イーサリアムの評価フレームワークについて語る: どのようにして ETH をスーパー資産クラスに含めることができるのでしょうか?

著者: マイケル・ナドー

元のソース:The DeFi Report

原文の編集: The Way of DeFi

著者: マイケル・ナドー

元のソース:

原文の編集: The Way of DeFi

今週は、イーサリアムに焦点を当てたレイヤー 1 ブロックチェーンの評価フレームワークに関する現在の考えを共有します。取り上げられるトピック:

資本形成の手段としてのトークン

ETHがスーパーアセットクラスの枠組みにどのように適合するか

オンチェーンファイナンスと割引キャッシュフロー(割引キャッシュフロー)分析

デジタル商品および価値の保存手段としての ETH監視すべきお気に入りの KPI。

トークンが役立つ理由

トークンの基本については以前に詳しく説明しました。興味があれば、次のサイトにアクセスしてください。

トークンエコノミクス 101 の詳細については、こちらをご覧ください。

このレポートの準備として、トークンが強力な自己資本形成ツールであると当社が考える理由を簡単に繰り返したいと思います。これについてすでによく知っている場合は、このセクションをスキップしてください。

簡単に言えば、トークンは、一般大衆の間で許可のない方法で特定の行動を奨励する必要がある場合に最も役立ちます。トークンは、共有された広範な分散型の目標に向けてアクティビティを調整するのに役立ちます。

イーサリアムを例に挙げると、その目標は、スマート コントラクト、ピアツーピア インタラクション、ユーザー制御データを活用して、新しいインターネット ベースのビジネス モデルを推進できる世界的なコンピューターまたはオープン データ ネットワークを構築することです。

イーサリアムは、データ ネットワークへのアクセス (または編集権限) を制御する個人や団体が存在しないオープンソース方式でその存在を方向付けるために、トークンを発行し、初期の貢献者に報酬を与えるブロックチェーンをプログラムしました。これは、ビットコインの成功を利用して、開発者、バリデーター、ノードオペレーター、マイナーなど、世界中の個々の貢献者やサービスプロバイダーの行動を調整するのに必要なインセンティブを生み出します。スーパーアセットクラスの枠組み

従来の金融では、通常、金融資産を次の 3 つの超資産クラスに分類します。1. 資本資産:

キャッシュフローを直接生み出す資産。債券、不動産、株式はすべてこのカテゴリに分類されます。2. 消費可能/変換可能なアセット:

消費または変換が可能で、経済的価値はあるが、直接キャッシュ フローを生み出さない資産。例としては、トウモロコシ、石油、貴金属などの商品が挙げられます。

3. 価値または金銭的資産の保存:収入源をもたらさず、消費または変換できない資産。例としては、通貨、貴金属(貨幣プレミアム)、美術品、収集品などが挙げられます。

ETHのようなレイヤー1暗号資産はこのフレームワークにどのように適合しますか?実際、ETH は 3 つのスーパー資産クラスすべての特徴を備えています。

資本資産:イーサリアムはキャッシュ フローを生成します。キャッシュ フローは、ユーザーのトランザクションを通じてバリデーター/ブロック プロデューサーによって獲得され、ネイティブ トークンを保持し、スマート コントラクトにステーキングすることによってのみ収入を得ることができます。

*配当を支払う株や債券のように、ETH自体を保有しても利回りは得られないことに注意してください。報酬を獲得するには、ETH をステーキングして、トランザクションを検証し、ネットワークにサービスを提供する必要があります。消耗品/交換可能な資産:

イーサリアムには商品としての性質もあります。ネットワークを使用する人が増えるにつれて、ETH は「消費」されます。この機能は、ブロック領域の需要が増加したときに自動株式買い戻しのように機能する書き込みメカニズムを通じてプログラムされています。車両や機械を動かすためにガソリンが必要なように、イーサリアム データベースやその上に構築されたアプリケーションを使用するには、ある程度の ETH が必要です。支払った ETH の約 70 ~ 85% は「焼却」され、流通から削除されます。 ETHが「デジタルオイル」のようなものだと言う人がいるのはこのためです。デジタル商品のように機能する機能を備えています。

価値/金銭資産の保存:

価値の保存/貨幣資産の知覚価値は、為替レートと市場参加者の認識によって異なります。たとえば、今後数年間で米ドルが通常よりも高いインフレになると人々が信じている場合、米ドルの代わりに金を保有したいと思うかもしれません。あるいは、米国の方が経済が安定していると考えれば、ユーロではなくドルを保有するかもしれない。

人々は、市場がそれらの品物の価値をどのように考えるかに基づいて、収集品や高級美術品を所有することがあります。一般に、価値の保存資産はユニークで希少である必要があります。 ETH(資産)の供給が減少する一方で、イーサリアム(ネットワーク)の有用性は今後数年で増加する可能性が高いため、一部の市場参加者はETHを価値の保存手段と見なしています。

チェーン上の金融

Aave で融資したり、Uniswap で取引したりしたいですか?ブロックスペースの料金を支払う必要があります。 NFTを鋳造または購入したいですか?家族にUSDCを送りたいですか?イーサリアムベースのゲームをプレイしたいですか?皆さんもある程度のブロックスペースが必要です。

データを記録するすべてのトランザクション (金融だけでなく) には、ブロック スペース料金を支払う必要があります。ユーザーはネイティブ トークン ETH を使用してブロック スペースの料金を支払います。イーサリアムはテクノロジープラットフォームであり、Amazon や Apple の iPhone のようなものと考えることができます。 Apple の iPhone は、ハードウェアの販売に加えて、開発者がアプリを構築して App Store に公開することでも収益を上げています。したがって、開発者が人々が使いたいと思うイーサリアムプラットフォーム上で興味深い新しいビジネスを構築すれば、プラットフォームを動かす暗号資産であるETHは経済的価値を生み出すはずです。

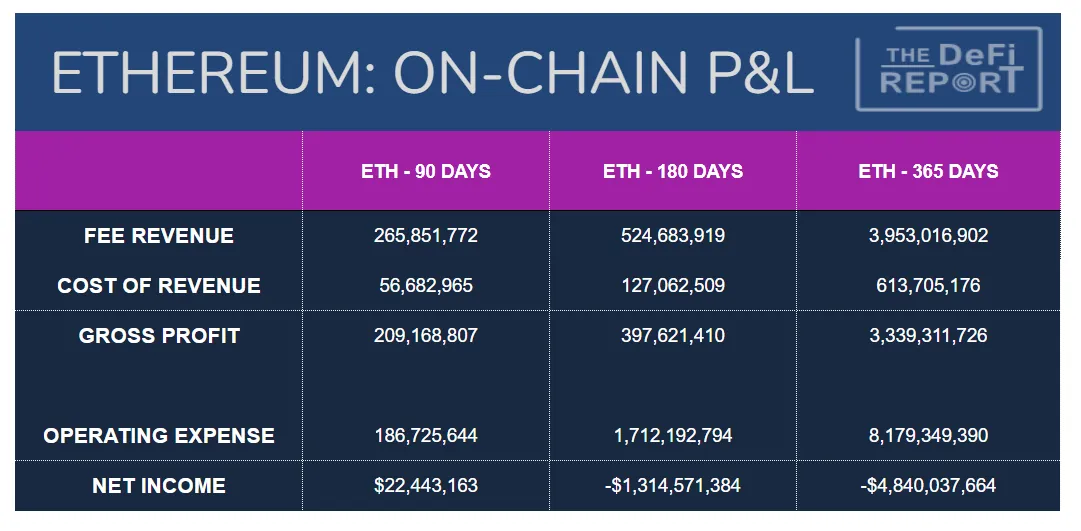

シンプルなオンチェーン財務報告フレームワークを使用して、これを分析してみましょう。画像の説明

データ: トークンターミナル手数料収入 (手数料収入):

期間中に販売されたブロックスペースの合計金額を指します。収益コスト:

グローバル サービス プロバイダー (バリデーター) に支払われる料金のドル価値を指します。昨年、料金の約 15% がバリデーターに支払われました。これは、今日のバリデーターの約 5.1% に相当します。粗利益:

発生した手数料の合計からサービスプロバイダー/検証者に支払われた金額を差し引いたものを指します。これは、焼かれたETHの総額でもあります。これは、ETHのパッシブ保有者に利益をもたらす自社株買いと考える必要があります。それについては後で詳しく説明します。営業経費:

これは、世界中のサービスプロバイダー/バリデーターに支払われるブロック補助金 (またはプロトコルインフレ) の金額です。このプロジェクトはイーサリアムのセキュリティ予算と考えることができます。合併後は90%削減されました。 *ここでは、ブロックチェーンが実際に何かを「支払う」わけではないことに注意してください。私たちはこれを、スタートアップが追加株式を発行して既存の株主を希薄化するようなものと考えるべきです。純利益:

重要:ブロックスペースの需要がセキュリティ予算を超えている限り、循環供給が(受動的な保有者に有利に)低下するため、ネットワークは収益性があると見なすことができます。同時に、バリデーター(アクティブホルダー)は取引手数料から多大な利益を得ることができます。

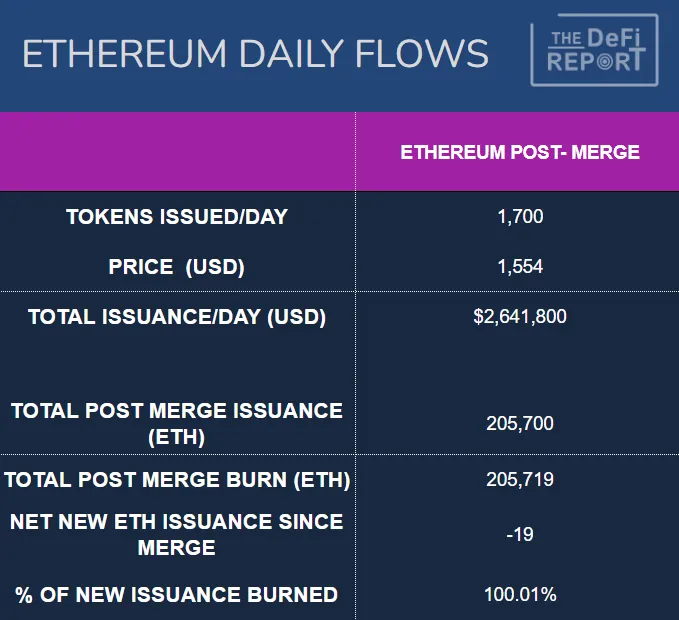

ETHの量は取引量に直接関係するため、理論的には「燃焼」または流通から除去できるETHの量に制限はありません。より多くのトランザクション (ブロックスペースの需要) = より多くの ETH が燃焼され、市場から削除されます。ただし、ETHの発行量には制限があります。これはイーサリアム財団のフォワード ガイダンスによって決定され、ステーキング/バリデーター スマート コントラクトにロックされている ETH の量によって決まります。現在、流通している ETH の 13.8% がステーキング契約に固定されており、ネットワークのインフレ率は約 1700 ETH/日となっています。

ブロックスペースの需要がセキュリティ予算を超えている限り、循環供給が(受動的な保有者に有利に)低下するため、ネットワークは収益性があると見なすことができます。同時に、バリデーター(アクティブホルダー)は取引手数料から多大な利益を得ることができます。

仮想通貨の深刻な弱気市場にもかかわらず、これが前四半期に当てはまったことがわかります。損益計算書を見ると、ブロックチェーンが過去 6 か月および 12 か月にわたって比較的収益性が低いのはなぜか疑問に思うかもしれません。

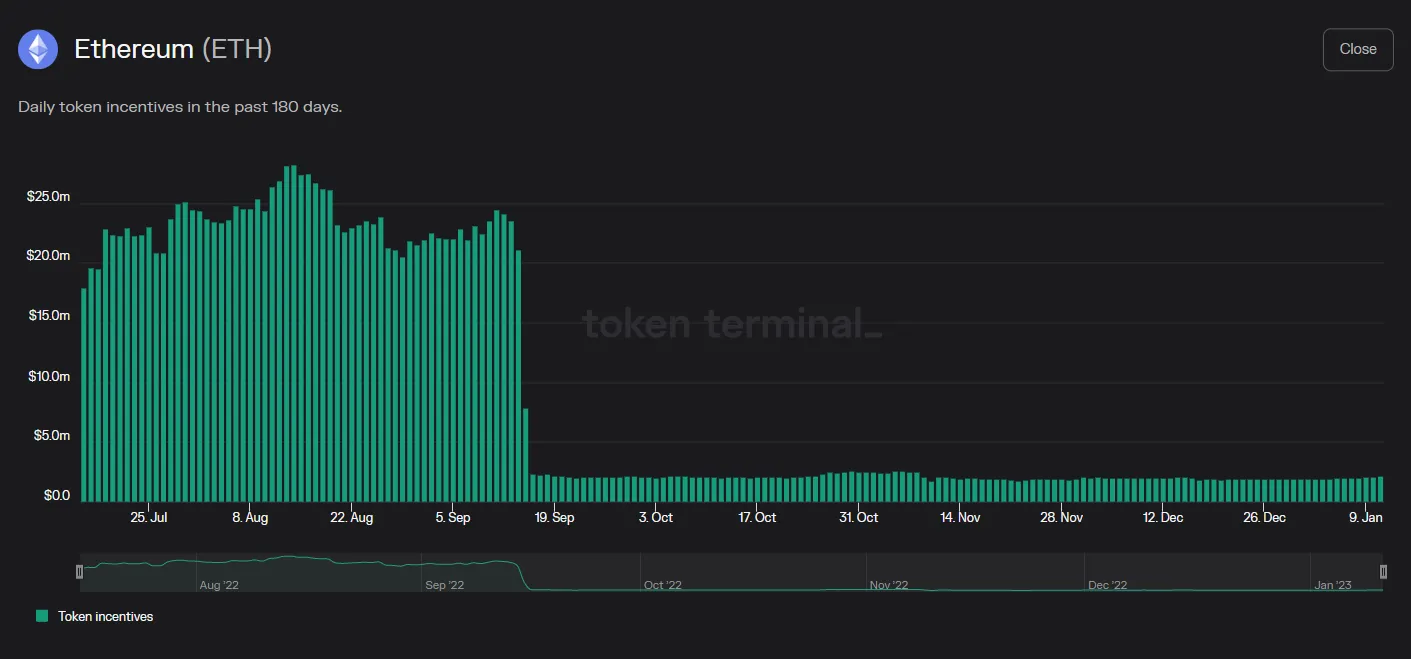

収益性の変化は、9月16日に行われた合併によるものと考えられます。以下では、合併以降のETHの純新規発行を観察できます。

画像の説明

データソース: トークンターミナル

イーサリアム財団はマイナーに過剰な報酬を支払っている!このグラフはこれを視覚的に示しています。前述したように、ネットワークがプルーフ・オブ・ステーク (PoS) に切り替わって以来、イーサリアムはセキュリティ料金を約 90% 削減しました。資本資産評価。

ETH は投機的で不安定な性質があるため、市場価値と使用量の観点から、2 つの異なる割引キャッシュ フローを実行しました。a. 2022 年の総取引コスト、年平均増加率は 25%、割引率は 12%、期間は 20 年です。これにより、時価総額は 4,160 億ドル、つまり完全に希薄化されたトークンあたり 3,459 ドルになります。 2022 年の手数料は 2021 年と比較して 58% 下がっているため、これらは弱気市場の数字であることに注意してください。

簡単な DCF 計算は次のとおりです。

b. 2021 年の総取引手数料、年間平均増加率は 25%。他のすべてを一定に保ち、2021 年の年間収益を推定すると、時価総額は 9,660 億ドル、つまり 1 トークンあたり 8,022 ドルになります。これにより、強気市場データを使用した評価のアイデアが得られます。

ここでは簡単な DCF の計算を示します。

イーサリアムは、他の多くのユースケースで世界金融の決済レイヤーとして機能する可能性を秘めています。したがって、対応可能な市場は非常に大きいです。この観点から見ると、時価総額 1 兆ドルはもっともらしいと思われます。

かなり控えめな平均年間料金増加率 25% を使用したことに注意してください。過去 5 年間におけるイーサリアム手数料収入の実質年間複利成長率は 146% であり、2022 年には 58% という大幅な減少となりました。

これらの計算は評価分析の開始点であり、投資アドバイスとみなされるべきではありません。期間、割引率、平均成長率は、さまざまなシナリオ分析のニーズに応じて調整できます。合計取引手数料を出発点として使用することも、間違った仮定を置く可能性があります。最後に、ETH の受動的保有者 (非ステーカー) とステーカー/バリデーターの個別の分析が必要になる場合があります。

収益/利益倍数

イーサリアムは分散型ネットワークであるため、その料金は分散型サービスプロバイダー/検証者が負担します。これらの手数料は基本的に、誓約の対価、つまり賭けられたETHのドル価値です。オンチェーンファイナンスのセクションで述べたように、ネットワーク料金は、バリデーターの参加を奨励するためにネットワークによって支払われるプロトコルインフレ/料金と考えることもできます。一部のアナリストは、ネットワーク料金は気を散らすものであるため、利益倍率分析や割引キャッシュ フロー分析に含めるべきではないと考えています。この場合、総収入は収益とみなされます。

これを大局的に考えるために、過去数年間の収益を掛け合わせて今日の時価総額と比較すると、次のようになります。

2022: 41 倍の収益倍率または価格売上高比率

高成長テクノロジー企業ではより高い収益倍率が見込まれる可能性があるため、これらの数字は魅力的であると考えられるかもしれません。テスラは極端な例で、2021年の強気相場ではPERが200倍以上で取引されている。アマゾンの株価収益率は現在86倍で、株価はピーク時から45%下落している。

毎日の交通量

画像の説明データ: イーサスキャン

合併後、私たちは 1 日あたり約 1700 の新しい ETH を発行しており、これはほぼ 90% の削減です。この数値はステーキングされた ETH の総量に基づいてわずかに変動します。

要点:バリデーターには運営費がかからないことを覚えておいてください。つまり、自動的に発生する新規供給の売り圧力の 80% が解消されました。

最後に、現在、DeFi アプリケーションにロックされている 1,800 万 ETH があり、この量を質権契約にロックされている 1,600 万 ETH に追加すると、流通供給量の約 28% がスマート コントラクトにロックされ、利回りを獲得しています。これを「非液体循環供給」と考えることができます。要点:

市場は統合の前に、毎日約 1,600 万ドルの保証された売り圧力を吸収する必要があります。その売り圧力は今日ではほとんど消え去った。実際、ETHの発行量よりも燃焼量の方が多かった時代には、価格上昇を防ぐために構造的な「資金流出」が必要でした。現在は弱気相場にあるが、イーサスキャンをざっと見ると、2023年はこれまでの14日間のうち11日間で発行がネットデフレとなっていることがわかる。

最近の市場活動におけるトラフィックの変化を観察できます。

イーサリアムは2022年6月(合併前)に急落し、900ドル付近で底を打った。 11月には、ビットコインが市場全体を新安値に導いたFTXの暴落(統合後)に関連して、さらに別の降伏がありました。しかし、イーサリアムはその立場を堅持しています。新安値を更新することはなかった。実際、その底値は6月の安値よりも約27%高かった。これは、2022 年 9 月 16 日の合併によるトラフィックの構造的な変化によるものと考えられます。

イーサリアム財団にとって重要なのは、ETHの消費がETHの生成を上回るが、過剰な取引コストが発生しないバランスを見つけることです。結局のところ、ガソリン価格が急激に上昇すると、人々はドライブ旅行を中止するでしょう。あるいは、他の旅行オプションを探します。イーサリアムの場合、ユーザーは他のブロックチェーンに移動する可能性があります。 (レイヤー 2 ソリューションにより) トランザクションあたりのコストは時間の経過とともに減少すると考えられますが、導入と使用例が増えるにつれてトランザクション量は増加すると考えられます。 L2 でのトランザクションは最終的にイーサリアム L1 でバッチ決済されるため、手数料は低いもののデフレ状態のトークンの供給がもたらされ、両方の長所が得られるはずです。ETH の商品価値を予測するのは困難です。需要と供給に関する推測に基づいています。イーサリアム財団のETHモーゲージ金利と新規発行額に基づいています

可用性を理解するための透明性のあるポリシーまたはフォワード ガイダンス。

要件は開発者の作業によって異なります。ステーブルコインでの支払いが簡単になるとき、ゲームが楽しくなり、ユーザーがNFTを通じてゲーム内資産を所有できるとき、世界最大のブランドがNFTを発行し、消費者のロイヤルティ体験を高めるとき、ソーシャルメディアでユーザーがユーザーをコントロールできるときウォレットとDeFiアプリケーションが使いやすくなり、KYC/AMLプールが導入され、スマートコントラクト監査の標準が作成されたときに実現します。

私たちは、オープン ネットワーク、優れたユーザー中心のビジネス モデル、ユーザーが管理するデータの利点により、これが実現すると考えています。

価値/金銭資産の保存

ETH はイーサリアム エコシステムにおける交換媒体であり、ブロックチェーンを駆動する潤滑油です。とはいえ、資産が法定通貨などの交換媒体として使用される場合、一般に価値の保存としては機能しません。しかし、このレポートで概説されているETHトークンの需給構造に基づいて、市場はETHに金銭的プレミアムを割り当てる可能性が高いと考えています。

主要なデータポイント

イーサリアムやその他のブロックチェーンの長期的な存続可能性を監視する際には、追跡すべきデータポイントが数多くあります。次のインジケーターは、このフェーズ中に最も多くのシグナルを提供します。

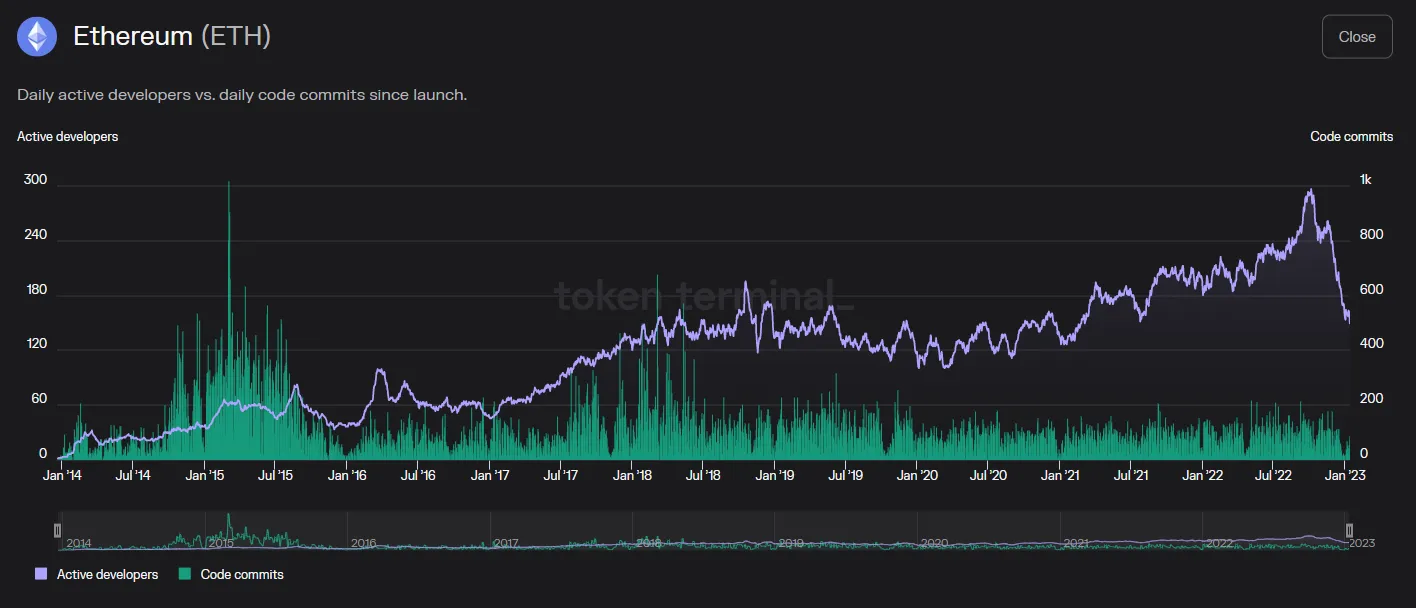

開発者の数と開発者の増加

データソース: トークンターミナル

過去 6 年間、イーサリアム開発者の年間平均成長率は 32% でした。私たちは最近の減少を監視していますが、これは主に季節的なものであると考えています。興味深いことに、コードのコミット数はここ数年横ばいで、以前と比べて減少しています。これは、構成可能なオープン ソース コードの力によるものです。各問題は一度解決され、他の人がその上に構築できるようになります。これは、相互にリンクするレゴ ブロックに似ています。

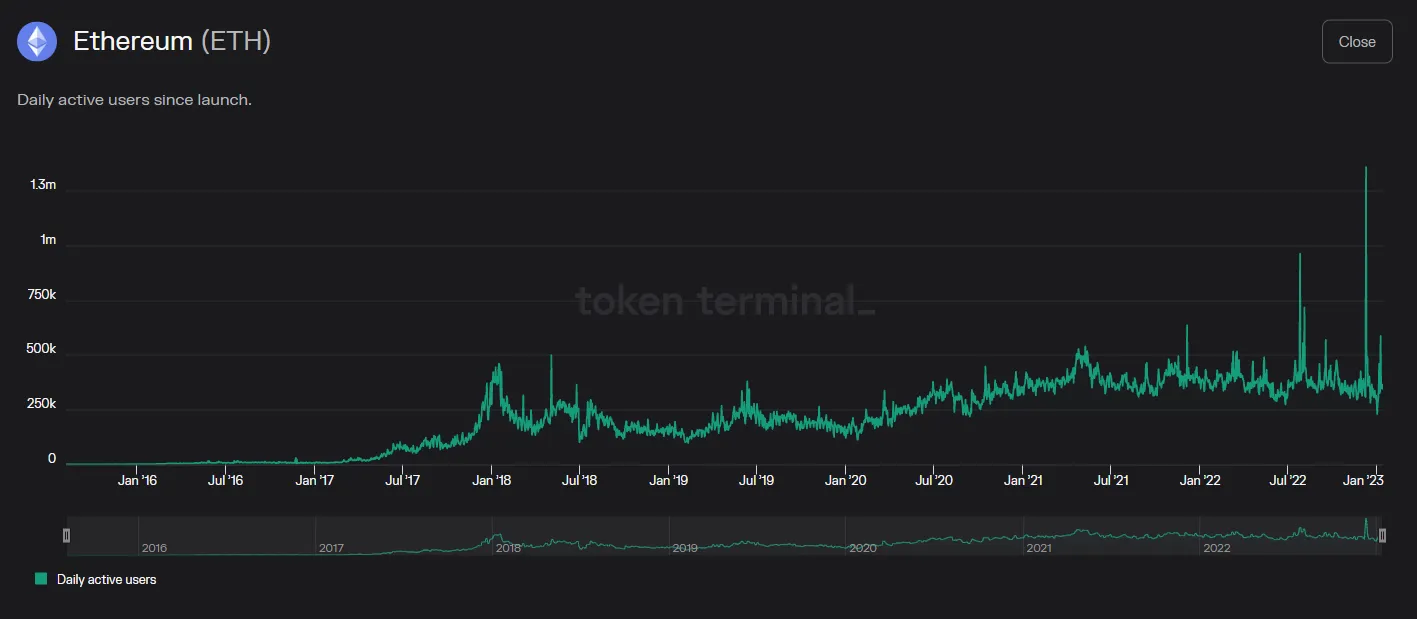

アクティブユーザー数とユーザーの増加

データソース: トークンターミナル

現在、デイリーアクティブユーザー数は約 400,000 人であり、その成長は非常に安定しています。 2016 年以降、ユーザーは 92.9% の CAGR で増加し、2017 年以降は 38% の CAGR で増加しました。 2022年の加入者数は2021年と比べて約3%減少した。

データソース: イーサスキャン

所得

価格下落にもかかわらず、取引量は昨年も大きく維持されています。今年のネットワークは12%減少した。そうは言っても、過去 6 年間で 76%、過去 5 年間で 32% の CAGR で成長しました。レイヤー 2 が拡大するにつれて、ベースレイヤーのトランザクションの増加が横ばいになり始めることがわかります。

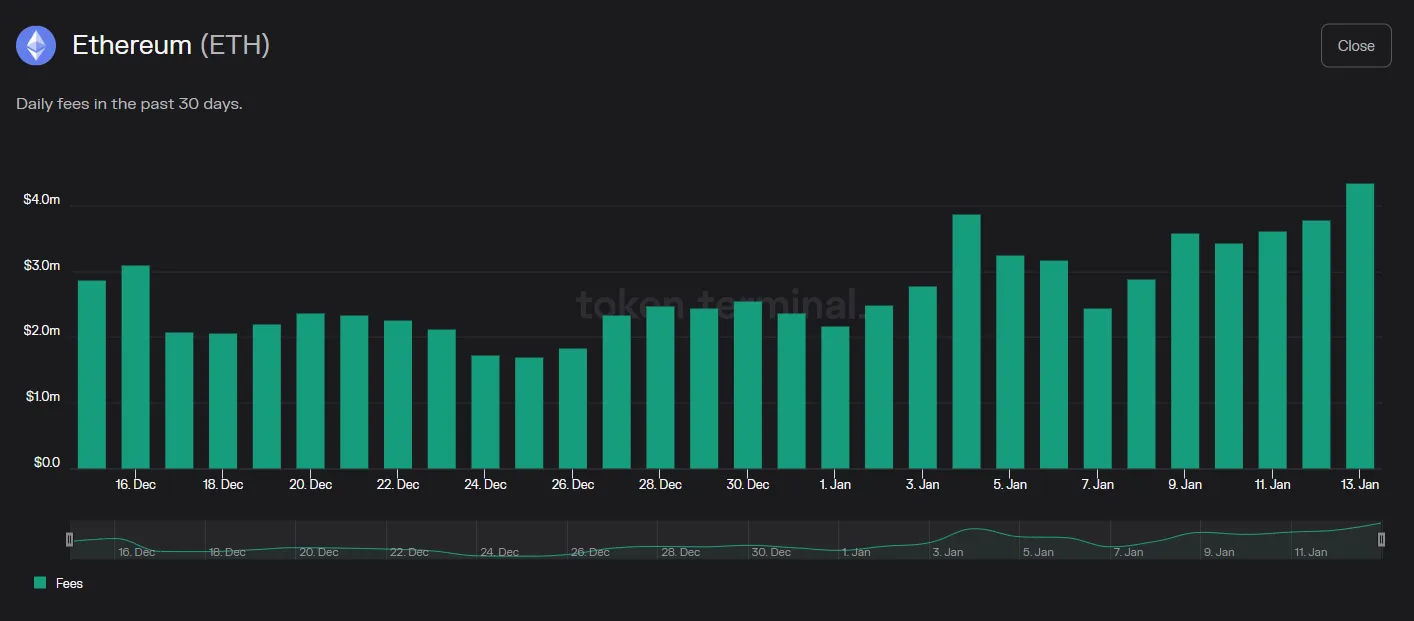

所得

画像の説明データソース: トークンターミナルイーサリアムの収益は引き続き好調です。過去 30 日間、ネットワークの 1 日あたりの売上は平均約 260 万ドルでした。過去 6 年間の年平均成長率は 454% です。より活発な 2017 年から始めると、2022 年が 2021 年と比べて 58% 減少したとしても、5 年間の CAGR は 146% です。

昨年のソラナで見たように操作することもできます