SignalPlus Morning Feature: Bond Armageddon และ ECB วันพฤหัสบดี

เพื่อน ๆ ที่รัก ยินดีต้อนรับสู่ SignalPlus Daily Morning News SignalPlus Morning News อัพเดทข้อมูลการตลาดในระดับมหภาคให้คุณทุกวัน และแบ่งปันข้อสังเกตและความคิดเห็นของเราเกี่ยวกับแนวโน้มระดับมหภาค ยินดีต้อนรับสู่การติดตามและสมัครสมาชิกและติดตามแนวโน้มตลาดล่าสุดกับเรา

อารมณ์ตลาดตราสารหนี้วันนี้...

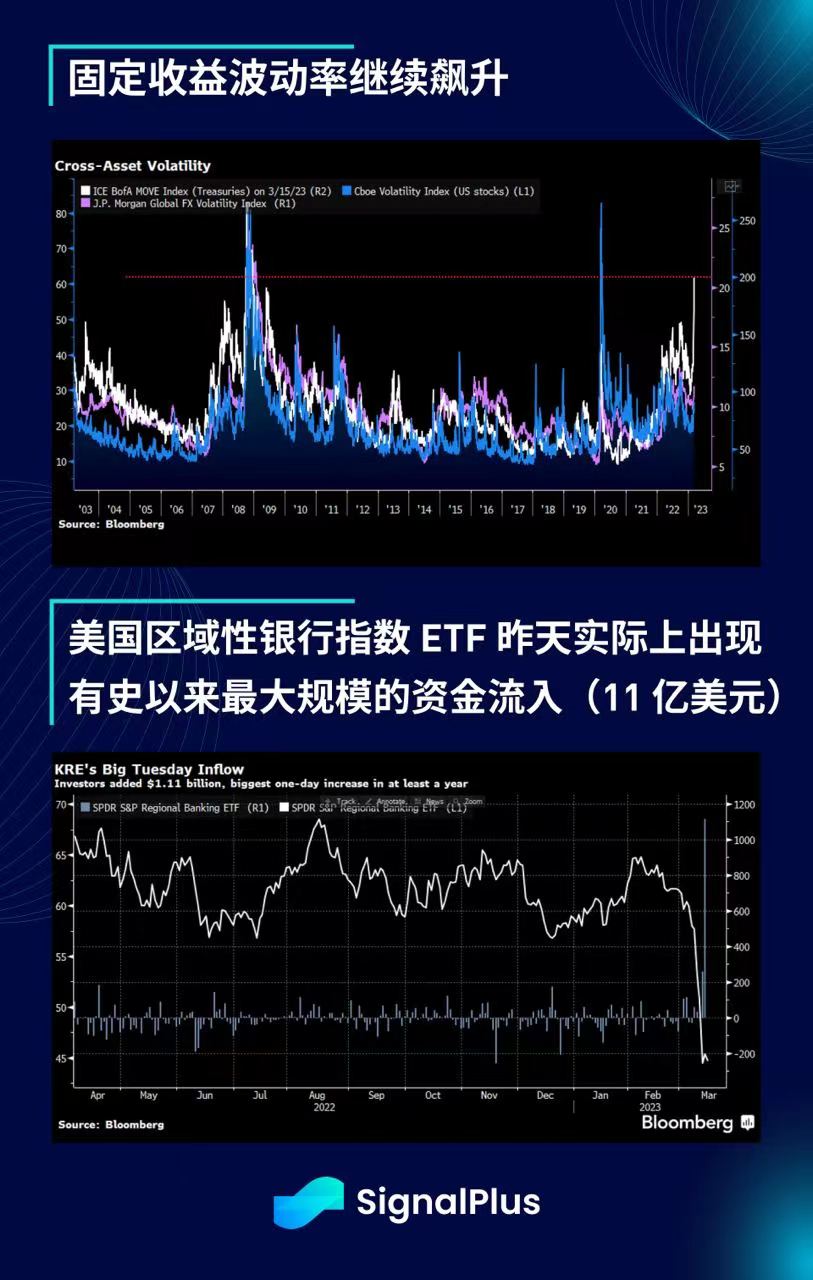

สภาพคล่องของตลาดตราสารหนี้ในตลาดที่พัฒนาแล้วหายไปอย่างสิ้นเชิงเมื่อวานนี้ โดยปราศจากการจงใจพูดเกินจริง และความผันผวนของพันธบัตรรัฐบาลในสหรัฐอเมริกา ยุโรป และสหราชอาณาจักรก็ไม่น้อยไปกว่าหรือมากกว่าระดับของวิกฤตเลห์แมนด้วยซ้ำ

สภาพคล่องของตลาดตราสารหนี้ในตลาดที่พัฒนาแล้วหายไปอย่างสิ้นเชิงเมื่อวานนี้ โดยปราศจากการจงใจพูดเกินจริง และความผันผวนของพันธบัตรรัฐบาลในสหรัฐอเมริกา ยุโรป และสหราชอาณาจักรก็ไม่น้อยไปกว่าหรือมากกว่าระดับของวิกฤตเลห์แมนด้วยซ้ำ

- สเปรดการเสนอราคาของกระทรวงการคลังสหรัฐฯ เป็น 2 เท่าจากปกติ ผลตอบแทน 2 ปีเคลื่อนไหว 70bps ในระหว่างวัน (เทียบเท่ากับการขึ้นอัตราดอกเบี้ย 3 ครั้ง) สกุลเงินยูโรเคลื่อนไหวมากถึง 90bps ในระหว่างวันในวันที่ 23 ธันวาคม (เทียบเท่ากับการขึ้น 4 ครั้ง) แม้แต่เส้นอัตราผลตอบแทน 2/10 วินาทีก็เห็น 40bp การแกว่งตัวระหว่างวัน และในความเป็นจริง CME ระงับการซื้อขายในสัญญา SOFR เดือนมิถุนายนรอบ NY เปิด ซึ่งเป็นเหตุการณ์ที่หายากมาก

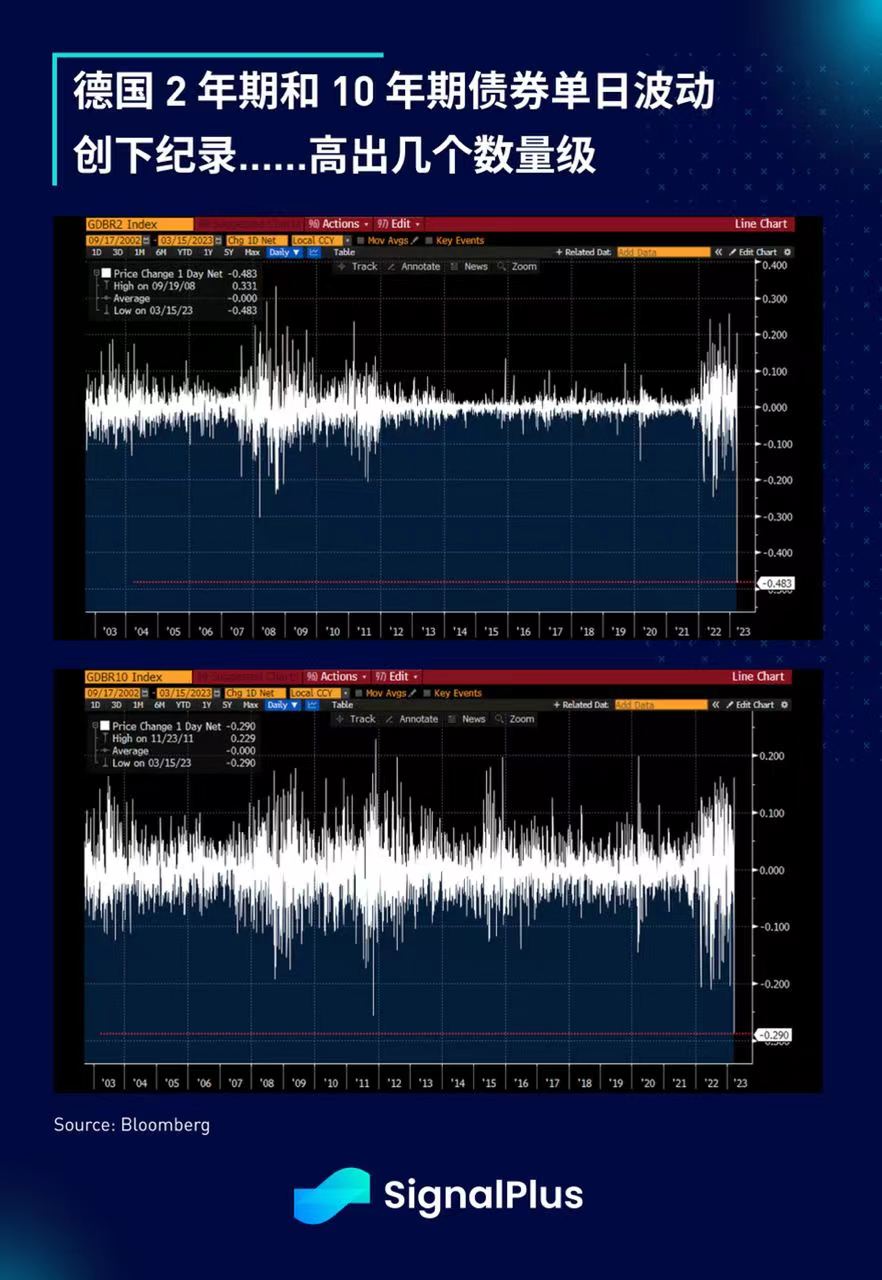

- ความลึกของตลาดพันธบัตรรัฐบาลเยอรมันพังทลายลงอย่างสิ้นเชิง สภาพคล่องลดลงเหลือ 25% ของระดับปกติ สเปรดราคาเสนอซื้อเกือบ 3-4 เท่าของปกติ อัตราผลตอบแทน 2 ปีลดลง 48 จุดพื้นฐานในวันนั้น และ 10 ปี อัตราผลตอบแทนลดลง 29 จุดพื้นฐาน ทั้งคู่สร้างสถิติในวันเดียวและแซงหน้าช่วงเวลาที่ผันผวนที่สุดในปี 2551 ได้อย่างง่ายดาย

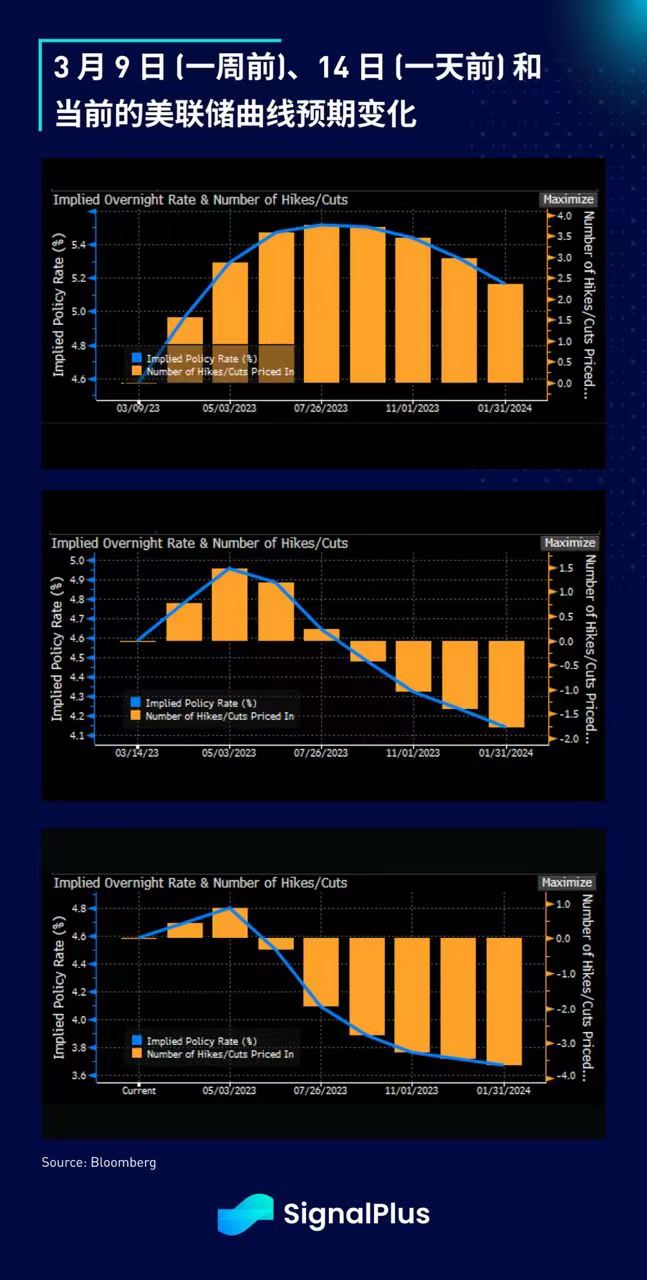

ธนาคารกลางยุโรปประกาศอย่างชัดเจนว่าจะต่อสู้กับเงินเฟ้อในเดือนกุมภาพันธ์ และข้อมูล CPI ที่ตามมาก็เพิ่มขึ้นอย่างคาดไม่ถึง ณ เวลานี้เมื่อสัปดาห์ที่แล้วตลาดยังคงกำหนดราคาว่าธนาคารกลางยุโรปจะขึ้นอัตราดอกเบี้ย 50 จุดพื้นฐานและดอกเบี้ยสิ้นสุด อัตราดอกเบี้ยอยู่ที่ประมาณ 4% ด้วยเหตุการณ์ SVB และ Credit Suisse (เพิ่มเติมในภายหลัง) อัตราดอกเบี้ยสุดท้ายได้ลดลงเหลือ 3% และ ECB ได้กลายเป็นธนาคารกลางแห่งแรกที่เผชิญกับการตัดสินใจนโยบายการเงินในสถานการณ์นี้

โดยพื้นฐานแล้ว อัตราเงินเฟ้อยังคงมีความยุ่งยาก แต่ความกังวลเกี่ยวกับความเสี่ยงเชิงระบบในภาคการธนาคารก็มีความสำคัญไม่แพ้กัน และทางการยังต้องรักษาสมดุลของความน่าเชื่อถือในการต่อสู้กับเงินเฟ้อและสงบสติอารมณ์เมื่อเผชิญกับแรงกดดันจากธนาคารในปัจจุบันเพื่อหลีกเลี่ยงการส่งข้อความผิด การแลกเปลี่ยน ในขณะที่การแสดงความเห็นอกเห็นใจในปริมาณที่เหมาะสมเพื่อแสดงให้เห็นว่าธนาคารกลางพร้อมที่จะปกป้องหากจำเป็นจริงๆ งานของ Tom Cruise นั้นง่ายกว่าความท้าทายที่ ECB เผชิญใน 24 ชั่วโมงข้างหน้าอย่างไม่ต้องสงสัย (รูปต่อไปนี้)

ขอให้ ECB โชคดี

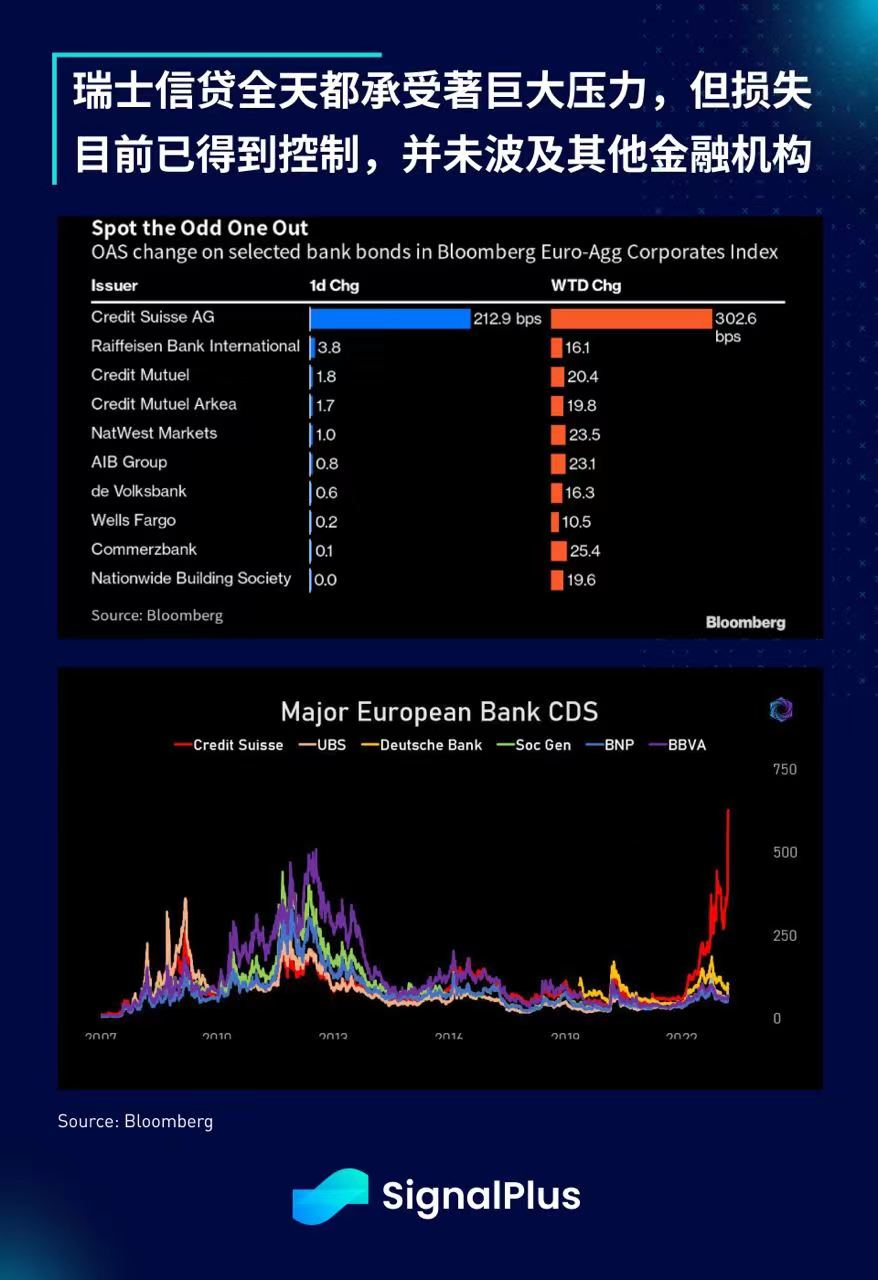

ล่าสุดที่ได้รับผลกระทบจากวิกฤตการธนาคารเมื่อวานนี้คือ Credit Suisse (CS) ซึ่งเผชิญกับความท้าทายมากมายในช่วงทศวรรษที่ผ่านมา และขณะนี้อยู่ภายใต้แรงกดดันอย่างรุนแรงจากคำถามเกี่ยวกับการสูญเสียพอร์ตการลงทุนและสภาพคล่อง โดยมีธนาคารและคู่ค้าในยุโรปบางแห่ง เปิดเผยต่อสาธารณชนถึงแผนการลดความเสี่ยงของคู่สัญญาต่อ CS ธนาคารรีบขอความช่วยเหลือจาก SNB (ธนาคารแห่งชาติสวิส) ซึ่งให้คำมั่นก่อนสิ้นสุดช่วงการซื้อขายเพื่อให้การสนับสนุน "สภาพคล่อง" หากจำเป็น ในขณะที่หุ้น CS ฟื้นตัวประมาณครึ่งหนึ่งของหุ้นของพวกเขา การขาดทุนในช่วงสิ้นสุดการซื้อขายช่วยดันหุ้นโดยรวม พันธบัตร CS และ CDS ยังคงอ่อนแอ และโชคดีที่ไม่เหมือนกับช่วง GFC ความเสี่ยงในการติดเชื้อยังคงอยู่ จนถึงขณะนี้ วิกฤตสินเชื่ออยู่ภายใต้การควบคุม วิกฤตสินเชื่อยังไม่ลุกลามไปยัง สถาบันการเงินอื่นๆ ในยุโรป และในขณะที่เขียนบทความนี้ ธนาคารเพิ่งประกาศว่าพวกเขาจะกู้ยืมเงินสูงถึง CHF 50 พันล้านจาก SNB เพื่อช่วยจัดการสภาพคล่องระยะสั้น

กลับไปที่สหรัฐอเมริกา ในส่วนของข้อมูล PPI ลดลง 0.1% ในเดือนกุมภาพันธ์ อ่อนแอกว่าที่คาดไว้ รายการส่วนประกอบทั้งหมดอ่อนแอลง และข้อมูลเดือนมกราคมก็ได้รับการแก้ไขเช่นกัน ข้อมูลยอดค้าปลีกในเดือนกุมภาพันธ์ลดลง 0.4% ข้อมูลการขายไม่รวมรถยนต์ ลดลง 0.1% แม้ว่าจะอ่อนแอกว่าที่คาดไว้ แต่ถูกชดเชยบางส่วนจากการปรับขึ้นอย่างรวดเร็วในเดือนธันวาคมและมกราคม และการเติบโตในกลุ่มควบคุมยังคงทรงตัวที่ 0.5% แม่ หลังการเปิดเผยข้อมูลยอดค้าปลีก แบบจำลอง GDPNow ของเฟดแอตแลนตาพุ่งขึ้นเป็น 3.15% จาก 2.63% ในสัปดาห์ที่แล้ว แต่ดัชนีภาคการผลิตของเฟดนิวยอร์กลดลงเหลือ -24.6 ซึ่งต่ำกว่าที่คาดการณ์ไว้อย่างมาก และหดตัวติดต่อกันเป็นเดือนที่ 4 โดยเฉพาะอย่างยิ่ง ในการจ้างงาน และคำสั่งซื้อใหม่อ่อนแอ ในทางกลับกัน ดัชนีตลาดที่อยู่อาศัยของ NAHB แตะระดับที่ดีที่สุดนับตั้งแต่เดือนกันยายน 2565 ซึ่งแสดงให้เห็นว่าตลาดที่อยู่อาศัยยังคงแข็งแกร่ง

ข้อมูลเศรษฐกิจที่ค่อนข้างขาดความดแจ่มใสและผลกระทบจากอัตราดอกเบี้ยในยุโรปส่งผลให้อัตราผลตอบแทนของกระทรวงการคลังสหรัฐฯ ลดลงอย่างมาก โดยฟิวเจอร์ส ED และ SOFR ที่มีวันที่สั้นนั้นดูเหมือน crypto altcoins มากกว่าหลักทรัพย์ของรัฐบาลในแต่ละวัน สัปดาห์ที่แล้ว ความน่าจะเป็นที่จะขึ้นอัตราดอกเบี้ย 50 จุดพื้นฐานสูงถึง 60% แต่เมื่อวานนี้ตลาดกำหนดราคาความน่าจะเป็นที่จะขึ้นอัตราดอกเบี้ย 25 จุดพื้นฐานในเดือนมีนาคมเพียงประมาณ 30% และอัตราดอกเบี้ยสิ้นสุดได้อย่างสมบูรณ์ ยุบตัว เส้นโค้งอัตราดอกเบี้ยคาดว่าจะเป็นช่วงต้นเดือนมิถุนายนเริ่มลดอัตราดอกเบี้ยและจะผ่อนปรนมากกว่า 100 จุดพื้นฐานก่อนวันคริสต์มาส อัตรากำลังถูกปรับราคาใหม่ด้วยความเร็วที่อธิบายไม่ได้ ในขณะที่เฟดกำลังถูกผลักเข้าสู่ภาวะที่กลืนไม่เข้าคายไม่ออกซึ่งต้องเลือกระหว่างอัตราเงินเฟ้อและความเสี่ยงทั้งระบบ

ตลาด crypto รู้สึกเหมือนเป็นโอเอซิสแห่งความสงบเมื่อเทียบกับการนองเลือดในตลาดตราสารหนี้ โดยเหรียญหลักไม่สามารถทำลายระดับสูงสุดและความผันผวนโดยนัยที่ปฏิเสธที่จะโอนเอน ความรู้สึกในการซื้อขายยังคงค่อนข้างมึนงงเมื่อเทียบกับปีที่ผ่านมา ผู้ค้าดูเหมือนจะไม่ค่อยเต็มใจที่จะจ่ายเบี้ยประกันภัยหลังจากผ่านช่วงเวลาที่ยากลำบากในตลาด และภาพมาโครยังคงท้าทาย ทำให้ผู้เข้าร่วมมีตัวเลือกในการซื้อขายที่ค่อนข้างอนุรักษ์นิยม ในด้านบวก Fidelity Crypto เพิ่งเปิดตัวอย่างเงียบ ๆ โดยนำเสนอบัญชีผู้ค้าปลีก 37 ล้านบัญชีซึ่งเป็นจุดเชื่อมต่อที่มีการควบคุมสำหรับสกุลเงินดิจิทัล ยิ่งกว่านั้น Cathie Wood ได้เปิดตัวกองทุน cryptocurrency แบบปลายเปิดใหม่ (ARK Crypto Revolutions) และ Circle ประกาศว่าพวกเขามีประสิทธิภาพ เคลียร์คำขอไถ่ถอนส่วนใหญ่จำนวน 3.8 พันล้านดอลลาร์ตั้งแต่เช้าวันจันทร์

หากคุณต้องการรับการอัปเดตทันที โปรดติดตามบัญชี Twitter ของเรา @SignalPlus_Web 3 หรือเข้าร่วมกลุ่ม WeChat ของเรา (เพิ่มผู้ช่วยขนาดเล็ก WeChat: Chillywzq), กลุ่ม Telegram และชุมชน Discord เพื่อสื่อสารและโต้ตอบกับเพื่อนมากขึ้น

Website: https://www. signalplus. com/