Summary

Stablecoins: The overall market value of stablecoins this week did not change much, but BUSD and TUSD experienced significant changes in market value due to Binance.

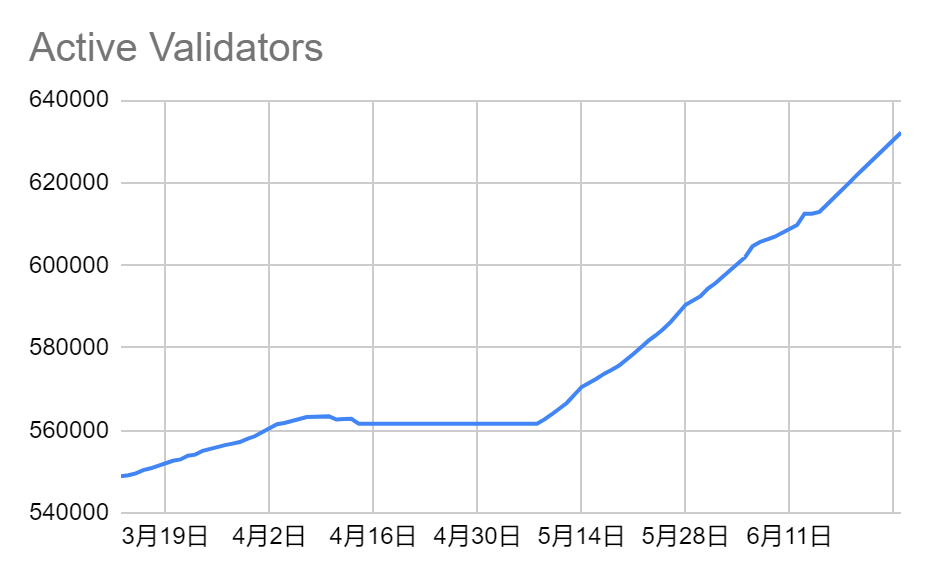

LSD: Last week, the ETH staking rate rose to 19.43%, a month-on-month increase of 1.46%. There were 23.3588 million ETH locked in the beacon chain last week, corresponding to a staking rate of 19.43%, a month-on-month increase of 1.46%. The ETH staking situation has gradually returned to normal growth trend, which is not subject to regulatory pressure from the U.S. SEC. Among them, there were 632.2 thousand active validating nodes, a month-on-month increase of 1.39%, and 92.4 thousand validating nodes in the queue, a month-on-month increase of 2.30%.

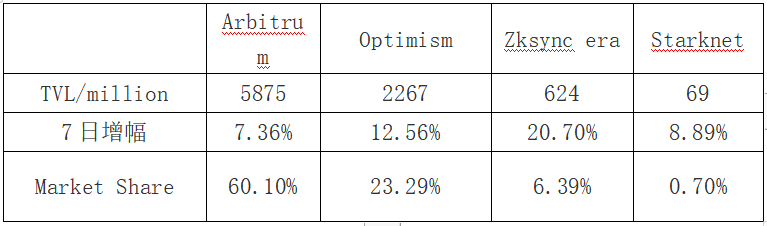

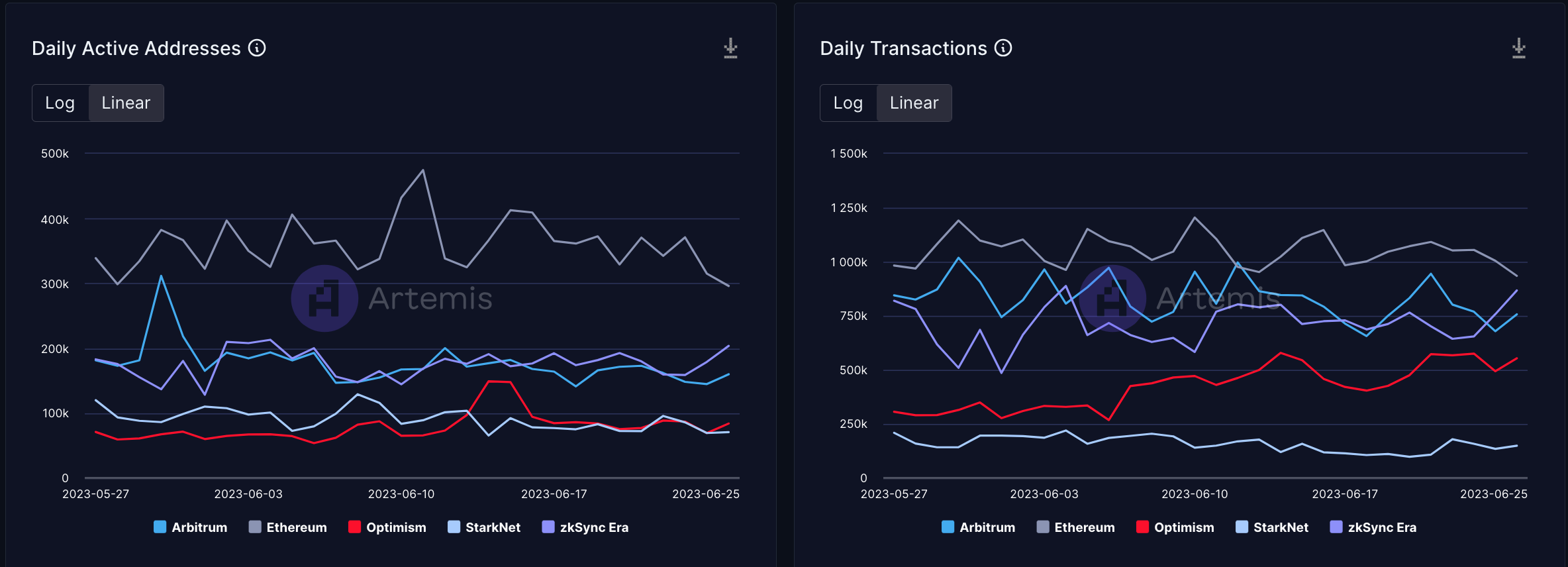

Ethereum L2: The total locked amount of Layer 2 TVL is 9.68 billion US dollars, and Zksync era still leads the way with TVL exceeding 600 million US dollars, a growth rate of over 20%. At the same time, the on-chain activity of Zksync has surpassed Arbitrum. With Offchain Labs releasing the Arbitrum Orbit development tool and Matter Labs releasing the ZK Stack for developing Hyperchain, the battle of Layer 2 has spread from the ecology itself to a broader L3 network and the RaaS field.

DEX: The combined TVL of DEX is 15.15 billion, decreased by 0.66 billion compared to last week. The 24-hour trading volume of DEX is 2.05 billion, and the 7-day trading volume is 17.99 billion, decreased by 0.64 billion compared to last week. Uniswap V4's popularity combined with the leading target of BTC sinking track, UNI leads the way this week.

Derivatives DEX: Last week (June 19th to June 25th), the overall trading volume of Derivatives DEX increased compared to the previous week, marking three consecutive weeks of trading volume growth. The weekly trading volume of the six major derivatives DEX protocols is approximately $15 billion, with a growth rate of about 25%.

Source: defillama, LD Capital

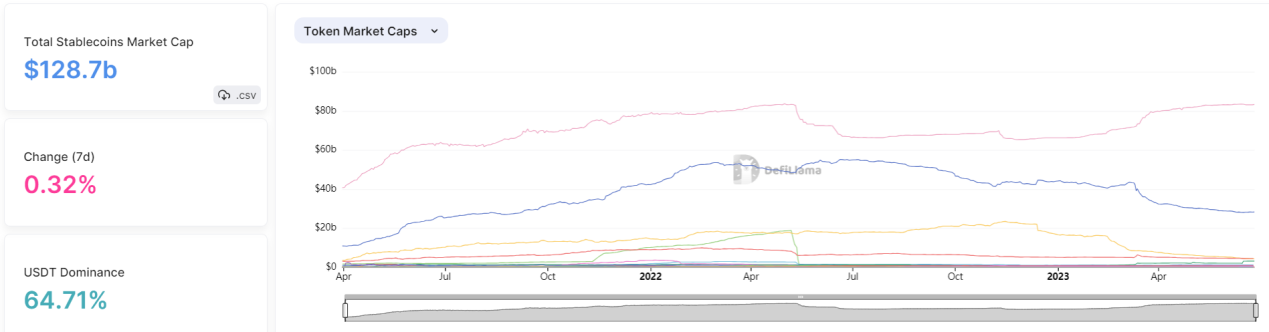

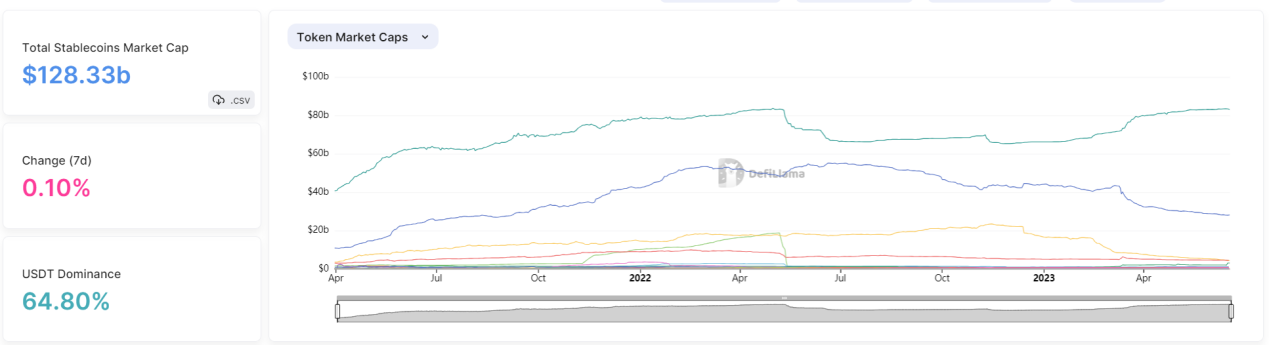

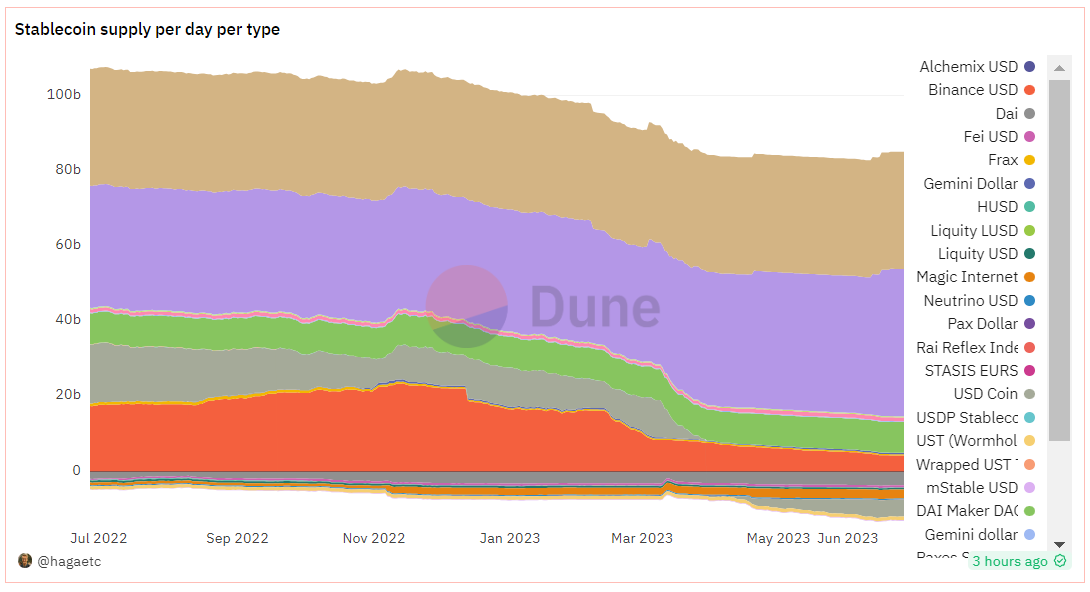

According to data from defillama.com, the total market value of stablecoins is currently about $128.7 billion, an increase of only about $400 million compared to last week. From the stablecoin supply curve, it can be seen that the overall supply of stablecoins is declining. Although the crypto market experienced a significant increase last week, there doesn't seem to be new large funds entering, which is likely due to internal fund circulation driven by institutional entry expectations (BlackRock's application for BTC trust/Volatility Shares launching 2x BTC strategy ETF).

Source: Dune Analytics, LD Capital

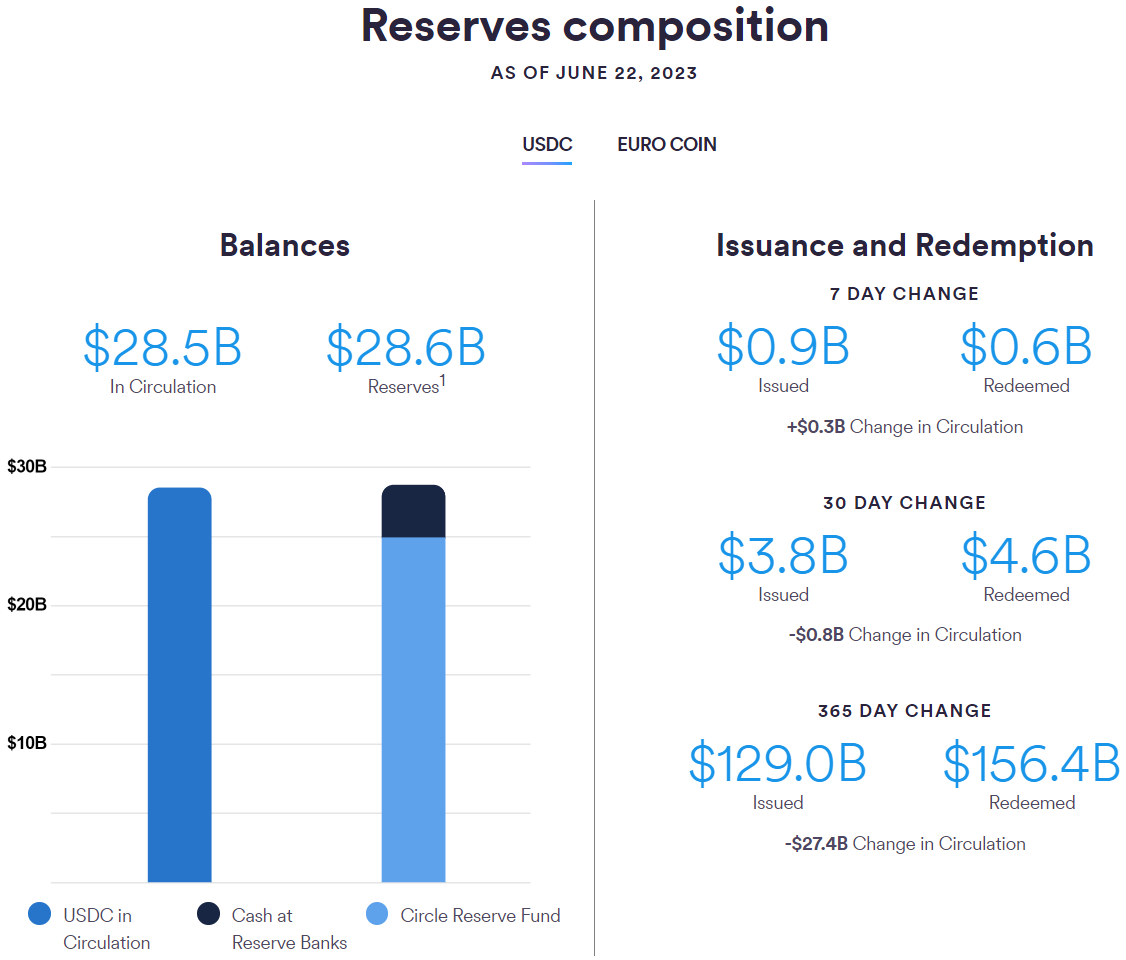

According to Circle's official website data, as of June 22nd, the total circulation of USDC is 28.5 billion US dollars, with a reserve of 28.6 billion US dollars, including 3.8 billion US dollars in cash, and the Circle Reserve Fund holding 24.9 billion US dollars. In the past week, Circle issued a total of 0.9 billion US dollars of USDC and redeemed 0.6 billion US dollars of USDC, resulting in an increase in circulation of approximately 0.3 billion US dollars.

Source: Circle official website, LD Capital

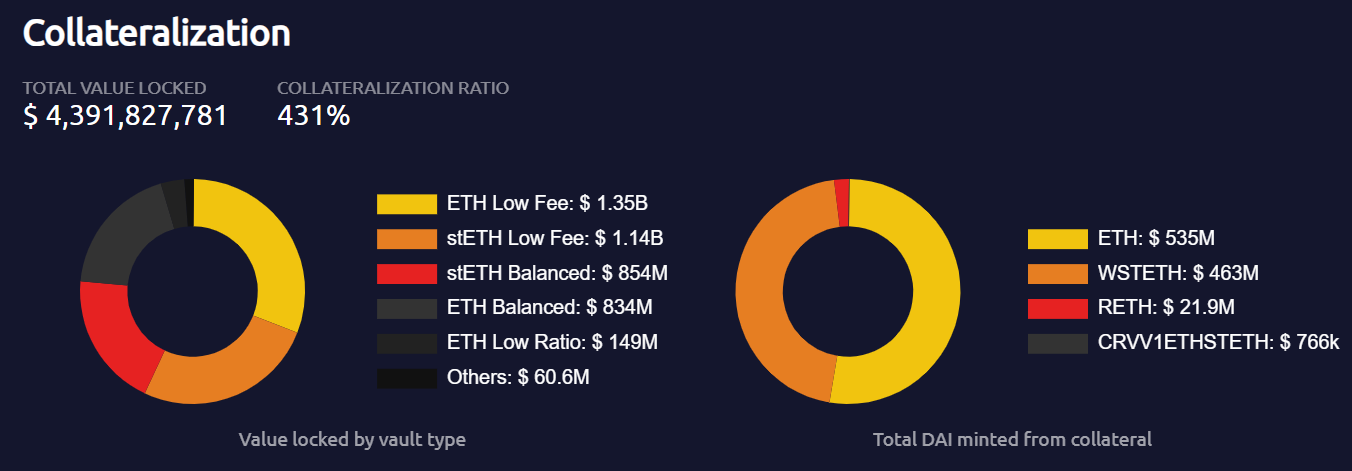

Since March 2023, there have been significant changes in the types of collateral within MakerDAO. The amount of USDC used as collateral in the MakerDAO Anchoring Stable Module (PSM) has decreased from 4 billion US dollars to around 0.5 billion US dollars. The main reason for the decrease in USDC share is that MakerDAO is diversifying its balance sheet.

Meanwhile, the share of stETH, an Ethereum derivative, as collateral has increased significantly from 0.65 billion US dollars to around 1.1 billion US dollars.

Source: makerburn.com, LD Capital

LSD

Beacon chain validator growth gradually recovering

Source: LD Capital

ETH staking yield falls to 4.3%

Source: LD Capital

Among the three LSD protocols, in terms of price performance, LDO has seen a weekly increase of 11.3%, FXS +8.1%, RPL -6.9%; in terms of ETH staking volume, Lido has seen a weekly increase of 2.06%, Frax +1.77%, Rocket Pool +1.74%.

Attention LDO Gradient Incentive Sharing Proposal: This proposal aims to expand Lido's market share by collecting 5% of the staking revenue (within 12 months) from potential stakers capable of staking a minimum of 2500 ETH on Lido and sharing it with new projects that can promote the Lido market. Stakers with 0-50000 ETH staked can share 30% of the revenue, and the percentage gradually increases with higher amounts of staked ETH, with stakers holding over 700,000 ETH being able to share 50% of the revenue. (Proposal details: https://snapshot.org/#/lido-snapshot.eth/proposal/0x9279cd4addefdd9185d024f471f1a29561f61556ae209cdda5dffb1fd73b181e)

Ethereum L2

TVL

Layer 2 TVL showed significant growth last week, with an overall increase of approximately 1 billion USD compared to the previous week, reaching a total locked amount of 9.68 billion USD.

Data Source: l 2b eat

The biggest gainers are Op Mainnet and Zksync Era, with Zksync era leading the way with a TVL of over $600 million, a growth rate exceeding 20%.

Cross-chain capital situation

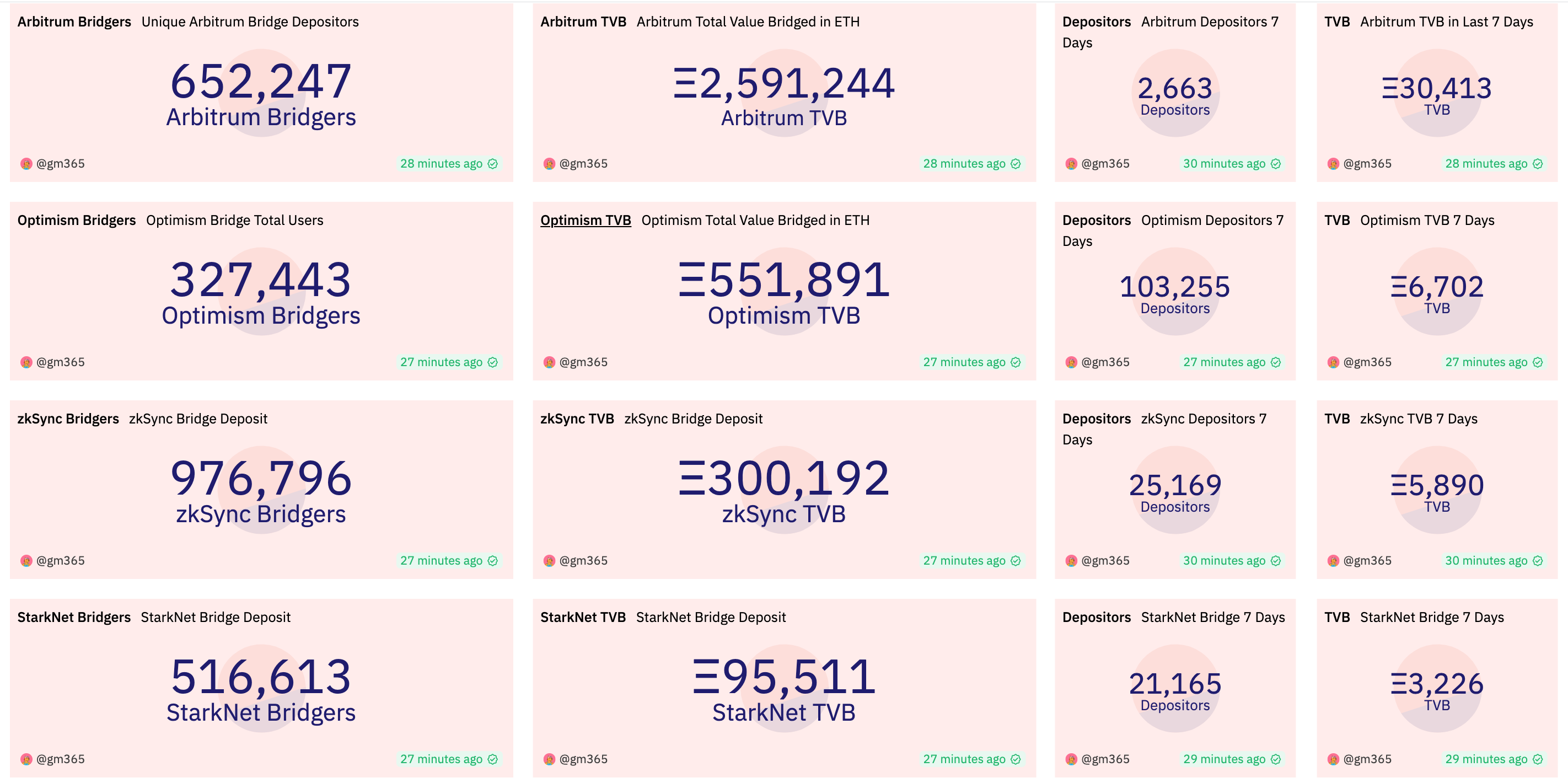

Arbitrum has been quite active in terms of cross-chain capital, with TVB data exceeding 30,000 ETH for two consecutive weeks.

On-Chain Activity

On-chain activity: Zksync has surpassed Arbitrum, with the ranking as follows: zksync era > arbitrum > optimism > Starknet.

Event Review

Arbitrum

On June 22, Offchain Labs released the Arbitrum Orbit development tools, aimed at helping developers easily develop and manage their own Arbitrum Rollup and AnyTrust chains on the L3 blockchain Arbitrum Orbit. Earlier on March 16th this year, Arbitrum launched Arbitrum Orbit, allowing developers to easily and permissionlessly launch their own Layer 3 blockchain within the Arbitrum ecosystem. Then on April 27th, AltLayer's RaaS (Rollups-as-a-Service) solution announced support for Arbitrum Orbit.

Optimism

On June 22, Optimism launched the third round of retroactive public goods funding, distributing 30 million OP tokens to builders, creators, and educators who have positively impacted the Optimism Collective. The distribution will take place in the fall of this year.

On June 24, Optimism was renamed to OP Mainnet.

zkSync Era

On June 26, Matter Labs released the ZK Stack for developing Hyperchains. Developers of Hyperchain can choose to create Layer 2 networks parallel to zkSync Era or run Layer 3 networks on top of it. Additionally, zkSync Era will be considered the first Hyperchain, and cross-chain transactions between chains can be done through Hyperbridges.

ZK Stack and Hyperchain can correspond respectively to the concept of Op Stack and Superchain in OP Mainnet, while also incorporating features similar to Arbitrum Orbit and zkSync Era L3. It can be seen that the fierce competition between layer 2 solutions has spread from the ecosystem itself to the broader L3 network and the RaaS field. Currently, the more advanced development is the OP Mainnet, which is supported by Base and Opbnb. We look forward to seeing how the major Layer 2 public chains will demonstrate their capabilities and compete for dominance.

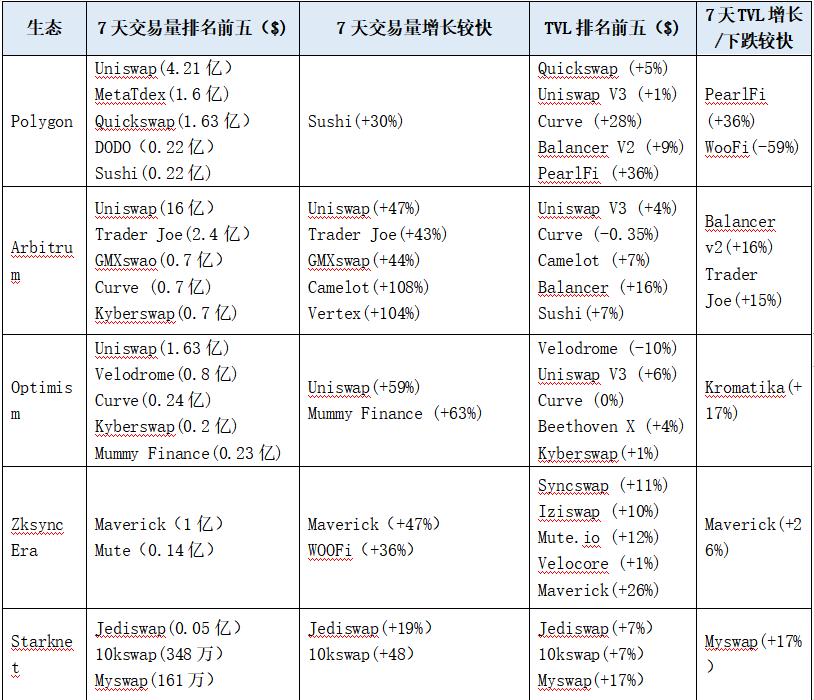

DEX

Dex combined TVL is 15.15 billion, a decrease of 0.66 billion compared to the previous week. Dex has a 24-hour trading volume of 2.05 billion and a 7-day trading volume of 17.99 billion, a decrease of 0.64 billion compared to the previous week. Uniswap V4 has gained popularity, boosted by the influx of BTC funds, and UNI is leading the way this week.

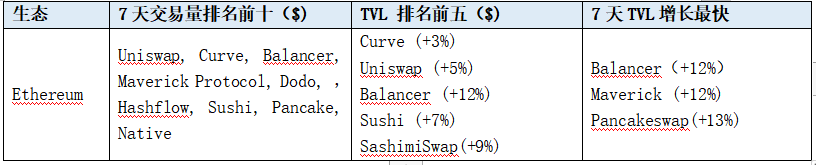

Ethereum

ETH L2/sidechain

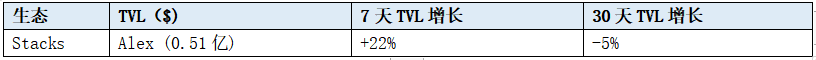

BTC L2/sidechain

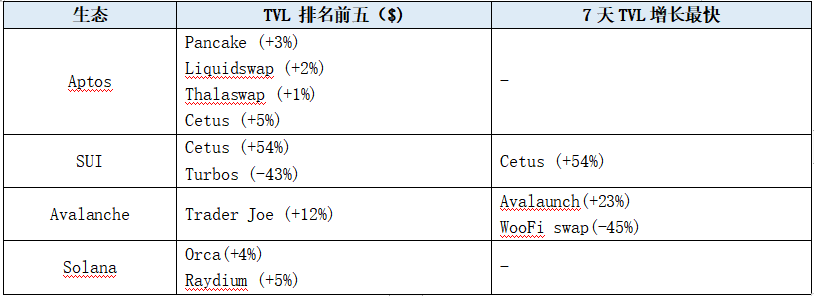

Alt L1

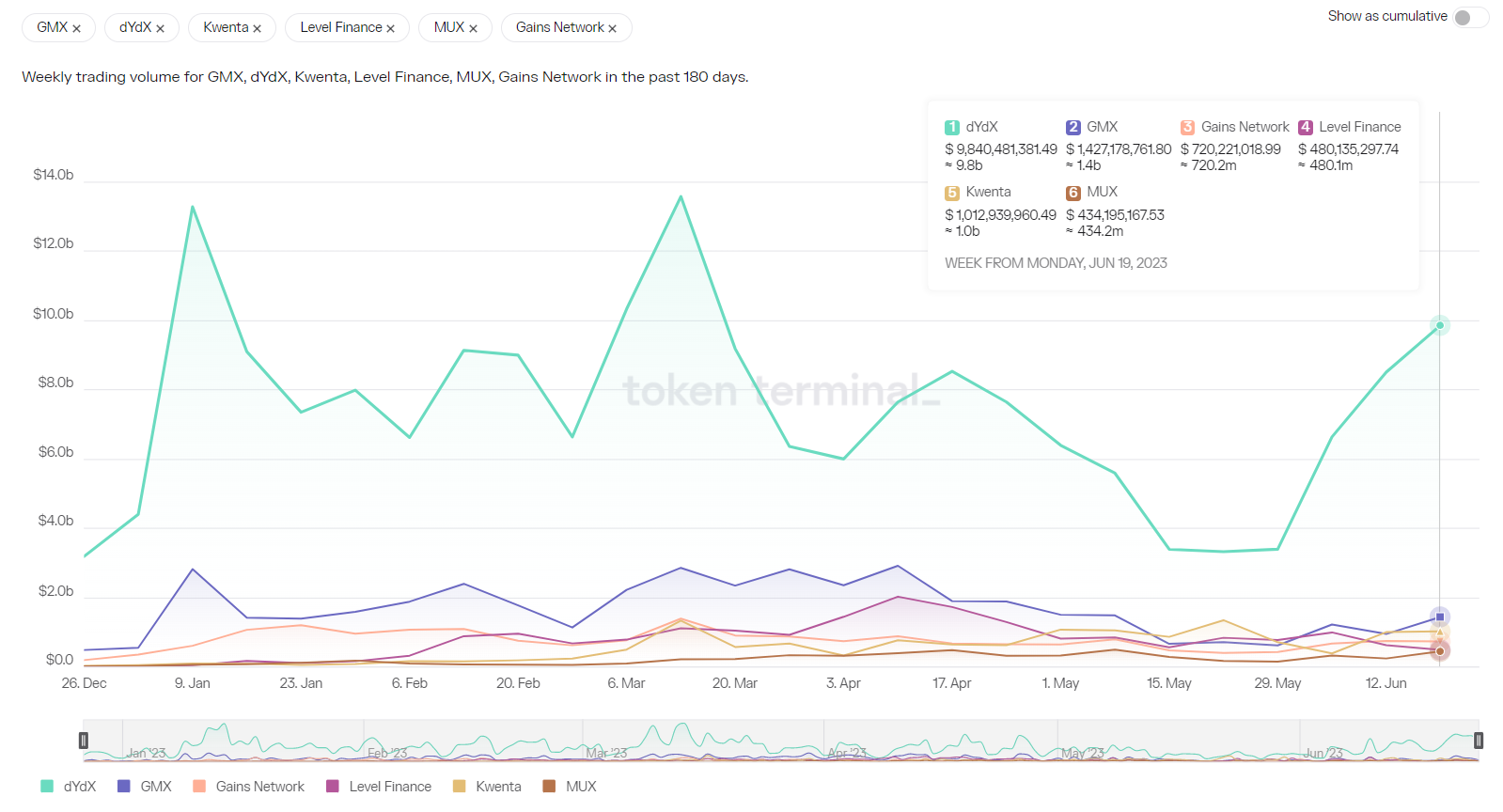

Derived Product DEX

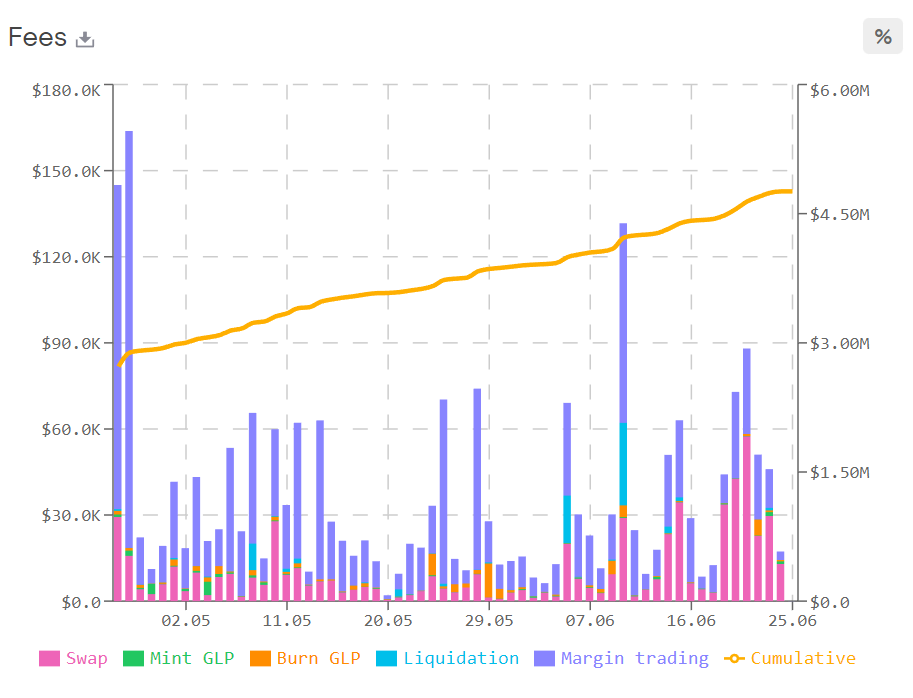

Image: Variation of weekly trading volume of 6 major derived product DEX protocols

Source: tokenterminal

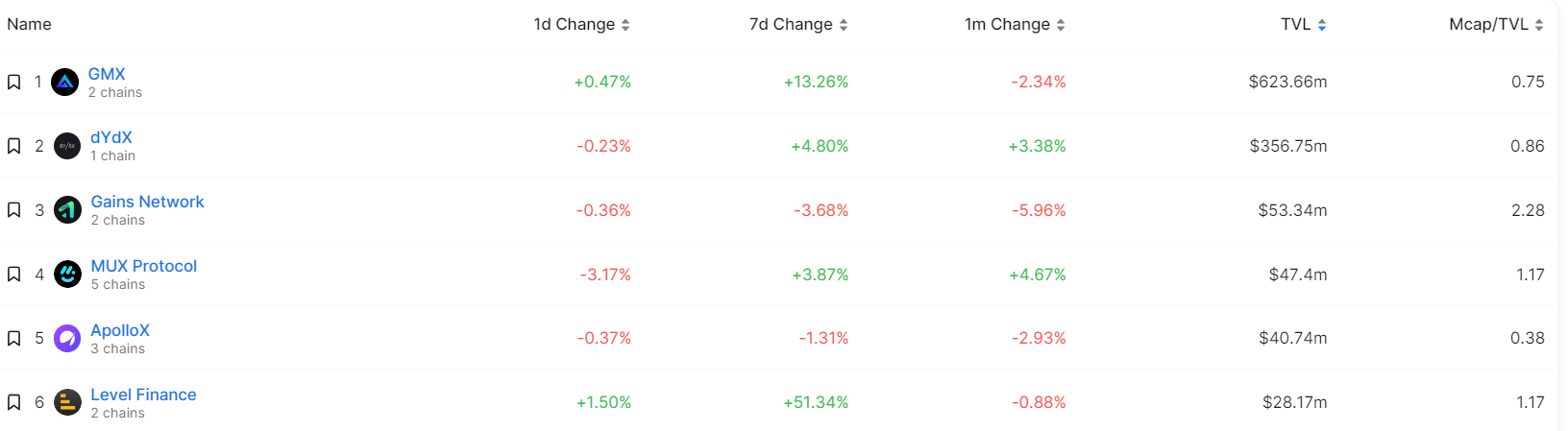

This week TVL has rebounded significantly. As of June 25th, the GMX TVL has increased by 13.26% this week, with the most funds flowing back, rising from 540m to 623m. DYDX and MUX both experienced growth in 30-day TVL, with monthly growth rates between 3% and 5%. Level TVL has increased by over 50% this week, recovering most of the decline in the past 30 days. Gains network and Apollo X have relatively weak performance, with TVL in a downward trend for both 30 days and 7 days, but the decline is not significant.

Source: Defillama

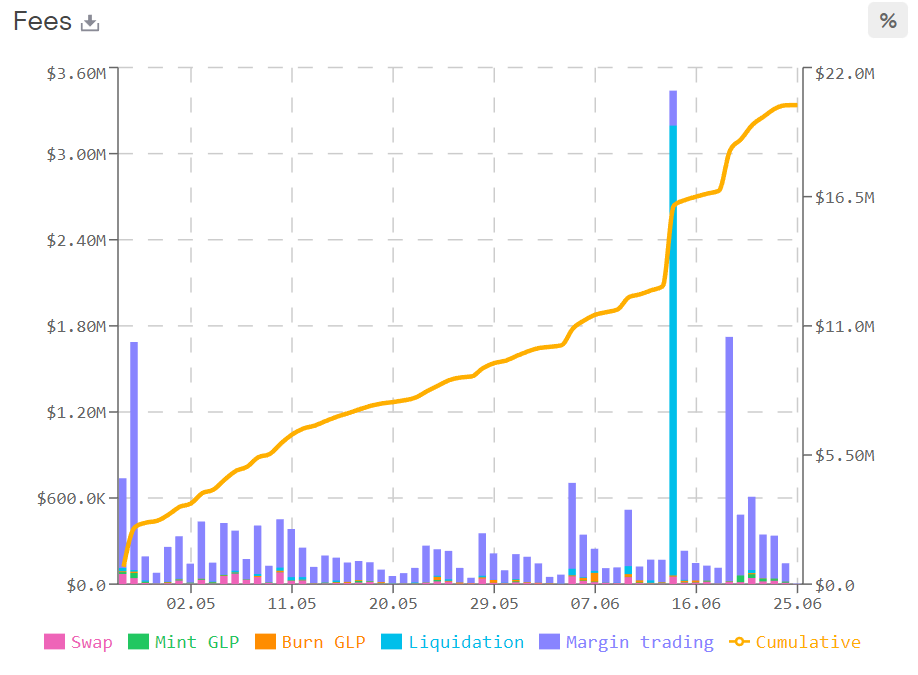

The rapid return of GMX TVL is mainly due to the recovery of earnings. Since Binance was sued by the SEC in early June, market volatility has increased, derivative trading volume has increased, and there have been several large-scale liquidations in the market, significantly increasing protocol revenue.

From the chart below, we can see that on Arbitrum, protocol fee revenue exceeded $3 million on June 14th and exceeded $1.7 million on June 19th, far higher than the usual range of $100,000 to $500,000.

Chart: GMX protocol revenue illustration (left: Arbitrum, right: Avalanche)

Source: GMX

The collateralization ratio of GMX also reached a new high of 80% this week. Previously, the collateralization ratio reached a maximum of 79% in mid-April. The increase in collateralization ratio may be related to the GMX community voting to modify the multiplier points mechanism.

The multiplier points system of GMX aims to reward long-term staking users. Staking GMX can earn multiplier points, which can be used to boost the staking yield of GMX. Currently, the APR for multiplier points is 100%, which means that when a user stakes 1000 GMX for one year, they can earn 1000 points.

According to community discussions, GMX has been in operation for over a year since the end of 2021, and the accumulated amount of multiplier points is increasing. Currently, approximately 50% of the protocol's revenue is distributed. This is not favorable for new stakers to participate. Therefore, a new proposal suggests that once the accumulated multiplier points of a staking user exceed a certain percentage of the staked tokens, the excess points can no longer be used to boost the staking yield. Users can stake additional tokens to use their multiplier points.

The vote is currently underway and will end on June 27th. Currently, the option with a multiplier points cap at 150% has garnered 65.4% support.