一文对比6大链上衍生品协议关键指标

原文编译:Jordan,PANews

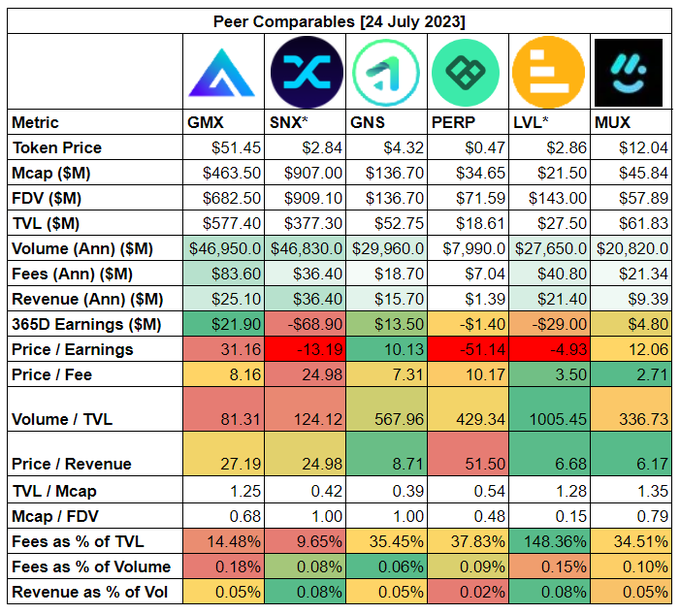

链上衍生品领域是 DeFi 中最具竞争力的领域,已有数十个协议上线,还有许多新项目即将推出,本文将重点分析 6 大链上衍生品协议关键指标对比。

虽然原始数据可能表明某个协议看起来是一项不错的投资,但了解背景依然非常重要,尤其是协议设计和收入分成模式。

(注:上表数据截取时间为 2023 年 7 月 24 日)

一、GMX

GMX 是一个永续合成去中心化交易所,其最知名的一个功能就是零滑点交易,从锁仓量、交易额、费用和收益这些指标来看,GMX 应该是当前规模最大的衍生品协议,他们与流动性提供者分享 70% 的费用收入,与 GMX 质押者分享 30% 的费用收入,使得 GMX 非常受欢迎并且对投资者有吸引力,其市盈率(收入减去代币激励)为 31.16 ,这意味着 GMX“相当昂贵”,但投资者可能会以 GMX v2定价,GMX V2将在几周内推出,具有以下功能:

Chainlink 低延迟预言机可提供更好的实时市场数据

支持更多资产(不仅仅是加密货币)

更低的交易费用

滑点在 GMX v1和v2将共存

随着竞争的加剧,GMX 市场份额正在逐渐减少,如果v2不能给平台带来更多的交易量和费用,GMX 的合理价格可能会落到 40 美元区间,市盈率大约为 20 。

二、Synthetix

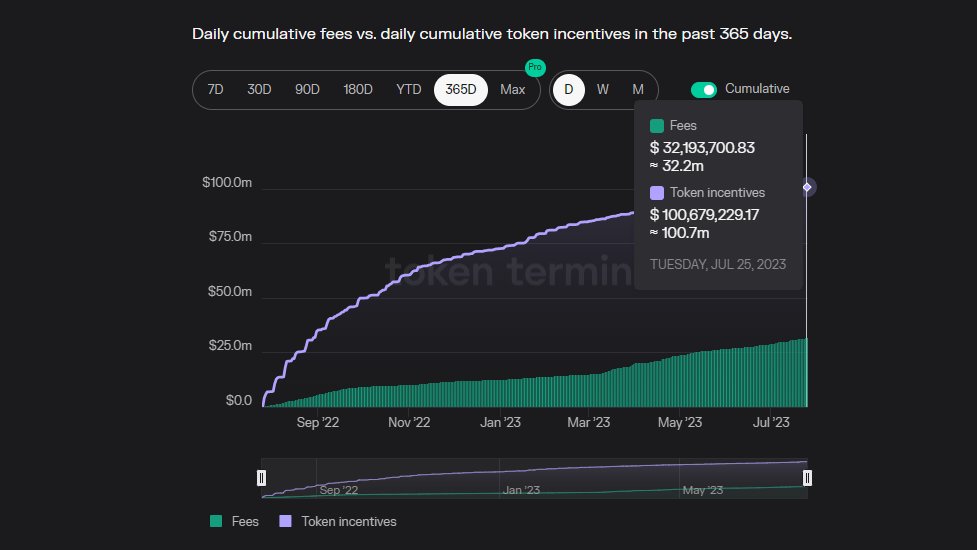

Synthetix 允许用户根据其原生代币 SNX 铸造合成资产,其他项目(例如 Kwenta)可以使用 Synthetix 构建自己的前端,以允许交易者访问永续 DEX 交易。在市值和收入方面,Synthetix 的规模都是六大衍生品协议中最大的,他们将 100% 费用收入分配给 SNX 代币质押者,而 SNX 质押者本身也是流动性提供者。

为了刺激用户提供流动性,Synthetix 通过解锁 SNX 代币来激励质押者,目前价值超过 1 亿美元的 SNX 已作为激励措施支付给了质押者,但该协议仅有 3600 万美元的费用收入且市盈率为负——这意味着他们正在亏损。

按照目前的估值、费用和代币释放量,SNX 似乎是一种非常昂贵的代币。如果没有额外的激励措施,未来交易量可能会下降。

三、Gain Network

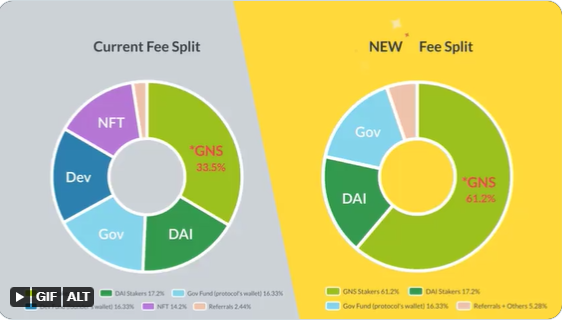

Gains Network 是一个综合衍生品平台,允许进行加密货币、外汇和大宗商品杠杆交易,该平台目前与 GNS 代币质押者分享约 33% 的费用收入,与流动性提供者分享约 17% 的费用收入,但从今年九月开始,与 GNS 代币质押者分享的费用收入比例将提升到 61% ,这一举措可能会提升其估值。

Gains Network 的市盈率是六个衍生品协议中最低的,只有 10 ,价格/收入比为 8.7 ,但在无激励条件下交易额/锁仓量比例较高,达到 568 ,从关键指标、产品开发和未来更新这几个方面来看,GNS 可能是一个被低估的项目。

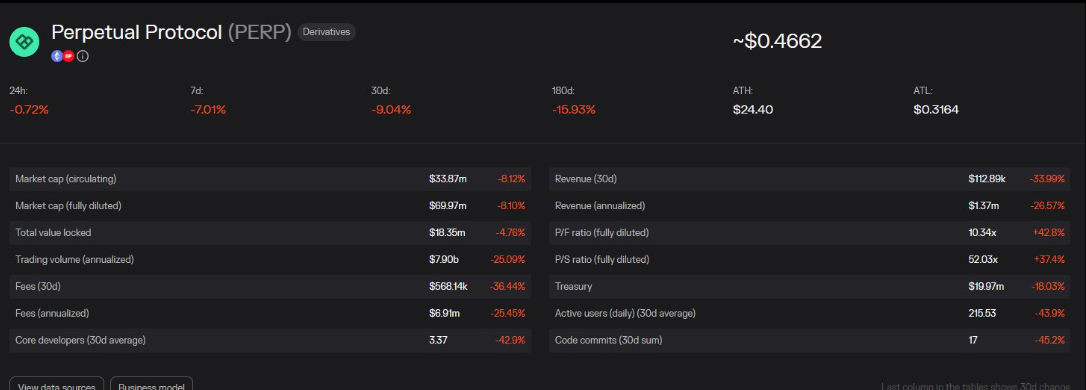

四、Perpetual Protocol

Perpetual Protocol 构建在 Uniswap v3智能合约之上,目前其 80% 的费用收入分配给流动性提供者,约 14% 分配给 PERP 代币质押者。Perpetual Protocol 年收入为 140 万美元,而解锁代币的价值却有 280 万美元,这意味着其年收益为负。综合各项指标,Perpetual Protocol 似乎对投资者并不具有吸引力,很难与 Optimism 上的 Kwenta (Synthetix)竞争。

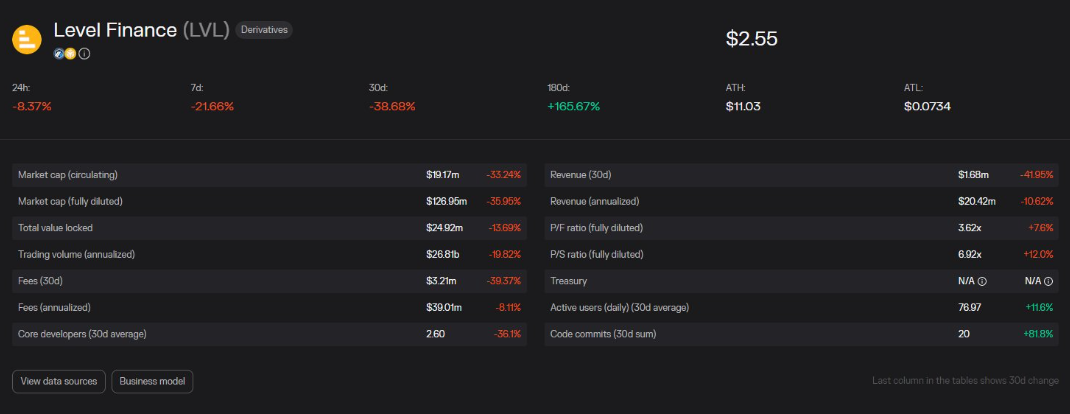

五、Level Finance

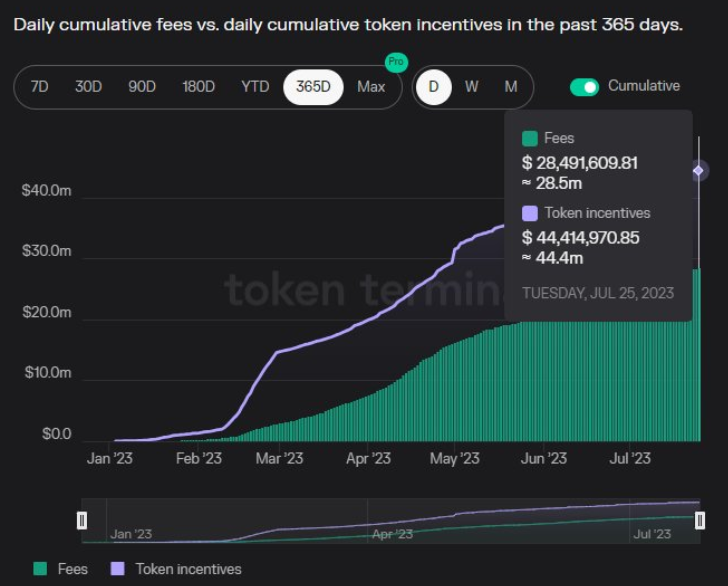

由于使用 LVL 代币进行了大量交易激励,Level Finance 协议在早期受到了很大的市场关注。 目前 Level Finance 协议的交易量一直维持在数十亿美元的水平,但由于代币的发行量和价格下降,一些关键指标处于下降趋势。

考虑到 Level Finance 具有与 GMX 类似的设计,交易额/锁仓量比值达到 1000 似乎有点过高(可能有人为因素导致),需要注意的是,尽管 Level Finance 产生了大量费用收入,但收益却是负数——这意味着该协议分发的代币多于产生费用的代币。

Level Finance 将 45% 的费用收入分配给流动性提供者, 10% 分配给 LVL 代币质押者, 10% 分配给 LGO 质押者(注:LGO 是 Level 生态系统中的推出第二个代币,具有治理权和财务权)。Level 的一些关键指标,比如交易量,似乎因早期激励阶段而膨胀,但其收益为负,因此似乎不是一个有吸引力的投资选择。

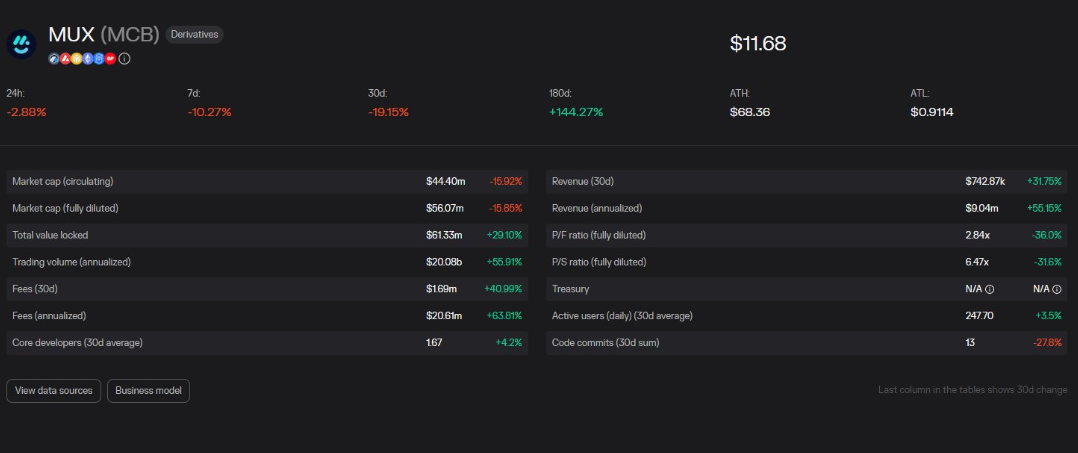

六、MUX Protocol

MUX Protocol 既是一种交易协议,也是一个聚合器,该协议将费用收入的 70% 分配给提供 ETH 的流动性提供者和 MUX 代币质押者。由于 MUX 部署在多个广泛采用的生态系统上,比如永续交易平台、期权平台、投注平台等,因此有不同类型的协议组合。MUX Protocol 的市值较低,但可扩展性和可靠性表现较好,因此 MUX 可以看做是一个“有趣”的投资机会。

总结

链上衍生品协议竞争日益激烈,很难发现最有前途的协议,也很难预测哪个协议会随着时间的推移而取得成功,本文也不是任何财务建议。