SignalPlus波动率专栏(20240223):月末期权交割,数字货币轻微回调

어제(22일) 미국 경제지표가 강세를 보였고 연준 관계자들은 최근 금리 인하 기대감에 계속 냉수를 쏟았다. 이번 주 신규 실업수당 청구 건수는 예상 21만8천건보다 낮은 20만1천건을 기록했다. 마킷 제조업 PMI는 예상치 50.5보다 높은 51.5를 기록했고, 하커 필라델피아 연준 총재는 가장 큰 위험은 금리를 너무 일찍 인하하는 것이라며 아직 금리 인하 시급성은 없다고 경고했다. 느슨한 정책은 인플레이션 역전이나 정체로 이어질 수 있으며, 올해 후반에 금리를 인하하는 것이 적절할 수도 있습니다. 이에 따라 미국 채권수익률은 점차 상승해 현재 2년만기 채권과 10년만기 채권이 각각 4.739%/4.343%를 기록하고 있다. 미국 3대 주가지수는 엔비디아의 예상보다 좋은 실적 데이터로 인해 상승세를 보였으며, 다우/SP/나스닥 지수는 각각 1.18%/2.11%/2.96% 상승을 마감했습니다.

Source: SignalPlus, Economic Calendar

출처: Binance TradingView, ETH가 3000포인트에서 다시 하락

디지털 화폐의 경우, 오늘 2월 말 옵션/선물 인도일을 맞이하여 이번 가격 상승으로 인해 많은 양의 마진이 풀려났습니다.BTC/ETH 가격은 약간의 조정을 보이며 51000으로 마감했습니다. (-1.6%)/2933(-1.8%)).

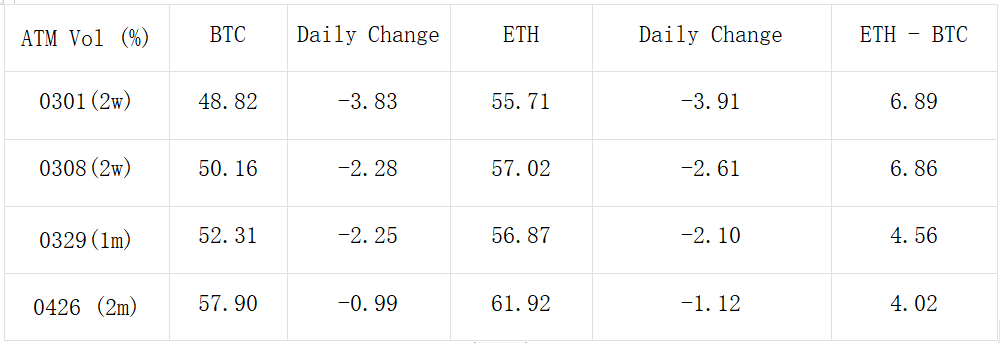

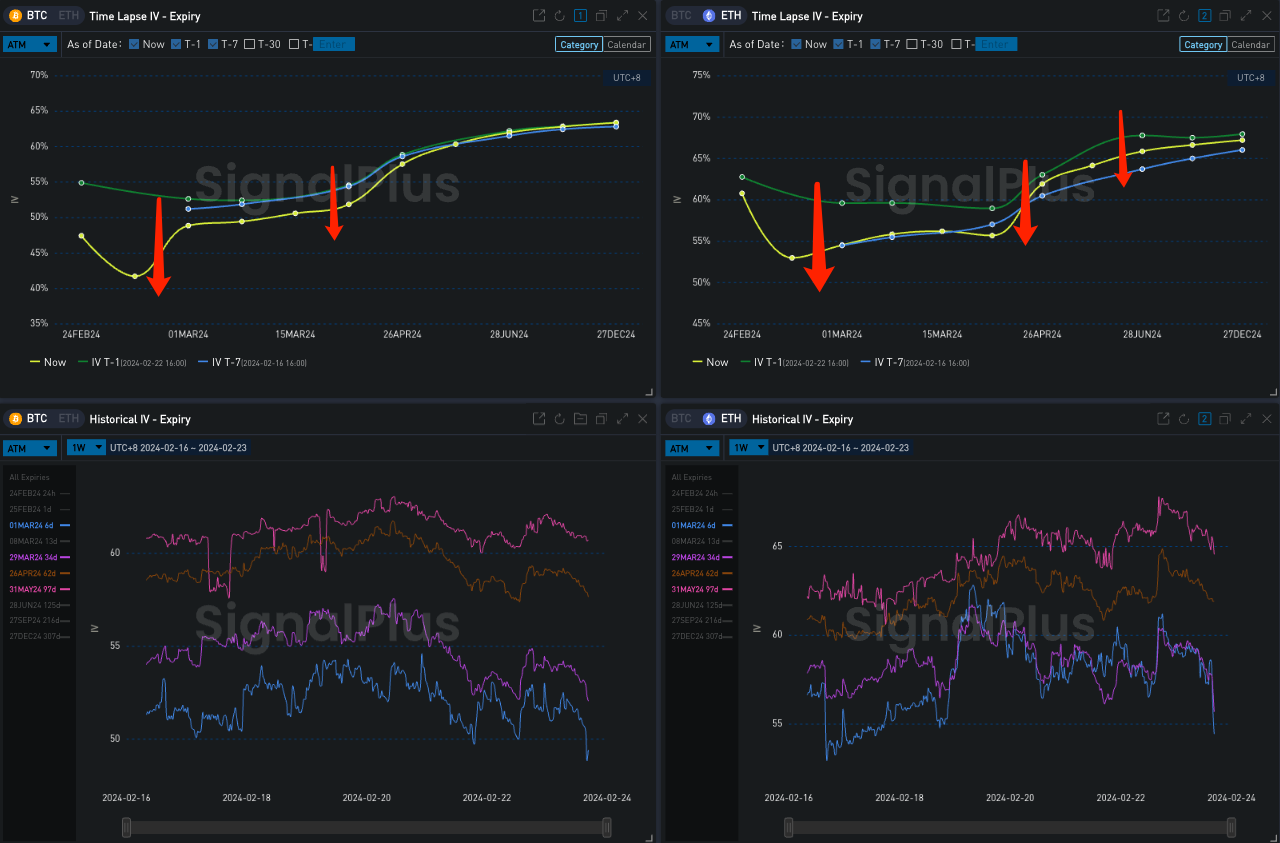

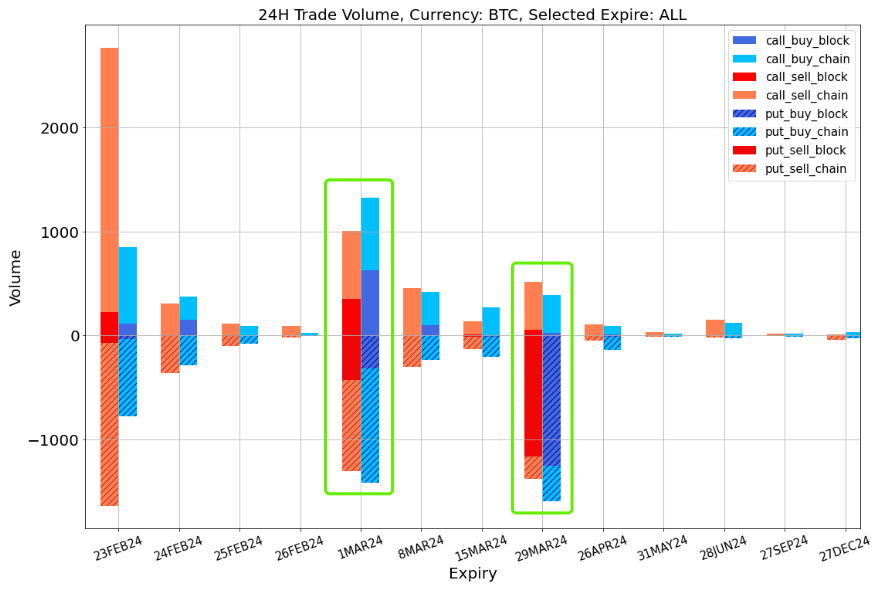

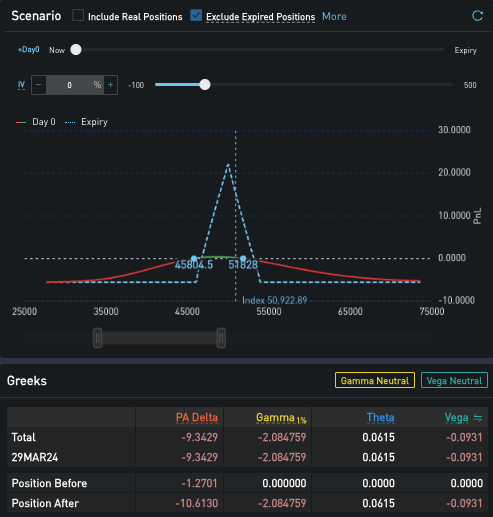

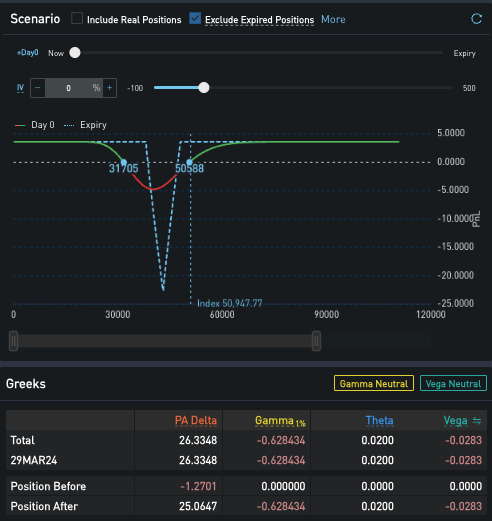

옵션 측면에서 내재 변동성 곡선은 하향 가파르게 변했고, BTC 대비 ETH의 Vol 프리미엄은 변하지 않았습니다. 거래 관점에서 BTC 거래는 3월 1일/3월 29일에 집중되어 있으며, 그 중 풋옵션 거래 비율이 크게 증가했으며, 주로 1MAR 50000/49000 Long Put Spread와 29MAR의 두 가지 디스크 풋 스프레드 전략으로 구성됩니다. , 기사 마지막 부분의 그림에 표시된 것처럼 두 전략의 손익 변화. 대부분의 ETH 거래도 3월에 집중되었으며, 가장 확실한 순 유입은 통화의 경우 3100/3200, 통화의 경우 3000입니다.

출처: Deribit(2월 23일 16:00 UTC+8 기준)

출처: SignalPlus, 내재변동성은 하향세를 보이고 있습니다.

데이터 출처: Deribit, 전날 BTC 거래는 3월 1일/3월 29일에 집중되었습니다.

출처: SignalPlus, Short 48000/43000/38000 PutFly 손익 변동, Long 54000/50000/46000 PutFly 손익 변동

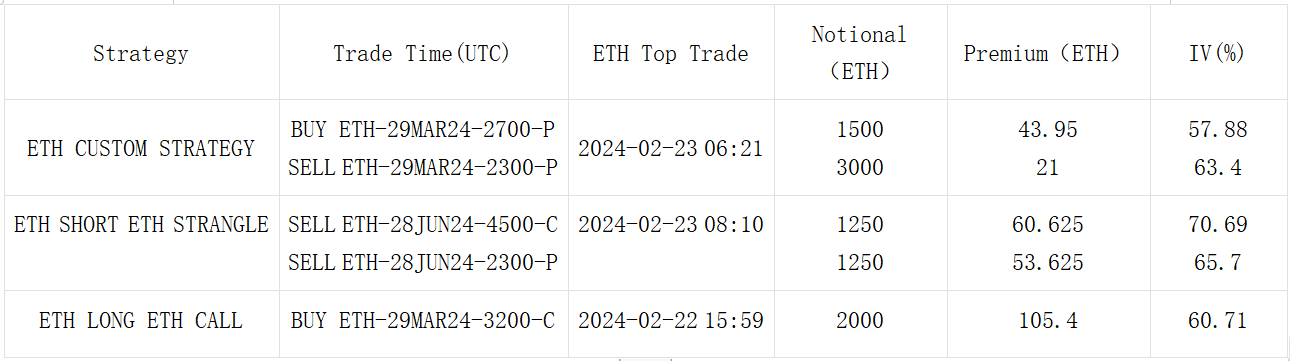

Source: Deribit Block Trade

Source: Deribit Block Trade

ChatGPT 4.0 플러그인 스토어에서 SignalPlus를 검색하시면 실시간 암호화 정보를 얻으실 수 있습니다. 업데이트를 즉시 받으려면 트위터 계정 @SignalPlus_Web3을 팔로우하거나 WeChat 그룹(WeChat 보조자 추가: SignalPlus 123), Telegram 그룹 및 Discord 커뮤니티에 가입하여 더 많은 친구들과 소통하고 소통하세요.

SignalPlus Official Website:https://www.signalplus.com