암호화 공간에서 다음 파괴적 혁신의 물결은 어디에서 올까요?

이 기사는 Substack이 기사는

, 원저자: Odaily 번역가 Katie Ku가 편집한 암호화 연구 기관 Messari의 전 분석가 Mason Nystrom.

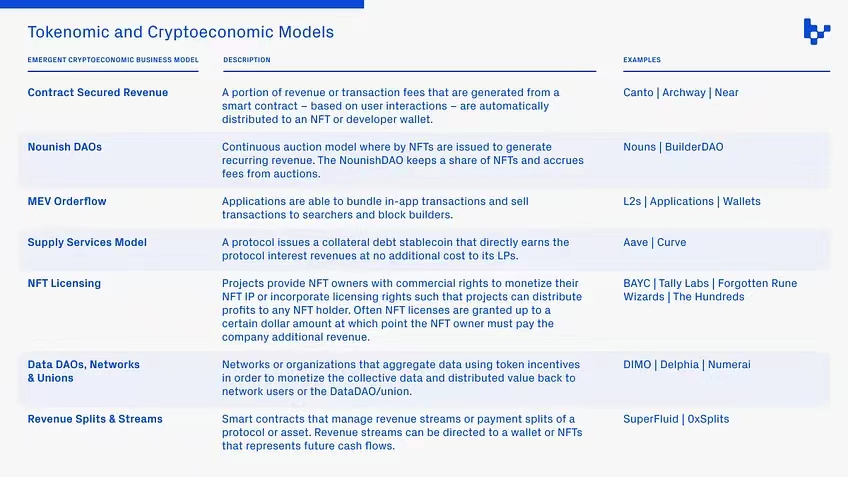

토큰 분배 메커니즘 및 암호 경제 모델 혁신(암호화 비즈니스 모델의 두 가지 구성 요소)의 새로운 추세에 초점을 맞춤으로써 다음 질문에 답할 수 있습니다. 암호 화폐의 파괴적 혁신의 다음 물결은 어디에서 올까요?

첫 번째 레벨 제목

토큰 분배 메커니즘과 암호 경제 모델은 어떻게 혁신을 주도합니까?

블록체인 네트워크는 토큰 배포 및 암호화 경제 모델을 위한 "빈 서판"을 제공합니다. 비트코인의 암호화 경제 모델인 작업 증명(Proof of Work)은 다양한 새로운 PoW 통화, 특히 Zcash 및 Ethereum을 탄생시켰습니다. Ethereum은 다양한 기술 혁신(예: 튜링 완전성, 스마트 계약 등)을 제공하지만 ICO)는 스마트 계약과 ERC-20 토큰 표준을 사용하여 신뢰 없이 참여자에게 토큰을 배포합니다. 이 토큰 배포 모델은 Web3의 개발에 매우 중요하므로 초기 거래소 제공, 초기 DEX 제공, 유동성 부트스트랩 풀(LBP), 자동화된 크라우드 펀딩 플랫폼(예: JuiceboxDAO) 등 핵심 개념의 추가 반복을 볼 수 있습니다.

NFT는 또 다른 흥미로운 기술 혁신이지만 SuperRare, Larva Labs 및 OpenSea와 같은 NFT 마켓플레이스를 배포하기 전까지는 NFT가 폭발적으로 증가한 온체인 로열티의 이전을 촉진하지 못했습니다.이더리움 확장성 솔루션의 차세대 물결은 ZK 시퀀싱, 증명, 인증 및 네트워크 가치 캡처를 장려하는 암호화 경제 모델의 설계 혁신에 의해 주도될 것입니다.

첫 번째 레벨 제목

암호화폐의 차세대 물결을 위한 경제 모델cryptocurrencies의 각 물결은 새로운 토큰 배포 메커니즘과 암호 경제 모델에 의해 지배됩니다. 세 가지 새로운 신흥 모델을 살펴보겠습니다.

계약 확보 수익(CSR), Nounish DAO 및 MEV 주문 흐름.

CSR은 Canto 네트워크의 비용 분담 모델로, 계약 개발자는 사용자가 계약과 상호 작용할 때 네트워크에 지불된 거래 수수료의 일정 비율을 가져가 수익을 얻을 수 있습니다.

보조 제목

계약 보안 수익 수수료 할당 모델(CSR)

계약 담보 소득 수수료 분배 모델은 스마트 계약을 사용하여 발생하는 수수료의 일부를 NFT 또는 주소(개발자 등)에 귀속시키는 것을 의미합니다. 이더리움에서는 스마트 계약과의 상호 작용에 대한 수수료가 소각되며 사용량을 생성하는 프로토콜은 애플리케이션별 거래(예: NFT 마켓플레이스 수수료)에서 발생하는 수익 외에 가치 창출에 대한 보상을 받지 못합니다. Canto와 같은 L1은 CSR을 핵심 요소로 사용하여 개발자와 경제 활동을 조정합니다. 중요한 것은 CSR NFT가 여러 스마트 계약(예: 서로 다른 버전의 계약이 포함된 스마트 계약)에서 특정 수수료를 추출할 수 있다는 것입니다.

Cosmos의 또 다른 L1인 Archway도 네트워크의 애플리케이션에 보상을 제공합니다. Archway는 가스 리베이트(개발자에게 50% 보상), 인플레이션 보상(앱 개발자에게 25% 보상) 및 스마트 계약 프리미엄(예: 맞춤 수수료)의 세 가지 구성 가능한 보상 분배 메커니즘을 제공합니다.

더 흥미로운 점은 이 모델이 수요 또는 사용 기반 수익의 일부가 제작자, 개발자 및 사용자와 같은 이해 관계자에게 가야 하는 모든 유형의 애플리케이션에 적용될 수 있다는 것입니다. TikTok의 크리에이터 펀드(크리에이터가 돈을 버는 방식의 큰 부분을 차지함)가 플랫폼의 조회수 또는 시청 시간에 따라 인플레이션 보상 또는 광고 수익의 일부를 콘텐츠 크리에이터에게 직접 할당하는 CSR 모델을 적용한다고 상상해 보십시오. CSR은 프로토콜 위에 구축된 애플리케이션을 더욱 조화시키는 비즈니스 모델을 제공합니다.

노니쉬 DAO 분배 방식

Nounish DAO 경매 모드 - Nouns DAO가 개척한 NFT 발행 방식. 그러나 최근에는 Nounish 배포 방식을 채택한 NFT 프로젝트의 물결을 목격하여 기한 없이 하루에 여러 개의 NFT를 출시했습니다. 이러한 프로젝트는 Nounish DAO 유형입니다.

텍스트

NFT 로열티가 불확실한 미래에 직면함에 따라 두 가지 중요한 질문이 떠오릅니다. NFT의 꾸준한 수입은 어디에서 나올 것이며 최고의 NFT 비즈니스 모델은 무엇입니까? Nounish DAO는 Nouns 경매 모델을 활용하여 NFT를 지속적으로 판매하는 프로젝트로, 공동의 목표로 통합되거나 자본 형성 및 분배를 중심으로 조정할 수 있는 커뮤니티 내의 소규모 커뮤니티에 모델을 제공합니다. Nouns Generator를 사용하면 누구나 몇 분 안에 Nounish DAO를 만들 수 있으며 출시 이후 수십 개의 새로운 Nounish DAO 생성을 지원했습니다.

아마도 가장 주목할 만한 것은 명사 생성기로 구축된 초기 Nounish DAO 중 다수가 더 많은 명사 밈을 만드는 데 집중하지 않고 대신 다음 세 가지 예와 같이 혁신을 통해 다른 출구를 찾았다는 것입니다.

ArtHaus - 아티스트와의 작업에 중점을 둔 Nounish DAO가 ArtHaus DAO에서 시작됩니다.

Spores — 온체인 음악을 위한 차세대 믹싱 장치를 만드는 데 중점을 둔 Nounish DAO

BLVKHVND - 프로 세계 챔피언이 된 최초의 DAO가 이제 Nounish 모드로 전환되었습니다.

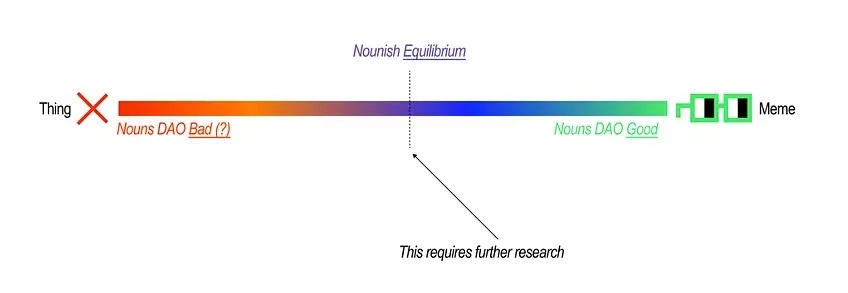

명사 메커니즘은 모든 유형의 조직에 적합하지 않습니다. NFT 마켓플레이스 Zora와 Nouns Generator의 공동 설립자인 Jacob Horne은 Nouns 모델이 특정 애플리케이션이 아닌 범용 목적에 적용될 때 가장 효율적이라는 가설을 세웠습니다. 이 가정의 핵심 구성 요소는 Nounish DAO가 광범위한 목표를 달성하기 위한 경쟁 접근 방식에 자금을 지원할 수 있을 때 가장 효과적이며 특정 목표를 위해 특정 방식으로 적용될 때 일반적으로 덜 효과적이라는 것입니다.

광범위하고 구체적인 목표에 대한 다음 예를 들어 보십시오.

명사 밈 추가 VS 명사 영화 만들기

재생 가능한 인프라 구축 VS 태양광 발전소 건설

탄소 소비 VS 탄소배출권 구매

Nounish DAO에는 몇 가지 기존 유형 사용 사례가 있습니다.

브랜드, 밈 및 IP

회원 정책

귀표 또는 투자

Nounish DAO 모델이 모듈화됨에 따라 비CC0 IP(다른 브랜드 및 IP용), 최소 NFT 구매(더 큰 자금 필요용), 분할(예: 다른 DAO 간에 자금 공유) 등을 제공하기 시작했습니다. 이러한 추가 및 더 광범위한 시도는 Nounish 모델을 활용하는 커뮤니티 및 DAO의 범주를 확장할 것입니다.

보조 제목

MEV 주문 흐름/PFTF(거래 흐름에 대한 지불)

MEV가 여러 이해 관계자(즉, 검색자, 블록 빌더 및 제안자)로 분할되기 때문에 사용자(및 따라서 트랜잭션 흐름)를 제어하는 애플리케이션은 사용자 트랜잭션을 묶고 개인 Meme 풀(메모리 풀)이 검색자에게 판매되는 방식으로 저장할 수 있습니다. 그리고 블록 빌더.

MEV는 암호화폐의 필수적인 부분이 될 것입니다. 애플리케이션 및 프로토콜이 제품 결정을 내릴 때 MEV를 고려함에 따라 MEV가 보장된 수익원 및 신흥 비즈니스 모델의 핵심 구성 요소로서 점점 더 중요해지고 있음을 알 수 있습니다.

보조 제목

더 나은 Web3 비즈니스 모델을 향하여사실 Web3는 획기적인 비즈니스 모델을 아직 표준화하지 못했습니다.오늘날 가장 성공적인 애플리케이션은 Web2의 트랜잭션 기반 모델(DEX, 마켓플레이스 등)에 의존합니다. 이러한 모델은 여전히 인기가 있고 수익성이 있을 가능성이 높지만 프로그래밍과 가치를 토큰화하는 능력은 새로운 비즈니스 모델의 잠재력도 가져옵니다.