1月比特币ETF终上市,公链稳健发展

author:stella@footprint.network

Data Sources:Public Chain Research - Footprint Analytics

In January 2024, the cryptocurrency field received a major breakthrough with the launch of the U.S. Bitcoin ETF. Against this backdrop, despite market enthusiasm, Bitcoin andEthereumPrices have shown significant stability. The development of the public chain field this year is not limited to these two giants, but also includes some key events such as the Bitcoin halving and the Ethereum Dencun upgrade. At the same time,Sui、RoninandManta PacificOther potential public chain projects have also attracted much attention.

The data for this report comes from Footprint AnalyticsPublic chain research page. This page provides an easy-to-use dashboard containing the most critical statistics and indicators for understanding the public chain field, updated in real time.

Key points overview

Crypto Market Overview

The broader crypto market focus turns to exploring synergies between the crypto industry and AI. Against the backdrop of the Federal Reserve’s decision to keep interest rates stable,StablecoinSteady increase in market capitalization.

Public chain overview

Bitcoin andEthereumThe price of BTC remained relatively stable during the month, while other altcoins performed less well.

At the end of January, the total value locked (TVL) in the public chain reached $75.1 billion.

In January 2024, SUI saw significant growth in value, jumping from $0.78 to $1.52, an increase of 94.9%. At the same time, Suis DeFi sector has also achieved significant growth, with its TVL reaching more than $500 million.

Layer 2

Manta PacificThe TVL achieved a staggering 164.3% growth, quickly emerging as the third largest Ethereum Layer 2 solution.

BlastTVL also achieved significant growth, from US$1.1 billion to US$1.4 billion, an increase of 20.5%.

Blockchain games

In January 2024, the average number of active users (number of wallets) in the blockchain gaming field surged 54.7% compared to the full-year average in 2023.

In terms of transaction volume, BNB Chain, Ronin and Ethereum are at the top, accounting for 32.8%, 15.9% and 15.8% of the total transaction volume of 377 million respectively.

NFT

January,EthereumLeading the NFT market with a trading volume of US$900 million, the market share is 89.1%, but this is the lowest level since 2021.

JanuaryPolygonThe trading activity increased significantly, with its trading volume reaching US$110 million, an increase of 97.2% from the previous month.

Investment and financing situation

In January, a total of six financing events occurred in the public chain field, raising a total of US$34 million in funds.

Polymer Labs recently successfully raised $23 million in Series A funding.

Key news

Etherscan already supports zkSync transaction query and other services.

Solana’s monthly transaction volume reached its highest level in nearly a year or two.

On-chain data shows that the Starknet network has supported the use of STRK to pay gas fees.

Klaytn, a Korean public chain project, and Finschia, a subsidiary of LINE, jointly proposed an on-chain merger.

Crypto Market Overview

The debut of U.S. spot Bitcoin ETFs in January 2024 marked a key moment for the crypto market, with daily trading volumes of up to $210 million in these ETFs quickly attracting investors attention, reflecting the growing role of cryptocurrencies in the traditional financial ecosystem. Deeper integration. Despite rising market excitement, Bitcoin andEthereumThe price remains relatively stable, indicating that traders remain cautious after the ETF is approved.

At the same time, the focus of the broader crypto market has turned to exploring synergies between the crypto industry and AI. In addition, against the backdrop of the Federal Reserve’s decision to keep interest rates stable,StablecoinSteady increase in market capitalization.

The crypto space is undergoing a subtle evolution, both in terms of institutional adoption through the approval of Bitcoin ETFs and in balancing considerations with continued expectations for macroeconomic and technological developments.

Public chain overview

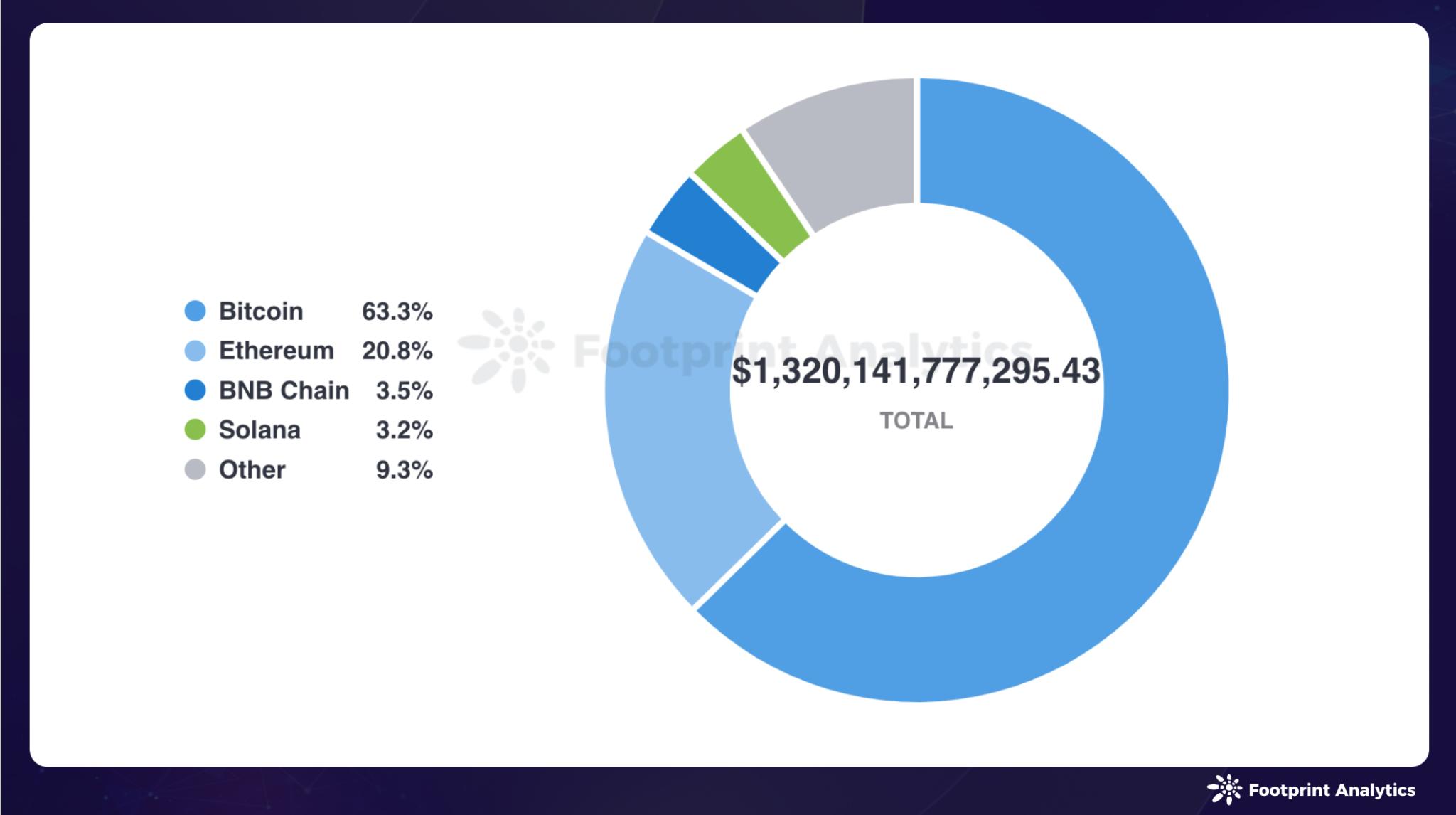

By the end of January, the total market value of public chain cryptocurrencies reached US$1.32 trillion, of which Bitcoin,Ethereum、BNBMainstream public chains such as Chain and Solana occupy a dominant position, with market shares of 63.3%, 20.8%, 3.5% and 3.1% respectively.

Data Sources:Public chain token market value share - Footprint Analytics

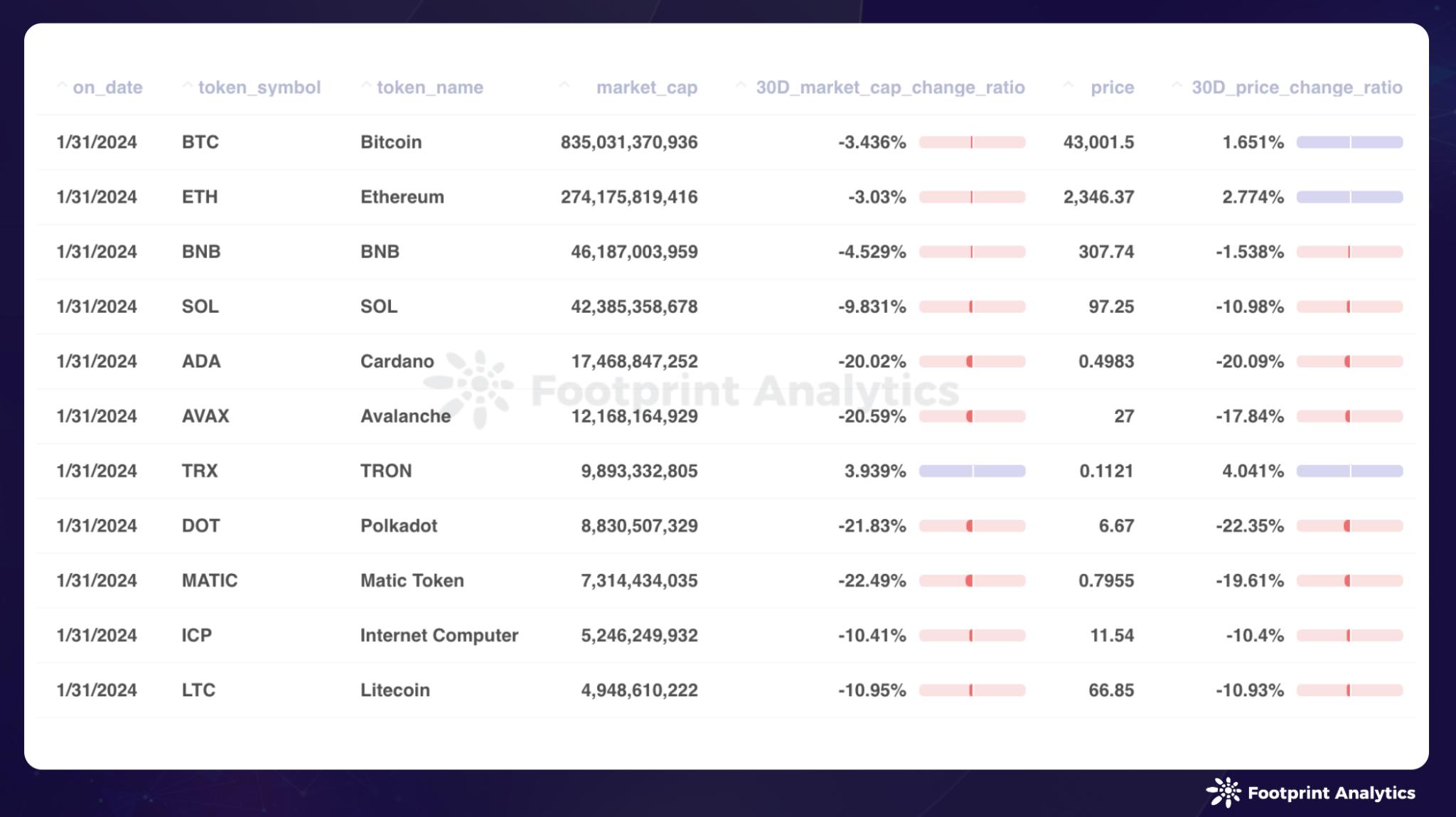

Bitcoin andEthereumGrowth continued in January, albeit at a slower pace. Bitcoin edged up 1.65%, starting the month at $42,303 and closing at $43,001.EthereumIt rose by 2.77%, from $2,283 to $2,346. With the launch of a spot Bitcoin ETF in the United States, January becomes the first month since 2023 for Bitcoin andEthereumThe month with the highest prices.

Data Sources:Bitcoin and Ethereum Prices - Footprint Analytics

Bitcoin andEthereumThe price of BTC remained relatively stable during the month, while the performance of other coins was less than satisfactory. Among the top ten cryptocurrencies by market capitalization, TRX is an exception, with its price increasing by 4.0%, whileBNB, SOL, ADA andAVAXThe prices of other tokens fell in January. Cryptocurrency prices previously experienced a surge in December, driven by expectations for the adoption of a Bitcoin ETF, but the market subsequently pulled back.

Data Sources:Public chain token price and market value - Footprint Analytics

At the end of January, the total value locked (TVL) in the public chain reached $75.1 billion. in,EthereumLeading the market with 73.2% market share and TVL of US$54.9 billion. Tron andBNBChain followed, accounting for 10.0% and 4.46% of the market respectively, corresponding to TVL of US$7.5 billion and US$3.4 billion.

Data Sources:Public chain TVL- Footprint Analytics

In October 2023, Sui launched a $50 million incentive program aimed at attracting developers by providing financial incentives (grant) and setting user incentives to attract investors. This strategy has significantly promoted DeFi activities within the Sui ecosystem. As a result, in January 2024, SUI saw a significant increase in value, jumping from $0.78 to $1.52, an increase of 94.9%. At the same time, Suis DeFi sector has also achieved significant growth, with its TVL reaching more than $500 million.

Layer 2

ArbitrumTVL achieved a 10.3% growth in one month, jumping from US$8.5 billion to US$9.3 billion, further consolidating its leading position in the Layer 2 market. at the same time,Manta PacificThe TVL also achieved a staggering 164.3% growth, quickly emerging as the third largest Ethereum Layer 2 solution. on the other hand,BlastTVL also achieved significant growth, from US$1.1 billion to US$1.4 billion, an increase of 20.5%. It is worth mentioning that,LineaTVL achieved a growth of 41.8%, from US$180 million to US$250 million.

In comparisonOptimismTVL fell from US$5.4 billion to US$4.7 billion, a decrease of 13.1%.BaseAlso underperforming, down 6.7%, whilezkSync EraTVL also fell by 10.8%.

Layer 2 solutions are diversifying to address competition and challenges within the blockchain ecosystem.

Manta Network successfully hosted the New Paradigm event, which greatly promoted the growth of its online activities. The network then further strengthened this momentum by airdropping 50 million MANTA, providingManta PacificTVLs rapid growth has injected strong momentum. This achievement is particularly noteworthy considering that its mainnet will only be officially launched in September 2023.

January 17,BlastAnnounced the launch of its testnet and simultaneously launched a developer competition called Blast BIG BANG to encourage more dApps to log on to its platform. besides,BlastAn airdrop distribution plan was also announced, with shares allocated to dApp developers and users participating in token staking. Despite the recent controversy over its use of manipulative marketing strategies to raise more than $1 billion and alleged plagiarism of Optimism code,Blastof TVL still achieved rapid growth.

on the other hand,StarknetEstablished a partnership with Celestia to jointly improve the data availability of Layer 3 application chains. The two parties will use Celestias core component Blobstream to build a data availability layer to achieve secure storage of off-chain data and provide verifiable proof of existence to ensure data integrity and reliability.

Blockchain games

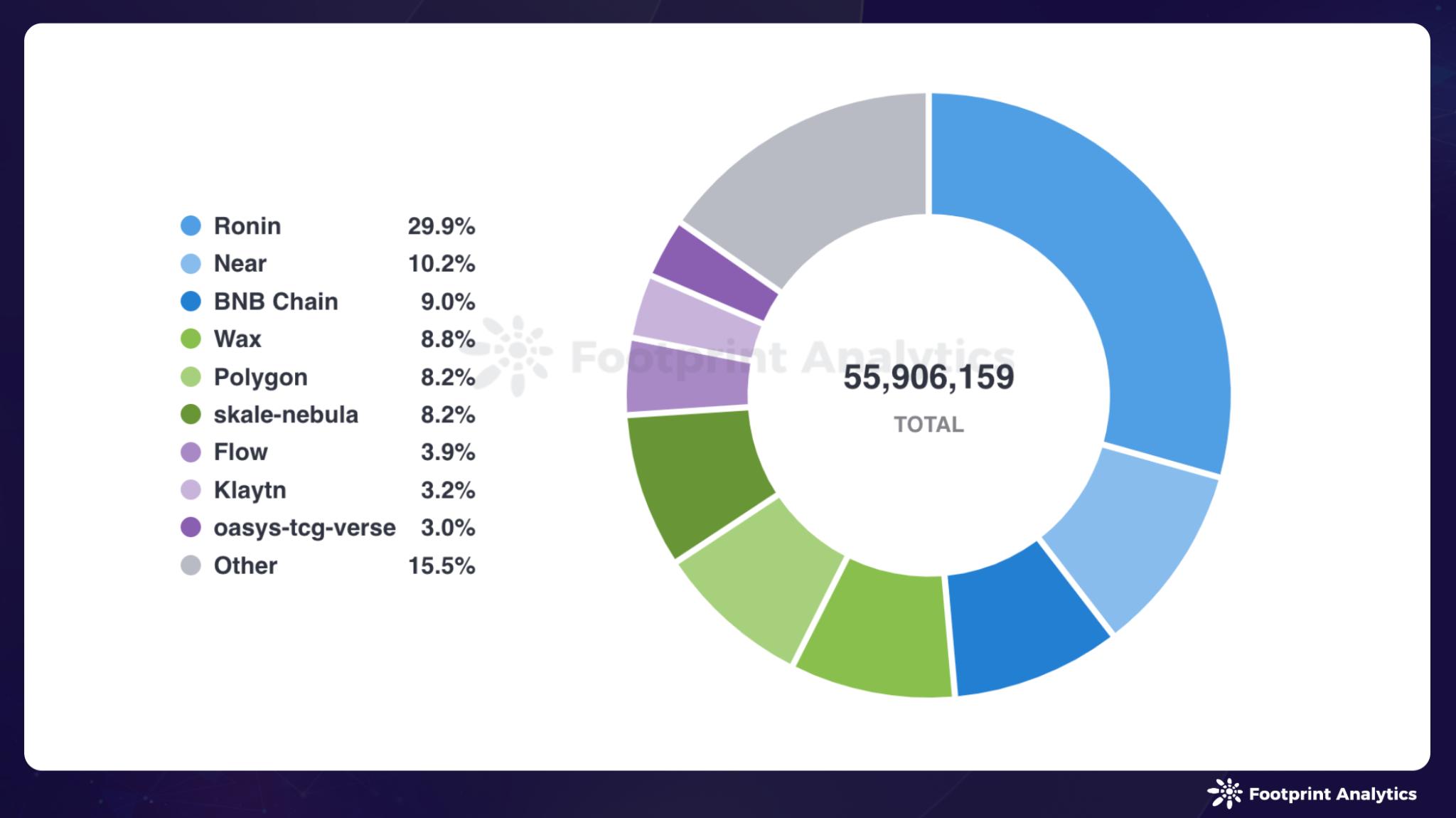

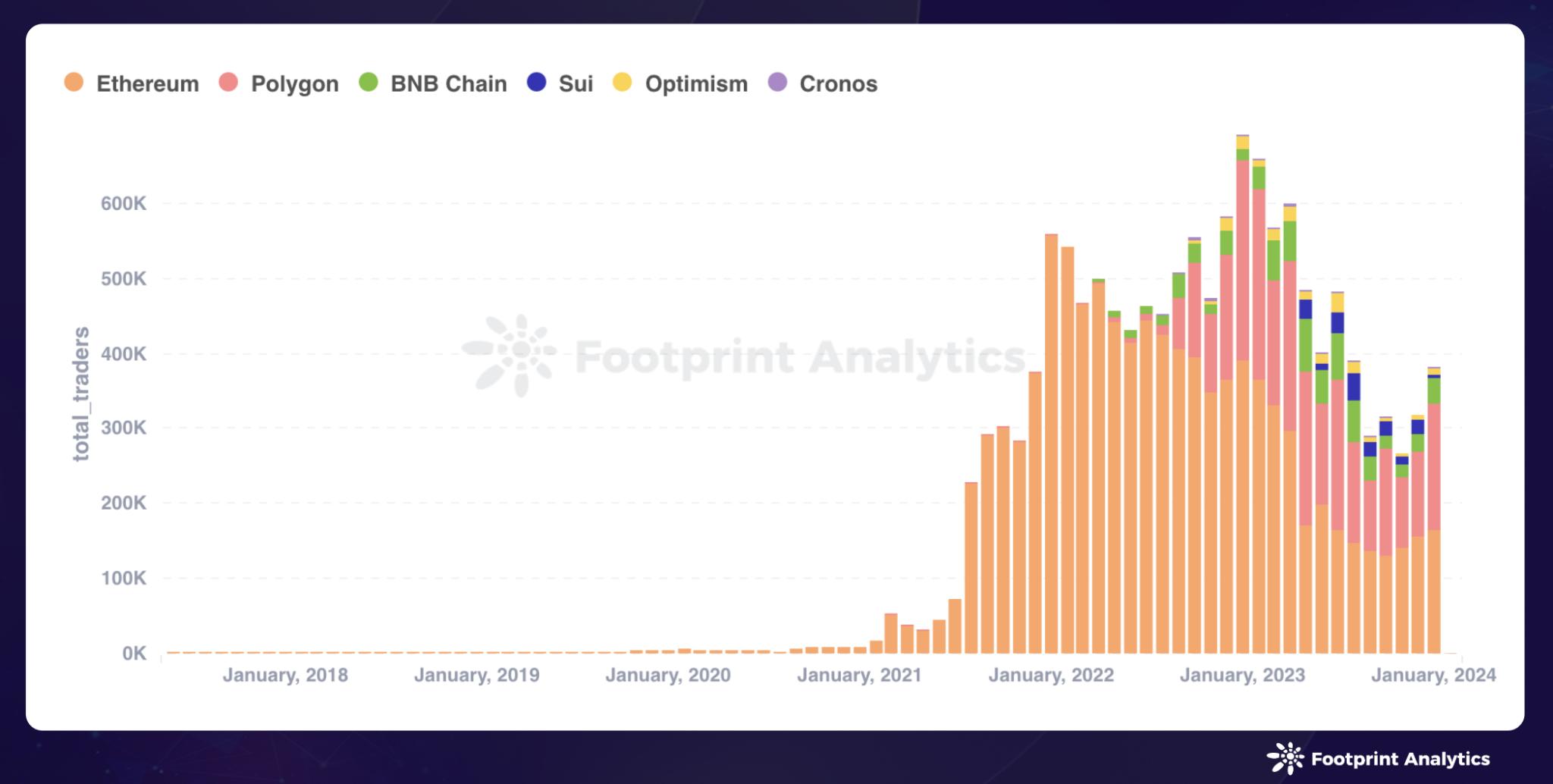

In January 2024, according toFootprint AnalyticsAccording to statistics, the average number of active users (number of wallets) in the blockchain gaming field has surged by 54.7% compared with the annual average in 2023, and the growth trend has begun to appear since November 2023.Ronin、NearandBNBChain has become the blockchain platform with the largest number of active users, accounting for 29.9%, 10.2% and 9% of the total respectively.

Data Sources:Active Gamers Shared by Chain - Footprint Analytics

In terms of transaction volume, BNB Chain, Ronin and Ethereum are at the top, accounting for 32.8%, 15.9% and 15.8% of the total transaction volume of 377 million respectively.

January,RoninThe trading volume and the number of active users have increased sharply. Compared with December, the trading volume surged by 213.41%. This growth is driven by continued improvements to the platform and the expansion of its ecosystem.RoninThe game wallet has added support for mainstream blockchains such as Ethereum, Polygon and BNB chains. This month, it also activated the platform’s activities through airdrops of projects such as Pixels and Apeiron.

You can read the blockchain game monthly report from Footprint Analytics to get more data insights: January Web3 Game Industry Overview: Market Achieves Unprecedented Growth》。

NFT

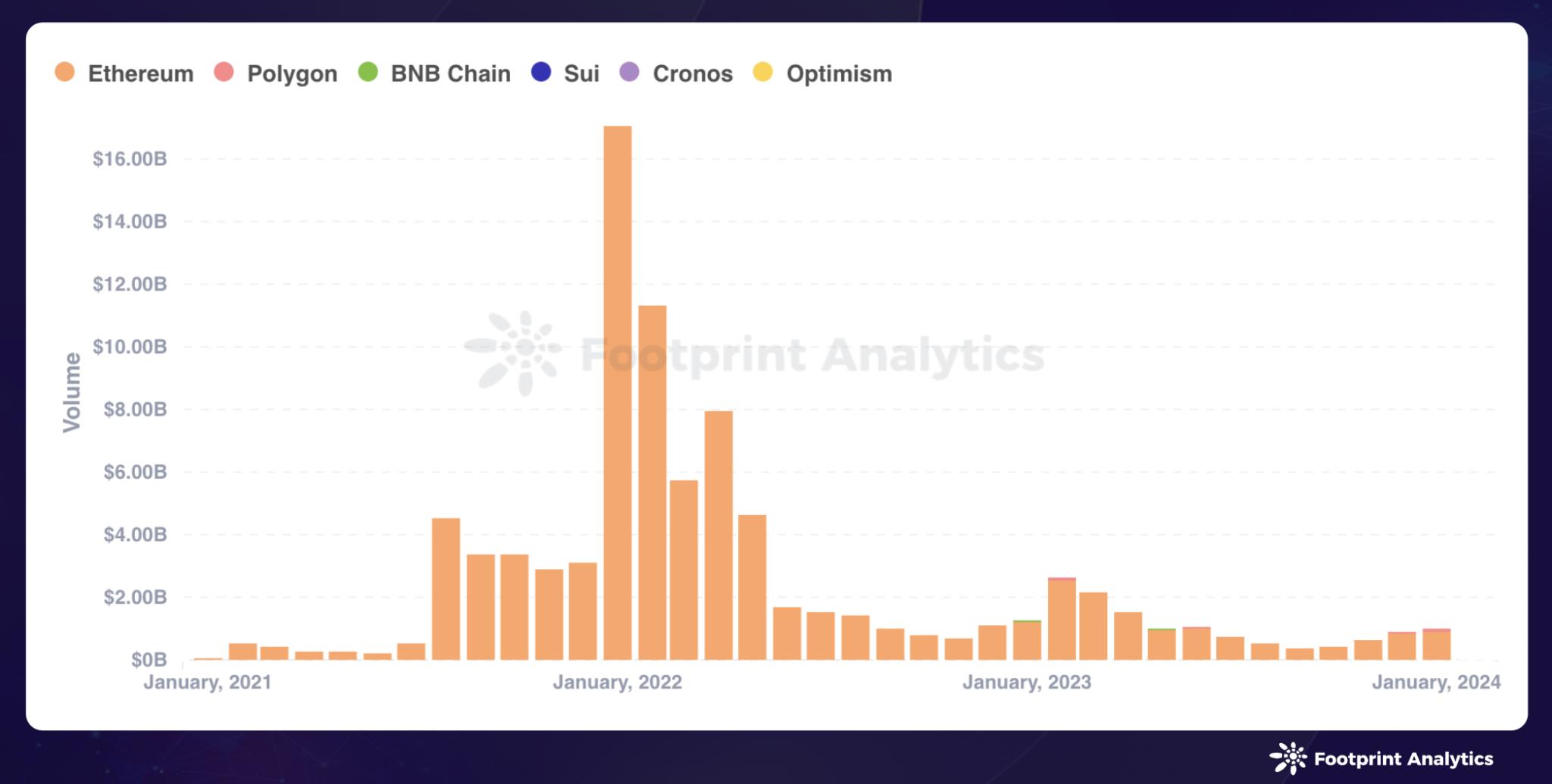

January,EthereumLeading the NFT market with a trading volume of US$900 million, the market share is 89.1%, but this is the lowest level since 2021. On the contrary, in JanuaryPolygonThe trading activity increased significantly, with its trading volume reaching US$110 million, an increase of 97.2% from the previous month. This significant growth has resulted inPolygonThe market share increased to 10.4%, almost double the 6.0% in December.

Data Sources:Monthly Volume by Chain - Footprint Analytics

EthereumThe number of unique users continued to grow, reaching 163,000, an increase of 4.9% from December, but its share of total users dropped from 49.0% to 42.7%. In contrast,PolygonThe user base has grown significantly, from 50.5% to 170,000, and its share has also increased from 35.5% to 44.5%, successfully having the largest user base in January. at the same time,BNBThe user share increased slightly from 7.5% to 8.6%.

Data Sources:Monthly Unique Users by Chain - Footprint Analytics

For more interpretation of the NFT industry in January, you can read the NFT monthly report from Footprint Analytics: NFT market trends in January: Polygon grows, Mooar rises, and TinFun sets off a cultural wave》。

Investment and financing situation

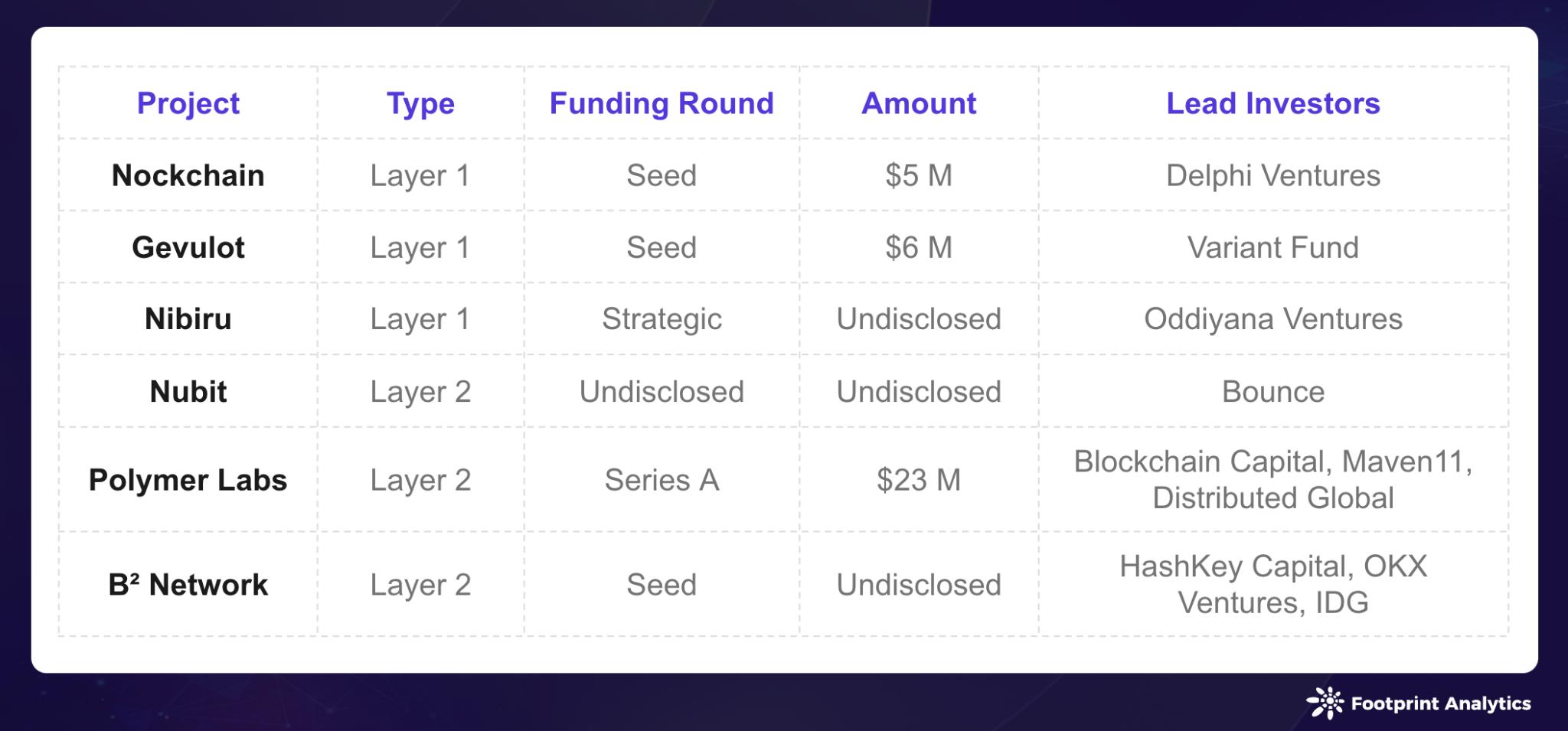

In January, a total of six financing events occurred in the public chain field, raising a total of US$34 million in funds. The financing amounts of three other events have not been disclosed.

Financing situation in the public chain field in January 2024

Polymer Labs recently successfully raised $23 million in Series A funding, co-led by Blockchain Capital, Maven 11 Capital and Distributed Global. Polymer Labs plans to use the funds to focus on the Ethereum Layer 2 network through the use of the Inter-Chain Communication Protocol (IBC) to further improve security and interoperability within the Ethereum ecosystem.

____________________

The content of this article is for industry research and communication only and does not constitute any investment advice. Market risk, the investment need to be cautious.

Footprint AnalyticsIs a blockchain data solutions provider. With the help of cutting-edge artificial intelligence technology, we provide the first code-free data analysis platform and unified data API in the Crypto field, allowing users to quickly retrieve NFT, Game and wallet address fund flow tracking data of more than 30 public chain ecosystems.

Product Highlights:

For developersData API

for GameFi projectFootprint Growth Analytics (FGA)

Big data batch download functionBatch download

All provided by Footprintdata set

Check out our Twitter (Footprint_Data) Learn more about product updates