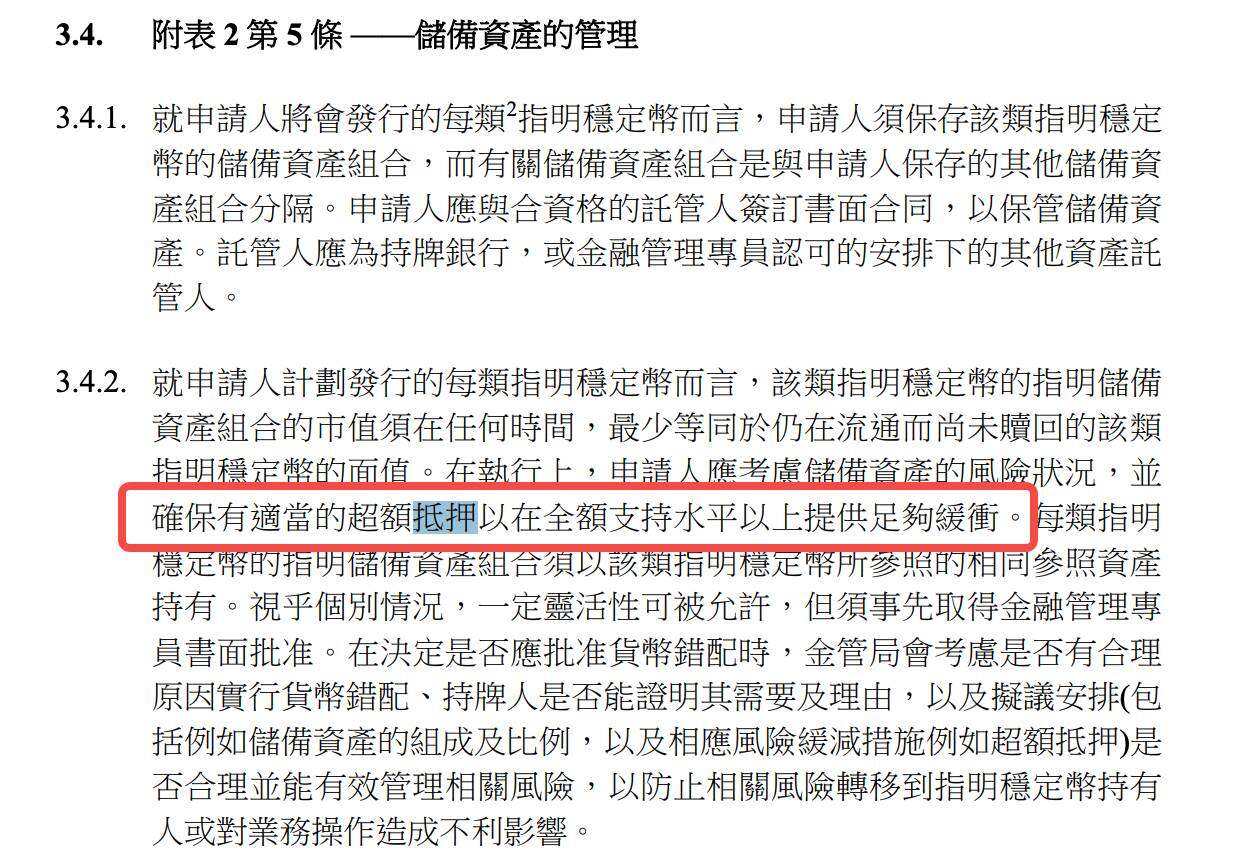

Reserve Management: 100% is just the starting point

In the management of reserve assets, Hong Kong has adopted a double insurance model of "100% + over-collateralization".

The regulatory guidelines explicitly require that the market value of reserve assets must be at least equal to the face value of stablecoins in circulation "at all times", while also "taking into account the risk profile of reserve assets and ensuring appropriate over-collateralization."

What exactly is this "appropriate"?

The guidelines do not give specific figures, but judging from the requirements for licensees to set internal limits on market risk indicators and conduct regular stress tests, regulators clearly hope that issuers will dynamically adjust the excess collateral ratio based on their own risk conditions.

This "principle-based" regulatory approach gives issuers a certain degree of flexibility, but it also means higher compliance costs - you need to establish a complete risk assessment system to prove your "suitability".

In defining eligible reserve assets, Hong Kong has demonstrated a prudent but not conservative attitude.

In addition to traditional options such as cash and short-term bank deposits, regulatory guidelines also explicitly accept "eligible assets in tokenized form." This leaves room for future innovation—in theory, tokenized U.S. Treasury bonds and tokenized bank deposits could become eligible reserve assets.

But the most eye-catching thing is the trust isolation arrangement.

For example, licensees must establish an effective trust arrangement to ensure that reserve assets are legally segregated from their own assets, and obtain independent legal advice to verify the effectiveness of this arrangement. This goes beyond simple accounting segregation; it ensures that the rights and interests of stablecoin holders are protected even if the issuer goes bankrupt.

Hong Kong has adopted a combination of "frequent disclosure and regular audits" in its transparency requirements. Issuers must publish the market value and composition of their reserve assets weekly, with independent auditors verifying this information quarterly. In contrast, even USDC, which boasts a higher level of compliance, currently only publishes reserve reports monthly. Hong Kong's requirements will undoubtedly significantly enhance the transparency of stablecoins.

Technical requirements: Private key management is very professional

When it comes to private key management, a risk point unique to Web 3, regulatory guidance demonstrates surprising professionalism:

From key generation to destruction, from physical security to leak response, the 12 specific requirements cover almost every aspect of the private key life cycle.

For example, "important private keys must be used in an isolated environment" - this means that the private keys used to mint and destroy stablecoins cannot access the Internet and must be operated in a completely offline environment;

"Key use requires authorization from multiple people" - no single individual can use the critical private key alone;

"The key storage medium must be placed in Hong Kong or a place approved by the HKMA" - this also directly rules out the possibility of hosting private keys overseas.

These requirements demonstrate that the HKMA is not simply applying traditional financial regulations, but rather truly understands the characteristics and risks of blockchain technology. To some extent, these guidelines can be seen as a regulatory version of "best practices for enterprise-level private key management."

Smart contract audit requirements are equally stringent. Issuers must engage a "qualified third-party entity" to audit smart contracts upon deployment, redeployment, or upgrade, ensuring that the contracts "execute correctly," "function as intended," and "have a high degree of confidence that no vulnerabilities or security flaws exist." Given the nascent nature of the smart contract audit industry itself, defining "qualified" can be a challenge in practice.

In terms of customer identity authentication, regulatory requirements reflect the integration of Web 3 and traditional KYC.

On the one hand, issuers must complete "relevant customer due diligence" before providing services; on the other hand, they are required to "only transfer stablecoins to the customer's pre-registered wallet address." This design attempts to strike a balance between anonymity and compliance.

Operational Standards: The Path to "Banking" of Stablecoins

"T+1 redemption", "pre-registered account", "three lines of defense" - from these requirements in the original document, it can be seen that Hong Kong hopes that stablecoin issuers will align their operating standards with traditional financial institutions and do their utmost to control risks.

First look at the redemption period.

"Valid redemption requests shall be processed within one business day of receipt"—a T+1 requirement that is stricter than many existing stablecoins. While Tether's terms of service reserve the right to delay or deny redemptions, Hong Kong regulations make timely redemption a legal obligation.

However, this "banking" is not a simple replication. Regulatory guidelines also provide for flexibility in "exceptional circumstances"—if redemption needs to be delayed, prior written consent from the HKMA is required. This mechanism, similar to the "withdrawal suspension" provisions in the banking industry, provides a buffer for systemic stability during extreme market conditions.

The three-line risk management system draws directly on mature practices in the banking industry:

The first line of defense is the business department, the second is independent risk management and compliance functions, and the third is internal audit. For many Web 3 native teams, this means a fundamental change in organizational structure—you can no longer be a flat technical team, but must establish an organizational system with clear hierarchies and clear responsibilities.

Of particular note is the management of third-party risks.

Whether it's reserve asset custody, outsourcing of technical services, or stablecoin distribution, all arrangements involving third parties must undergo rigorous due diligence and ongoing monitoring. Regulatory guidelines even require that if the third-party service provider is outside of Hong Kong, the issuer must assess the data access permissions of the local regulator and promptly notify the HKMA if requested.

KYC Myth: Do You Need Real-Name to Hold Cryptocurrency?

Currently on social media, what everyone is most concerned about is actually the KYC issue.

Previous analysis has pointed out that regulatory documents strictly require that any stablecoin holder must undergo identity verification, which also means real-name verification.

We can look at the original text of this document:

Although the regulatory guidelines distinguish between "customers" and "holders" in terms of expression, a careful analysis reveals that this distinction is more like a "trap" - you can obtain and hold stablecoins relatively freely, but to realize its core value (redemption of fiat currency at any time), KYC is almost inevitable.

The regulatory guidelines use seemingly loose expressions in many places:

- "Licensed persons should only issue specified stablecoins to their customers"

- "The Terms and Conditions shall apply to all holders of Specified Stablecoins (whether or not they are clients of the Licensee)"

This distinction implies the existence of two groups of people: "customers" who require KYC and "holders" who do not. However, when we delve deeper into the specific service provision process, we find that this distinction is more theoretical.

The key is the regulation on redemption services: "No issuance or redemption services shall be provided to holders of specified stablecoins and/or potential holders of specified stablecoins unless relevant customer due diligence has been completed."

This means that any holder who wants to exercise the redemption right must first complete KYC and upgrade from "holder" to "customer".

Regulatory guidelines repeatedly emphasize the right of stablecoin holders to redeem at face value, which is considered the core guarantee of stablecoin "stability." However, in reality, the exercise of this right is conditional—you must be willing and able to complete KYC.

For holders who are unable to complete KYC due to privacy concerns, geographical restrictions or other reasons, this "right" is actually unexerciseable.

In addition to identity verification, geographic restrictions may be a higher hurdle.

The guidelines require issuers to "ensure that they do not issue or offer specified stablecoins in jurisdictions where trading in specified stablecoins is prohibited" and to " take reasonable steps to identify and prevent the use of virtual private networks" (VPNs).

For global cryptocurrency users, this geofencing may be more restrictive than KYC itself.

But for Hong Kong, this may be an acceptable trade-off: moderate restrictions in exchange for regulatory certainty and financial stability. But for the global cryptocurrency ecosystem, whether this model will become mainstream remains to be seen.

Exit mechanism: a "safety valve" for rainy days

Of all regulatory requirements, "business exit planning" may be the most overlooked yet the most important one.

Regulatory guidelines require each issuer to prepare a detailed exit plan, including how to sell reserve assets, how to handle redemption requests, and how to arrange the handover of third-party services.

Behind this requirement is the regulators' deep consideration of systemic risks.

Stablecoins differ from other crypto assets in that their promise of stability makes them more likely to be adopted on a large scale, but this also means that any problems could have a wider impact. By requiring issuers to plan an exit path in advance, regulators are trying to ensure that even in the worst-case scenario, the market can absorb the impact in an orderly manner.

Exit plans must cover asset sale strategies under both "normal and stressed circumstances." This means issuers need to consider:

If market liquidity dries up, how can reserve assets be liquidated without causing a stampede? If a banking partner terminates service, how can redemption channels be ensured?

The answers to these questions will directly determine the viability of a stablecoin project in times of crisis.

The underlying logic behind Hong Kong’s regulatory approach

Looking at this regulatory guideline, it can be seen that Hong Kong has taken a unique path in stablecoin regulation: it is neither the US-style "law enforcement-oriented" (forcing compliance through law enforcement actions) nor the European-style "rule-oriented" (written regulations on every detail), but a hybrid model of "principles + rules".

On key risk points such as reserve management and private key security, the regulatory guidelines provide detailed rules; in specific implementation such as excess collateral ratio and risk indicator setting, principled flexibility is retained.

This design reflects the pragmatic approach of Hong Kong regulators, who recognize that the stablecoin industry is still evolving rapidly and that overly rigid rules may quickly become outdated.

The licensing threshold of 25 million is not low, but it is relatively reasonable compared to the 5 million US dollars capital requirement for Hong Kong virtual asset trading platforms; the technical requirements are very detailed, but they also clearly accept innovations such as "tokenized assets"; the operating standards are very strict, but they also reserve emergency mechanisms for market fluctuations.

More importantly, this regulatory framework demonstrates Hong Kong's understanding of the nature of stablecoins: they are not simply "cryptocurrencies," but rather critical infrastructure connecting traditional finance and the digital economy. Therefore, regulatory standards must be high enough to maintain financial stability, yet flexible enough to accommodate technological innovation.

For market participants, the signal sent by this guidance is clear:

Hong Kong welcomes responsible innovators, but please be prepared for strict regulation.

Institutions wishing to issue stablecoins in Hong Kong need to carefully assess whether they have the necessary financial strength, technical capabilities and compliance resources.

For the entire industry, Hong Kong's practice provides an important reference: stablecoin regulation is not to stifle innovation, but to provide a fertile ground for sustainable development of innovation.

When regulatory rules are clear and enforcement standards are explicit, the cost of compliance is predictable and the boundaries of innovation are explorable.

This may be the key to Hong Kong's continued competitiveness as an international financial center in the era of digital assets.