香港フィンテックウィーク初日の速報: SBF、シャオ・イー、エイドリアン・チェンは何と言ったか?

出典: Shenchao TechFlow

10月31日、香港金融管理局と特別行政区政府投資促進局が共催する「香港フィンテックウィーク2022」が香港で盛大に開幕した 香港特別行政区の政策宣言では、政府の政策スタンスやアプローチが示された香港で活気に満ちた仮想資産産業とエコシステムを発展させる。

さらに、FTXの創設者であるSBF、Animocaの創設者であるXiao Yi、New World DevelopmentのCEOであるAdrian Cheng...およびその他のスター起業家が参加し、香港の金融テクノロジーの将来について話し合いました。

香港フィンテックウィーク初日の速報: SBF、シャオ・イー、エイドリアン・チェンは何と言ったか?

香港金融長官のポール・チャン氏の開会スピーチで香港フィンテックウィークが始まりました。 5年前、市内にはフィンテック企業は180社に満たなかったという。現在では新興企業から大企業まで800社以上が存在する。

同氏は香港の成長の要因として、香港の開かれた市場、厳格な規制体制、法の支配、よく発達したインフラ、資本と情報の自由な流れを挙げた。チェン氏はまた、香港は仮想資産ビジネスに携わるイノベーターの国際コミュニティに対してオープンであり、包括的であると述べた。

政府は金融規制当局と協力して、香港の仮想資産業界の持続可能かつ責任ある発展を促進するための環境を提供するために懸命に取り組んでいます。"政府は金融規制当局と協力して、香港の仮想資産業界の持続可能かつ責任ある発展を促進するための環境を提供するために懸命に取り組んでいます。"

香港における仮想資産の開発に関する政策声明

香港政府は今朝、香港における仮想資産(VA)の開発に関する政策声明を発表した。金融サービス・財務局(「FSTB」)が発行した声明は、香港における活気のある仮想資産産業とエコシステムの発展に向けた政府の政策スタンスとアプローチを明らかにしています。

政府は、香港でのスマートコントラクトの発展を促進するために、将来的にトークン化された資産の所有権とスマートコントラクトの合法性を見直す用意がある。

政府は、香港でのスマートコントラクトの発展を促進するために、将来的にトークン化された資産の所有権とスマートコントラクトの合法性を見直す用意がある。

"香港フィンテックウィーク初日の速報: SBF、シャオ・イー、エイドリアン・チェンは何と言ったか?"

アバターの姿で登壇した香港金融管理局のエディ・ユー最高経営責任者(CEO)は、メタバースが現実世界の金融活動の将来の風景をどのように形作るのかを探求したいと述べた。

彼はまた、これまでのフィンテックへの取り組みから得た 3 つの重要なポイントについても共有しました。

根本的にオープンマインド- 新しいアイデアに対して根本的にオープンになり、金融システムを改善できるものを実験する必要があります。この考え方により、香港は人気の高速決済システム (FPS) を開発し、8 つの仮想銀行を設立し、金融システムにおけるより高度なデータ インフラストラクチャをサポートする可能性があります。

新しい機会が新しいユーザーをもたらす- 小売決済、データ インフラストラクチャ、国境を越えた決済プラットフォームにおける新しいプラットフォームは、広く採用されるとより成功し持続可能になる傾向があり、強力なネットワーク効果につながります。言い換えれば、ネットワークが大きければ大きいほど、ユーザーも多くなります。

テクノロジーを超えて—最初のレベルのタイトル

Animoca CEO Yat Siu:"香港フィンテックウィーク初日の速報: SBF、シャオ・イー、エイドリアン・チェンは何と言ったか?"

囲炉裏での会話中、主催者のホイ金融サービス・財務長官は、アニモカ・ブランズの共同創設者兼執行会長であるシウに、彼の数あるビジネスの中でどれが一番気に入っているかを最初に尋ねた。シウ氏は答えを選ばなかったが、新興インフラがどのように社会を変えることができるかについて自分の考えを述べた。

「古典的な資本主義の形態では、通常、価値は株主にのみ与えられます。香港はこの状況で繁栄していますが、参加するのが難しい人もいます。Web3 が行うことは、この関係を顧客/消費者から、共有する顧客/所有者に変えることです」ビジネスそのものの可能性です。」

「スピードは香港の特徴の1つであり、テクノロジーの導入が早いです。4年前、香港のほとんどの人はNFTが何であるかさえ知りませんでしたが、今では香港政府がNFTを発行し始めています。これはこれは、人々がこの新しいタイプのものに真の関心を持っていることを示しています。」愛、そして香港の発展の可能性を促進することができます。"

中国証券監督管理委員会:暗号通貨サービスプロバイダーを規制することがイノベーションを受け入れる唯一の方法である

SFCのジュリア・レオン氏は、仮想通貨には業界を保護しイノベーションを支援するために秩序ある市場発展が必要だと主張した。"仮想通貨コミュニティは長年、規制がイノベーションを阻害し、フィンテックの開発や投資家の選択を制限すると主張してきた。しかし、特定の暗号通貨企業の行き過ぎは暗号通貨エコシステム全体を脅かし、暗号資産の時価総額はピークの3兆ドルから1兆ドルに縮小しました。"レオン氏は語った。

彼女は付け加えた:"はっきり言っておきます。私たちは基盤となる DLT テクノロジーをサポートしており、香港のフィンテック コミュニティの発展を歓迎します。 NFT、メタバース、Web 3.0 は私たちの生活を再構築し始めています。"

"しかし、仮想通貨の冬は、これらの機会を活用するのが決して簡単ではないことを示しています。実際、それらはリスクをはらんでいて、投資家に損害を与え、この分野に対する信頼を損なう可能性があります。サービスとしての仮想通貨プロバイダーを規制下に置くことが、イノベーションを受け入れる唯一の方法です。"

香港フィンテックウィーク初日の速報: SBF、シャオ・イー、エイドリアン・チェンは何と言ったか?

中国人民銀行の易綱総裁も講演した。eCNY は中国の中央銀行デジタル通貨で、国内の決済ニーズを満たし、金融包摂の発展を促進して通貨と決済システムの効率を向上させることを目的としています。

同氏は、中国人民銀行(人民銀行)がeCNYの利用を、交換・流通サービスに必要な情報のみを収集する認可事業者に限定していること、個人情報の安全性は高度な技術と厳格な管理によって保証されており、消費者プライバシー保護法や法令を完全に遵守していると付け加えた。規則。

暗号化された機密情報は、すべての非取引当事者に対して匿名化され、組織や個人が法的許可なしに恣意的に問い合わせることを禁止します。しかしイー氏は、状況は白黒はっきり付けられるものではないと指摘した。プライバシーの保護と違法行為との闘いの間で微妙なバランスを取る必要があります。

中国人民銀行は、世界および国内の投資家により良いサービスを提供し、国際金融センターとしての香港の役割を強化するために、香港金融管理局およびその他の通貨当局とCBDCに関して協力している。

SBF: 資産ベースのシステムではなく知識ベースのシステムの必要性

仮想通貨起業家のサム・バンクマン・フリード氏は、資産や投資は富ではなく知識に基づくべきだと信じています。

「富に基づく資産は階級差別的で人種差別的であり、デジタル資産への大規模で不公平なアクセスを生み出します。それが富裕層をより豊かにします。」

"彼は言った。"彼は言った。

香港フィンテックウィーク初日の速報: SBF、シャオ・イー、エイドリアン・チェンは何と言ったか?

彼は言った:

彼は言った:"調査によると、新型コロナウイルス感染症の流行下で従来の景気刺激策をデジタル消費者クーポンに置き換えることを決定した政府は、従来の方法を採用した地域に比べて少なくとも3倍の効果があるという。 」

「消費者市場を再定義したテクノロジーは現在、産業バリューチェーンを再構築しており、香港は再びデジタル時代の最前線に立っています。」

「新しいテクノロジーと関連ソリューションにより、"信託コスト"そして摩擦。スマートコントラクトにより、調達に関する情報が自動的に確認・実行されます。この高レベルのコラボレーションにより、貿易および物流のバリュー チェーン全体で効率が向上し、エラーが削減されます。"。

中央銀行とイノベーション: 進化か革命か?

香港金融管理局のリー副総裁が司会を務めた囲炉裏での雑談の中で、国際決済銀行BISイノベーションセンター所長のキングスリー女史は、中央銀行とイノベーションの関係についての熱意を表明した。彼女はそれを指摘した国内機関は国によって大きく異なる場合があるため、中央銀行と地方政府は密接な関係にあります。

BIS イノベーション センターは、世界中の中央銀行が協力して未来の金融インフラを提供し、革新的なテクノロジーに対応する方法を模索する機会を創出してきました。

BIS イノベーション センターが長年にわたって開発したレポートとコーディングは透明性が高く、他の機関がそこから学び、独自の実験に使用することが期待されています。中央銀行にとって、テクノロジーとは何か、それがどのように使用されるか、または使用されないのかを理解することも重要です。

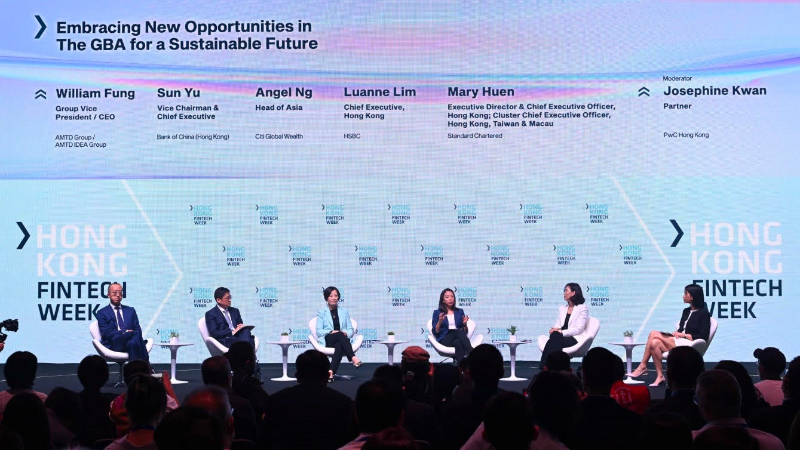

大湾区での新たな機会を活用して持続可能な未来を創造する

大手銀行や金融サービス会社のリーダーは、財務上の意思決定にESGをどのように、そしてなぜ組み込むのかを尋ねられました。香港中国銀行の孫宇氏は最初から、多くのグループメンバーの気持ちに同調し、次のように述べた。"ESG はもはや企業が語る単なる概念やスローガンではありません。いよいよ具体的な事業戦略へ"。

一方、スタンダードチャータード銀行香港のCEO、メアリー・フエン氏は次のように述べた。"香港の強みは、中国、大湾区、そして海外の企業に資金提供者やアドバイザーを提供していることです。どちらの立場においても、私たちはクライアントをより持続可能な選択へと導く機会を持っています。"

ATMD Idea Group の CEO、William Fung 氏は次のように述べています。"ESGは生き方です。それはあなたが望むものに基づいているのではなく、私たちが必要としているものに基づいています。私たちは皆、将来の世代のために世界をより良い場所にするために自分の役割を果たさなければなりません。"

香港フィンテックウィーク初日の速報: SBF、シャオ・イー、エイドリアン・チェンは何と言ったか?

New Century DevelopmentのCEOであるAdrian Cheng氏は、香港における仮想資産の開発に関する香港特別行政区政府の最新の政策声明を支持すると述べた。同氏は、デジタル資産、暗号通貨、ブロックチェーンに関して、香港には多くの魅力があると述べた。同氏はまた、中国国務院がブロックチェーンをサポートする重要性も強調した。

"香港は、大湾区における独自の立場により、ブロックチェーンエコシステムだけでなく、国境を越えたブロックチェーンインフラの地域開発をリードしていきます。香港はまた、企業が中国本土でブロックチェーンの機会を掴むよう導く上で最適な立場にある。"

"また、物理的側面とデジタル的側面が絡み合い、イノベーターや起業家が文化的および芸術的体験の次の波を形成しリードするための新しい舞台を提供する機会も見られます。これは、私たち全員にとって、特に生活がすでに Web3 の世界にどっぷり浸かっている若い世代にとって、一生に一度の機会です。"

メタ: アジア太平洋地域の 1 兆ドル規模のメタバースに足を踏み入れる

メタ・アジア・パシフィック担当副社長のダン・ニアリー氏はビデオで会議に参加し、香港とアジア太平洋地域の金融業界の驚異的な成長、そしてWeb3テクノロジーとメタバースの発展に興奮していると述べた。

Meta Corporation は、メタバースをインターネットの次の社会的進化と見ています。メタバースは、どこにいても、どんなデバイスからでも、誰とでも通信できるデジタル接続です。

ニアリー氏はこう言いました。メタバースは信じられないほど没入感があり、世界を変える力を持っています。たとえば、私たちとインターネットの関係は常に画面を見てきましたが、メタバースの出現により、人々はインターネットの中に住み、インターネットの一部になるだろうと彼は信じています。

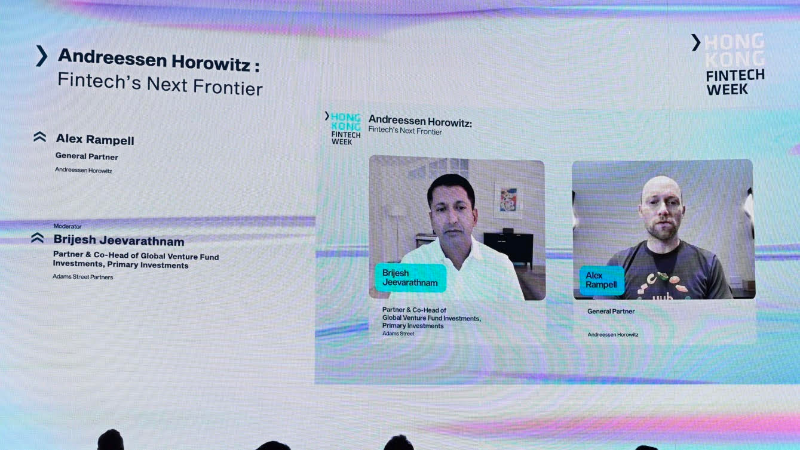

アンドリーセン・ホロヴィッツ (a16z): フィンテックの次のフロンティア

アンドリーセン・ホロウィッツのパートナーであるランプベル氏は、フィンテック企業が消費者の小規模なニーズに対応する多くの機会があると見ていると述べた。 Airbnb が家を借りたいユーザーのために作られ、Uber が車に乗りたいユーザーのために作られたのと同じように、フィンテックは一般の金融顧客の生活における多くの小さなギャップやニーズを埋めることができます。

なぜこれがまだ起こらなかったのかと尋ねられたとき、アレックスは次のように答えました。多くの金融テクノロジーは新しいものであり、トレンドが完全にデジタル化し始めるにはパンデミックが必要です。

"彼は言った。"彼は言った。

"動いている物体は動き続け、静止している物体は静止したままであるのと同じように、銀行の顧客は、大幅に押されたり混乱されたりしない限り、銀行に留まります。少なくとも米国では、1 つの金融機関での銀行業務の多くの手間を省くことができるシンプルなアプリがあれば、多くの顧客の生活がはるかに楽になるでしょう。"

トップのフィンテック投資とトレンド

このセッションで、Gobi の共同創設者である Cao 氏は、東南アジアは非常に大きな市場であるため、南に目を向け始めるように全員に言いました。主に若くて革新的な人々。同氏はまた、中国市場が発展の第3段階に入っているため、中国市場に焦点を当てることが重要であるとも述べた。"グレーターベイエリア、特に香港はフィンテックの発展に非常に適しており、"彼が追加した。

Kenetic の共同創設者兼マネージングパートナーである Jehan Chu 氏は、ブロックチェーンがインターネットの次のバージョンであると述べました。"ハイブリッドは新しい合言葉です"、 彼が追加した。彼はこう言い返した「Web 2.5」は、ブロックチェーンとフィンテックをより広範な人々にアクセスしやすくするため、成功の鍵となります。

一方、GGVキャピタルのマネージングパートナーであるリー氏は次のように述べた。企業が成功するには、革新的であり、香港の他のフィンテック企業とは異なる必要があります。管理可能なコスト、予測可能かつ達成可能な ROI で成長を達成することも重要です。 「簡単に言えば、確実にお金を稼ぎたいのです!」と彼女は言いました。

香港フィンテックウィーク初日の速報: SBF、シャオ・イー、エイドリアン・チェンは何と言ったか?

香港特別行政区金融サービス長官兼財務省のクリストファー・ホイ氏が司会を務めた囲炉裏での雑談の中で、ウェストキャップのトシ氏は、今後10年間のフィンテック投資の3つの主要分野、すなわち決済、銀行技術、民間市場へのアクセスについて言及した。彼が最も驚いた企業は、適応力があり、時間をかけて反復してきた企業だった、と彼は語った。

彼はまた、自分のビジネスを始めようと考えている人たちに次のようなアドバイスをしています。

情熱を持ち続ける- 好きなことをしてください。場合によっては、成功はその人が取り組んでいる個人的な問題である可能性があります。

学び続けます– エコシステムで何が起こっているのかを理解し、学ぶことが重要です。

文化を創る- 人々が現状に挑戦し、新しいアイデアを受け入れることができる文化を育む。

クリストファー・ホイ氏はまた、香港の人材基盤を拡大し、すでにこの分野で活躍している人々の知識向上を支援するために、政府が海外からフィンテック人材を採用していると述べた。

香港フィンテックウィーク初日の速報: SBF、シャオ・イー、エイドリアン・チェンは何と言ったか?

MASはイスラエル銀行と協力して中央銀行デジタル通貨(CDBC)を作成しています。その背後にあるアイデアは、デジタル決済のワンストップ ショップを構築することです。

"最近新しい携帯電話を購入したのですが、"香港金融管理局の最高金融技術責任者であるネルソン・チョウ氏は次のように述べています。"私の携帯電話には非常に多くの異なる支払いアプリがあることに気づきました。"

CDBC の創設により、すべてが 1 つのデジタル通貨に統合されるため、一般の人々はデジタル銀行取引や商店との取引がより簡単になるでしょう。

香港フィンテックウィーク初日の速報: SBF、シャオ・イー、エイドリアン・チェンは何と言ったか?

HSBC(香港)のウェルス・個人バンキング責任者マギー・ン氏は、ミレニアル世代とZ世代が金融業界のデジタル化の主な推進力だが、銀行が考慮する必要があるのは彼らだけではないと述べた。社会の高齢者グループはこれらのテクノロジーを導入するのが遅いかもしれませんが、同じくらい重要です。

"誰も置き去りにしないようにしたい",彼女は付け加えた。"デジタル化を利用して、誰もが物事をよりアクセスしやすくすることは、私たちにとって非常に重要です。新しいテクノロジーを受け入れるのが遅い高齢者が取り残されるとしたら、私たちはこの目標を達成したことにはならず、優先順位を若い人たちに移しただけです。"

グローバル リーダー - 明日の経済

ブルームバーグ記者のイボンヌ・マン氏の司会で、JPモルガン社長兼COOのダニエル・ピント氏、スタンダードチャータードCEOのビル・ウィンターズ氏が金融サービスと銀行業界全体の構造について語った。ピント氏によれば、銀行はテクノロジーの発展に適応しつつありますが、主に投資面で依然として課題が残っています。

データについてピント氏はこう語った。今日の銀行は、データをビジネスと顧客にとって役立つものに変えようとしています。銀行はデータを使用して顧客をセグメント化し、特定の顧客にサービスや製品を提供できます。一方、ウィンターズ氏はこう語った。データ分析に重点を置いている企業が多いため、銀行がこの競争に勝つ可能性は低いです。市場は常に急速に成長しており、ウィンターズ氏は銀行に対し、従業員にデータの重要性を教えます。データを賢く利用する方法を知っていれば、これが銀行で勝つための鍵となるかもしれません。