Cycle Capital: Review of BitDeer (Btdr.US)’s first quarter performance in 2025

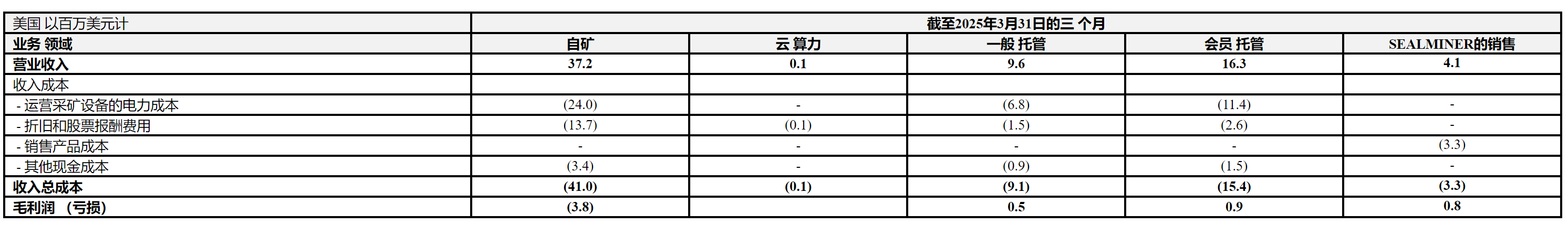

Event: BitDeer (Btdr.US) released the first quarter report of fiscal year 2025. The company achieved operating income of US$70.1 million in the first quarter, a year-on-year decrease of 41.3% and a month-on-month increase of 1.6%. Among them, the self-operated business income was US$37.2 million, a year-on-year decrease of 10.4%; the comprehensive gross profit was negative US$3.2 million, and the gross profit margin was -4.6%. The main reason was that the dry season in Bhutan led to an increase in electricity prices, and the short-term closure of the Bhutan mine by Btdr. However, after entering the flood season in the second quarter, the electricity price has returned to the level of US$0.042/kwh; Seal mining machine sales were US$4.1 million, marking the official start of the company's mining machine sales. Adjusted EBITDA was negative US$56.1 million, and the same period in 2024 was positive US$27.3 million. Net profit was US$410 million, mainly due to the fair value reversal of convertible notes ($448.7 million) and TEDA options ($58.4 million) provided for in the fourth quarter of 2024.

Comments:

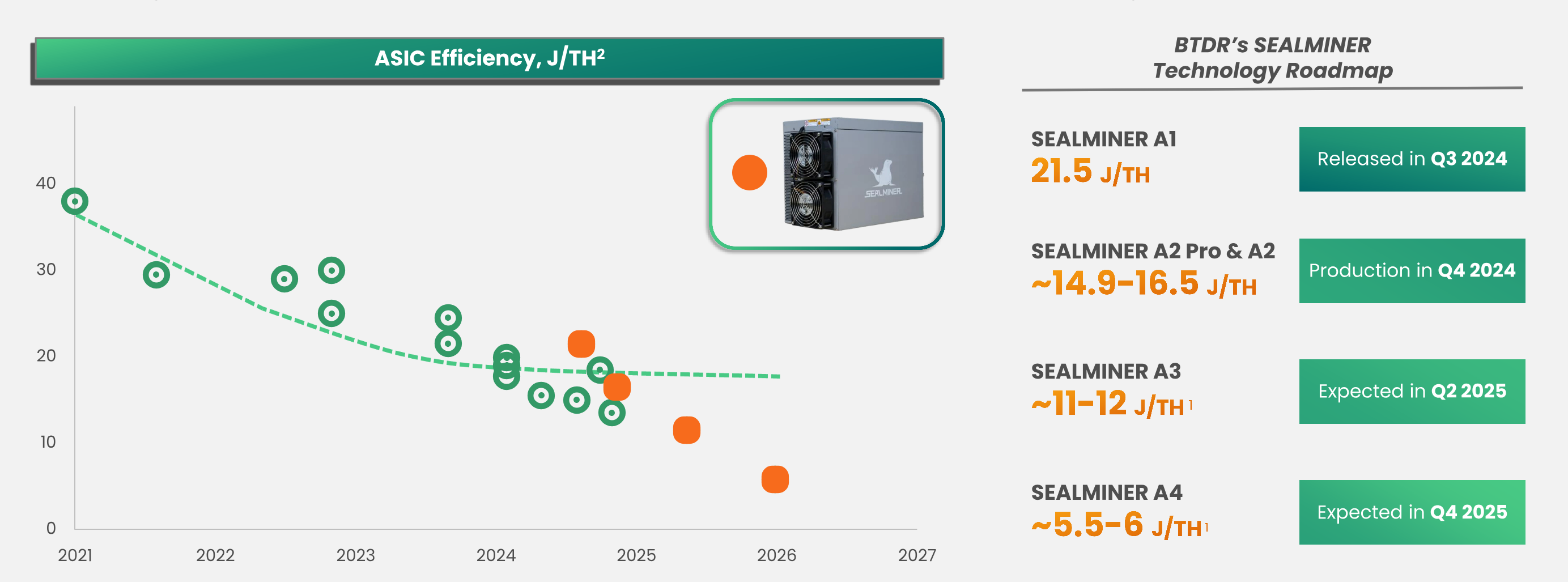

1. Xiaolu's prepaid accounts further increased to US$382 million in the first quarter of 2025 (US$310 million in the fourth quarter of 2024), and the amount required for the maximum tape-out volume that can be obtained at present has been fully covered. Sea l0 2 mining machine has entered the shipment stage, and the subsequent self-operation and sales rhythm will depend on the pricing strategy of competitors. If the competition is fierce, it will give priority to lighting up the self-operated mine; Sea l0 3 mining machine also completed tape-out in the first quarter and is still in the testing stage. It is expected that the layout and sales stage of the self-operated mine will be officially entered in the fourth quarter of 2025 at the end of the third quarter.

2. Regarding the US tariff war. Xiaolu will complete the construction of the North American assembly plant in the second quarter, and North American sales will come from local assembly. Although the cost has increased by nearly 10%, it is negligible compared to the current Southeast Asian tariffs. The Southeast Asian assembly plant will meet the needs of mines in non-US regions.

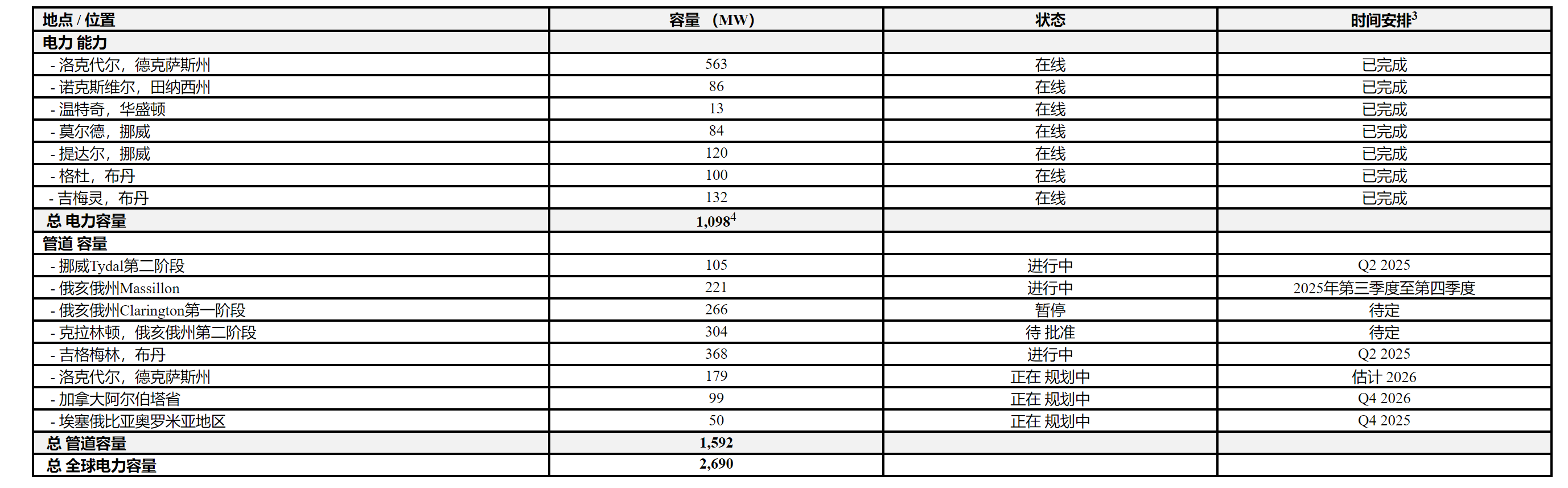

3. Xiaolu Global power infrastructure construction remains rapid. It is expected that by the end of the second quarter, the global available power capacity will be close to 1.6 GW and will reach 1.8 GW by the end of this year.

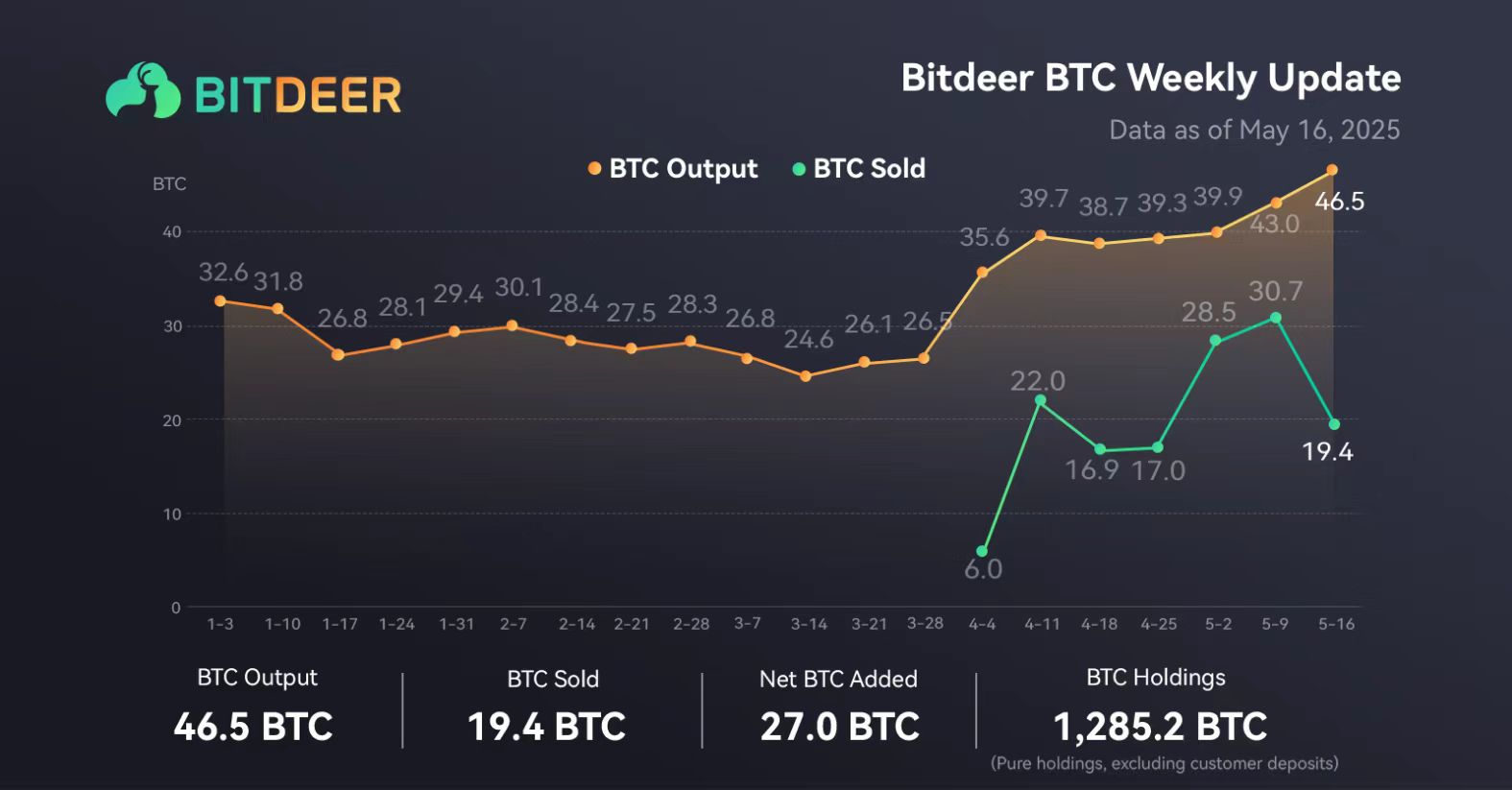

4. As of April, the hash rate of Xiaolu's self-operated mine has reached 12.5 Eh/s, and it is expected to rise to 40 Eh/s in October and exceed 40 Eh/s by the end of 2025. The company's latest Sea l0 1 and Sea l0 2 mining machines were only put into operation in March, but the overall mining cost is still at least 20% lower than that of its peers (including Mara, CLSK, etc.). After fully replacing old mining machines, the cost advantage will be further revealed, and the monthly output will show an exponential upward trend starting from the second quarter.

Investment advice: Bitcoin prices have recently resumed their upward trend and are expected to break through the previous historical high price of $109,000 per coin. Since the US trade war, the US dollar has been under pressure, and Bitcoin, as an alternative asset, has begun to show its gold-like safe-haven properties. The Federal Reserve has also recently begun to adopt an "average inflation" policy, and is expected to cut interest rates in June in advance. The expected rate cut for the whole year has been increased to three times (previously once), which has formed positive support for Bitcoin prices. After experiencing the operating transition period in the fourth quarter of last year and the first quarter of this year, BitDeer will usher in an important moment. The speed of mining machine research and development and the speed of lighting up self-operated mines are important highlights in the next few quarters. The operating conditions in the first quarter of 2025 should be the worst period in the next two years, and the operating turning point will also begin from this. It is still the best choice for North American Bitcoin mining stocks.

Investment risks: Risk of further adjustment in Bitcoin prices, risk of TSMC’s wafer production falling short of expectations, and risk of the company’s self-operated mining machines coming online slower than expected.