온체인 데이터 분석: 수렁에 빠진 솔라나는 "역경에서 살아남을" 수 있을까?

원문 편집: Bai Ze Research Institute

원문 편집: Bai Ze Research Institute

솔라나에 대한 투자 심리가 하락했다는 데는 의심의 여지가 없습니다...

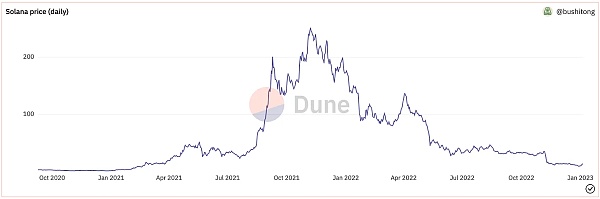

아래 가격표를 확인하세요. 지난 14개월 동안 SOL(Solana의 기본 토큰) 가격은 약 260달러에서 10달러 미만으로 떨어졌고 이 글을 쓰는 시점에는 16달러를 조금 넘었습니다.

즉, SOL은 사상 최고치에서 거의 97% 하락했습니다.

설상가상으로 Solana의 상위 NFT 프로젝트 중 하나인 DeGods는 최근 이더리움으로 마이그레이션할 것이라고 발표했으며 팀의 두 번째 프로젝트인 Y 00 ts도 Polygon으로 마이그레이션할 예정입니다.

물론 이 모든 것은 SOL의 최대 보유자 중 하나(전체 공급량의 10% 이상)와 Solana 생태계 투자자인 FTX가 파산하는 동안 발생했습니다.

지금 상황이 솔라나에게 끔찍해 보인다는 데는 의심의 여지가 없습니다.

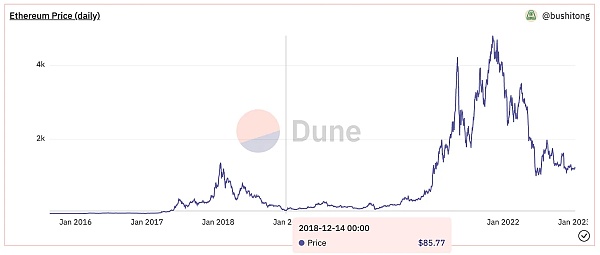

하지만 2018년 암호화폐 투자자들이 알다시피 이더리움도 비슷한 경험을 했다.

2018년 ETH 가격은 사상 최고치인 $1,428에서 약 $85로 거의 94% 하락했습니다.

그 당시의 암호화폐와 Web3 공간은 지금과 매우 달랐고 약세장이 닥친 후 많은 프로젝트가 돈이 바닥나고 투자자들이 공간을 떠났기 때문에 많은 사람들, 심지어 이더리움 커뮤니티의 충실한 구성원들도 이더리움을 의심하게 만들었습니다. 블록체인이 성공할까요?

고맙게도 이더리움 커뮤니티는 결국 긴 암호화 겨울을 살아남아 오늘날 우리가 알고 있는 활기차고 번성하는 이더리움 생태계가 되었습니다.

2018년 ETH 폭락에서 배운 것이 있다면 이더리움 블록체인과 기본 통화인 ETH 사이에 큰 차이가 있다는 것입니다.

Solana 블록체인과 기본 통화 SOL도 마찬가지입니다. 따라서 SOL의 가격이 상당히 나빠 보이지만, 이는 Solana 블록체인과 그 커뮤니티에서 일어나는 일을 반영하지 않을 수 있습니다.

실제로 아래 Amazon 주식의 가격 차트를 살펴보십시오.

2000년에 AMZN의 가격은 $4로 94.79% 하락했습니다. AMZN의 최근 26년 주식 시장 거래에서 사상 최고가인 $165는 다음과 같습니다.

30% 이상 가격 하락 7회

50% 이상 가격 인하 4회

60% 이상의 세 번의 가격 인하

그러나 이것이 Amazon이 현재 세계에서 가장 큰 회사 중 하나가 되는 것을 막지는 못합니다.

요점은 가격은 기본 기술과 아무 관련이 없다는 것입니다. 기술의 가격은 항상 변동하며 때때로 기본 가치에서 상당히 "분리"될 수 있습니다.

첫 번째 레벨 제목

네트워크 효과가 중요한 이유

네트워크 효과는 특정 기술을 사용하는(또는 상호 작용하는) 참가자가 점점 더 많아지면 해당 기술의 "가치"가 증가하는 현상입니다.

더 가치 있는 기술은 기술을 사용하는(또는 상호 작용하는) 액터의 수를 늘리고, 이는 다시 "가치"를 증가시켜 액터의 수를 늘립니다.

예를 들어, 인터넷은 점점 더 많은 사람들이 사용하기 시작하면서 점점 더 좋아지고 있습니다. Facebook, Amazon 등은 동일한 네트워크 효과 이점이 있습니다.

기술이 특정 수준의 네트워크 효과에 도달하면 죽기 어렵습니다. 특히 해당 네트워크가 시간이 지남에 따라 계속 성장하는 경우 더욱 그렇습니다. 비트코인과 이더리움 모두 이 지점에 도달했을 수 있습니다.

따라서 "솔라나가 죽게 될까요?"라는 질문을 할 때 우리가 해야 할 일은 솔라나의 네트워크 효과를 살펴보는 것입니다. 우리는 Solana 블록체인의 참여자(즉, 사용자와 개발자)가 무엇을 하고 있는지 조사해야 했습니다.

블록체인 기술의 아름다움은 우리가 그렇게 할 수 있다는 것입니다!

솔라나 블록체인의 신규 사용자 동향을 살펴볼 수 있습니다.

솔라나 블록체인에서 사용자 트랜잭션 및 가치의 추세를 검토할 수 있습니다.

가장 중요한 것은(특히 기술 초기에) 개발자 활동의 추세와 블록체인에 배포되는 새로운 프로젝트를 연구할 수 있다는 것입니다.

온체인 데이터를 분석하기 전에 우리는 현재 약세장에 진입한 지 14개월이 되었기 때문에 당연히 수치가 나빠 보일 수 있다는 점을 명심하십시오.

활성 지갑

활성 지갑

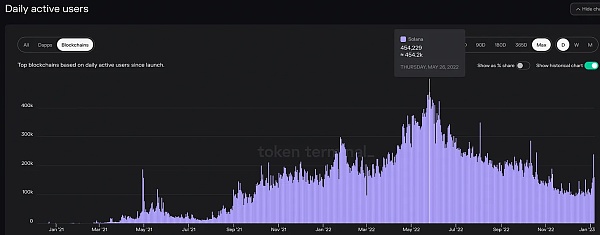

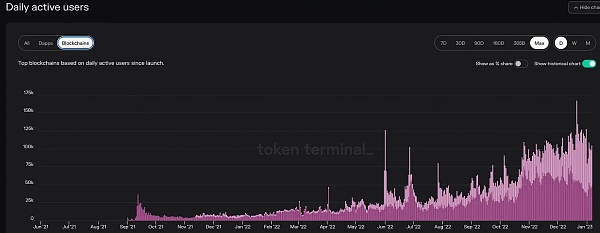

솔라나 블록체인의 일일 활성 사용자(DAU)를 보면 DAU가 사상 최고치인 454,229명에서 FTX 이벤트 직후 최저치인 95,958명으로 78.8% 감소했습니다.

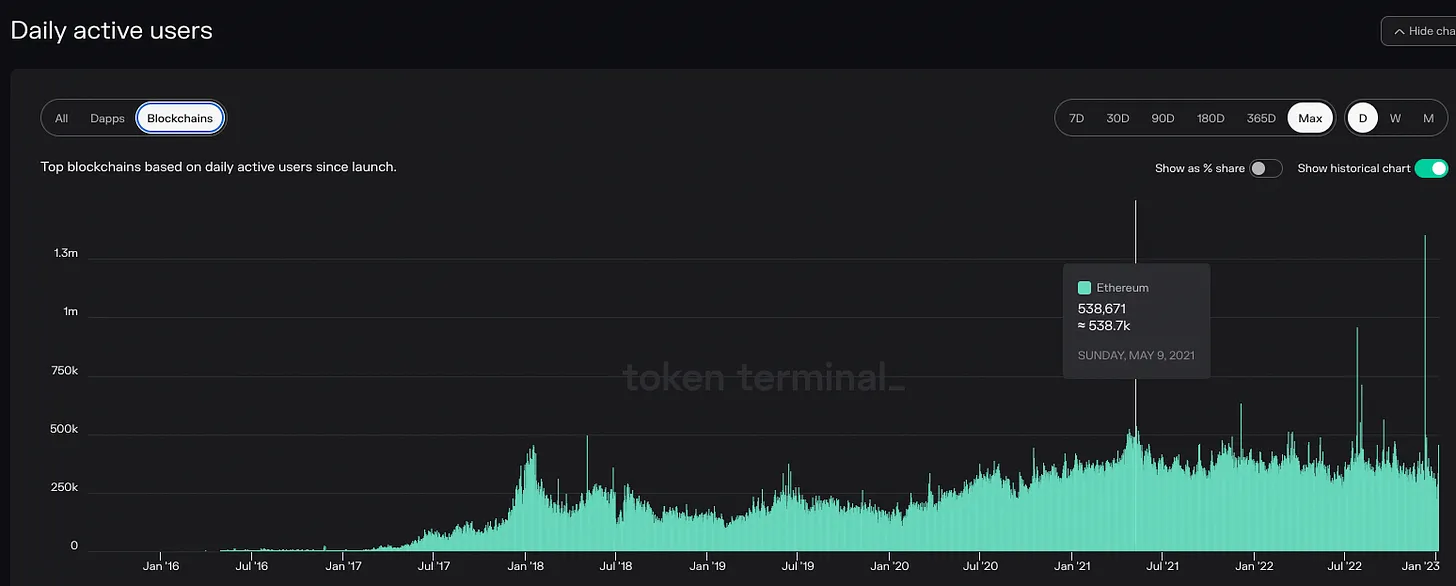

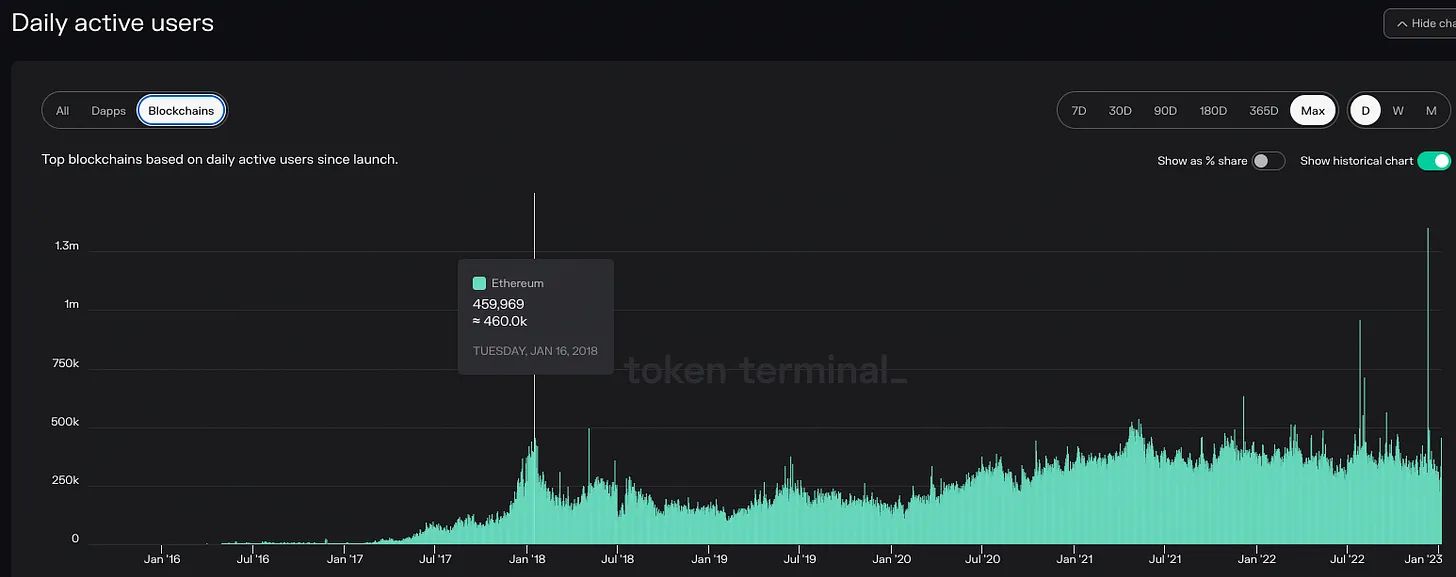

반면 이더리움은 DAU 하락폭이 훨씬 작았습니다. 이더리움의 DAU는 528,671에서 최저 295,500으로 떨어졌으며, 솔라나에서 같은 기간 동안 44% 하락했습니다.

우리는 또한 이더리움 커뮤니티의 현재 초점이 Arbitrum 및 Optimism과 같이 레이어 1에서 새롭게 번창하는 레이어 2로 사용자를 이동시키는 데 있음을 기억해야 합니다.

아래 그래프에서 이러한 L2가 약세장 14개월 동안 실제로 사용자를 확보했음을 볼 수 있습니다.

그러나 더 공정한 비교는 2018년 ETH 충돌 동안 Ethereum의 DAU 하락을 살펴보는 것일 수 있습니다. 흥미롭게도 2018년 약세장에서 이더리움 DAU는 459,969에서 128,265로 72% 감소했습니다.

요약하자면...

일일 활성 사용자

Solana 2022 = -78.8%

2022년 이더리움 = -44%

가격

가격

Solana 2022 = -97%

이더리움 2022 = -79%

이더리움 2018 = -94%

지금까지 이 약세장에서 솔라나는 가격과 DAU 측면에서 2018년 이더리움과 유사한 성과를 거두고 있는 것으로 보입니다.

가장 큰 차이점은 솔라나가 이 약세장에서 다른 퍼블릭 체인과 직접적인 경쟁에 직면한 반면, 2018년에는 이더리움이 기본적으로 유일하게 실행 가능한 스마트 계약 플랫폼이라는 점입니다.

Ethereum L1과 Solana 블록체인은 목표가 상당히 다르기 때문에 경쟁자로 간주되어서는 안 된다는 점은 주목할 가치가 있습니다. 그러나 Ethereum L2와 Polygon은 Solana의 직접적인 경쟁자입니다.

첫 번째 레벨 제목

거래 및 TVL

솔라나는 이더리움보다 훨씬 더 많은 트랜잭션(txns)을 매주 실행합니다.

그러나 이러한 txns의 합법성은 의심스럽습니다. Solana의 많은 txns가 배치 트랜잭션을 수행하는 봇으로 여겨지기 때문입니다.

솔라나는 주간 거래가 496,847,478에서 127,963,178로 74% 감소했고 이더리움은 같은 기간 11,074,661에서 6,705,093으로 40% 감소했습니다. (이 그래프는 참조용이며 Solana의 모든 투표 트랜잭션을 포함하지 않습니다.)

역사를 되돌아보고 2018년 약세장에서 이더리움이 어떻게 거래되었는지 살펴보겠습니다. 이더리움의 주간 거래량이 8,203,034건에서 2,959,182건으로 64% 감소한 것을 볼 수 있습니다.

요약하자면...

주간 거래

Solana 2022 = -74%

이더리움 2022 = -40%

2018년 이더리움 = -64%

마찬가지로 솔라나와 이더리움은 2018년에 비슷한 통계를 가지고 있습니다.

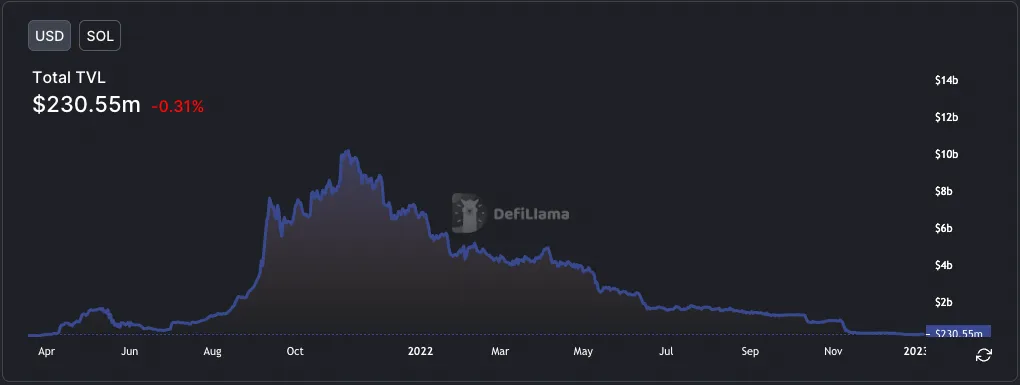

거래 외에도 블록체인에 잠긴 자금의 총 가치와 시간이 지남에 따라 어떻게 변화했는지 확인할 수 있습니다. 솔라나의 TVL은 101억7000만 달러에서 2억3000만 달러로 98% 감소했다.

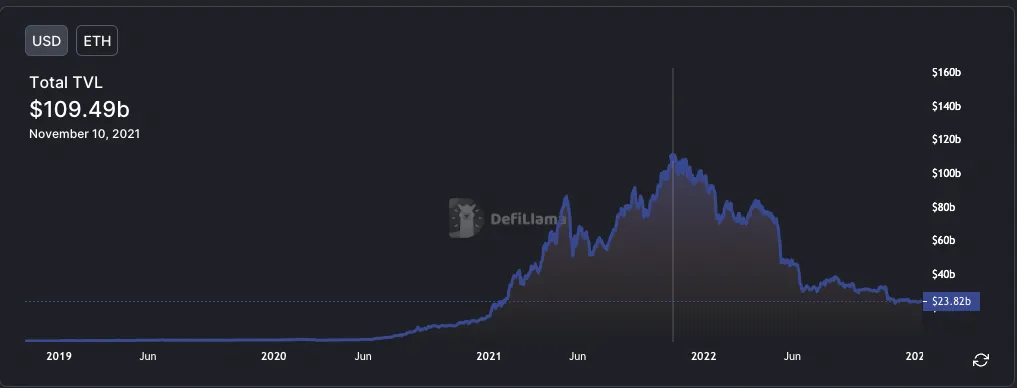

이더리움의 TVL은 1094억9000만 달러에서 238억2000만 달러로 78% 하락했다.

첫 번째 레벨 제목

개발자 활동 및 배포

트랜잭션과 유사하게 우리는 개발자 활동 수치를 소금 한 알로 가져와야 합니다.

이는 다양한 이더리움 클라이언트가 있기 때문에 특히 이더리움 생태계에서 추적하기 어려운 지표입니다. 또한 현재 많은 팀이 이더리움 자체가 아닌 L2에서만 구축하고 있습니다.

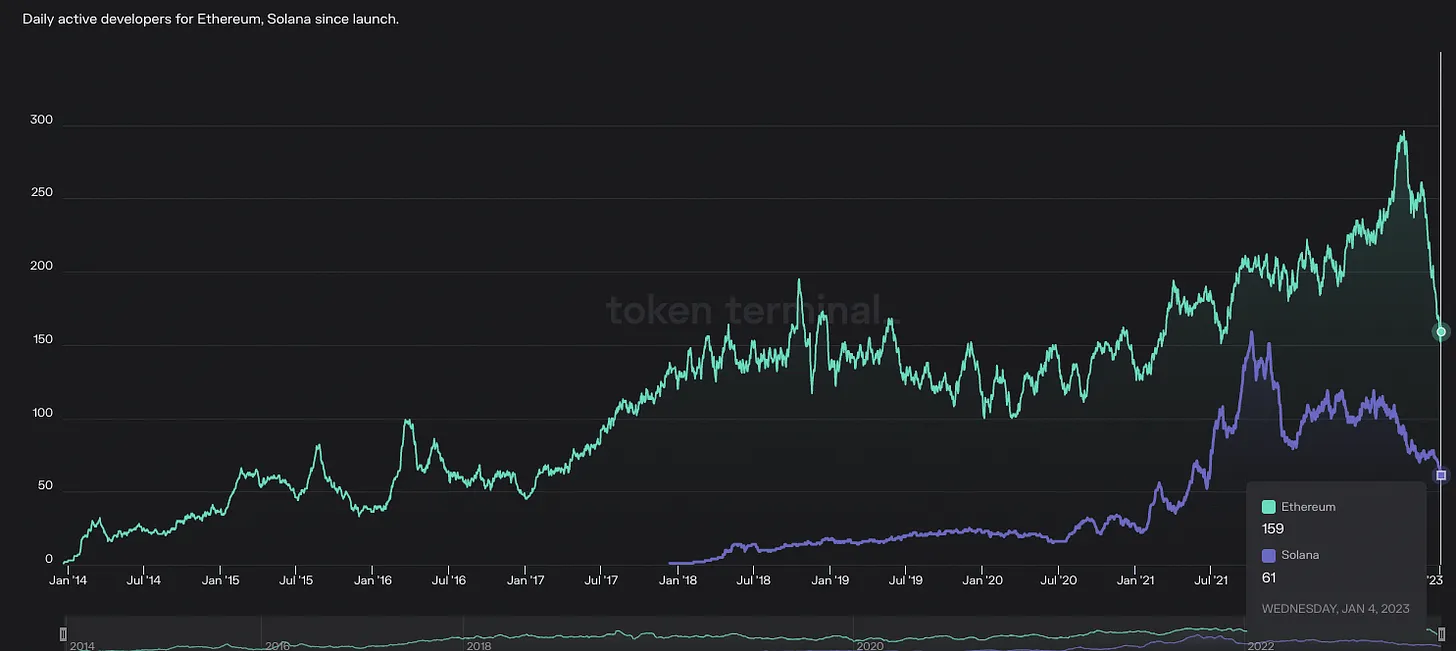

아래 차트에서 우리는 Token Terminal의 각 블록체인에 대한 Github 커밋 추적을 사용했으며 수치적으로 정확하지 않다는 것이 분명합니다. 따라서 실제 숫자보다는 백분율 변화에 더 초점을 맞추겠습니다.

솔라나의 일일 활성 개발자 수는 최고 156명에서 최저 61명으로 61% 감소했습니다. 이더리움은 최근 최고가 296, 최저 153으로 48% 하락했습니다.

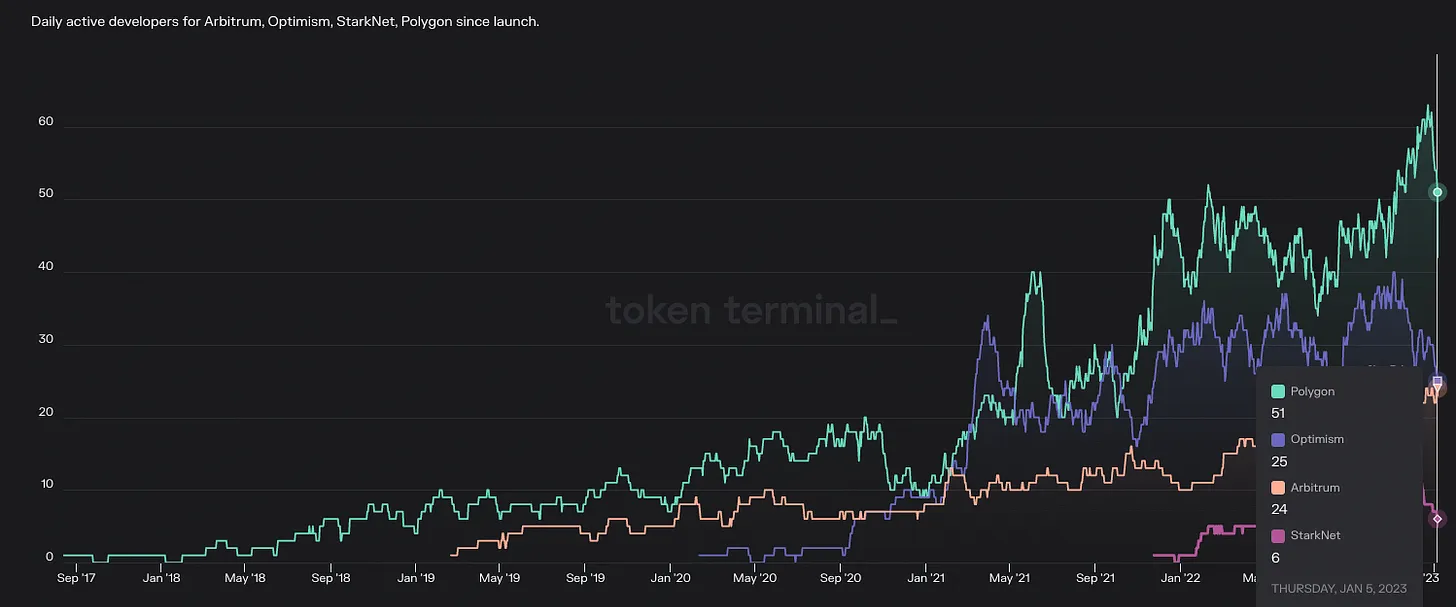

그러나 다시 말하지만, 많은 이더리움 개발자와 팀이 더 빠르고 저렴한 다양한 이더리움 L2로 이동하고 있기 때문에 전체 이더리움 생태계의 개발자 성장을 고려해야 합니다.

이것이 Arbitrum, Optimism, Starknet 및 Polygon 개발자 수의 최근 증가를 무시해서는 안 되는 이유입니다.

하지만 다시 2018년 이더리움의 과거 데이터를 살펴보겠습니다. 당시 이더리움의 일일 활성 개발자는 195명에서 100명으로 49% 감소했습니다.

요약하자면...

일일 활성 개발자:

Solana 2022 = -61%

2022년 이더리움 = -48%

2018년 이더리움 = -49%

이것은 솔라나가 2018년에 이더리움을 흉내내지 않는다는 것을 지금까지 이 기사에서 보여주는 첫 번째 지표입니다. 그 이유는 다시 경쟁 때문이라고 생각합니다.

2018년 개발자들이 이더리움이 아닌 스마트 컨트랙트 플랫폼에서 개발하고 싶다면 갈 곳이 없다. 현재 개발자가 선택할 수 있는 L1은 20개 이상, L2는 20개 이상입니다.

처음에 언급했듯이 지난 몇 주 동안 Solana의 일부 잘 알려진 프로젝트가 Ethereum 및 Polygon으로 마이그레이션되는 것을 보았습니다. 따라서 이러한 추세가 2023년 내내 계속되는지 지켜보는 것은 흥미로울 것입니다.

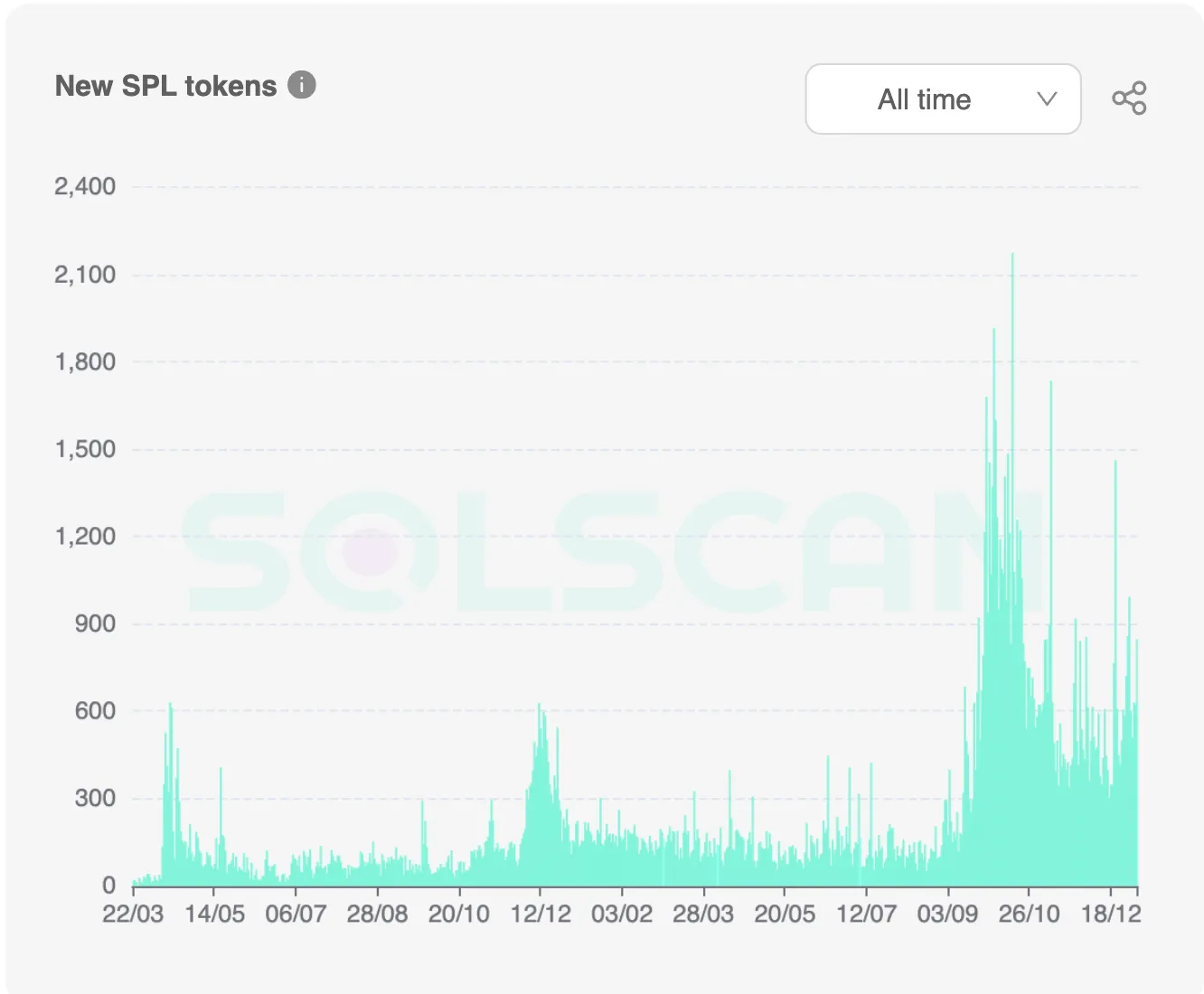

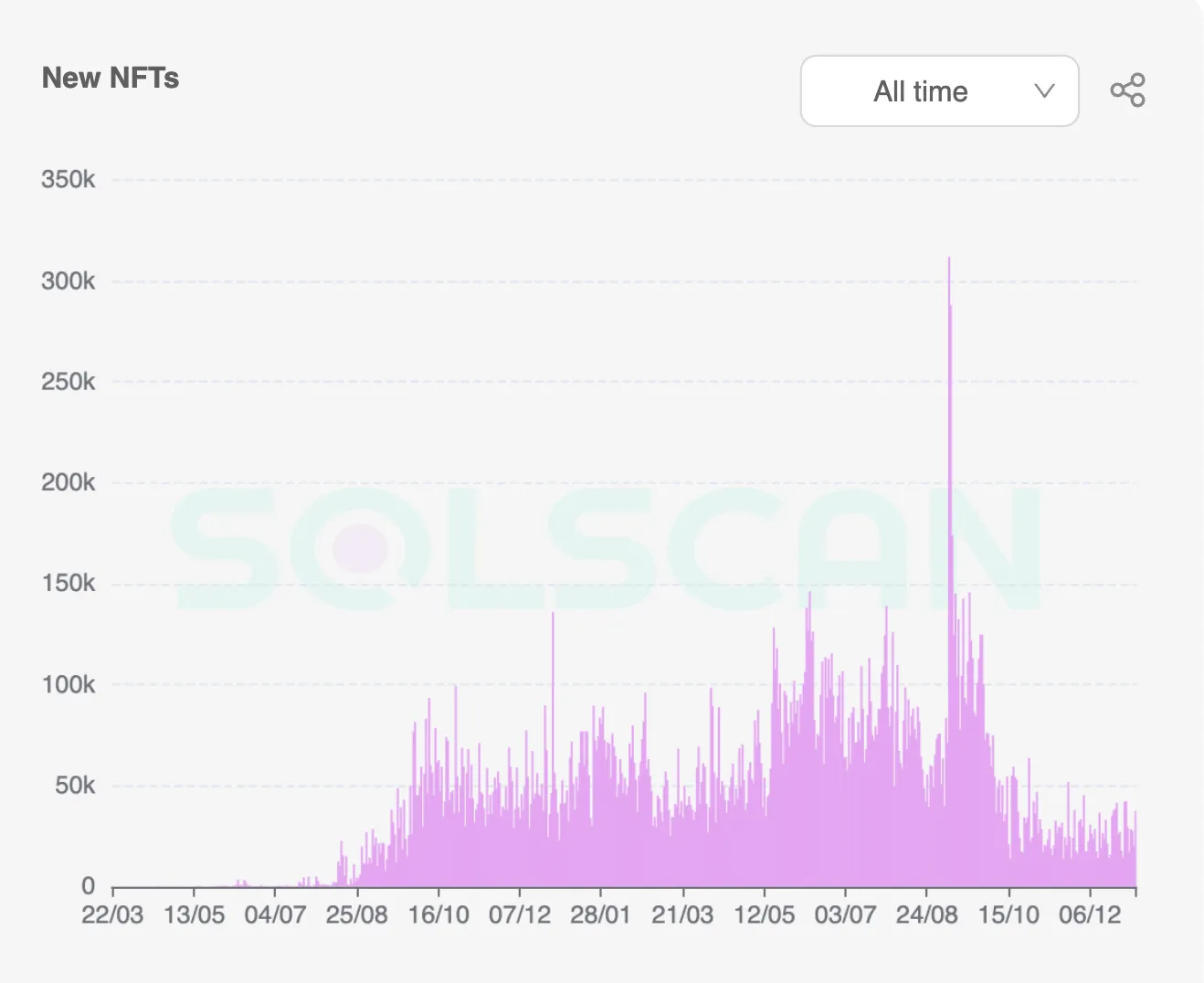

마지막 몇 가지 비교를 위해 두 생태계에서 새로 발행된 대체 가능 토큰(FT)과 대체 불가능 토큰(NFT)의 추세를 조사할 것입니다.

사실 저는 개발자들이 블록체인에서 단순한 토큰 이상을 구축하고 있기 때문에 두 생태계에서 총 스마트 계약 배포량을 비교하고 싶습니다. 그런데 솔라나의 스마트 컨트랙트 전개 데이터를 찾을 수 없습니다.

아래 그래프에서 우리는 Solana가 2022년 3분기에 하루에 1,000~1,500개의 새로운 FT가 배포되는 정점을 찍고 그 후 약 300~800개로 떨어지는 것을 볼 수 있습니다.

10월에 몇 차례 급증한 것을 제외하면 이더리움의 FT 배포는 지난 몇 달 동안 500에서 1,000 사이에서 강세를 유지했습니다.

NFT에 따르면 솔라나는 10월 이후 상당히 눈에 띄는 타격을 입었습니다. 이전에는 하루 평균 약 100,000개의 NFT가 발행되었지만 현재는 하루 평균 25,000개로 10월 이전 정점보다 훨씬 낮습니다.

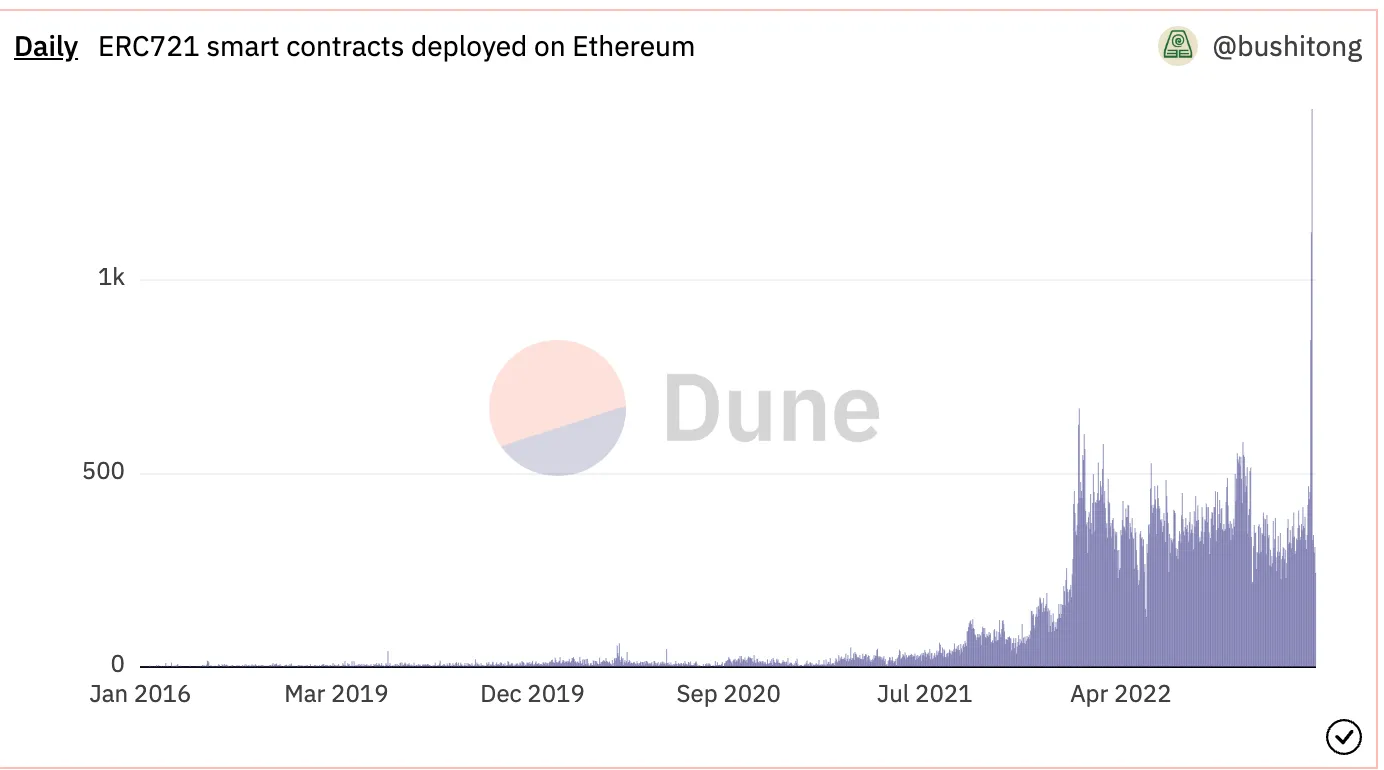

Ethereum의 데이터는 약간 다릅니다. 이 차트는 발행된 NFT의 수가 아니라 NFT 스마트 계약의 수를 반영하기 때문입니다. 즉, 이더리움은 다시 한 번 10월 이전 최고 수준으로 돌아갔습니다.

첫 번째 레벨 제목

솔라나가 죽었나요/곧 죽나요?

온체인 지표만 본다면 솔라나가 죽었다는 것을 암시하는 것은 없습니다.

혹자는 이러한 통계가 솔라나가 "죽어가고 있다"는 것을 보여준다고 주장할 수도 있습니다. 그러나 솔라나에 대한 이러한 수치는 2018년 이더리움과 매우 유사하여 2년 약세장에서 살아남고 번창했습니다.

Solana가 왜 이것을 할 수 없는지 이해할 수 없습니다. 믿을 수 없을 정도로 재능 있는 리더십 팀을 보유하고 있을 뿐만 아니라 강력한 커뮤니티도 있는 것 같습니다.

그러나 오늘날 솔라나와 2018년 이더리움의 가장 큰 차이점은 솔라나가 치열한 경쟁에 직면해 있다는 것입니다.

솔라나는 대중을 위한 빠르고 저렴하며 모바일 친화적인 블록체인인 "소비자" 블록체인의 왕이 되기 위해 노력하고 있습니다.

Ethereum은 목표가 아니기 때문에 전투에 참여하지 않습니다. 대신 이더리움은 인터넷을 위한 궁극적인 탈중앙화 및 보안 합의 계층이 되는 것을 목표로 합니다.

즉, 이더리움 생태계는 이미 Polygon, 다수의 Optimistic L2(Arbitrum 및 Optimism), Immutable과 같은 ZK L2와 같은 일부 경쟁자를 Solana에 출시했으며 더 많은 L2가 경쟁에 합류할 예정입니다.

이더리움을 기반으로 하는 이러한 각 L2는 빠르고 저렴한 트랜잭션을 제공하는 동시에 분산되고 안전한 상태를 유지할 수 있습니다.

솔라나의 기술은 확장성 측면에서 우월할 가능성이 있지만 아직 실제로 적용되지는 않았습니다.

다중 체인의 미래와 블록체인에 필요한 속성에 대한 논의는 이 기사의 범위를 벗어납니다.

그러나 내가 말할 것은 주류 세계에서 블록체인에 대한 수요가 많고 시간이 지남에 따라 성장할 것이라는 점입니다. 블록체인 간의 경쟁이 가열되고 있지만, 중단기적으로 주류 세계에서 대량 채택을 처리할 수 있는 사용 가능한 블록체인이 여전히 충분하지 않습니다.

솔라나, 이더리움 생태계 및 기타 블록체인이 시장 점유율을 놓고 경쟁하기보다 파이를 함께 성장시킬 여지가 충분합니다.

중앙은행 및 기타 부서에서 발행한 "가상 화폐 거래의 과대 광고 위험 추가 방지 및 처리에 관한 통지"에 따르면 이 기사의 내용은 정보 공유만을 위한 것이며 어떠한 운영 및 투자를 장려하거나 지지하지 않습니다. 불법적인 금융 행위에 가담하지 마십시오.

위험 경고:

중앙은행 및 기타 부서에서 발행한 "가상 화폐 거래의 과대 광고 위험 추가 방지 및 처리에 관한 통지"에 따르면 이 기사의 내용은 정보 공유만을 위한 것이며 어떠한 운영 및 투자를 장려하거나 지지하지 않습니다. 불법적인 금융 행위에 가담하지 마십시오.