合併のメリットは尽きたのか?仮想通貨市場はいつまで下落するのでしょうか?

イーサリアムが統合に参加し始めて以来、暗号通貨市場は下落し続けています。

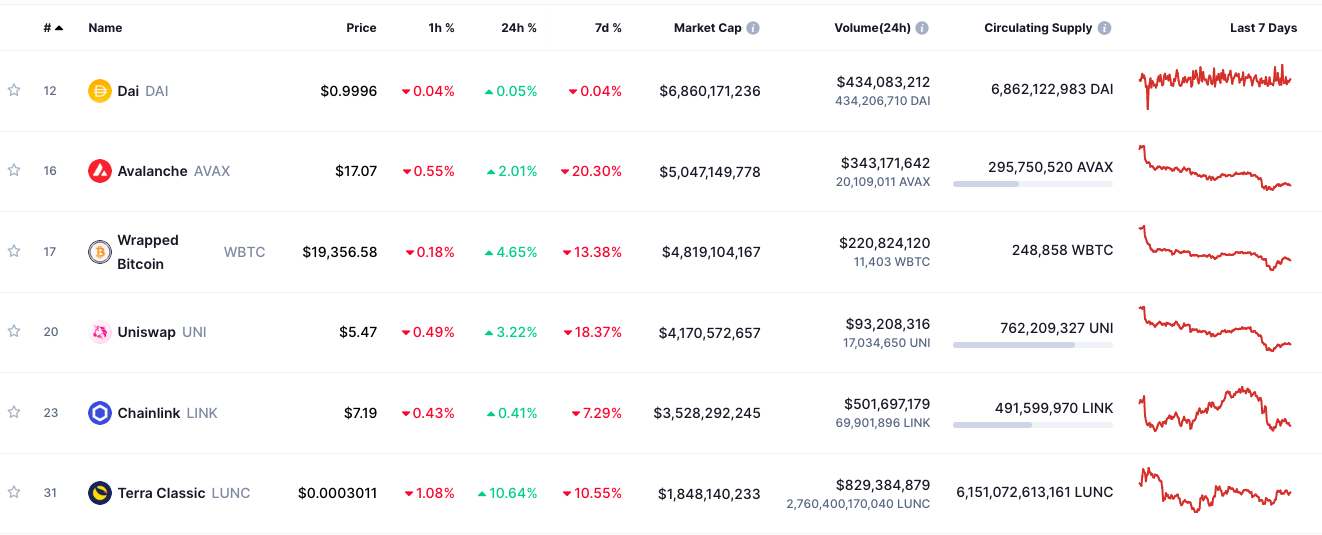

OKX市場によると、昨日BTCは1万8000ドルの水準に近づき、過去3カ月で最低の1万8235ドルまで下落し、ETHは一時1300ドルを下回り、1280ドルまで下落し、約2カ月ぶりの安値となった。他のアルトコインも程度の差はあれこれに追随しました。

本稿執筆時点では、BTC と ETH の価格はそれぞれ 19,209 ドルと 1,350 ドルです。

時間を1か月前に巻き戻します。 8月28日にBTCが2万ドルを下回って以降、市場は混乱に陥っている。 9月7日、ショックは終わり、再び下落傾向が始まりました。ビットコインは一時1万9000ドルを割り込み、この日の最安値は1万8505ドルだった。ビットコインの下落は、多くの主流通貨やアルトコインの下落にもつながりました。以前のビットコインショック時にずっと上昇していた主流通貨は売られ過ぎ、9月7日にはETHは最安値で1485USDT、24日には7.55%まで下落し、最高値では11%も下落した。残りの主流通貨とさまざまなDeFiトークンは総じて約7%下落した。

現時点では、ETH 2.0の合併までまだ1週間あり、市場は一般的にETH 2.0の合併の成功に賭けています。したがって、市場は短期的な下落を経験した後、すぐに上昇市場を迎えました。イーサリアムの合併前、BTCは約20%上昇して3週間ぶりの高値を記録し、市場は小反発を迎えた。 ETHも約10%上昇し、9月以来の最高値を突破した。 AAVE、CRV、LINKなどを筆頭に、多数の初期のDeFi主導プロジェクトが再び立ち上がり始め、その上昇ペースはETH 2.0の合併と一致していました。

でも、楽しい時間は長くは続かず、CPIデータの開示により、投資家は様子見を始めた。

9月13日、米国が発表した8月の消費者物価指数は8.3%で、市場予想の8.1%を下回った。予想より悪いマクロ経済指標の発表直後に米国株も下落し、ハイテク株の多いナスダック総合指数先物は3.6%下落した。

これに応じて仮想通貨市場も調整し、BTCの反発は鈍化し始め、一時22,800ドルまで回復した後、急落し始め、過去3日間の上昇分を帳消しにした。

現時点では、サークル内でのイーサリアムの合併に対する前向きな期待はマクロトレンドに抵抗することができません。合併の初期段階では、多くの投資家がフォークされたコインのエアドロップを見越してETHを買いだめしていましたが、同時に市場にはETHのヘッジを空売りしようとする強い力があります。 14に到達すると、Aaveの資金利用率も一時100%に達しました。

合併が成功した後は、予想通り安定した状況と判断したのか、投資家の空売り注文が相次ぎ、Binance ETHUSDTの無期限契約の調達率は合併前の-0.5%近くから調整されました。 to -0.24%; Aave プラットフォーム上で貸し出されたETHも合併完了後に返還され、資金の利用率は75%を下回りました。現時点では合併は順調でフォークコインの人気は沈静化し、ETHスポット市場も一定の売り圧力に直面している。一部の投資家がスポットを売却し、市場のETH価格は全面下落した。

現時点では、「PoS仮想通貨は連邦証券規制の対象となる有価証券として認識される可能性がある」発言でパニックの痕跡がさらに強まる、暗号市場全体が再び下落し始めました。

Coinの9月19日のデータによると、過去24時間でネットワーク全体で総額15億5,000万米ドルが清算され、合計19万人が清算の犠牲者となり、1回の清算で最大額は1億5,000万米ドルに達した。この影響を受け、暗号化市場全体の市場価値も過去 2 日間で 300 億ドル以上減少しました。

また、極端な市場状況の出現により、ETH価格が約1284.684米ドルだった時点で、MakerDAOの財務省は約330万のDAI負債の清算リスクに直面することになりました(幸いなことに破綻はありませんでした)。

今日(9月20日)を見ると、ETHは合併終了以来28%下落し、1,280ドルまで下落しました。 BTCは約20%下落しており、どちらも9月19日に最近の安値を付けた。

このような市場状況に直面して、コミュニティユーザーは苦情を言いました:ETHは一夜にしてCardanoの悪いバージョンになってしまいました…合併は私のウォレットと他の人の合併であることが判明しました…

これに対し、暗号化データ会社カイコのリサーチアナリスト、リヤド・キャリー氏は次のように述べた。突然の価格暴落は「噂を買って事実を売る」反応のように見える。市場厚みの減少とスプレッドの増加が見られ、価格への影響がさらに大きくなる可能性があります。”

仮想通貨の将来の市場に関しては、それが際限なく下落するのか、それとも大きく反発するのか、さまざまな機関も二極化した態度をとっています。

ブルームバーグ・インテリジェンスのシニア商品ストラテジスト、マクグローン氏は、「FRBの行動は投資家心理を弱め続けるだろう。BTC、ETH、そしてより広範な仮想通貨業界は更なる市場の大虐殺に見舞われる可能性があり、ETHは1,000ドル、あるいはそれ以下に下落する可能性がある。」と述べた。

(デイリーメモ:FRBの利上げ会合に合わせて、市場では当局者らが3回連続で基準金利を75ベーシスポイント引き上げることについて議論すると一般的に予想されており、金利を100ベーシスポイント引き上げる可能性も予想されている) 25%。具体的なデータはありませんが、投資家の取引センチメントは不満に満ちており、今日のパニックと貪欲指数は 23 で、レベルは依然として極度のパニックです。)

楽観主義者の代表であるバンエックのデジタル資産調査責任者マシュー・シーゲル氏は、「ETH 2.0の合併後、市場関係者がコミットメントを行い、流動性を確保していることは明らかだ。それは時間の経過とともに続くので、私はそう思う」と語った。価格変動にもかかわらず、初期の結果はかなり心強いものだと思います。」

しかし、主流通貨市場は長い間世界経済状況から独立できていないため、私たちはより悲観的であり、主流通貨が今後数カ月以内に歴史的高値に戻ることは難しいと考えています。いつものように、慎重に操作しながら自信を維持し、レバーを減らします。