Editor of this issue | Colin Wu

Editor of this issue | Colin Wu

Liquidity leaves farms at an alarming rate. "For the farmers who entered the farm on the day the farm was launched, 42% of the users quit within 24 hours, about 16% of the users would leave within 48 hours, and by the third day, 70% of the users would leave the farm." This sentence comes from Nansen's chef analyst, and it is also written as a motto on the official website of OlympusDAO.

This sentence expresses the drawbacks of existing DeFi ecological farms for lp liquidity mining, that is, mining and selling, users cannot advance and retreat with the team as long-term holders, and project tokens will have to face continuous pressure. When the increase of users and funds encounters a bottleneck, and the APY of the farm drops due to mining and withdrawal, users will withdraw their LPs and withdraw from the farm one after another, and the liquidity will also be lost. In addition, users also need to combat impermanent loss.

secondary title

"Unstable" Algorithmic Stablecoins

In the field of cryptocurrency market, stablecoins such as USDT and USDC are the most used assets, and most users purchase other underlying assets through stablecoins. Most of these encrypted stablecoins are pegged to the US dollar, which means that if the US dollar depreciates, the actual purchasing power of these encrypted stablecoins will also decline. OlymupusDAO believes that a high-quality currency should maintain consistent purchasing power at all times.

OHM is the native token of OlympusDAO, a free floating currency supported by a basket of assets. At the beginning, 1 OHM is supported by 1 DAI, and the treasury (DAO) will have at least 1 DAI to support the value of OHM, at this time 1OHM=1DAI. When 1OHM<1DAI, the agreement will repurchase OHM from the market and destroy it, and push the OHM price back to the value level of 1OHM=1DAI by reducing the market circulation. When 1OHM>1DAI, the agreement will sell the OHM held in the treasury at a discounted price, and increase the circulation of OHM in the market to reduce the price.

It should be noted that 1DAI and 1OHM are not linked 1:1. In addition to 1DAI, the price of OHM is determined by the market premium, that is, 1OHM price = 1DAI + market premium. It doesn't matter that the price of 1OHM deviates from 1DAI, and in fact it doesn't matter what the price of 1OHM is (explained below).

Taking the current price as an example, 1OHM=935USDT=935DAI. If the user spends 935DAI to buy 1OHM at this time, the agreement will receive 935DAI and mint 935OHM at the same time, of which the user will get 1OHM, and 10% of the remaining 934OHM will be kept in the treasury, and the remaining 90% of OHM will be Enter the pledge contract, that is, STAKE, to distribute to other pledge (STAKE) users.

In this example, the user only buys 1OHM, but the agreement actually mints 935OHM, so the value fissioned when buying 1OHM is actually 935²DAI, which is called rebase. The rebase effect is one of the important reasons why OlympusDAO can maintain a super high APY. The user pledged 1OHM, and the agreement minted 1+934OHM, most of which flowed to the users who were staking. Staking users can only see the pledged OHM balance, so the protocol increases the pledged OHM balance through rebase, and also ensures that the pledged 1OHM can always be exchanged for 1OHM.

Taking it a step further, the price of OHM has changed from 1OHM=1DAI to 1OHM=935DAI, and the rebase geometric effect brought about during this period is completely different. Then the users who enter the pledge earlier will enjoy the bonus, which will be the geometric multiple growth of the following users. However, the fundamental reason for the later users to enter is to enjoy the ultra-high APY, and it is the long-term pledge of the former users that can guarantee the ultra-high APY. The vast majority of OHM holders only need to pledge OHM to bring continuous high returns through high APY. The more pledges, the reduction of the circulating supply in the market, and the reduction of selling pressure makes the price more stable.

secondary title

Protocol controls liquidity instead of liquidity mining

In addition to staking, users can also purchase OHM from the agreement at a discount by trading with LP Token or other single-currency assets such as DAI and wETH. This process is called Bonding, and the former is called liquidity bonds. bonds), the latter are known as reserve bonds. The most important liquidity bonds are the OHM/DAI lp pool on Sushiswap.

Bonding is an important way for the OlympusDAO protocol to own and control liquidity. When users sell their LP Token, users will get incentives to buy OHM at a discounted price, and LP Token will bring depth and liquidity to the treasury, deeply raising the lower limit of OHM prices. The protocol captures LP Token, and LP Token provides liquidity. In fact, the protocol controls the liquidity itself. Owning and controlling liquidity, OlympusDAO becomes its own market maker. LP Token liquidity creates income for the agreement, and OlympusDAO will receive market maker commissions from the transaction pairs, realizing the profitability and sustainable development of the agreement. OlympusDAO has more than 99.5% of its own liquidity in the market.

secondary title

Nash Equilibrium in OlympusDAO: (3, 3)

After explaining the basic principles of the protocol, it is necessary to single out STAKE as a chapter. The long-term pledge of each OHM holder will have a crucial impact on this protocol.

In the assistance of OlympusDAO, the three types of behaviors of users and the resulting benefits:

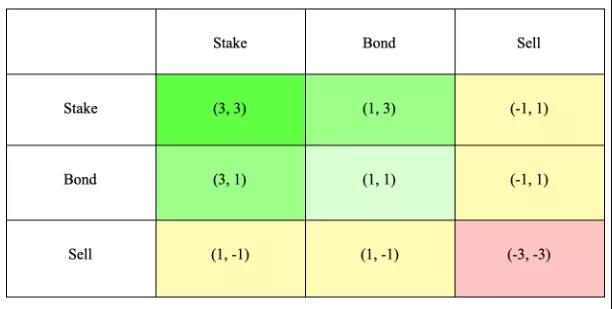

STAKE(+2) Bonding(+1) Sell(-2)

Both STAKE and Bonding have a positive effect on the agreement, while Selling has no benefit; both Staking and Selling have a direct impact on the price of OHM, and Bonding does not.

Assuming that there are two people A and B in the market, there are nine outcomes based on the above three behaviors:

Both A and B adopt STAKE or Bonding that has a positive effect on the agreement, and the STAKE party that has an impact on the OHM price will get half of the income (+1). Both B and the agreement itself can produce the best effect (3, 3); A and B respectively adopt the method of opposing the interests of the agreement, and the profit of the Selling party will be based on the loss of the STAKE or Bonding party, that is, for OHM The Sell party that has an adverse effect on the price will get half of the profit (+1), and the Stake party that has a favorable impact on the OHM price will bear half of the loss (-1); A and B both take the Sell that is unfavorable to the agreement, and each bears Half loses (-1), which is the worst choice for both A and B, and the protocol itself (-3, -3).

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Readers are requested to strictly abide by the laws and regulations of the region and do not participate in Any illegal financial conduct. Wu said that without permission, it is forbidden to reprint or copy the content, and those who violate it will be investigated for legal responsibility.

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Readers are requested to strictly abide by the laws and regulations of the region and do not participate in Any illegal financial conduct. Wu said that without permission, it is forbidden to reprint or copy the content, and those who violate it will be investigated for legal responsibility.