บทความนี้จะสำรวจกรอบการอยู่รอดของ Web3

การรวบรวมต้นฉบับ: บล็อกยูนิคอร์น

การรวบรวมต้นฉบับ: บล็อกยูนิคอร์น

รับทราบเรื่องงี่เง่าทั้งหมดที่เกิดขึ้นในพื้นที่สินทรัพย์ดิจิทัล และเหตุผลที่เราทำ นอกจากนี้ ยังเป็นความพยายามของฉันในการพิจารณาว่าอุตสาหกรรมจะมุ่งไปทางไหนต่อไป และสิ่งนี้ก็สอดคล้องกับพวกคุณหลายคน

จากที่กล่าวมา ฉันได้วางกรอบการทำงานสำหรับสิ่งต่อไปสำหรับสตาร์ทอัพและ VC ในอุตสาหกรรม มันขึ้นอยู่กับแบบจำลองทางความคิดที่ฉันใช้เพื่อคิดว่าธุรกิจใดมีแนวโน้มที่จะเริ่มต้นที่จุดต่ำสุดของตลาดหมี และฉันต้องการใช้เวลากับมันในอีกไม่กี่ไตรมาสข้างหน้า

ในเดือนมีนาคม 2022 ฉันได้เขียนเกี่ยวกับทฤษฎีการรวมตัวและการนำไปใช้กับ Web3 สิ่งนี้จะทำให้ธุรกิจรุ่นใหม่สามารถสร้างและขยายขนาดด้วยความเร็วที่ไม่เคยมีมาก่อน คิดถึงโอเพ่นซี ไม่มีทีมใดยืนยันว่า Boring Ape ทุกตัวที่ขายบนแพลตฟอร์มเป็นของแท้ ตราบใดที่มีสัญญาอัจฉริยะที่ถูกต้องเข้ามาเกี่ยวข้อง ก็จะไม่ต้องกังวลเรื่องธุรกรรมสินทรัพย์ที่ซ้ำกัน

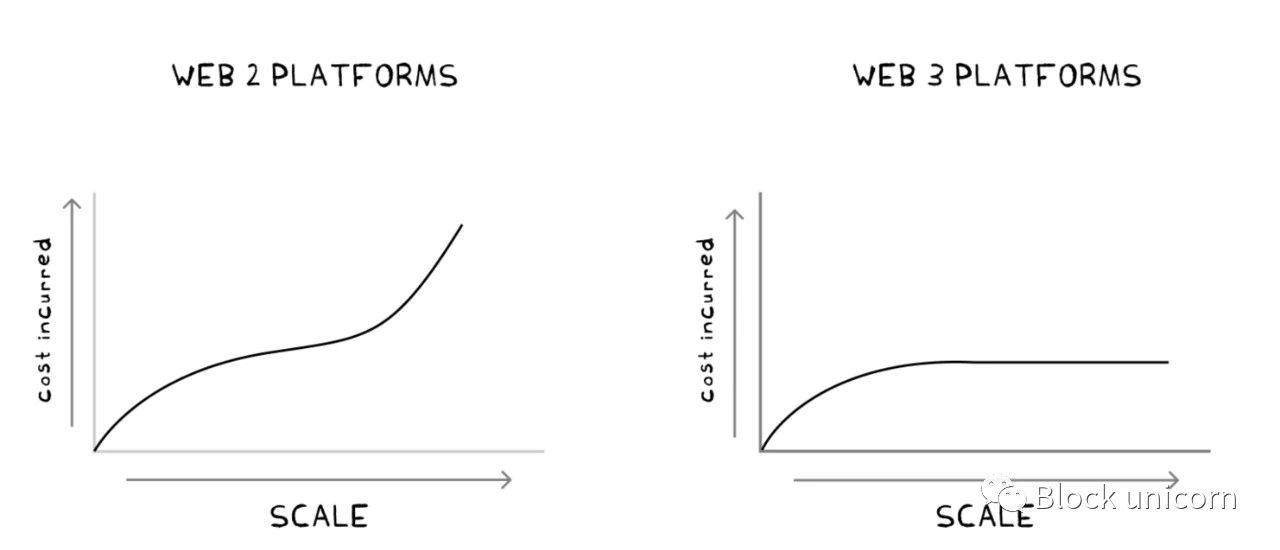

ในตลาดแบบดั้งเดิม เช่น Amazon หรือตลาดโฆษณาของ Facebook ต้นทุนส่วนเพิ่มของการโต้ตอบกับตลาดใหม่แต่ละครั้งจะเพิ่มขึ้นเมื่อมีผู้ใช้เข้ามาที่แพลตฟอร์มมากขึ้น เนื่องจากมีโอกาสเกิดการฉ้อโกงสูง แม้แต่ในสินค้าอุปโภคบริโภคดิจิทัล เช่น การสตรีมเพลง (บน Spotify) หรือการขายสินค้าในเกมผ่าน Steam ต้นทุนส่วนเพิ่มจะเพิ่มขึ้นตามจำนวนผู้ใช้ เมื่อแพลตฟอร์มมีผู้ใช้ 10,000 คน การตรวจสอบการฉ้อโกงที่คุณทำจะแตกต่างอย่างมากจากสิ่งที่แพลตฟอร์มที่มีผู้ใช้ 1 ล้านคนต้องการ และบล็อกเชนมีแนวโน้มที่จะบีบต้นทุนให้เหลือศูนย์

แผนภูมิด้านบนแสดงต้นทุนของแพลตฟอร์มที่ใช้อินเทอร์เน็ตทั่วไปในช่วงทศวรรษที่ผ่านมา ประการแรก มีการสะสมต้นทุนเริ่มต้นในการสรรหา พัฒนา และจัดหาผู้ใช้ จากนั้น เมื่อมีการเพิ่มผู้ใช้ในโปรแกรมที่มีอยู่มากขึ้นเรื่อยๆ ค่าใช้จ่ายก็จะลดลง ในที่สุด เมื่อถึงจุดวิกฤตในการรักษาส่วนแบ่งการตลาดสัมพัทธ์ การเผาผลาญเงินสดจะเร่งขึ้น

สำหรับแพลตฟอร์ม Web3 เช่น Uniswap ค่าใช้จ่ายเริ่มต้นอยู่ที่การปรับใช้โค้ดและการตรวจสอบ ผู้ใช้แบกรับค่าใช้จ่ายในการเพิ่มสภาพคล่องให้กับพูล ดังนั้นจึงไม่มีต้นทุนส่วนเพิ่มเพิ่มขึ้นเมื่อแพลตฟอร์มขยายตัว dApps ที่เกี่ยวข้องกับ Blockchain มีลักษณะเฉพาะในต้นทุนส่วนเพิ่ม (เทียบกับเงินร่วมลงทุน) มีแนวโน้มที่จะคงที่ไม่ว่าจะมีธุรกรรมเกิดขึ้นกี่ล้านรายการก็ตาม

อย่างไรก็ตาม เมื่อสร้างแอปพลิเคชันแรกที่ใช้บล็อกเชน มีความเสี่ยง นั่นคือสภาพคล่อง สตาร์ทอัพส่วนใหญ่แข่งขันกันเพื่อแย่งชิงทรัพยากรจากสองแหล่ง หนึ่งคือความสนใจ และอีกอย่างคือทุน แพลตฟอร์มสื่อ web2 แบบดั้งเดิมแฮ็คเข้าสู่หัวหรือกระเป๋าเงินของคุณผ่านเอฟเฟกต์เครือข่ายอันทรงพลัง เมื่อฐานผู้ใช้ของพวกเขามีจำนวนถึงระดับวิกฤต ผู้คนจะถูกบังคับให้สมัครใช้งานแพลตฟอร์มอย่าง Facebook หรือ WhatsApp เพราะการไม่มีส่วนร่วมจะทำให้พลาดการอัปเดตหรือกิจกรรมที่สำคัญ ชานชาลาเหล่านี้กลายเป็นจัตุรัสกลางเมืองที่ทุกสิ่งที่เกิดขึ้นในโลกสามารถมองเห็นได้ ประตูสู่อารยธรรม (และการล่มสลายของอารยธรรมในที่สุด)

แต่บริษัทต่างๆ เช่น Meta สามารถสร้างกระแสความสนใจได้เนื่องจากผู้ใช้สามารถเข้าสู่ระบบได้อย่างง่ายดาย (ฉันใช้คำว่า "ความลื่นไหล" เพื่ออ้างถึงระยะเวลาที่ผู้ใช้ใช้ในแอป) ตัวอย่างเช่น WhatsApp แทบจะไม่ต้องการให้ผู้คนมีที่อยู่อีเมลเพื่อเข้าร่วม สิ่งนี้มีบทบาทสำคัญในตลาดเกิดใหม่อย่างอินเดีย ซึ่งหมายเลขโทรศัพท์เป็นรูปแบบเดียวของข้อมูลประจำตัวดิจิทัลที่ผู้ใช้มี

ชื่อระดับแรก

ปัญหาสาธารณะ

เมื่อเปรียบเทียบกับแอปพลิเคชัน Web3 ในปัจจุบัน มันซับซ้อนมากในการสับเปลี่ยนเชน วอลเล็ต และเว็บอินเตอร์เฟส ก่อนที่ผู้ใช้จะได้รับสิ่งที่ต้องการ สิ่งนี้ยอมรับได้หากคุณกำลังกำหนดเป้าหมายไปยังกลุ่มเฉพาะที่ยอมทนทุกข์เพราะไม่มีทางเลือกอื่น ตัวอย่างเช่น Stablecoins ให้ประสบการณ์ผู้ใช้ในตลาดเกิดใหม่ที่ดีกว่าธนาคารซึ่งดำเนินการช้าเกินไป

แต่ถ้าคุณต้องการปรับขนาดผู้ใช้หลายสิบล้านคน สถานการณ์จะแตกต่างออกไป ความท้าทายที่ Dapps ส่วนใหญ่ต้องเผชิญในปัจจุบันคือพวกเขากำลังแข่งขันกันเพื่อแย่งชิงส่วนแบ่งหุ้นในระบบนิเวศแบบกระจายศูนย์ ซึ่งปัจจุบันจำนวนผู้ใช้ Web3 ทั้งหมดมีน้อยกว่า 10% ของระบบนิเวศอินเทอร์เน็ตแบบดั้งเดิม

นักวิจัยพบว่า dApps ในปัจจุบันดึงดูดเฉพาะผู้ใช้ที่สนใจในความผันผวนและความเสี่ยงเท่านั้น นี่อาจเป็นจริง แต่การสะท้อนกลับนี้ทำงานได้สองวิธี 1) เมื่อราคามีแนวโน้มสูงขึ้น ผู้คนหลั่งไหลเข้ามาซื้อขายกัน 2) เมื่อตลาดล่ม ผู้คนสูญเสียเงินและออกจากอุตสาหกรรมนี้โดยสิ้นเชิง แอปที่ผู้บริโภคเผชิญกับความผันผวนมากเกินไปซึ่งไม่คำนึงถึงผลประโยชน์สูงสุดของผู้บริโภคนั้นไม่ยั่งยืนในตลาดหมี ความคลั่งไคล้ในการเก็งกำไรที่เก็งกำไรผลิตภัณฑ์เหล่านี้เป็นการแฮ็กชั่วคราวที่เพิ่มคุณค่าให้กับผู้ถือโทเค็นแบบสุ่ม

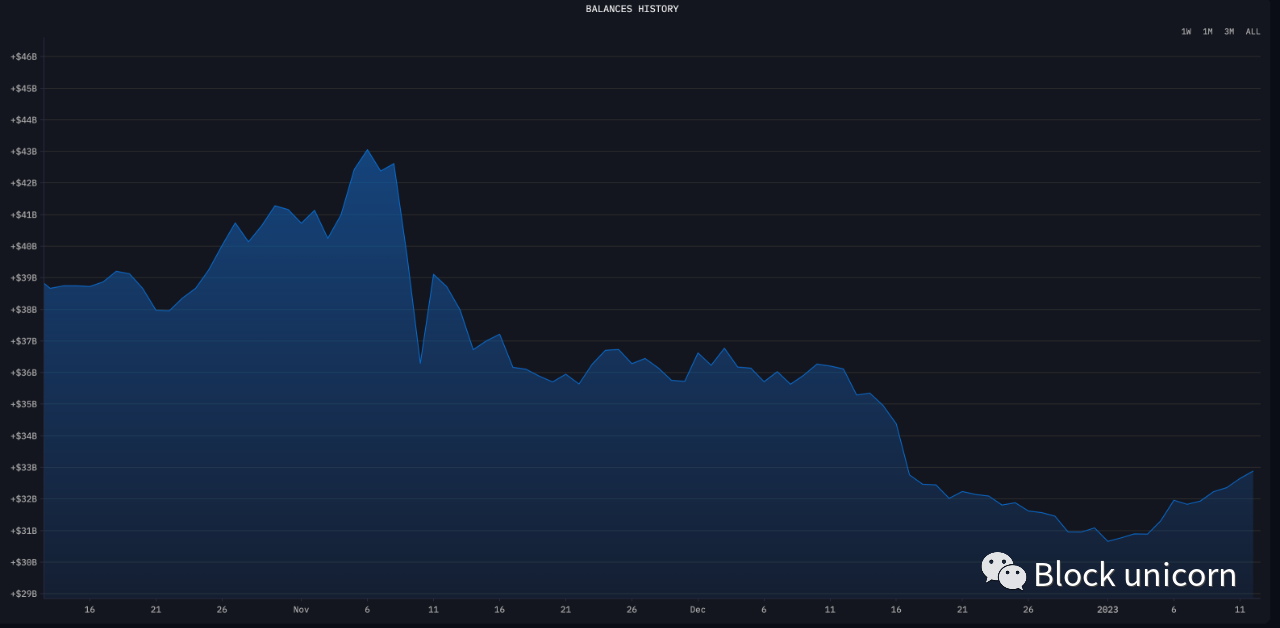

การเพิกเฉยต่อความง่ายดายในการหนีเงินทุนในบริบทของสินทรัพย์ดิจิทัลคือจุดจบของ dApps สำหรับขนาด Binance มีเงิน 3 พันล้านดอลลาร์จากยอดคงเหลือใน 24 ชั่วโมง (Nansen 14 ธ.ค.) ตลาดหมีเช่นเดียวกับที่เราอยู่ในขณะนี้สามารถฆ่าสตาร์ทอัพได้เนื่องจากความไม่แยแสของผู้บริโภคเป็นเวลานานก่อนที่จะถูกแฮ็กหรือขาดเงินทุน

ชื่อระดับแรก

ต่อสู้กับความไม่แยแส

ตลาดเป็นลูกตุ้มที่แกว่งไปมาระหว่างช่วงเวลาแห่งความตื่นเต้นและช่วงเวลาแห่งความไม่แยแส วัฏจักรของตลาดกระทิงและตลาดหมีเป็นการวัดเชิงปริมาณของความรู้สึกของมนุษย์ แต่ยังมีวิธีที่แตกต่างกันในการแสดงวัฏจักรของตลาด: ระหว่างช่วงเวลาของการรวมและการคลายการรวมกลุ่ม ซึ่งทั้งสองอย่างนี้เป็นอาการเมาค้างจากความผันผวนของความสนใจของผู้บริโภค ให้ฉันอธิบาย

ทฤษฎีการรวมเชื่อว่าการรวมฐานผู้ใช้ขนาดใหญ่เข้าด้วยกันสามารถลดต้นทุนช่องทางการขายและทำให้รูปแบบธุรกิจใหม่เช่น OpenSea เป็นไปได้ การแยกเป็นสิ่งที่ตรงกันข้ามกับทฤษฎีการรวมตัว ในช่วงเวลานี้ ผู้ก่อตั้งแทนที่จะมุ่งเน้นไปที่กลุ่มธุรกิจเฉพาะกลุ่มที่มีฐานผู้ใช้ที่เหนียวแน่น แทนที่จะหมกมุ่นอยู่กับจำนวนผู้ใช้ที่เพิ่มขึ้นในช่วงที่ตลาดไม่แยแส

ต้นทุนการจัดจำหน่ายเพิ่มขึ้นเมื่อคุณมีฐานผู้ใช้ขนาดเล็ก ซึ่งหมายความว่าสตาร์ทอัพต้องสามารถบีบเงินจากผู้ใช้แต่ละรายได้มากขึ้น หากพวกเขาหวังว่าจะอยู่รอดในตลาดหมี (CAC และ LTV ในสำนวนของ Silicon Valley) วิธีที่จะทำให้แน่ใจว่าผู้ใช้แต่ละรายได้เพิ่มรายได้ของคุณคือการตัดออกทั้งหมด"ดี"ส่วนที่เน้นความพึงพอใจของผู้ใช้ที่มีอยู่หมกมุ่นอยู่กับผู้ใช้ไม่กี่คนที่ยินดีจ่ายมากกว่า

การเติบโตของอินเทอร์เน็ตมีตัวอย่างมากมายเกี่ยวกับเรื่องนี้ Amazon ยุติการค้าอย่างที่เราทราบ แต่มันเริ่มต้นจากความหลงใหลในการช่วยเหลือผู้สนใจซื้อหนังสือออนไลน์ แล้วเฟสบุ๊คล่ะ? แต่ตัวอย่างเดิมคือการให้นักเรียน Ivy League ให้คะแนนเพื่อนนักเรียน และแน่นอนว่ามันสามารถนำมาใช้เพื่อโค่นล้มรัฐบาลและเผยแพร่โฆษณาชวนเชื่อในปัจจุบันได้ แล้ว Netflix ล่ะ? งบประมาณการผลิตของพวกเขามากกว่างบประมาณด้านการศึกษาในอินเดียในปัจจุบัน แต่พวกเขาเริ่มต้นด้วยการมุ่งเน้นที่การส่งดีวีดีถึงบ้าน คุณรู้ไหมว่าฉันกำลังพูดถึงอะไร

มีเหตุผลสำหรับสิ่งนี้ ผลิตภัณฑ์ที่เน้นจุดปวดจุดเดียวโดดเด่นเร็วกว่า เมื่อบริษัทมุ่งเน้นไปที่ชุดย่อยของคุณสมบัติเท่านั้น จะช่วยลดการใช้เงินสด และเมื่อบางสิ่งเป็นเรื่องง่าย การได้ลูกค้าใหม่ก็เกิดขึ้นเอง นี่คือขั้นตอนของการทำซ้ำอย่างรวดเร็วของผลิตภัณฑ์ เมื่อเวลาผ่านไป เนื่องจากผลิตภัณฑ์มีการปรับปรุงอย่างต่อเนื่อง ผู้ใช้จึงเสนอผลิตภัณฑ์ที่พวกเขาต้องการเพิ่มลงในผลิตภัณฑ์"ทำได้ดีนี่"。

สิ่งนี้แสดงให้เห็นในวัฏจักรตลาดหมีสองสามรอบที่ผ่านมา ในช่วงเริ่มต้น Nansen มุ่งเน้นไปที่การอนุญาตให้ผู้ใช้ติดตามกระเป๋าเงินและการโอนโทเค็น จากนั้นพวกเขาได้ขยายไปสู่ DAO, NFT และโลกหลายเครือข่าย เดิมที Binance เป็นสถานที่สำหรับการซื้อขายแบบสปอต ตั้งแต่นั้นมา Binance ได้ขยายไปสู่เศรษฐกิจเชิงนิเวศของอุตสาหกรรมโดยสนับสนุนการซื้อขายตราสารอนุพันธ์ และ OTC, เกม, VC และธุรกิจอื่นๆ ในท้ายที่สุด CoinMarketcap และ CoinGecko เริ่มต้นจากการเป็นแพลตฟอร์มที่ให้ข้อมูลราคาโทเค็น วันนี้คุณเปิด CoinGecko และคุณเห็นว่าพวกเขาขยายตัวอย่างไรในอนาคตเพื่อเป็นเทอร์มินัลการซื้อขาย ผู้จัดการพอร์ตโฟลิโอ ศูนย์วิจัย และผู้ให้บริการ API คุณเข้าใจการเปลี่ยนแปลงของเทรนด์หรือไม่?

ธุรกิจ DeFi จำนวนหนึ่งได้นำกลยุทธ์เดียวกันนี้ไปใช้ ตัวอย่างเช่น Curve เริ่มต้นจากการเป็นผู้ดูแลสภาพคล่องอัตโนมัติโดยมุ่งเน้นที่ Stablecoin เพียงอย่างเดียว การแลกเปลี่ยนบนพื้นฐาน AMM นี้ได้กลายเป็นหนึ่งในสถานที่ที่ดีที่สุดสำหรับการแลกเปลี่ยนเหรียญ Stablecoin มูลค่าหลายล้านเหรียญ โดยมีการคลาดเคลื่อนของธุรกรรมต่ำ แม้กระทั่งการแลกเปลี่ยนแบบรวมศูนย์เช่น FTX ด้วยการมุ่งเน้นไปที่ประเภทธุรกิจเฉพาะเจาะจง พวกเขาหลีกเลี่ยงการเผชิญหน้ากันกับ Uniswap ซึ่งกำลังขยายไปสู่หางยาวของสินทรัพย์ที่ไม่แสดง

แต่ธุรกิจเหล่านี้ (หรือ dApps) จะยังคงรวมกันอยู่หรือไม่ มันไม่เป็นความจริง. เมื่อมีสภาพคล่องเพียงพอ—ไม่ว่าจะเป็นความสนใจหรือเงินทุน—เข้ามาในผลิตภัณฑ์ ทีมงานอาจเพิ่มคุณสมบัติย่อยอื่นๆ เพื่อรักษาผู้ใช้ในระบบนิเวศให้ดียิ่งขึ้น ในกรณีของ Aave พวกเขาเริ่มให้ยืมผลิตภัณฑ์เร็วมาก เมื่ออาจมีผู้เล่นที่น่าเชื่อถือห้าคนไล่ตามโอกาส พวกเขาได้รวมฟังก์ชันการซื้อขายสินทรัพย์ไว้ในอินเทอร์เฟซ AAVE และภายในเดือนสิงหาคม 2565 พวกเขาวางแผนที่จะเปิดตัว Stablecoin ในตลาด

ชื่อระดับแรก

บทบาทของการแบ่งเลเวอเรจ

สิ่งที่ฉันพูดจนถึงตอนนี้ไม่มีทฤษฎีใดที่ผ่านการทดสอบอย่างสมบูรณ์ เป็นเรื่องปกติที่ผู้ก่อตั้งควรลด CAC (ต้นทุนการได้มาซึ่งลูกค้า) และมุ่งเน้นไปที่การสร้างเครื่องมือที่สำคัญ ทั้งหมดที่ฉันทำไปแล้วคือให้แบบจำลองทางความคิดและยกตัวอย่างว่าการแยกส่วนทำงานอย่างไรในอดีต แต่ถ้าคุณคิดว่า ฉันควรจะมุ่งเน้นไปที่การแบ่งสิ่งที่ฉันกำลังสร้าง เนื่องจากฉันไม่มี PMF (ข้อมูลเกี่ยวกับความต้องการของผู้ใช้) คุณจะดำเนินการอย่างไร

ชื่อระดับแรกการเริ่มต้นทั้งหมดกำลังได้รับความสนใจและเงินทุน

ประสิทธิภาพของเงินทุน

ฉันเชื่อว่าในบริบทของการเริ่มต้นที่ใช้เงินทุนมาก เช่น DeFi การถอดประกอบผลิตภัณฑ์สามารถทำได้โดยการทำให้ผลิตภัณฑ์มีต้นทุนที่คุ้มค่ามากขึ้น ข้อโต้แย้งพื้นฐานคือผู้บริโภคจะไปที่ตลาดด้วยต้นทุนที่ต่ำที่สุด หากคุณสามารถทำซ้ำฟีเจอร์เพื่อลดต้นทุนได้ มันจะดึงดูดผู้ใช้

ฉันใช้ "ประสิทธิภาพของเงินทุน" เป็นเมตริก - การวัดว่าธุรกิจต้องใช้เงินทุนเท่าใดจึงจะขยายขนาดได้โดยไม่มีคอขวด (TVL) หากยอดขาย 100 ล้านดอลลาร์ต้องใช้เงินฝากผู้ใช้ 1 พันล้านดอลลาร์ แสดงว่าคุณมีเครื่องเพิ่มหนี้ การให้สิ่งจูงใจในรูปแบบของโทเค็นสามารถรวบรวมเงินทุนจากผู้ใช้ได้ แต่นั่นหมายความว่าธุรกิจอาจถูกแฮ็คโจมตีสัญญาอัจฉริยะ

มีตัวอย่างบางอย่างในอุตสาหกรรมนี้ เช่น ผลิตภัณฑ์เช่น 0x Matcha (การรวม DEX) และ Hashflow (l คือ DEX ที่ป้องกัน MEV และไม่มีการเลื่อนหลุดเป็นศูนย์) มุ่งเน้นที่การปกป้องผู้บริโภคจาก MEV (ค่าที่สกัดได้ของเครื่องมือขุด) ดังนั้น พวกเขาสามารถเสนอราคาที่ดีกว่า Binance สำหรับคำสั่งซื้อจำนวนมากที่แปลง ETH เป็น USDC แม้จะมีความเสี่ยงจากการรวมศูนย์ก็ตาม

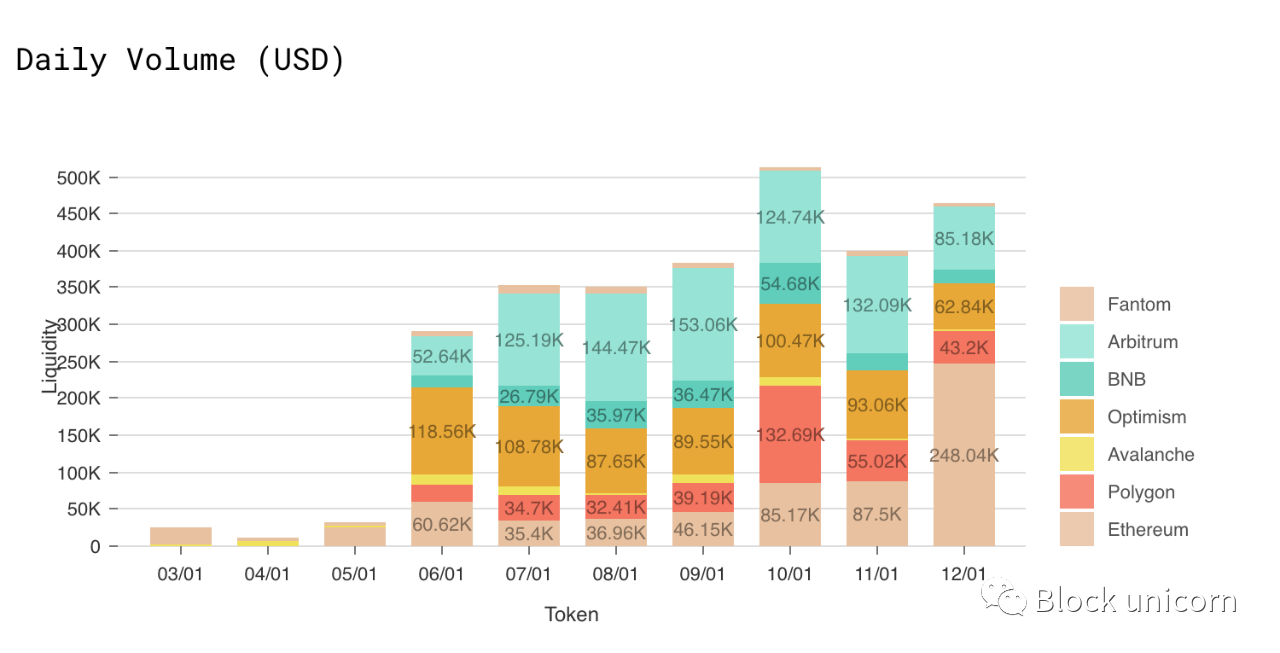

Hashflow ทำธุรกรรมเสร็จสิ้นสะสมเกือบ 1.2 หมื่นล้านดอลลาร์ โดยเป็นสถานที่ที่ดีที่สุดในการแปลงสินทรัพย์จำนวนจำกัด ในทางตรงกันข้าม Uniswap แสวงหาสินทรัพย์ระยะยาวด้วยมูลค่าหลักทรัพย์ตามราคาตลาดที่น้อยลงผ่านโมเดลผู้ดูแลสภาพคล่องอัตโนมัติ (AMM)

เช่นเดียวกับสะพานบล็อกเชนซึ่งมักถูกแฮ็ก และมีหลักฐานเพียงพอที่จะบ่งชี้ว่าการถือครองสัญญาอัจฉริยะบล็อกเชนมูลค่าหลายพันล้านดอลลาร์อาจไม่ใช่ความคิดที่ดี มีตัวเลือกอื่น ๆ ในอุตสาหกรรมนี้เช่นกัน ตัวอย่างเช่น Hyphen (แอปพลิเคชันสะพานข้ามโซ่) ของ Biconomy (โครงสร้างพื้นฐานสะพานข้ามโซ่) ได้ให้บริการปริมาณธุรกรรม 178 ล้านเหรียญสหรัฐสำหรับผู้ใช้มากกว่า 54,000 ราย และล็อคเฉพาะในสมาร์ทเท่านั้น สัญญา 3 ล้านเหรียญ

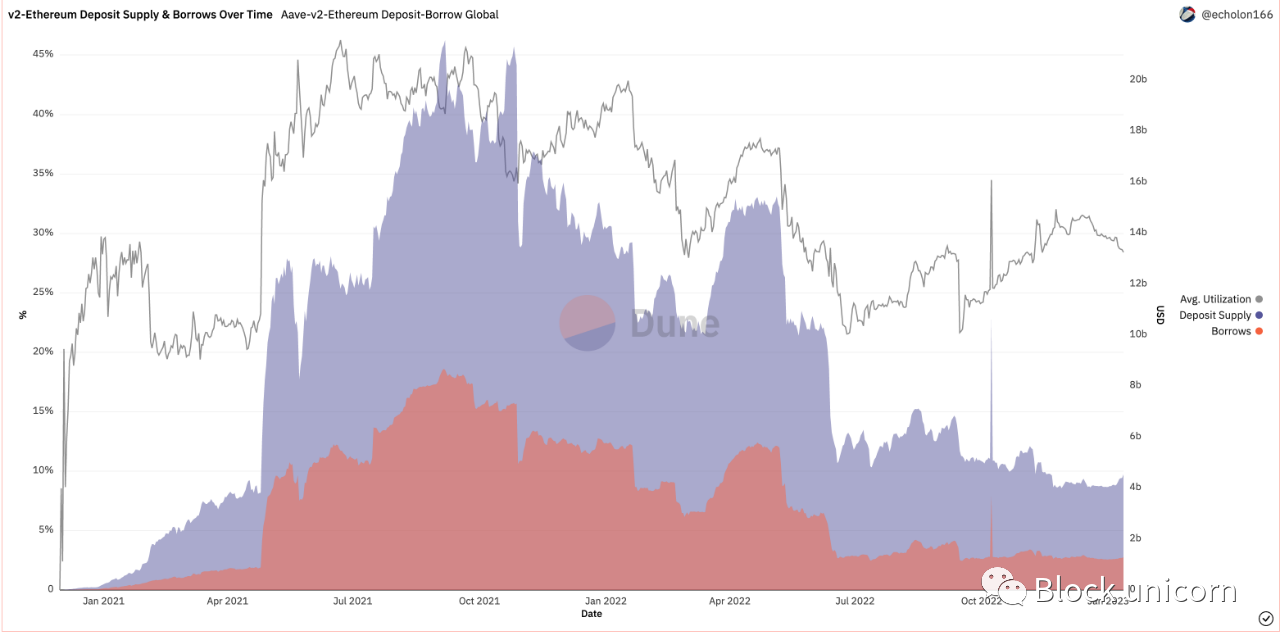

สิ่งที่เกี่ยวกับการยืม? แน่นอนว่าการวางเงินหลายพันล้านดอลลาร์ในข้อตกลงที่ให้ผลตอบแทนน้อยกว่าบัญชีธนาคารนั้นฟังดูไม่สมเหตุสมผล แต่นั่นคือจุดที่เราอยู่ในขณะนี้ เพราะในช่วงเวลาที่มีความผันผวนต่ำ ความต้องการยืมมักจะน้อยลง หากกองทุนจำนวนมากที่ให้ยืมไม่มีการใช้งาน อัตราผลตอบแทนของโปรโตคอลจะลดลง

ตัวชี้วัดหนึ่งที่ใช้วัดคือการใช้งานโดยเฉลี่ย มันหมายถึงจำนวนเงินที่ยืมหารด้วยทุนทั้งหมดที่ฝาก บนแพลตฟอร์มเช่น Aave การใช้งานโดยเฉลี่ยในช่วงไม่กี่ปีที่ผ่านมาอยู่ที่ประมาณ 30%

ผลิตภัณฑ์การให้ยืม DEFI ดั้งเดิมที่ใหม่กว่า เช่น Gearbox มีอัตราการใช้เงินทุนสูงถึง 70% แน่นอนว่าผลิตภัณฑ์เหล่านี้เป็นสองผลิตภัณฑ์ที่แตกต่างกันซึ่งไม่สามารถเปรียบเทียบได้ เนื่องจากผลิตภัณฑ์หนึ่งเป็นผลิตภัณฑ์ให้ยืม และอีกผลิตภัณฑ์หนึ่งให้หลักประกัน และความสามารถในการให้ผลตอบแทนแก่กลุ่มเงินทุนที่ใหญ่ขึ้นจะเริ่มมีความสำคัญมากขึ้นในอีกไม่กี่เดือนข้างหน้า หากคุณเป็นผู้ก่อตั้ง การพิจารณาการเปลี่ยนแปลงสายผลิตภัณฑ์ที่มีอยู่อาจช่วยลดต้นทุนให้กับลูกค้าหรือปรับปรุงผลตอบแทนให้กับลูกค้าได้เมื่อการเก็งกำไรเกี่ยวกับผลิตภัณฑ์ไม่สมเหตุสมผล มีเพียงสองสิ่งเท่านั้นที่สำคัญ (ลดต้นทุนให้กับลูกค้าและเพิ่มผลกำไร)

ส่วนประสิทธิภาพเงินทุนจะมีความเกี่ยวข้องมากยิ่งขึ้นเมื่อพูดถึงแอปพลิเคชันที่ตอบสนองผู้บริโภค เพราะคุณกำลังแข่งขันกับเศรษฐศาสตร์หน่วยของธนาคารแบบดั้งเดิมและบริษัทฟินเทค ผู้ใช้ไม่สามารถเปลี่ยนได้ เว้นแต่จะมีค่าใช้จ่ายเพิ่มขึ้น

เราได้เห็นสิ่งนี้เกิดขึ้น VC เช่น Moonpay และ On-meta ได้ลดเวลาและค่าใช้จ่ายลงอย่างมากสำหรับผู้ใช้รายย่อยในการซื้อสกุลเงินดิจิทัลจำนวนเล็กน้อย ซึ่งเคยใช้เวลาหลายชั่วโมงและอย่างน้อย 20-30 ดอลลาร์ในการระดมทุน ฉันลองใช้ On-meta เมื่อวันก่อน และพวกเขาลดราคาเหลือ $4 และไม่กี่นาที

ชื่อระดับแรก

การก่อสร้างอุตสาหกรรม

เรามักจะพูดถึงการรอเงินหลายพันล้านดอลลาร์ในการร่วมทุนเพื่อนำไปใช้ และไม่ใช่เรื่องแปลกอีกต่อไปที่สตาร์ทอัพจะระดมทุนได้หลายสิบล้านดอลลาร์ แต่ถึงแม้จะมีเงินทั้งหมด ผู้ก่อตั้งก็แทบไม่มีความเข้าใจว่าลูกค้าเป้าหมายของพวกเขาคือใคร ปัจจุบัน ชุดข้อมูลที่เป็นที่ต้องการมากที่สุดสำหรับผู้ประกอบการระยะเริ่มต้นคือต้นทุนในการหาลูกค้า (CAC) มีเพียงไม่กี่คนในอุตสาหกรรมที่รู้ว่ามีค่าใช้จ่ายเท่าใดในการหาผู้ใช้ที่ทำธุรกรรม และแม้แต่น้อยรายที่ทราบราคาในอดีต

ในอดีต การไม่มีข้อมูลดังกล่าวเป็นที่ยอมรับได้ เนื่องจากสิ่งจูงใจโทเค็นมักหมายความว่าผู้ก่อตั้งไม่จำเป็นต้องผ่านช่องทางแบบชำระเงิน (เช่น การโฆษณา) เพื่อดึงดูดผู้ใช้ ข้อตกลงระบุ CAC (ต้นทุนในการรับผู้ใช้) แต่คุณจะถอดรหัสได้อย่างไรหากคุณไม่มีแผนโทเค็นในแผนงานทันที นี่คือปริศนาที่บริษัทร่วมทุนที่ได้รับทุนสนับสนุนอย่างดีส่วนใหญ่ (ส่วนได้เสีย) ต้องต่อสู้ด้วย

สมมติว่าคุณมีข้อมูล CAC คุณจำเป็นต้องรู้เพิ่มเติมเกี่ยวกับบทบาทของผู้ใช้ ก่อนหน้านี้ คุณอาจคิดว่าคนที่ใช้ Uniswap เป็นเพียงชาวนาที่เลวทราม แต่ในขณะที่อุตสาหกรรมมีวิวัฒนาการ ประเภทของผู้ใช้ผลิตภัณฑ์เหล่านี้จะพัฒนาไปในรูปแบบที่ซับซ้อนมากและจำเป็นต้องใช้เครื่องมือในการระบุตัวตน

ตัวอย่างเช่น สมมติฐานทั่วไปคือผู้เล่นเกมบนอุปกรณ์เคลื่อนที่โดยเฉลี่ยคือเด็กอายุ 12 ปีที่พยายามให้พวกเขาผ่อนคลายหลังจากรับประทานอาหารเย็นกับครอบครัว ในทางกลับกัน ผู้ใช้ที่จ่ายเงินจำนวนมากในอุตสาหกรรมเกมมือถือเป็นผู้หญิงอายุ 40 ปี

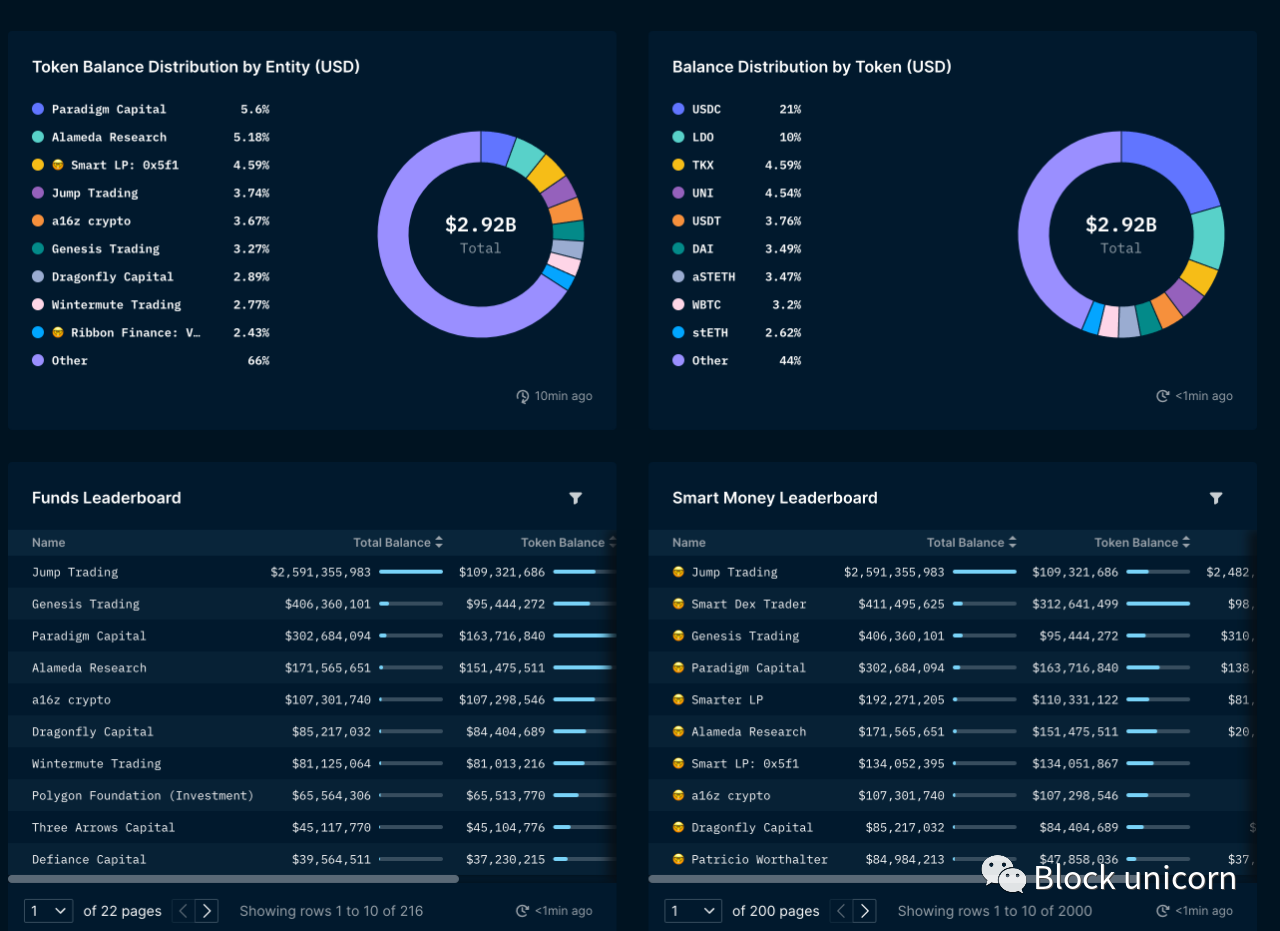

Nansen ตระหนักถึงความต้องการนี้ ซึ่งเป็นสาเหตุที่ผลิตภัณฑ์ของพวกเขาอาศัยการแท็กตัวตนของผู้ใช้ตามการกระทำในกระเป๋าเงิน ตัวอย่างเช่น การระบุกระเป๋าเงินเป็น - สมาร์ทมันนี่ (กระเป๋าเงินอัจฉริยะ) หรือ Heavy Dex Trader (ผู้ค้า DEX หนัก) ช่วยให้นักสืบออนไลน์ได้รับบริบทเบื้องหลังธุรกรรมเฉพาะ บริษัทใหม่จำนวนหนึ่งกำลัง "กำหนดสถานการณ์" ธุรกิจภาพเหมือนของผู้ใช้ และเลเยอร์ 3, Galxe และ Rabbithole มีหน้าที่รับผิดชอบในการจัดการภาพเหมือนของผู้ใช้ที่สตาร์ทอัพใหม่สามารถกำหนดเป้าหมายผ่านงานต่างๆ

สตาร์ทอัพใหม่มักจะร่วมมือกับแพลตฟอร์มเหล่านี้เพื่อระบุและกำหนดเป้าหมายผู้ใช้เริ่มต้น แทนที่จะใช้ข้อมูลประวัติเพื่อระบุผู้ใช้เช่น Nansen แพลตฟอร์มเช่น Layer 3 จะจัดอันดับผู้ใช้ตามการกระทำภายในแพลตฟอร์ม ตัวอย่างเช่น สมมติว่าคุณมีผู้ใช้ที่ทำกิจกรรมเกี่ยวกับเกมทั้งหมดบนแพลตฟอร์มจนเสร็จสิ้น เมื่อ UX ของเกมใหม่เข้าสู่ตลาด ก็อาจสมเหตุสมผลที่จะกำหนดเป้าหมายผู้ใช้เฉพาะรายนั้น ผู้ใช้ที่สร้างตัวตนบนเครือข่ายบนแพลตฟอร์มจะได้รับประโยชน์อย่างทวีคูณจากทุกกิจกรรมล่าสุด เนื่องจากมีผู้ใช้เพียงไม่กี่คนเท่านั้นที่ดำเนินการทั้งหมดเสร็จสิ้น

หากคุณกำลังใช้การสร้างฉากหลังเป็นคันโยกในการปลด การดูช่องในแนวตั้งอาจเป็นประโยชน์ ตัวอย่างเช่น ด้วยความคลั่งไคล้ NFT จึงมีการเปิดตัวคลาสใหม่ของการจัดการพอร์ตโฟลิโอและแพลตฟอร์มการค้นพบ NFT เมื่อไม่นานมานี้ อุตสาหกรรมเกมได้รับการยอมรับจากบริษัทต่างๆ เช่น ฟินเทค เหตุผลก็คือว่าแต่ละประเภทใหม่มีผู้บริโภคที่แตกต่างกันอย่างสิ้นเชิง

ชื่อระดับแรก

ใช้งานง่ายและค้นพบ

คำอธิบายภาพ

Limewire PRO เป็นแพลตฟอร์มแบ่งปันทรัพยากรไฟล์ หลังจากแพ้คดีก็ถูกบังคับให้ปิดตัวลง Limewire ใช้เวลาสิบปีกว่าที่ Spotify

วิธีหนึ่งในการลดปัญหานี้คือผ่านโครงการเผยแพร่ เช่น Daily Ape ของ Darren Lau ซึ่งกลายเป็นจัตุรัสกลางเมืองอย่างรวดเร็ว โดยมีผู้คนราว 55,000 คนสมัครรับจดหมายข่าวของพวกเขา ในทำนองเดียวกัน Compendium ของ Sov จะดูแลจัดการเครื่องมือสำหรับผู้ใช้ที่สนใจการวิเคราะห์และจดหมายข่าว ทั้งสองอย่างนี้เป็นเครื่องมือที่สร้างโปรโมชันที่ได้รับการคัดสรร ดึงดูดผู้คนไปยังแหล่งข้อมูลอื่นๆ

แต่มีแนวทางที่แตกต่างออกไป นั่นคือการใช้แพลตฟอร์มข้อมูล ในระดับนั้น ดูเหมือนว่า DApp Radar หรือ Token Terminal ทั้งสองใช้ข้อมูลแบบออนไลน์เพื่อให้เข้าใจถึงจำนวนผู้ใช้และกิจกรรมของพวกเขาบน DApps ที่โดดเด่นในระบบนิเวศ ในทำนองเดียวกัน DeepDAO ยังเปิดเผยกิจกรรมที่เกิดขึ้นใน DAO (อันที่จริง แรงจูงใจเบื้องหลังผลิตภัณฑ์เหล่านี้คือการขยายแอปพลิเคชันหรือผลิตภัณฑ์ย่อยอื่นๆ)

สังเกตว่าสิ่งเหล่านี้เข้าถึงธุรกิจประเภทใดประเภทหนึ่งได้อย่างไร กลุ่มหนึ่งติดตาม DAO ส่วนอีกกลุ่มแชร์ข้อมูลจาก DApps และกลุ่มที่สามทำให้ง่ายต่อการดูแอปพลิเคชันบล็อกเชนผ่านเลนส์ของเมตริกทางการเงินแบบดั้งเดิม พวกเขาเป็นแพลตฟอร์มข้อมูลทั้งหมด แต่พวกเขาจัดแพ็คเกจข้อมูลใหม่เพื่อช่วยผู้ใช้ชุดอื่น ในอีกไม่กี่ปีข้างหน้า เครื่องมือวางแผนแคมเปญหลายรายการที่แสดงข้อมูลเดียวกันในรูปแบบอื่นๆ จะกลายเป็นเรื่องปกติ

เนื่องจากคุณสามารถทราบความถี่ของธุรกรรมหรือปริมาณธุรกรรมในหน่วย nft เท่านั้น คุณต้องมีภูมิหลังเฉพาะอุตสาหกรรมที่มาจากบุคคลที่เคยทำงานในอุตสาหกรรมนั้นแล้วเท่านั้น ผู้ใช้ผลิตภัณฑ์เหล่านี้จำเป็นต้องเปรียบเทียบกับทางเลือกดั้งเดิมเพื่อดูว่าผลิตภัณฑ์ Web3 ดีกว่าหรือไม่ RWA.xyz เป็นตัวอย่างของการเปรียบเทียบระหว่างแพลตฟอร์มการให้ยืมสินทรัพย์ในโลกแห่งความเป็นจริงใน DeFi

เนื่องจากอุตสาหกรรมอยู่ในยุคขาดดุลความไว้วางใจ เราจึงต้องการผลิตภัณฑ์ที่ให้ข้อมูลเชิงลึกเกี่ยวกับการใช้แพลตฟอร์มในตลาดแนวตั้ง วิธีเดียวที่จะสร้างความชอบธรรมได้คือความโปร่งใสอย่างสิ้นเชิง แต่ไม่ใช่ทุกคนที่ต้องการข้อมูลเพื่อตัดสินใจเลือก ผู้ใช้ปลายทางมักต้องการ "สวนที่มีกำแพงล้อมรอบ" ซึ่งมีสิ่งที่ต้องการ

นี่คือความหมายสำหรับผู้ก่อตั้งที่สร้าง SDK เพื่อฝังฟังก์ชันต่างๆ เช่น สะพานบล็อกเชน การให้ยืม หรือการซื้อขาย พวกเขาใช้องค์ประกอบเดียว (เช่น สินทรัพย์การทำธุรกรรม) แยกส่วนและทำให้พร้อมใช้งานเป็นฟังก์ชันสำหรับหลายธุรกิจ เช่น MetaMask

ชื่อระดับแรก

สร้างคูเมือง

ลองนึกถึงสิ่งที่ฉันเพิ่งพูดไป ตลาดกำลังผันผวนระหว่างการคลายกลุ่มและการบรรจบกัน เนื่องจากความไม่คล่องตัวของเงินทุนที่อาจเกิดขึ้นและความสนใจในอุตสาหกรรมที่เพิ่งตั้งไข่ ในช่วงที่มีสภาพคล่องสูงสุด เป็นไปได้ที่จะเริ่มต้นการรวบรวมและค้นหาความสนใจ แต่เมื่อไม่มีใครสนใจ จะเป็นการดีกว่าหากมุ่งเน้นไปที่ผู้ใช้กลุ่มเล็กๆ ที่ต้องการคุณเนื่องจากไม่มีทางเลือกอื่น ผู้ใช้เหล่านี้เหนียวแน่น ใช้จ่ายมากขึ้น และให้ข้อเสนอแนะอันมีค่าซึ่งช่วยขยายผลิตภัณฑ์

แกนหลักของการแยกคือการทิ้งลูกไม้ในผลิตภัณฑ์และเป็นแนวดิ่งสำหรับตลาดบางกลุ่ม ช่วยให้ธุรกิจมีความได้เปรียบเหนือผู้ครอบครองตลาดเนื่องจากเป็นการเปลี่ยนแปลงหน่วยเศรษฐกิจของการให้บริการลูกค้า เมื่อธุรกิจร่วมทุนประสบปัญหากับช่องทางการขาย การรับเงินเพิ่มจากผู้ใช้แต่ละคนอาจเป็นความแตกต่างระหว่างการปิดกิจการหรือการระดมทุนที่ตามมา ความเชี่ยวชาญเฉพาะทางในแนวดิ่งช่วยให้ผู้ก่อตั้งคิดเงินได้มากขึ้นเนื่องจากไม่มีทางเลือกสำหรับผู้บริโภค

ผู้เข้ามาใหม่ไม่สามารถจำลองโมเดลที่เป็นกรรมสิทธิ์ซึ่งใช้ในการระบุผู้ใช้ (เช่น Nansen) และไม่สามารถจำลองลูกค้าที่ทำซ้ำในชั่วข้ามคืนบนแพลตฟอร์มเช่น Layer 3 ความสัมพันธ์ทางธุรกิจที่ผู้จำหน่าย SDK สร้างขึ้นในช่วงหลายปีที่ผ่านมานั้นยากที่จะแข่งขันด้วย ดังนั้น โดยพื้นฐานแล้ว การแยกส่วนทำให้สตาร์ทอัพระยะเริ่มต้นแข่งขันได้ยากขึ้น

ทุกสิ่งที่ฉันพูดถือว่าเราจะต้องต่อสู้กับการขาดความกระหายในการเก็งกำไรและการขาดความไว้วางใจในเครื่องมือที่เราสร้างขึ้น ตลาดหมีไม่ใช่แค่ตัวเลขที่ลดลง แต่เราตายอย่างไร้ความหมายก่อนที่เราจะล้มละลาย การแบ่งกลุ่มคือการทำให้ผลิตภัณฑ์มีความเกี่ยวข้องเพียงพอกับผู้ใช้ในประเภทธุรกิจที่พวกเขากลับมาที่ผลิตภัณฑ์ที่คุณกำลังสร้างอยู่เรื่อยๆ ในเวลาเดียวกัน และแยกแยะความเสี่ยงให้เพียงพอเพื่อหลีกเลี่ยงการแย่งชิงความสนใจที่จำกัดเช่นเดียวกัน