Mar. 2022, Vincy

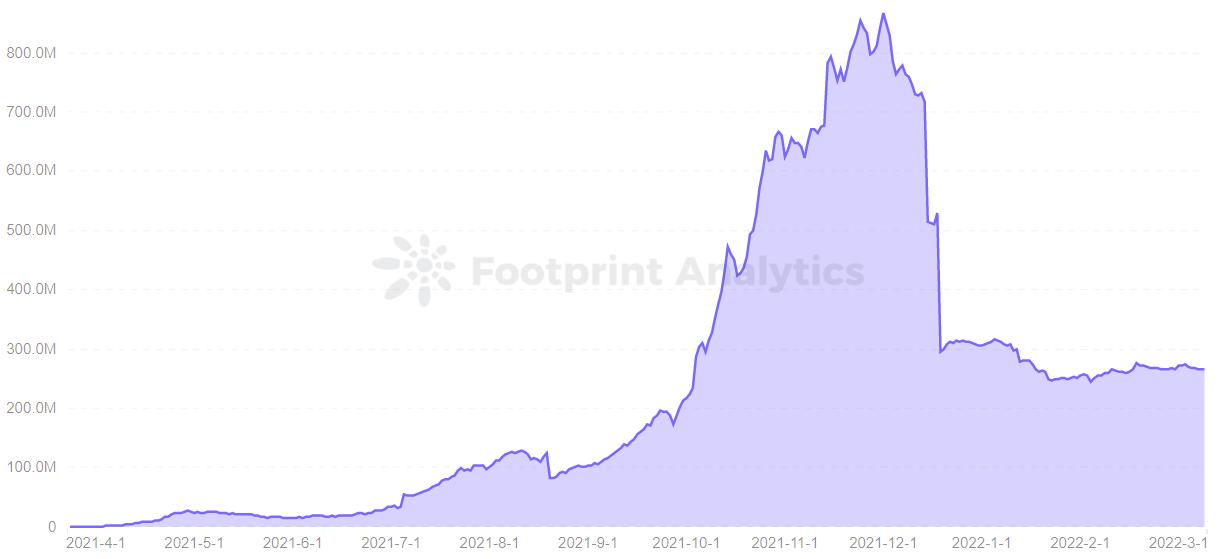

Data Source: Footprint Analytics - Olympus DAO Dashboard

Olympus DAOHit by the recent market sell-off, OHM traded as low as $32.6 on March 9, down 97.7% from its all-time high of $1,415.26 set in April 2021.

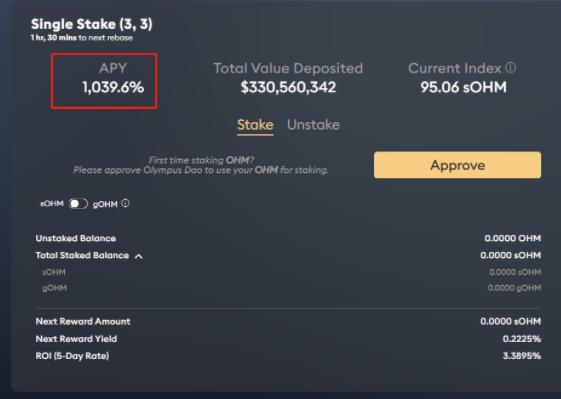

Olympus DAO as a protocol for the first decentralized reserve currency. As of the end of October 2021, staking OHM has an APY of over 8,000%, and it still has an APY of 1,039% so far. Faced with such a high APY, its TVL and token OHMPrices are falling.

What prevents the continued development of OHM?

Olympus DAO controls its own liquidity

image description

Footprint Analytics - TVL of Olympus DAO

Olympus DAO is the first protocol that uses the Bond mechanism to create an alternative to the "liquidity mining" model. It issues token OHM at a discount and creates LP tokens to provide liquidity, creating the concept of "protocol has liquidity" .

Olympus DAO supports three user behaviors: pledge, bond purchase and sale.

Bond buying is a unique mechanism of Olympus DAO that allows users to buy discounted OHM from the treasury by backing assets such as wETH and DAI. However, to get the discounted OHM, you need to pay the corresponding value of treasury assets such as wETH and DAI, and a waiting period of 2 to 5 days is required to fully obtain the purchased OHM.

In addition to treasury-backed assets, users can also exchange for discounted OHM by paying LP tokens, which are generally liquid pair tokens related to OHM, such as OHM-DAI LP, etc. Combining LP token with stable currency ensures that the treasury can control most of the liquidity and earn service fees through LP token.

image description

Screenshot source - Olympus DAO website

Using the "Prisoner's Dilemma" model in game theory

The reason why Olympus DAO attracts a large number of users stems from its (3,3) economic model, which comes from the famous "Prisoner's Dilemma" model in game theory.

image description

Screenshot source - Olympus DAO website

When obtaining OHM by purchasing bonds, users will pay assets such as wETH, DAI, and FRAX to increase Olympus' treasury funds to support the value of OHM. The growth of Olympus DAO treasury funds and the agreement controls 99.8% of OHM, so the market price of OHM in 1DAI can be hundreds or even thousands of times higher.

A higher APY also means a higher premium, which will lead to a large amount of OHM output as incentive inflation. At the same time, there will be a large number of OHM mining, withdrawing and selling operations in the market, and the price of OHM and the pledged APY of the agreement will also decrease. In the worst case, it may be reduced to the stage of (-3,-3). This means that both Olympus DAO and users will get a corresponding loss.

In this mode, users who enter the market at the right time can obtain short-term high returns, but the greedy Tokenomics created with APY will also be driven by human nature. Therefore, high returns are not sustainable.

The price of OHM currency floats freely and is determined by the market

The price of OHM is backed by the DAO's treasury assets such as wETH, DAI, and FRAX. The underlying logic implied:

When the price of OHM rises, the agreement lowers the price by issuing additional OHM;

When the price of OHM drops, the agreement will repurchase and destroy OHM to pull back the price.

image description

Footprint Analytics - OHM of Price

Through the currency price trend of OHM, analyze the main rising and falling factors.

Currency price rise:

Olympus has introduced a bond function, which allows users to purchase discounted OHM to form LP tokens and earn APY between 1000% and 8000%.

The rewards obtained are compounded 3 times a day, which accelerates the growth of the asset pool.

Currency price drops:

More users who pledge OHM will also lead to a drop in currency prices.

The price of OHM is basically maintained by newly purchased users.

OHM currently has no practical program. The demand for OHM comes from users who want to use OHM to obtain high APY, and provide liquidity for OHM trading pairs, linking their LP tokens to discounted OHM.

On January 17, Whale dumped 82,526 OHM (valued at $13.3 million at the time), triggering a new low for the coin.

ComparedLido pledge protocolepilogue

epilogue

The Footprint Community is a global, mutually supportive data community where members leverage data visualizations to co-create communicable insights. In the Footprint community, you can get help, establish links, and exchange learning and research on blockchains such as Web 3, Metaverse, GameFi, and DeFi. Many active, diverse, and highly engaged members inspire and support each other through the community, and a worldwide user base is built to contribute data, share insights, and drive the community forward.

This article comes fromFootprint Analyticscommunity contribution

The above content is only a personal opinion, for reference and communication only, and does not constitute investment advice. If there are obvious understanding or data errors, feedback is welcome.

Copyright Notice:

This work is original by the author, please indicate the source for reprinting. Commercial reprinting needs to be authorized by the author, and those who reprint, extract or use other methods without authorization will be investigated for relevant legal responsibilities.

The Footprint Community is a global, mutually supportive data community where members leverage data visualizations to co-create communicable insights. In the Footprint community, you can get help, establish links, and exchange learning and research on blockchains such as Web 3, Metaverse, GameFi, and DeFi. Many active, diverse, and highly engaged members inspire and support each other through the community, and a worldwide user base is built to contribute data, share insights, and drive the community forward.