Compilation of the original text: Deep Tide TechFlow

Compilation of the original text: Deep Tide TechFlow

Although Sui Network announced that there will be no airdrops, Sui Network still has a $2 billion valuation and a strong technical foundation. Recently, Sui announced that it will open the subscription of the Sui Token whitelist for token sales. Driven by this wave of narratives, projects built on Sui may gain attention.

text

OmniBTC

Omni BTC is the first project to build a full-chain financial protocol, aiming to link the liquidity of multiple ecosystems.

Their aggregator is called DOLA Protocol and connects through Layer Zero, Wormhole and $SUI to build financial applications.

Project link: https://twitter.com/OmniBTC

Onchain Trade

Onchain Trade ($OT) is also a full-chain protocol, but it mainly focuses on the efficiency of utilizing unilateral liquidity, with its stablecoin $OSD as the main support.

Since all liquidity is unilateral, $OSD is backed by all assets in the liquidity pool.

In short, $OT is building a powerful full-chain DeFi platform with a unique model designed to provide users with an excellent experience.

Project link: https://twitter.com/OnchainTrade

Araya Finance

Araya Finance is currently developing the world's first $SUI-based liquid collateralized derivatives, stablecoin and game token derivatives protocol.

They have confirmed that the community will directly receive over 50% of the governance tokens.

Project link: https://twitter.com/ArayaFinance

MovEX

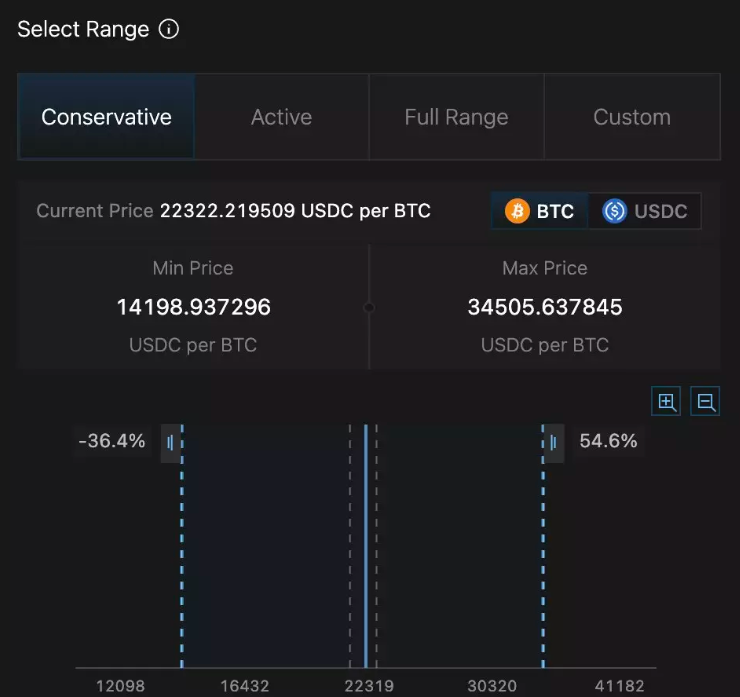

MovEX is currently developing a centralized liquidity automated market maker (AMM) and smart liquidity management service, which will allow users to manage their liquidity positions more efficiently.

The project will also establish an ILO, allowing Bulider in the ecosystem to raise funds.

Project link: https://twitter.com/joinMovEX

Turbos

Turbos is building the first decentralized perpetual DEX with zero slippage on SUI. The project takes advantage of the high performance provided by the Sui network, which is able to improve transaction efficiency and reduce transaction fees. In addition, Turbos Finance has the backing of a number of high-profile investors, including Jump and Mysten Labs.

Project link: https://twitter.com/Turbos_finance

Cetus

Cetus is developing a DEX and centralized liquidity protocol using $APT and $SUI, which can improve capital efficiency by 10 times compared to traditional AMMs.

The project is highly composable, ensuring seamless integration with other ecosystems.

Project link: https://twitter.com/CetusProtocol

KriyaDEX

KriyaDEX is a fast derivatives trading platform that uses Move to create anti-front-running order books. With KriyaDEX, you will experience the following features:

Increased capital efficiency (lower latency);

Excellent user experience;

Unmanaged service.

Project link: https://twitter.com/KriyaDEX

Umi Protocol

Umi Protocol is building the broadest DEX aggregator for the $SUI and $APTOS networks. Through Umi Protocol, traders can easily access the most efficient trading routes.

Project link: https://twitter.com/umi_protocol

SuiPad

SuiPad is the first IDO and INO platform developed based on Sui. They recently partnered with Mysten Labs to help launch a major SUI-based project.

Their future roadmap includes staking, liquidity pools, and an NFT issuance platform.

Project link: https://twitter.com/SuiPadxyz

SuiDex

SuiDex is currently building a DeFi hub for Sui, which will include a range of products such as:

Automated Market Maker (AMM) DEX;

Stablecoin Swap;

liquidity pool;

NFT market;

Distribution platform (Launchpad).

Project link: https://twitter.com/Suidex_io